Any Exempt Property With No Money Down

Description

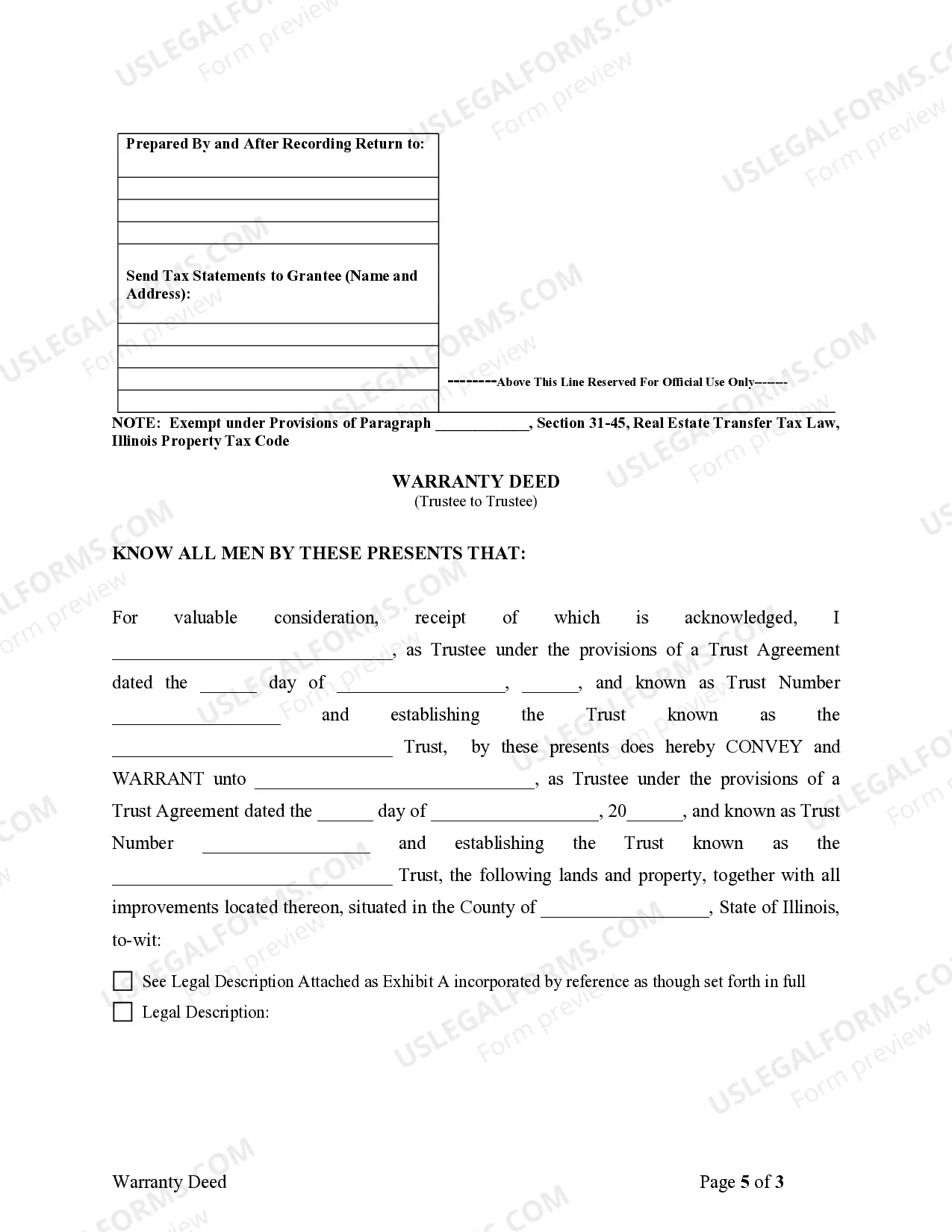

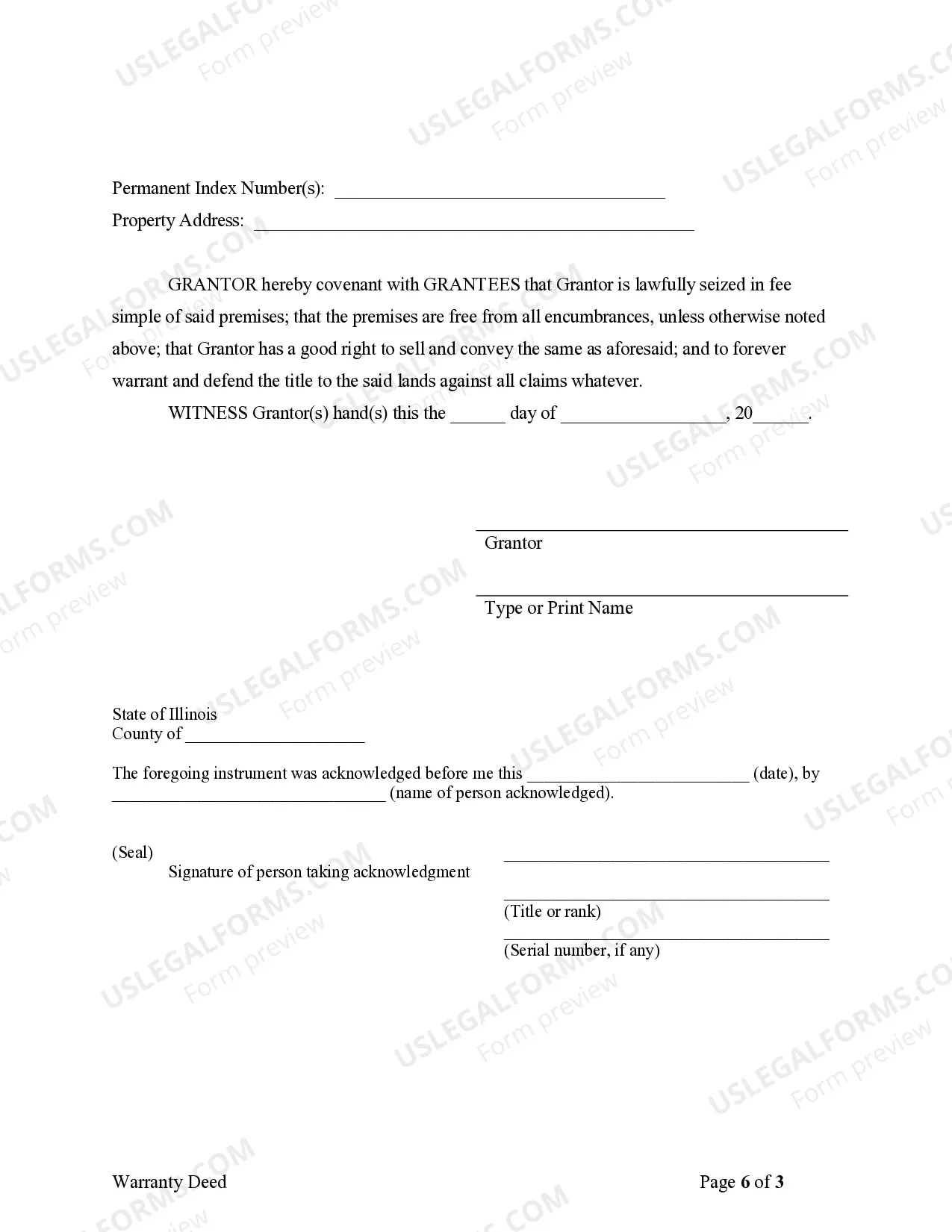

How to fill out Illinois Warranty Deed From Trustee To Trustee?

It’s obvious that you can’t become a legal expert overnight, nor can you learn how to quickly prepare Any Exempt Property With No Money Down without the need of a specialized set of skills. Creating legal documents is a long venture requiring a particular training and skills. So why not leave the creation of the Any Exempt Property With No Money Down to the specialists?

With US Legal Forms, one of the most extensive legal document libraries, you can access anything from court documents to templates for internal corporate communication. We understand how crucial compliance and adherence to federal and state laws are. That’s why, on our website, all forms are location specific and up to date.

Here’s start off with our platform and get the document you require in mere minutes:

- Find the form you need by using the search bar at the top of the page.

- Preview it (if this option available) and check the supporting description to figure out whether Any Exempt Property With No Money Down is what you’re looking for.

- Start your search over if you need any other template.

- Set up a free account and choose a subscription option to buy the template.

- Pick Buy now. As soon as the payment is complete, you can get the Any Exempt Property With No Money Down, complete it, print it, and send or mail it to the designated individuals or entities.

You can re-access your documents from the My Forms tab at any time. If you’re an existing customer, you can simply log in, and find and download the template from the same tab.

No matter the purpose of your documents-whether it’s financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

The Homeowner Exemption reduces the Equalized Assessed Value (EAV) of a property by $10,000.

Homeowner exemptions If a home has an EAV of $200,000, its tax value would be $190,000. For counties bordering Cook, the maximum homeowner's exemption is $8,000 for tax levy year 2023. All other counties have a maximum homeowner's exemption of $6,000.

A municipality is barred from collecting property taxes after the lapse of ten (10) years from April 1 of the year following the year in which such taxes become delinquent. T.C.A. § 67-5-1806.

The owner has a 24 to 30-month period in which to redeem those taxes (i.e. pay them off plus any penalties). If they fail to redeem their taxes, the buyer gets a tax deed and is entitled to do as they will with the property.

Typically, exempt property includes a family car, and a certain amount of cash (perhaps $10,000-$20,000), or the equivalent value in personal property. Exempt property calculations and provisions are determined on a state-by-state basis.