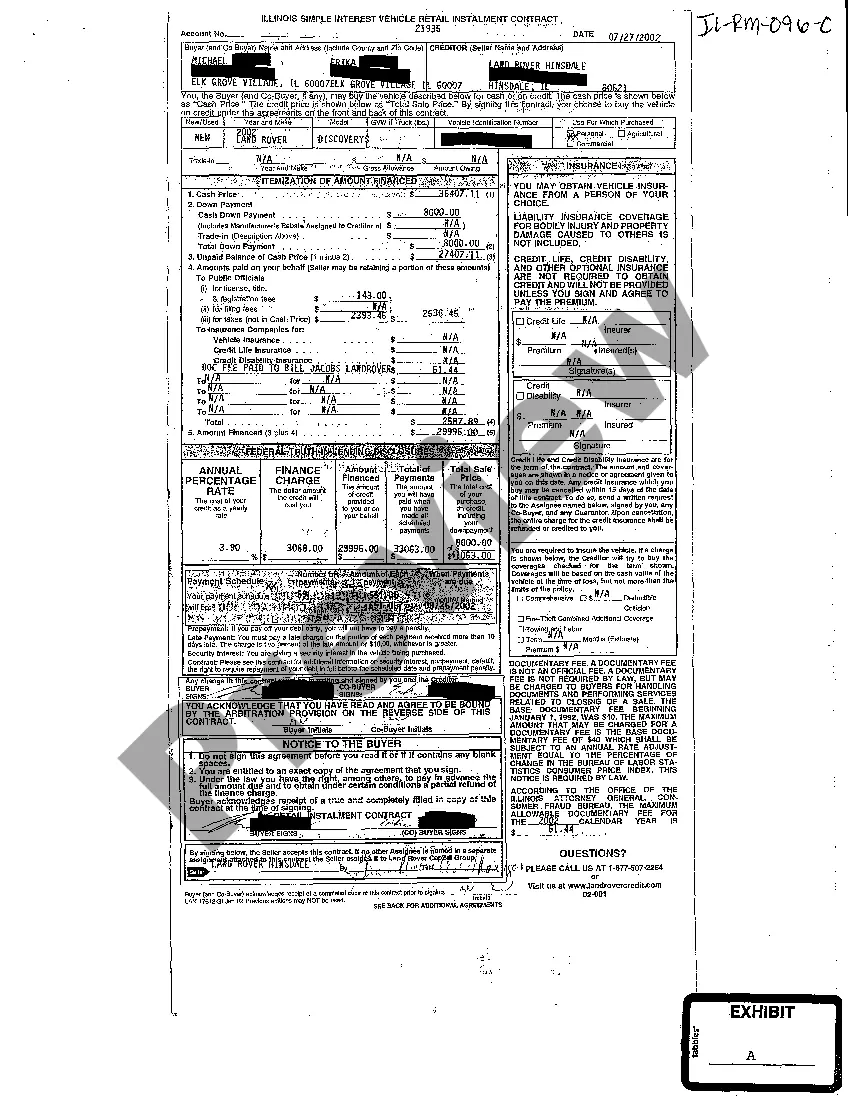

Retail Installment Contract Form

Description

How to fill out Illinois Exhibit A Copy Of Retail Installment Contract?

Bureaucracy necessitates exactness and correctness.

If you do not regularly handle the completion of documents like the Retail Installment Contract Form, it may lead to some confusions.

Selecting the appropriate sample from the outset will ensure that your document submission proceeds smoothly and avert any complications of resubmitting a document or starting the same task anew.

If you are not a subscribed user, finding the necessary sample will necessitate a couple of additional steps.

- Obtain the suitable sample for your documentation at US Legal Forms.

- US Legal Forms is the largest online forms database that provides over 85 thousand templates for various fields.

- You can discover the most current and relevant version of the Retail Installment Contract Form by simply searching it on the site.

- Locate, store, and save templates in your account or refer to the description to confirm you have the correct one available.

- Having an account at US Legal Forms allows you to easily obtain, store in one place, and browse through the templates you have saved for quick access.

- When on the website, click the Log In button to authenticate.

- Then, navigate to the My documents page, where your document list is kept.

- Review the description of the forms and save those you require at any time.

Form popularity

FAQ

An installment sales contract is often referred to as a retail installment contract. This form helps buyers and sellers agree on terms for paying for goods over time. By using a retail installment contract form, both parties clarify payment details, interest rates, and other conditions of the sale.

A retail installment contract is not the same as a bill of sale, although they are related. The bill of sale serves as a receipt for the transaction, confirming ownership transfer, while the retail installment contract outlines the payment plan and financing terms. Knowing this distinction can help you make informed decisions. Use the available resources at USLegalForms to find the right documentation for your needs.

A retail installment contract is generally not considered a security under federal law. Instead, it is a payment arrangement between a buyer and a seller use for purchasing goods, securing financing for items like vehicles or appliances. Understanding this difference can clarify your financial responsibilities. For complete clarity on the usage of retail installment contract forms, consult with a legal expert.

A retail installment contract is a legal agreement between a seller and buyer that outlines the terms for paying for goods over time. It specifies the total amount financed, interest rates, and the payment schedule, ensuring transparency for both parties. USLegalForms offers easy-to-use templates for creating compliant retail installment contract forms that meet your specific needs.

No, a retail installment contract differs significantly from a lease. While a retail installment contract allows you to own the item after completing payments, a lease gives you temporary use of an item without ownership. Therefore, it's important to understand the implications of both agreements when making purchases. If you're unsure, you can find clear information and examples in a retail installment contract form on platforms like US Legal Forms.

In an installment sale contract sometimes called a contract for deed generally the owner agrees to sell the real estate to the buyer for periodic payments to be applied to the purchase price in some fashion.

A retail installment sales contract agreement is slightly different from a loan. Both are ways for you to obtain a vehicle by agreeing to make payments over time. In both, you are generally bound to the agreement after signing.

When the company buys the contract, the dealer will transfer and assign the contract to that company. The company then becomes what is called an assignee. The company now has the right to receive monthly payments from you.

A retail installment sale is a transaction between you and a dealer to purchase a vehicle where, you agree to pay the dealer over time, paying both the value of the vehicle plus interest. A dealer can sell the retail installment contract to a lender or other party.

A retail installment sales contract agreement is slightly different from a loan. Both are ways for you to obtain a vehicle by agreeing to make payments over time. In both, you are generally bound to the agreement after signing.