Power Attorney Powers With A Will

Description

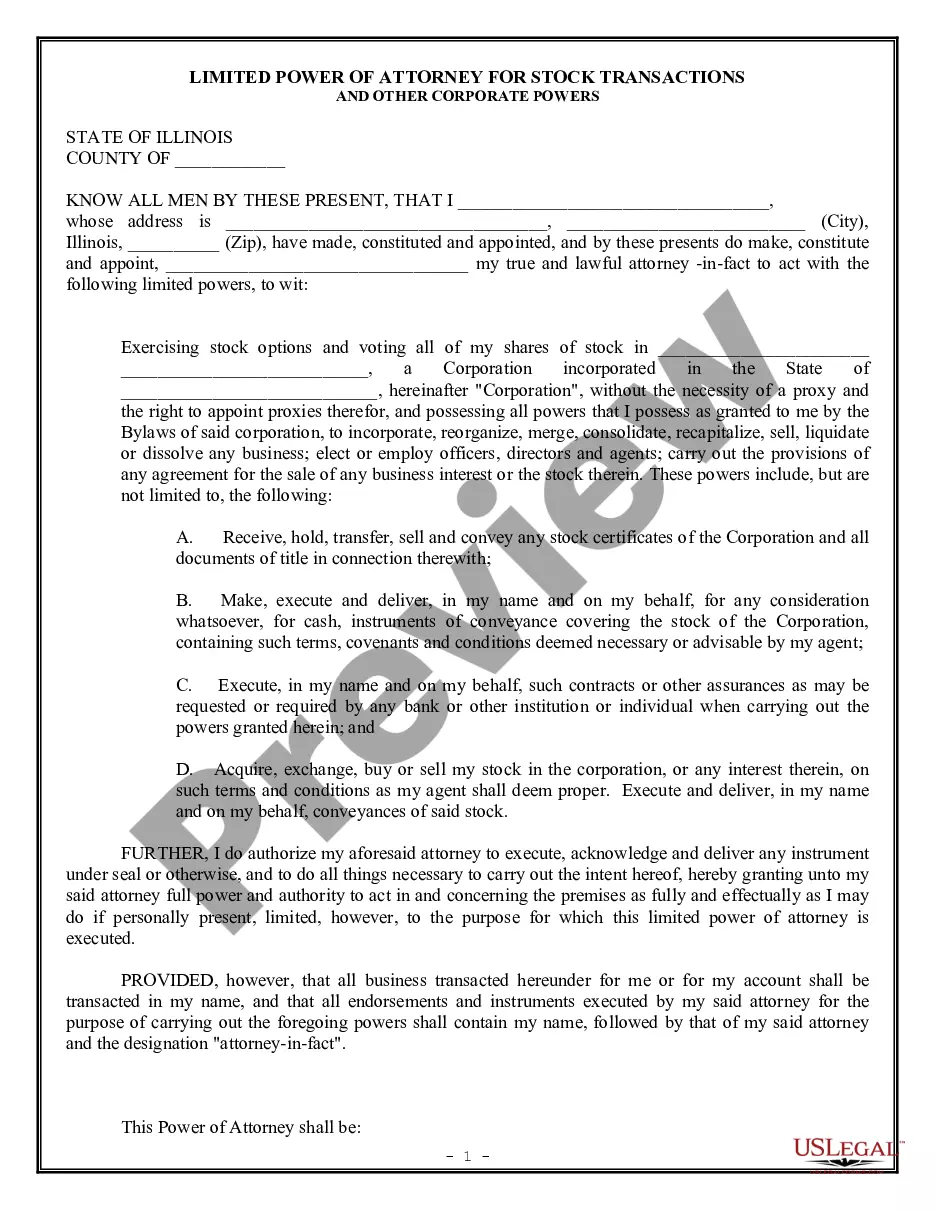

How to fill out Illinois Limited Power Of Attorney For Stock Transactions And Corporate Powers?

- If you are a returning user, log in to your account and access the form template you require. Confirm that your subscription is active, or renew it if necessary.

- For first-time users, begin by reviewing the Preview mode and description of available forms to find the one that best suits your needs.

- If you need a different template, use the Search bar to explore other options. Choose one that matches your requirements accurately.

- After selecting a document, click the Buy Now button and opt for a subscription plan that fits you. You'll need to create an account to proceed.

- Complete your purchase by providing your payment details, either through credit card or PayPal.

- Download the form and store it on your device. You can also access it later in the My Forms section of your profile.

By following these steps, you can leverage US Legal Forms’ extensive library of over 85,000 legal documents, ensuring that you receive a well-crafted and compliant form tailored to your needs.

Take control of your legal needs today with US Legal Forms and streamline your document preparation process!

Form popularity

FAQ

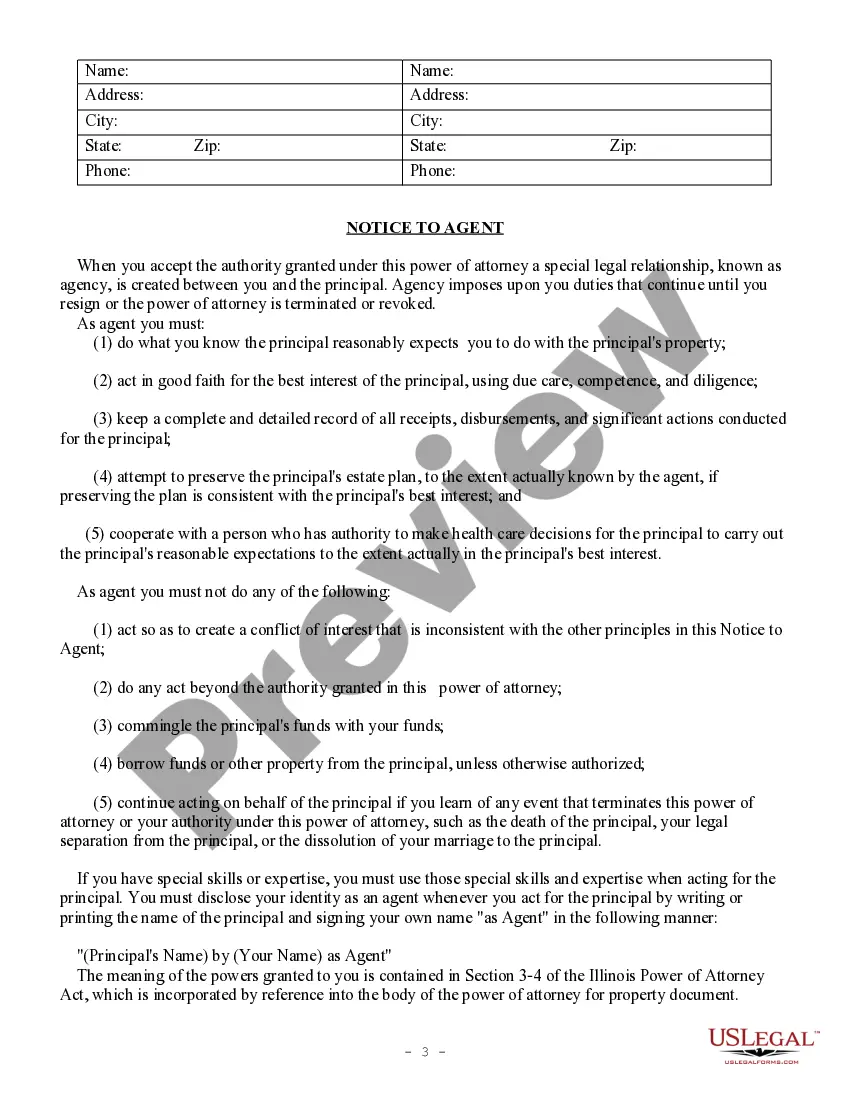

Power of attorney powers with a will are separate legal tools that serve different purposes. While a will outlines your wishes for after your death, a power of attorney allows someone to act on your behalf while you are still alive. You may wish to create both to ensure clarity and control over your affairs. Uslegalforms offers templates and information to help you create these important documents.

A will typically does not include power of attorney powers with a will. However, a will can designate an executor, who may also be someone you trust with power of attorney during your life. It's essential to create both documents to ensure your preferences are respected in every situation. If you need assistance, consider uslegalforms for guidance.

It is not possible to obtain power of attorney powers with a will for a deceased person. Power of attorney is valid only during an individual's life. After death, you must rely on the will and the appointed executor to manage the deceased's affairs. If you have questions, uslegalforms provides resources to help you navigate these processes.

Power of attorney powers with a will operate during your lifetime, allowing someone to make decisions on your behalf. Conversely, a will only takes effect after your death. Therefore, in cases where both documents exist, the power of attorney can make decisions that a will cannot. Consider establishing both for a comprehensive plan.

One downside of being a power of attorney is the potential for significant responsibility. You take on the obligation to act in the best interests of the principal, which can include handling financial matters or making medical decisions. Additionally, if the principal's wishes are unclear, you may face difficult choices. Understanding the power attorney powers with a will helps mitigate these risks, so consulting legal resources like U.S. Legal Forms is beneficial.

Generally, a power of attorney does not have access to the will unless they are specifically named in the document. The power attorney powers with a will often vary based on the individual's preferences. If you want your power of attorney to manage your will, it is essential to make that clear in your estate planning documents. For tailored solutions, consider using U.S. Legal Forms to create precise legal documents.

Yes, having a power of attorney is important even if you have a will. A will only takes effect after your death, while a power of attorney comes into play during your lifetime. Therefore, you should consider both documents to ensure that your wishes are fulfilled during your life and after, as power attorney powers with a will provide comprehensive coverage of your estate.

When you hold a power of attorney, you have a legal responsibility to act in the best interests of the person granting you that power. This includes managing finances, making health care decisions, and carrying out their wishes as outlined in the power of attorney document. Understanding these responsibilities is crucial, especially when combined with the power attorney powers with a will, for effective estate management.

A legal power of attorney typically cannot make decisions regarding your personal care, such as marriage or divorce, cannot change your will, and cannot make decisions that are against your wishes. It is essential to understand these limitations to ensure your desires are respected. Therefore, it's advisable to prepare both a power of attorney and a will to cover all aspects of your estate.

A power of attorney grants the agent authority to make decisions on your behalf, particularly regarding your financial matters, legal affairs, and health care. However, these power attorney powers with a will can be limited based on your specified preferences. You must clearly outline the extent of authority in the document to ensure it meets your needs.