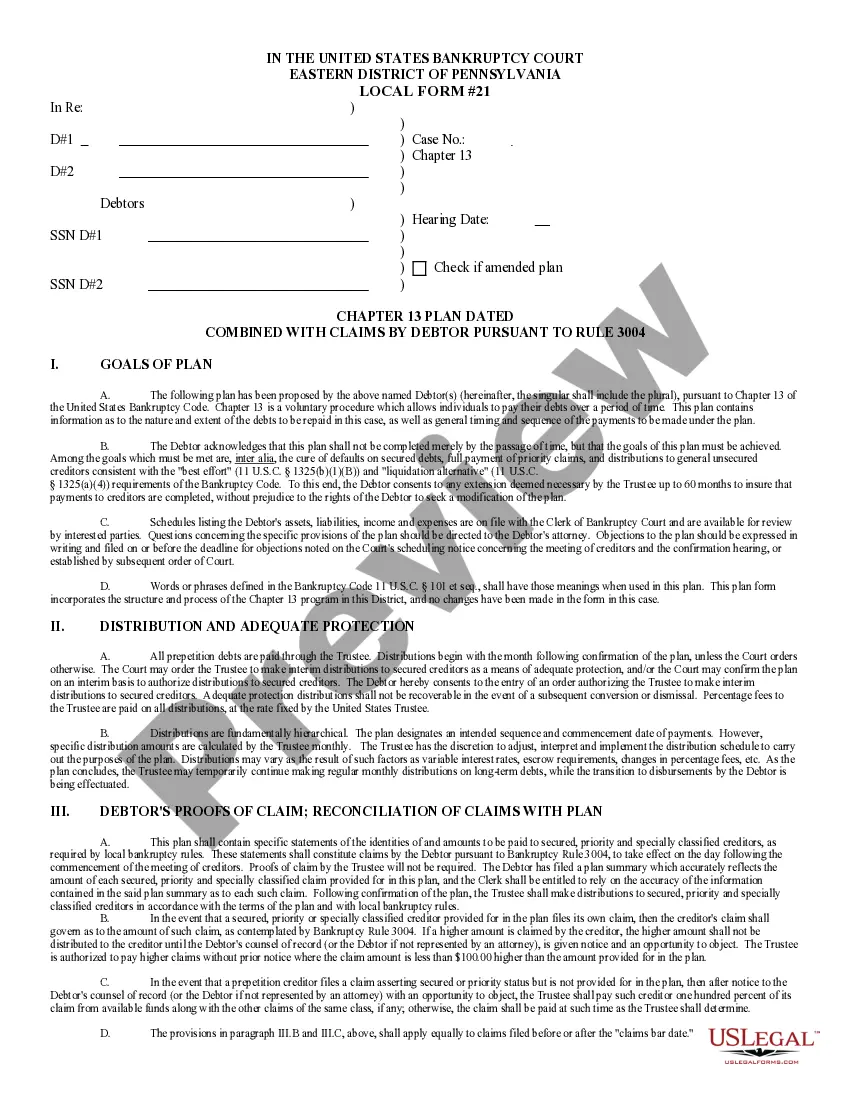

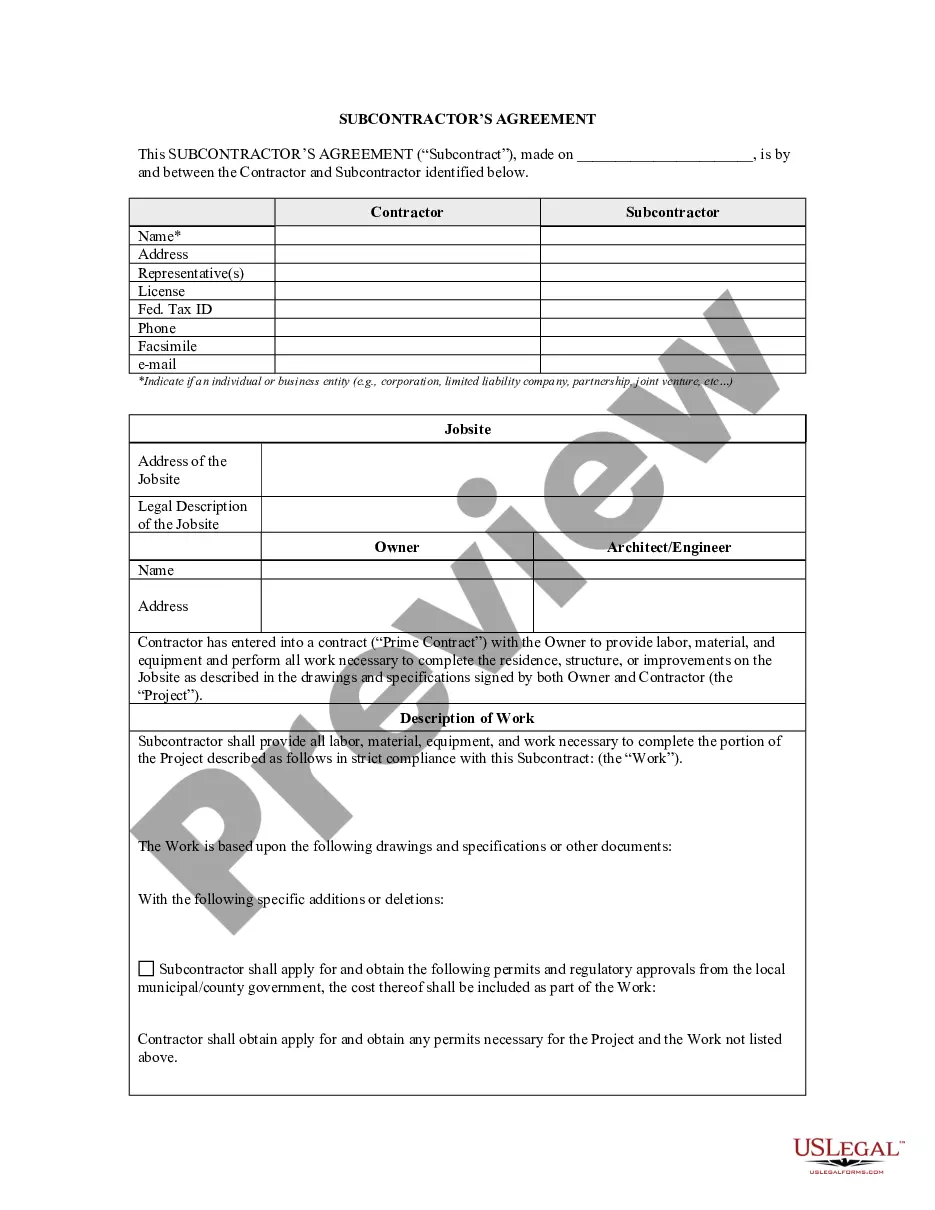

Installment Promissory Note Document With Interest

Description

How to fill out Illinois Unsecured Installment Payment Promissory Note For Fixed Rate?

Steering through the red tape of formal documents and templates can be challenging, particularly if one does not engage in that professionally.

Selecting the appropriate template to obtain an Installment Promissory Note Document With Interest could also be labor-intensive, as it must be valid and accurate to the very last figure.

Nonetheless, you will invest significantly less time picking an appropriate template if it originates from a source you can rely on.

Acquire the right form in just a few simple steps: Enter the document name in the search box, select the correct Installment Promissory Note Document With Interest from the list of results, review the description of the sample or preview it. If the template meets your requirements, click Buy Now. Then, proceed to choose your subscription plan. Use your email and create a secure password to register at US Legal Forms. Choose a payment method, whether credit card or PayPal. Finally, download the template document in your desired format. US Legal Forms will conserve your time and energy by verifying that the form you discovered online is appropriate for your needs. Create an account and gain unlimited access to all the templates you require.

- US Legal Forms is one platform that streamlines the process of locating the correct forms online.

- It serves as a single venue where you can access the latest templates, verify their application, and download these templates for completion.

- This resource boasts over 85K templates applicable across various professional domains.

- When seeking an Installment Promissory Note Document With Interest, you can trust in its relevance as all templates are authenticated.

- Having an account on US Legal Forms guarantees that all the essential templates are within your reach.

- You can either store them in your history or add them to the My documents collection.

- Saved forms can be retrieved from any device by simply clicking Log In on the library's website.

- In case you do not yet possess an account, you can continually search for the required template.

Form popularity

FAQ

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.19-Aug-2021

Find the principal amount of the loan as stated in the promissory note. Use a free online amortization calculator to calculate the amount of monthly interest. Divide the monthly interest amount by the principal loan amount to get the monthly interest rate.

If interest on your loan is calculated as simple interest, the formula for calculating interest begins with the total principal balance multiplied by the interest rate. For example, if the principal is $5,000 and the interest rate is 15 percent, multiply 5,000 by 0.15 to equal 750.

Promissory notes usually call for monthly payments. Interest is calculated each month based on the outstanding balance of the loan, called the principal. Suppose you take out a loan for $1,000 and the promissory note stipulates a 12 percent annual interest rate and a monthly payment of $50.

A simple promissory note will state the full amount is due on the stated date; you won't need a payment schedule. You can decide whether to charge interest on the loan amount and include the interest in the document if needed.