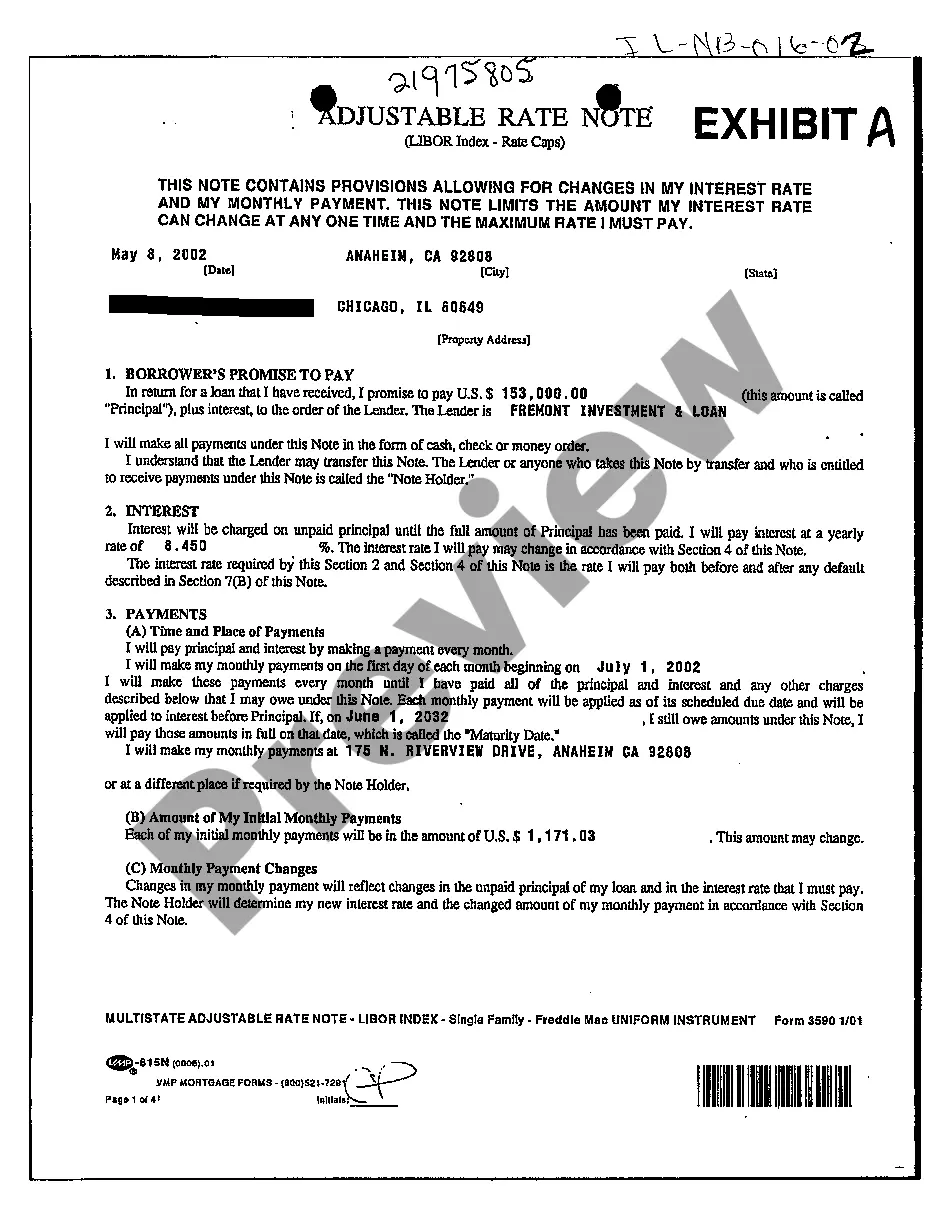

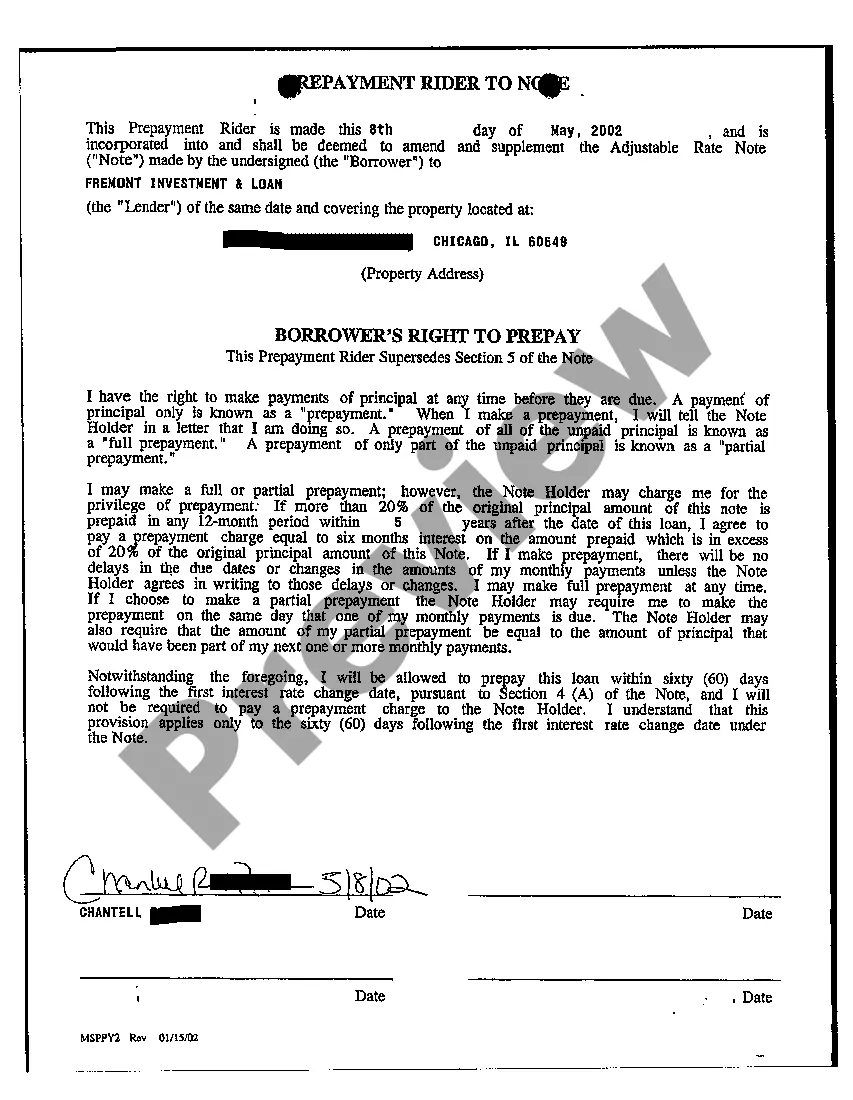

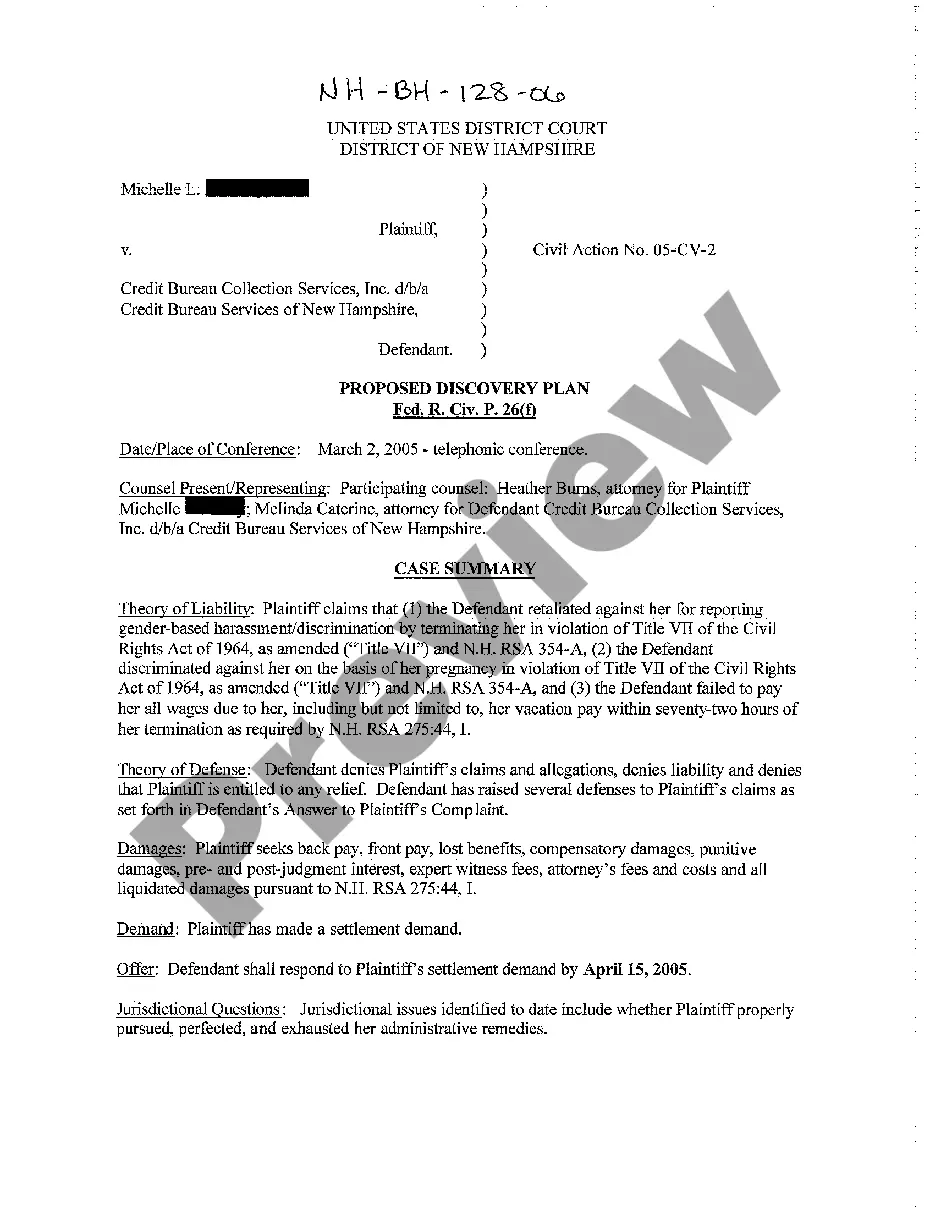

Adjustable Rate Promissory Note Form

Description

How to fill out Illinois Exhibit A Adjustable Rate Note?

Whether you deal with documents frequently or occasionally need to send a legal document, it is essential to find a helpful resource where all the templates are pertinent and current.

The first step you need to take with an Adjustable Rate Promissory Note Form is to ensure that you have the most recent version, as it determines whether it can be submitted.

If you wish to simplify your search for the most current document examples, look for them on US Legal Forms.

To obtain a form without an account, follow these steps: Use the search menu to locate the form you want. View the Adjustable Rate Promissory Note Form preview and summary to ensure it is the exact one you need. After confirming the form, click Buy Now. Select a subscription plan that suits you. Create an account or Log In to your existing one. Use your credit card or PayPal information to complete your purchase. Choose the document format for download and confirm your selection. Eliminate confusion when dealing with legal documents. All your templates will be organized and verified with a US Legal Forms account.

- US Legal Forms is a repository of legal documents that contains almost any template example you could require.

- Find the templates you need, verify their relevance instantly, and learn more about their application.

- With US Legal Forms, you have access to over 85,000 form templates across a broad range of areas.

- Acquire the Adjustable Rate Promissory Note Form samples with just a few clicks and store them anytime in your account.

- Having a US Legal Forms account will enable you to access all the samples you require more conveniently and with less hassle.

- Simply click Log In in the site's header and navigate to the My documents section where all the forms you need will be readily available.

- You won't need to waste time searching for the correct template or checking its validity.

Form popularity

FAQ

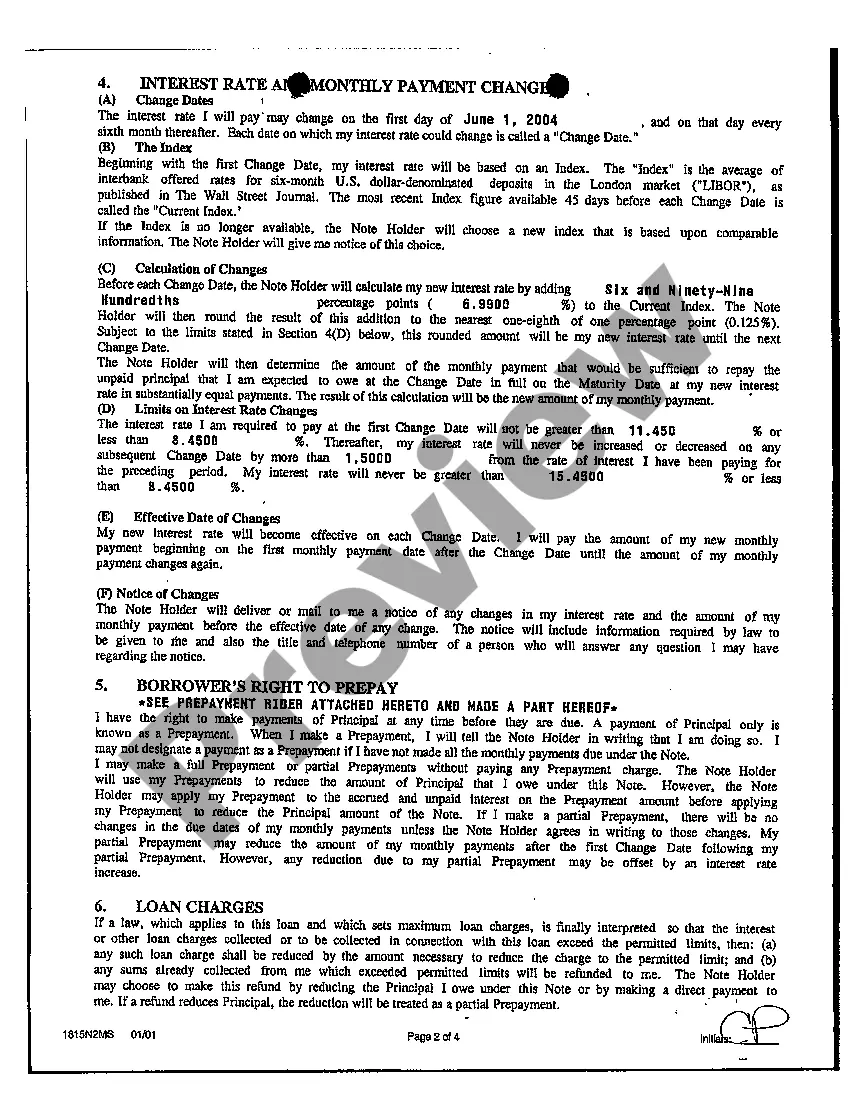

If our payments are monthly, then we divide our annual interest rate by 12. The P stands for the fixed monthly payment amount that we will have to pay. To find the total amount that we end up paying, we multiply this fixed monthly amount by the total number of payments.

If interest on your loan is calculated as simple interest, the formula for calculating interest begins with the total principal balance multiplied by the interest rate. For example, if the principal is $5,000 and the interest rate is 15 percent, multiply 5,000 by 0.15 to equal 750.

An adjustable rate note is a debt instrument with an interest rate that can fluctuate over time. Lenders typically use adjustable rates to compensate for risk and inflation, allowing borrowers to save money on their loan's interest payments.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

Find the principal amount of the loan as stated in the promissory note. Use a free online amortization calculator to calculate the amount of monthly interest. Divide the monthly interest amount by the principal loan amount to get the monthly interest rate.