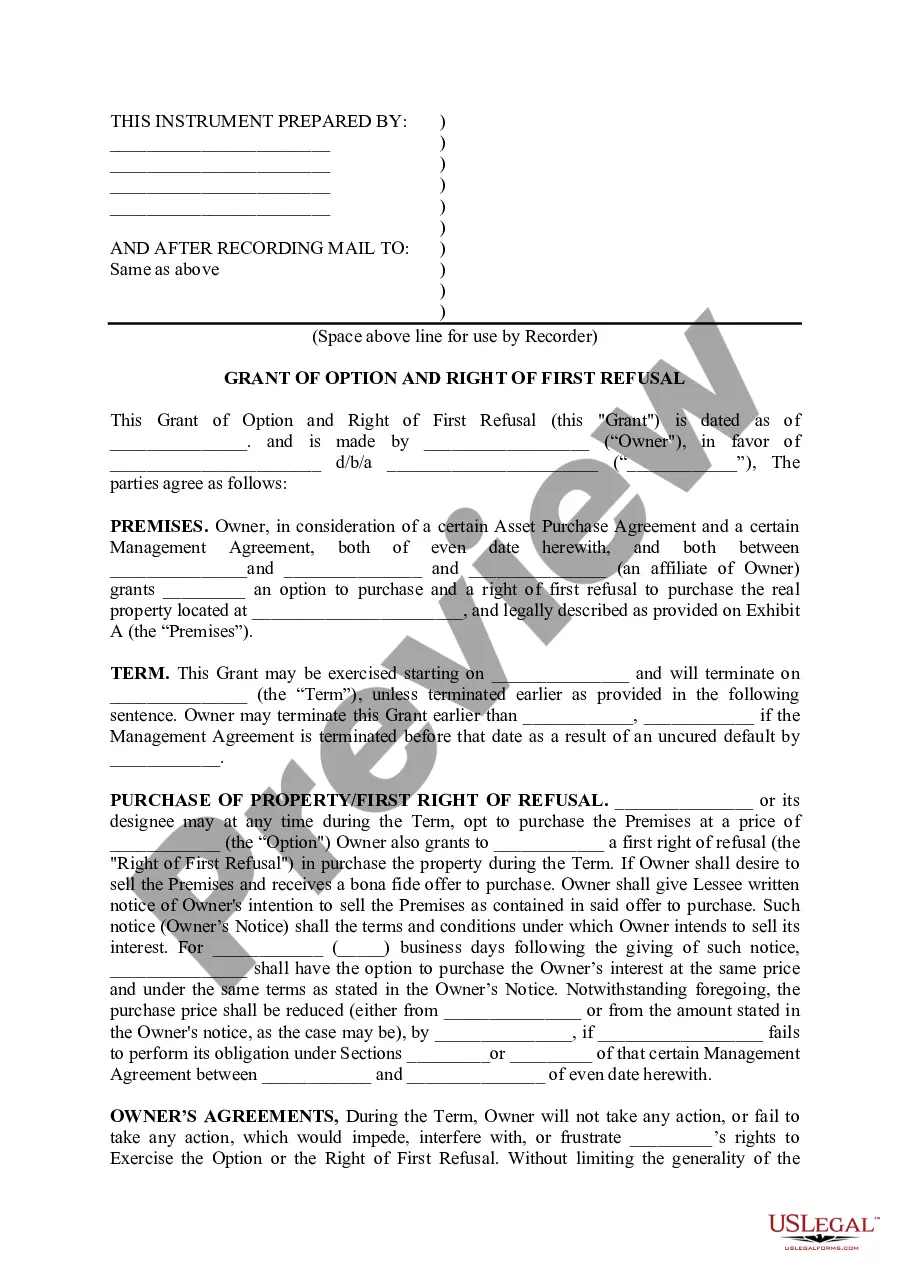

Right Of First Refusal For Lease

Description

and first option to purchase

How to fill out Right Of First Refusal For Lease?

Maneuvering through the red tape of official documents and formats can be challenging, particularly if one does not engage in this professionally.

Even selecting the appropriate format to obtain a Right Of First Refusal For Lease will consume quite a bit of time, as it needs to be valid and accurate down to the last detail.

However, you will be able to significantly reduce the time spent searching for a suitable template from a reliable source.

Obtain the appropriate form in a few straightforward steps.

- US Legal Forms is a service that streamlines the process of locating the proper documents online.

- US Legal Forms is the sole destination you need to acquire the most up-to-date examples of forms, consult their utilization, and download these examples to complete them.

- This is a compilation featuring over 85,000 forms that are applicable across diverse sectors.

- When searching for a Right Of First Refusal For Lease, you won’t have any doubts about its relevance since all the forms are authenticated.

- Having an account at US Legal Forms will guarantee you have all the necessary examples at your fingertips.

- Store them in your history or include them in the My documents directory.

- You can access your saved documents from any device by clicking Log In on the library site.

- If you don't have an account yet, you can still search for the template you require.

Form popularity

FAQ

Rights of first refusal clauses are similar to options contracts as the holder has the right, but not the obligation, to enter into a transaction that generally involves an asset. The person with this right has the opportunity to establish a contract or an agreement on an asset before others can.

Both Options and Rights of First Refusal must be in writing, signed, contain a legal description of the property, and have consideration to be legally enforceable.

Once that is done the ROFR holder has the option of purchasing the property instead or waiving their ROFR and allowing another sale to go through. To get to closing, a title company has to have a signed Waiver of Right of First Refusal document in the file before funding can occur.

When you have a first right of refusal the seller must contact you and let you potentially move forward with a purchase before an offer can be accepted from another party. The first right of refusal can be put together either before a home is listed for sale or during the time it is on the market.

The right of first refusal is usually triggered when a third party offers to buy or lease the property owner's asset. Before the property owner accepts this offer, the property holder (the person with the right of first refusal) must be allowed to buy or lease the asset under the same terms offered by the third party.