Il Name Change Form With Irs

Description

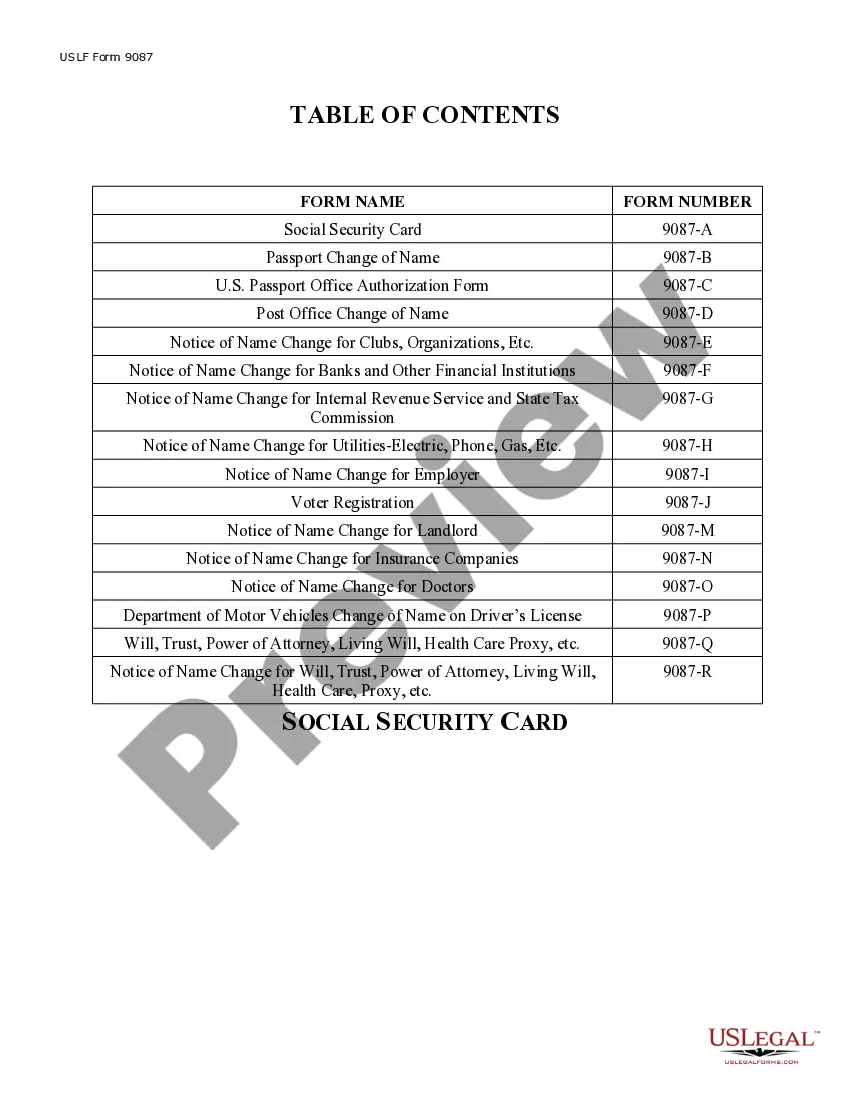

How to fill out Illinois Name Change Notification Package For Brides, Court Ordered Name Change, Divorced, Marriage?

Legal administration can be exasperating, even for proficient professionals.

When you seek an Il Name Change Form With IRS and lack the time to search for the correct and current version, the process may be distressing.

Utilize cutting-edge tools to complete and manage your Il Name Change Form With IRS.

Access a valuable resource center of articles, guidelines, manuals, and materials related to your context and needs.

Ensure that the sample is valid in your state or county. Click Buy Now when you are ready. Choose a subscription plan. Select the formatting you require, and Download, fill out, eSign, print, and send your documents. Experience the advantages of the US Legal Forms online library, backed by 25 years of experience and reliability. Streamline your daily document management into a seamless and user-friendly process today.

- Save time and effort searching for the necessary documents, and employ US Legal Forms’ enhanced search and Review tool to locate Il Name Change Form With IRS and obtain it.

- If you hold a monthly subscription, Log Into your US Legal Forms account, search for the form, and retrieve it.

- Check your My documents tab to review the documents you've previously saved and manage your folders as required.

- If you are a first-time user of US Legal Forms, create a complimentary account for unlimited access to all the features of the library.

- After downloading the form you need, follow these steps to ensure proper handling: Validate that it is the correct form by previewing it and reviewing its description.

- A robust online form repository could be a pivotal element for individuals looking to navigate these circumstances efficiently.

- US Legal Forms stands as a leading provider in the realm of online legal forms, featuring over 85,000 state-specific legal documents accessible at any time.

- With US Legal Forms, you can find state- or county-specific legal and organizational documents, catering to any requirements you may have, from personal to business paperwork, all centralized in one location.

Form popularity

FAQ

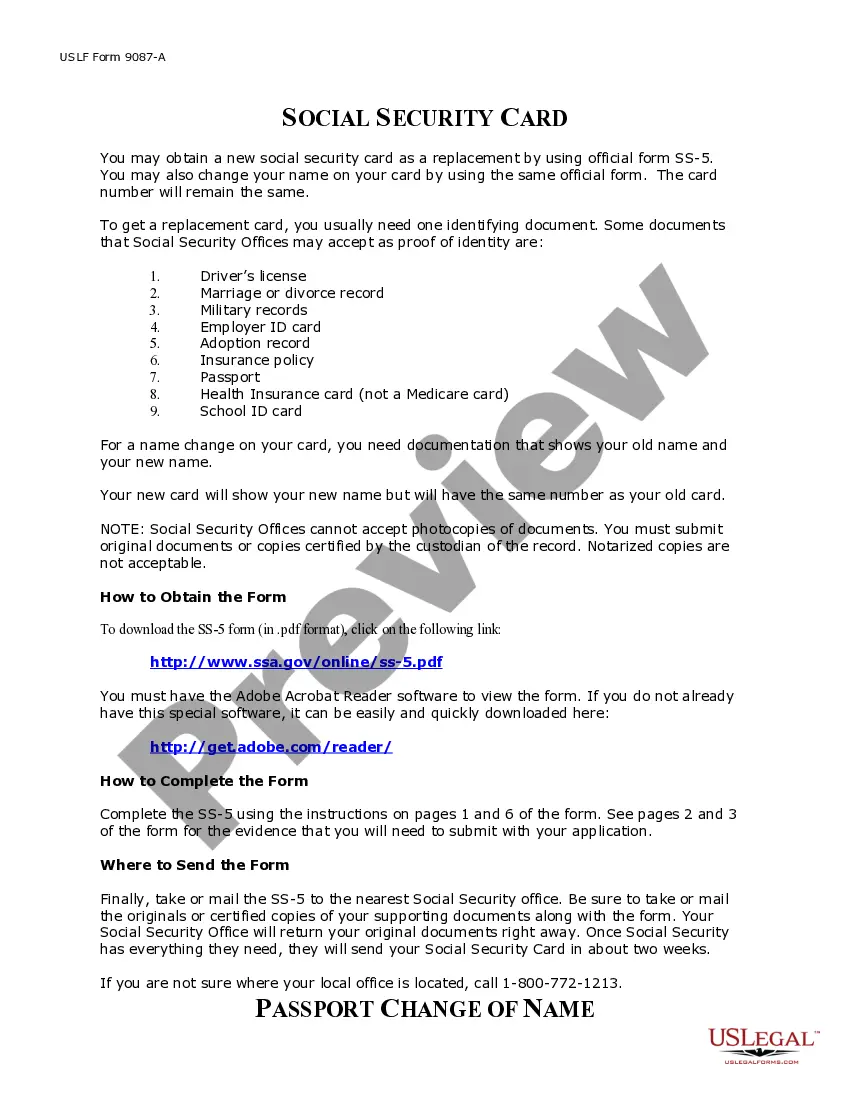

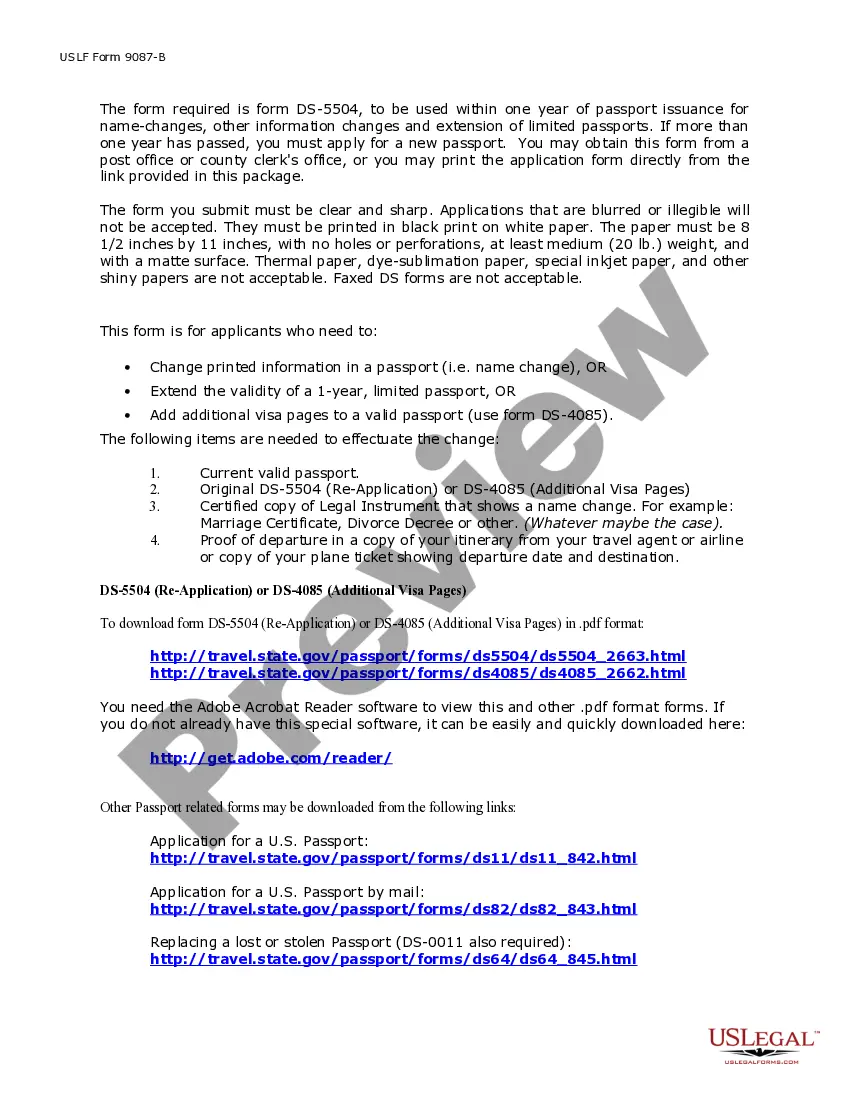

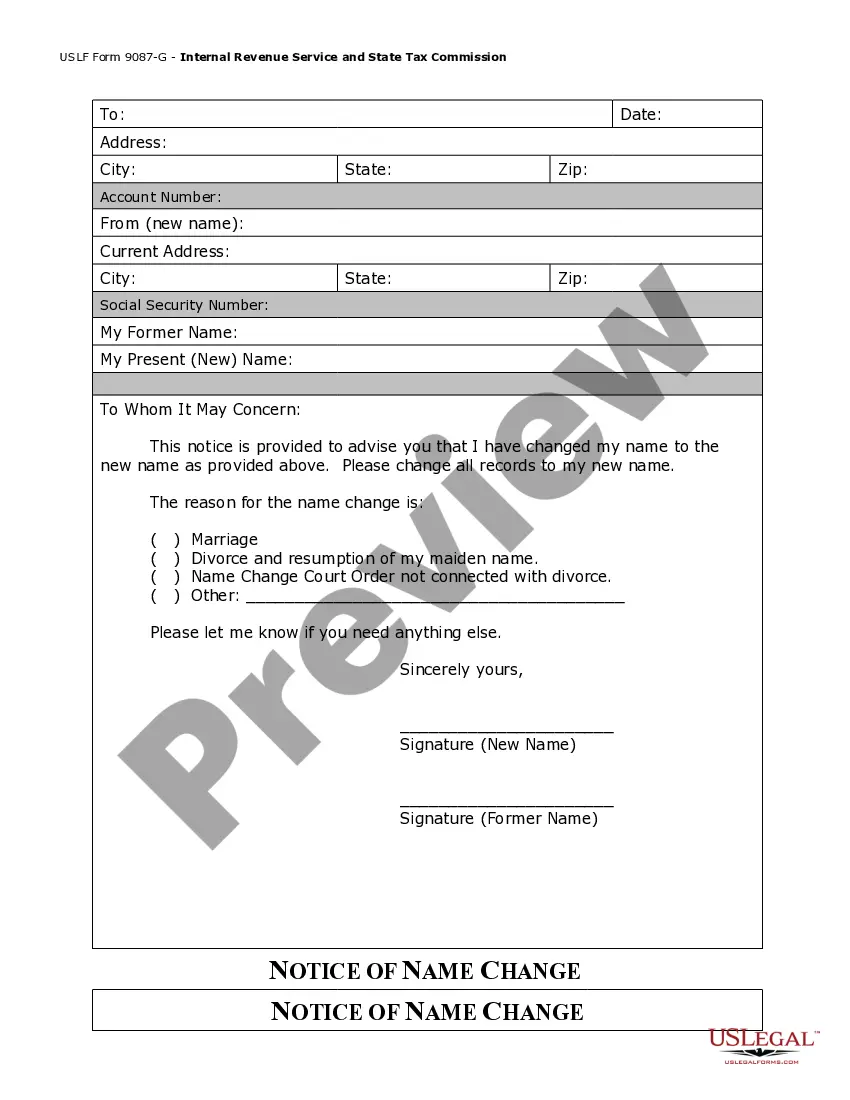

If you change your name soon after you file your annual tax return, then you can inform the IRS of the EIN number change name through a signed notification, similar to a sole proprietorship.

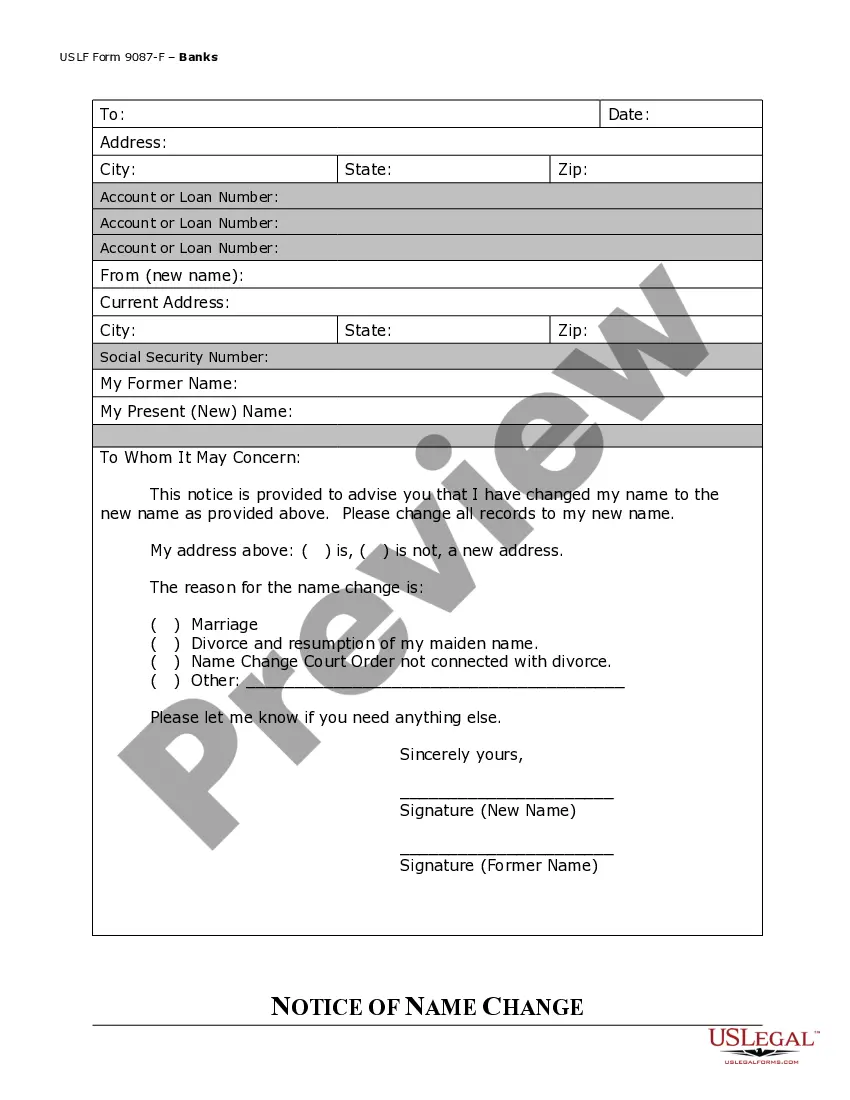

Contents of the Name Change Letter Your current EIN. The old name of the business as mentioned in the IRS records. Complete address of the business as it exists in the IRS records. The new name of your business. Date from which the name has been changed. New address if applicable.

By Form. To change your address with the IRS, you may complete a Form 8822, Change of Address (For Individual, Gift, Estate, or Generation-Skipping Transfer Tax Returns) and/or a Form 8822-B, Change of Address or Responsible Party ? Business and send them to the address shown on the forms.

Generally, businesses need a new EIN when their ownership or structure has changed. Although changing the name of your business does not require you to obtain a new EIN, you may wish to visit the Business Name Change page to find out what actions are required if you change the name of your business.

Whether you file Form SS-5 at your local Social Security office or by mail, you'll need to provide documents to support your legal name change, such as an original or certified copy of your marriage certificate. For more information, go to IRS.gov.