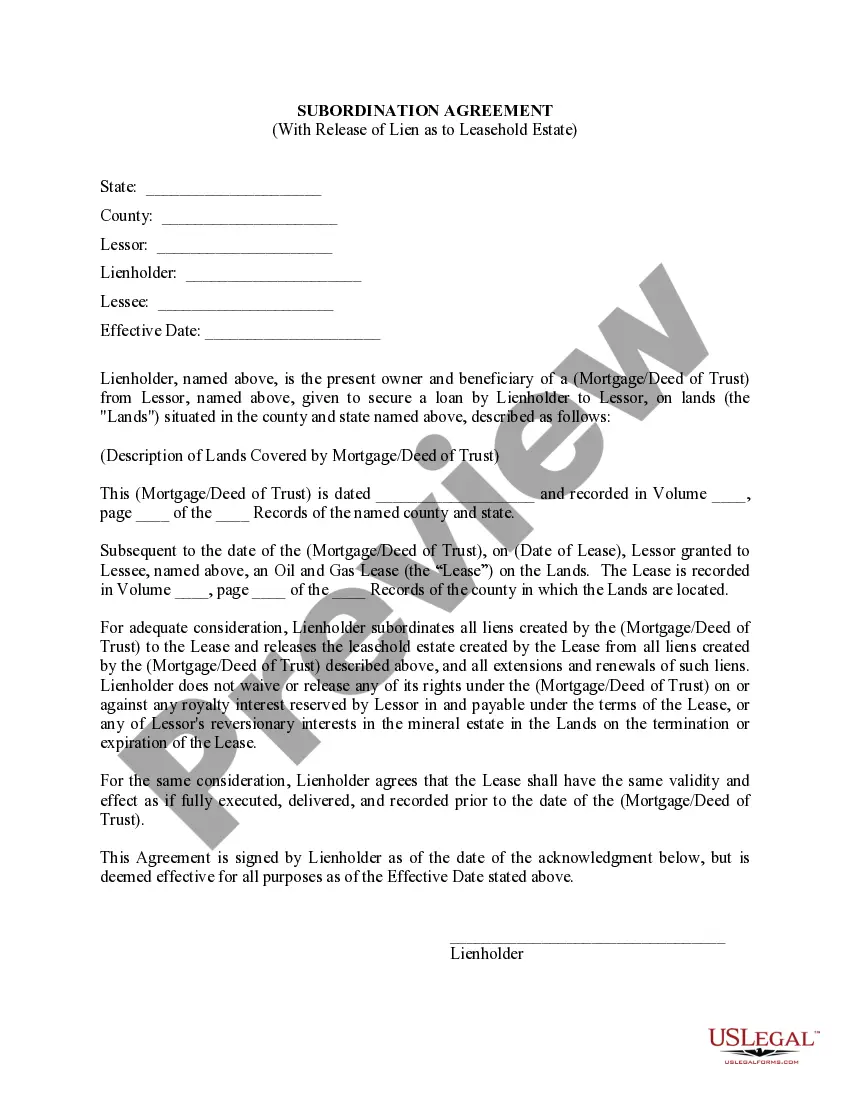

Fillable Subordination Agreement With Loan

Description

How to fill out Illinois Lease Subordination Agreement?

What is the most dependable service to obtain the Fillable Subordination Agreement With Loan and other recent iterations of legal documents? US Legal Forms is the answer!

It's the widest array of legal paperwork for any scenario. Each template is properly crafted and validated for adherence to federal and local statutes and regulations. They are categorized by area and state of application, making it easy to find what you require.

US Legal Forms is an ideal solution for anyone who needs to handle legal documentation. Premium users can enjoy more benefits as they can complete and sign the previously stored documents electronically at any time with the incorporated PDF editing tool. Try it out now!

- Experienced users of the website just need to Log In to the system, ensure their subscription is current, and click the Download button next to the Fillable Subordination Agreement With Loan to obtain it.

- After saving, the document remains accessible for future use within the My documents section of your account.

- If you haven't created an account with us yet, here are the steps you should follow to obtain one.

- Form compliance review. Before you acquire any template, you must verify whether it meets your use case requirements and complies with your state or county regulations. Review the form description and utilize the Preview if provided.

Form popularity

FAQ

Subordinations are, essentially, a way for a lender to ensure that their lien takes priority over any other liens a customer may have on their property. This process costs money, which is what you pay for in a subordination fee. This fee may apply to a mortgage refinance, depending on your circumstances.

Subordinate financing is debt financing that is ranked behind that held by secured lenders in terms of the order in which the debt is repaid. "Subordinate" financing implies that the debt ranks behind the first secured lender, and means that the secured lenders will be paid back before subordinate debt holders.

Subordination is the process of ranking home loans (mortgage, HELOC or home equity loan) by order of importance. When you have a home equity line of credit, for example, you actually have two loans your mortgage and HELOC. Both are secured by the collateral in your home at the same time.

Fee for Subordination:$100 for one mortgage and $150 for two mortgages. This fee may not be able to be charged to the borrower. Each financial institution will need to determine if this is allowed per their regulator and be prepared to pay the fee if required.

A subordination agreement is a legal document that establishes one debt as ranking behind another in priority for collecting repayment from a debtor. The priority of debts can become extremely important when a debtor defaults on payments or declares bankruptcy.