Rental House App

Description

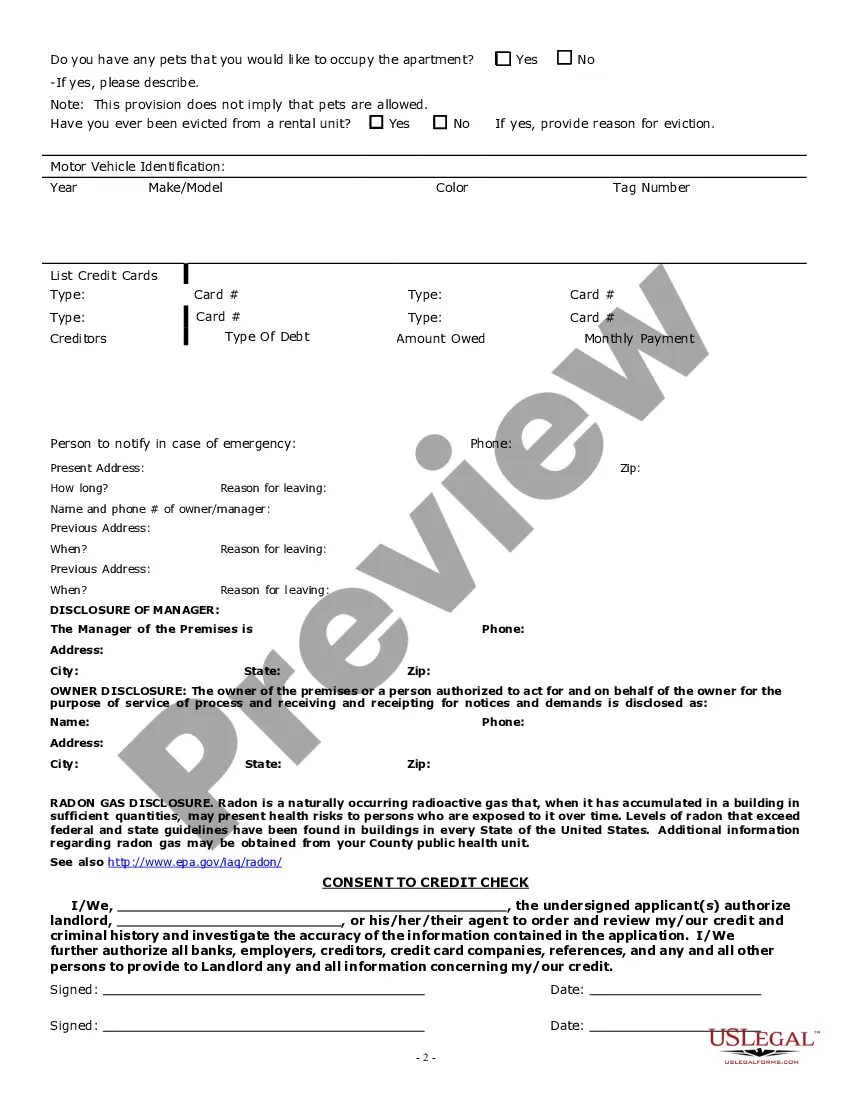

How to fill out Illinois Apartment Lease Rental Application Questionnaire?

- If you are an existing user, log into your account and select the necessary template. Ensure your subscription is active; if not, renew your subscription to proceed.

- For new users, start by checking the Preview mode and form description. Match the form to your requirements and ensure it complies with local laws.

- If you encounter any inconsistencies, utilize the Search tab to find additional templates that may suit your needs better.

- Purchase the document by clicking the Buy Now button and choosing a suitable subscription plan. You will be required to create an account to access the full library.

- Complete your transaction by entering your payment details or using PayPal.

- Download the form to your device and access it anytime through the My Forms section in your profile.

US Legal Forms empowers both individuals and attorneys by simplifying the legal document creation process. With a vast selection of forms and access to premium expert support, you can ensure your documents are completed accurately.

Don’t wait! Start your journey with US Legal Forms today and leverage the convenience of the Rental House App for all your legal needs.

Form popularity

FAQ

Organizing your rental property files begins with keeping digital and physical copies of important documents, such as leases, maintenance records, and tax documents. A rental house app can greatly simplify this process, allowing you to store and categorize your files in a user-friendly manner. This organization will save you time and stress come tax season or whenever you need documentation.

The IRS is notified of rental income through various reporting forms, such as 1099s and Schedule E forms on your tax return. If you use a rental house app, it will help you maintain accurate records, which is crucial for auditing purposes. Consequently, filing accurately ensures you remain compliant with tax regulations.

TurboTax can handle numerous rental properties, making it a flexible solution for property owners. Users can effectively manage and file taxes for multiple rental units through the rental house app. This capability allows you to keep all your rental incomes and expenses organized in one place.

Yes, you can definitely use TurboTax if you have a rental property. The software provides specific tools and features for users with a rental house app, allowing you to input your rental income and expenses easily. This ensures you receive the appropriate tax deductions and accurately file your returns.

To file income from rental, you need to report it on Schedule E of your tax return. Make sure to include all earnings generated from your rental house app, along with any deductibles like mortgage interest, repairs, and management fees. Keeping good records will help simplify this task during tax season.

Yes, you can use TurboTax Deluxe if you have investment income, as this version allows you to report various types of income. However, if you have a rental house app, keeping your rental and investment income organized within the software helps streamline your tax-filing process. This way, you’ll avoid confusion and ensure you report everything accurately.

The most tax-efficient way to own rental property often involves forming an LLC or a suitable business entity. This protects your personal assets while allowing you to deduct expenses related to your rental house app, such as maintenance costs, property taxes, and depreciation. Additionally, keeping detailed financial records will help ensure you maximize these benefits and minimize tax liabilities.

Filling out a rental verification form involves providing detailed information about your rental history and current situation. Ensure you include references from past landlords and any supporting documentation. Utilizing a rental house app can simplify the process by offering templates and guidelines for accuracy.

When filling out a landlord application, provide accurate information about your background and rental history. Be prepared to include details about your finances and employment. A rental house app will guide you through the required fields, ensuring that you submit a thorough application that meets landlords' expectations.

To list your house for rent online, start by taking high-quality photos and writing a compelling description. Choose popular rental platforms and consider using a rental house app to simplify the listing process. These apps often integrate with various websites, making it easier to manage inquiries and applications all in one place.