Apartment Rent

Description

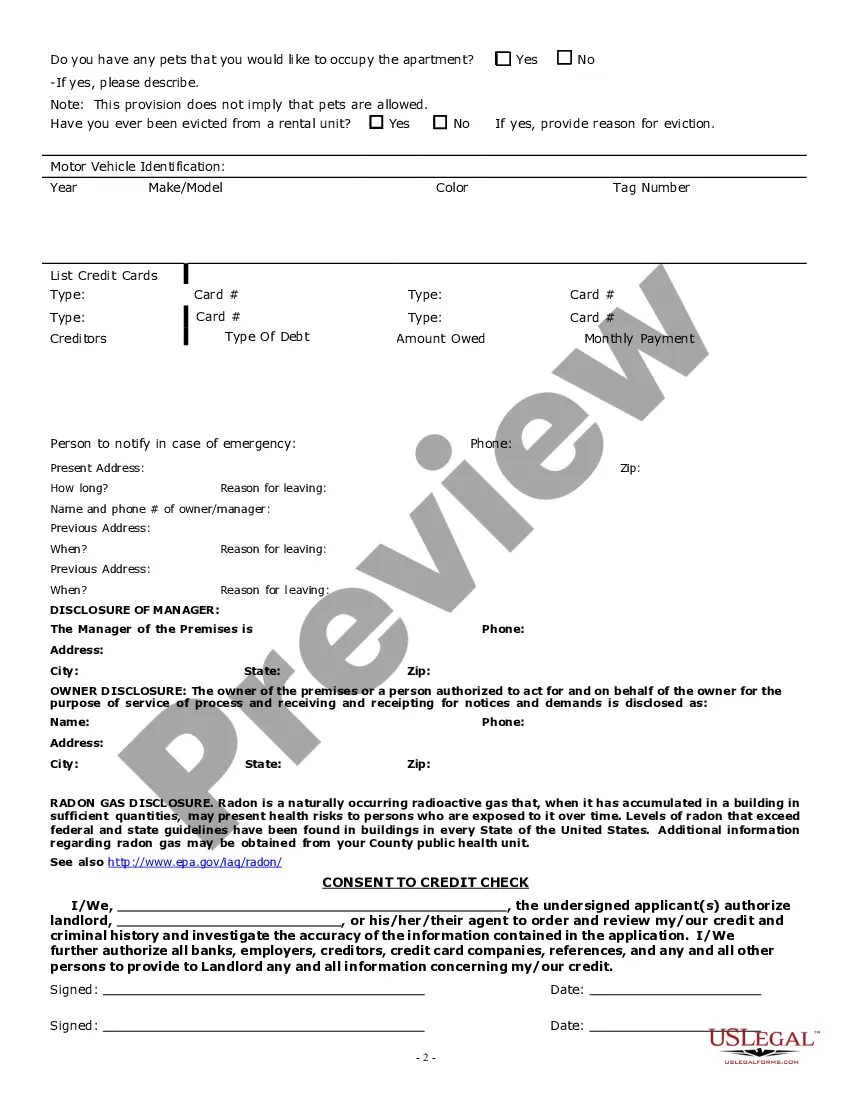

How to fill out Illinois Apartment Lease Rental Application Questionnaire?

- Log into your US Legal Forms account or create a new one for first-time users.

- Browse through the extensive collection and ensure you select the right form that complies with your local jurisdiction by checking the Preview mode.

- If you don’t find the correct template, utilize the Search feature to locate the appropriate form.

- Choose your preferred subscription plan by clicking the Buy Now button.

- Enter your payment details, using either a credit card or PayPal, to finalize your purchase.

- Download your completed document and save it securely on your device for future use. You can also find it anytime in the My Forms section.

Completing the above steps allows individuals and attorneys to quickly execute essential legal documents necessary for apartment rent. US Legal Forms offers a robust resource with over 85,000 forms that cater to various legal needs.

Start today and experience the simplicity of securing your legal documents with US Legal Forms. Visit their website now and empower yourself with the right tools!

Form popularity

FAQ

While getting approved to rent an apartment can seem daunting, many first-time renters successfully navigate the process. Preparation is key; having your financial documents in order and understanding the application requirements will help. Landlords generally want tenants who are responsible and can manage their apartment rent, so showcasing reliability will work in your favor.

Renting for the first time can present challenges, but many first-time renters successfully find suitable apartments. Knowing what landlords expect, such as documentation of income and rental history, can make the process smoother. Consider using resources like USLegalForms to access important documents and guides on apartment rent, which can help set you up for success.

Many landlords require that your monthly income be three times the rent amount. For example, if you find an apartment with a rent of $1000, your income should ideally be around $3000 per month. This requirement helps ensure that tenants can comfortably afford their apartment rent and other living expenses.

Getting approved for your first apartment can be challenging, but it is possible with the right preparation. Landlords often look for stable income and a good credit history. If you don’t have established credit, providing references or a co-signer may improve your chances of approval. Understanding the apartment rent process can also help alleviate concerns.

Affording an apartment on a $2000 monthly income depends on various factors, such as location and expenses. Typically, experts recommend that you spend no more than 30% of your income on apartment rent. This means you should aim for rent around $600 per month. Be sure to consider other costs, like utilities and groceries, too.

You can report your apartment rent, but it typically does not influence your federal taxes. On the state level, some regions allow for reporting rent to claim deductions. As tax rules can be intricate, leveraging platforms like US Legal Forms may help simplify the process and clarify what you need to report.

Generally, apartment rent is not claimable on federal income tax returns. However, some states allow renters to deduct certain amounts from their state taxes. Therefore, keep informed about your local tax laws and consider utilizing resources from US Legal Forms to clarify your options on reporting apartment rent.

Common tax-deductible housing expenses include mortgage interest, property taxes, and, in some cases, rent. Renters should check if their state allows for rent deductions, which can be beneficial for your tax situation. As you navigate these complexities, consider using US Legal Forms to identify relevant deductions and ensure compliance.

Yes, in some states, you can claim a portion of your apartment rent on your state taxes. The eligibility and specific benefits vary significantly from one state to another, so it's crucial to familiarize yourself with your state's rules. If you're unsure, US Legal Forms offers resources to help you determine what applies to your situation.

Generally, as a renter, you do not receive specific tax forms solely for apartment rent. However, if your landlord reports rental income or if you receive certain credits, you may deal with related tax documentation. Always maintain records of your rent payments, as they can be essential if your state offers rental deductions. US Legal Forms can help you access the necessary forms and guidance.