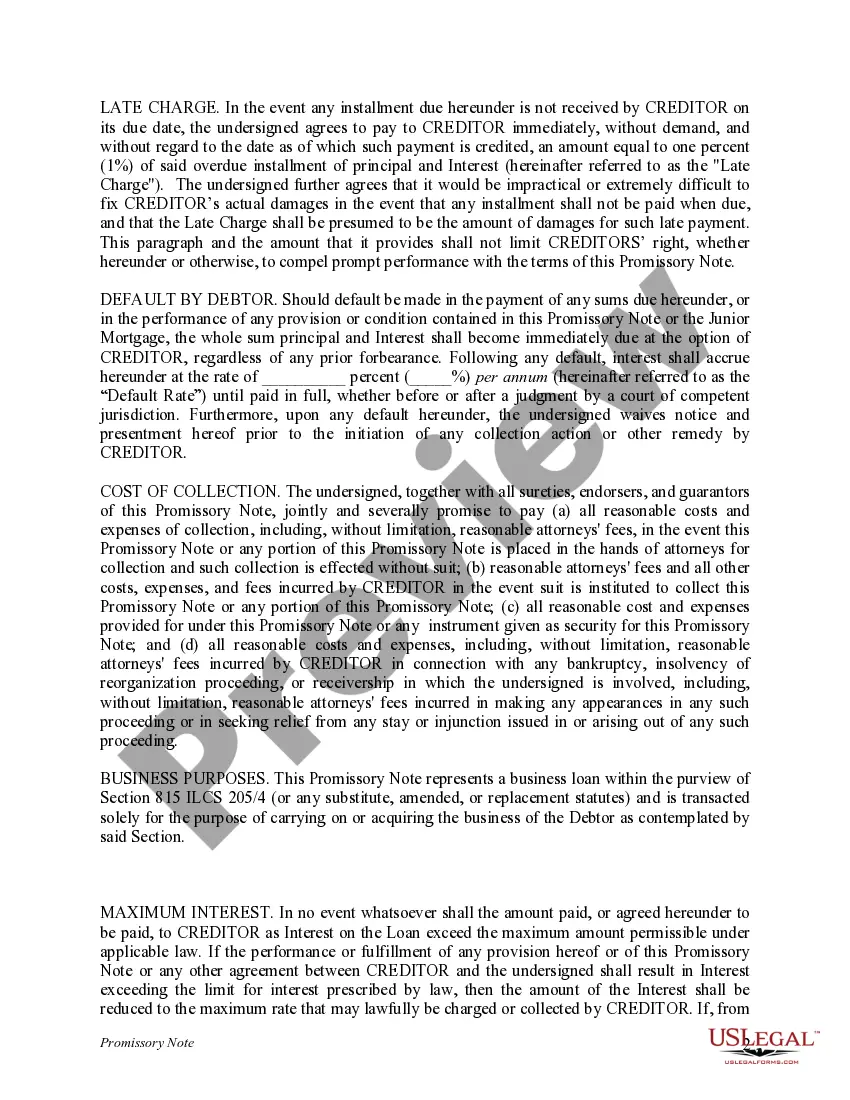

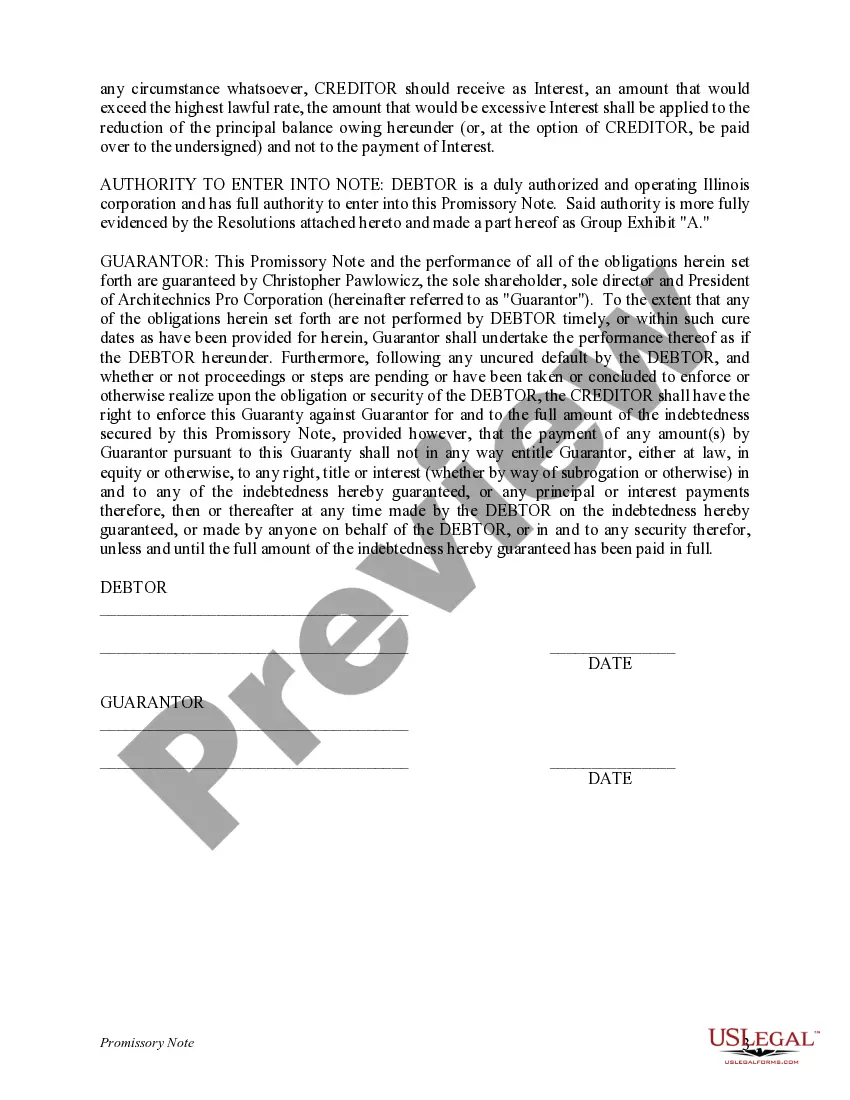

A promissory note is a legal document that outlines the terms and conditions of a loan or payment agreement between two parties. It serves as a written promise to pay a specific amount of money on a specified date or within a predetermined time frame. Promissory notes for payment are commonly used in various financial transactions and can be tailored to accommodate different situations and requirements. One example of a promissory note for payment is a demand promissory note. This type of note requires the borrower to repay the loan amount upon the lender's request. It does not have a fixed maturity date and is typically used for short-term loans or when the lender wants greater flexibility in determining when the payment is due. Another type of promissory note for payment is the installment promissory note. This note requires the borrower to make regular payments, either monthly, quarterly, or annually, over a specified period. The note includes the payment schedule, interest rate, and other terms related to the repayment of the loan. A balloon promissory note is yet another example wherein the borrower makes smaller periodic payments, often in the form of monthly installments, with a larger final payment due at the end of the term. This type of note is suitable for borrowers who expect a significant influx of cash or plan to refinance the loan before the balloon payment becomes due. A secured promissory note involves the borrower providing collateral as security for the loan repayment. The collateral could be personal assets, such as a car or house, which the lender can seize in case of default. Secured notes generally have lower interest rates compared to unsecured notes, as they pose less risk for the lender. On the other hand, an unsecured promissory note is not backed by any specific collateral. This type of note typically carries higher interest rates to compensate the lender for the increased risk involved. In conclusion, promissory notes for payment are versatile instruments that facilitate the borrowing and lending of money. They come in various types, including demand, installment, balloon, secured, and unsecured notes, catering to different financial scenarios and preferences of the involved parties.

Promissory Note Example For Payment

Description

How to fill out Illinois Promissory Note?

Utilizing legal templates that adhere to national and local regulations is essential, and the web provides countless alternatives to choose from.

However, what’s the benefit of wasting time looking for the right Promissory Note Example For Payment sample online when the US Legal Forms digital library has all of these templates compiled in a single location.

US Legal Forms is the largest online legal repository with over 85,000 editable templates created by attorneys for any business or personal situation. They are straightforward to navigate with all documents classified by state and intended use.

Utilize the search feature at the top of the page to look for an alternative sample if necessary.

- Our experts keep up with legislative changes, so you can always be confident that your form is current and compliant when obtaining a Promissory Note Example For Payment from our site.

- Acquiring a Promissory Note Example For Payment is quick and easy for both existing and new users.

- If you already possess an account with an active subscription, Log In and download the document sample you need in the correct format.

- If you are unfamiliar with our site, follow the instructions below.

- Review the template using the Preview option or through the text description to confirm it satisfies your requirements.

Form popularity

FAQ

Lifetime licenses are NOT going away. The new lifetime licenses include recreational hunting, fishing, and gear privileges. After June 1, 2022, a lifetime license will cost $500 for any individual, except seniors 65 and older.

You can take Louisiana's Hunter Education Course one of three ways: in the classroom, online with an additional field day component, or online only (for those age 16 and older).

(Licenses valid for 365 Days from Purchase) Resident, Military & StudentHuntingBasic Hunting (required for all hunters; additional licenses are required to hunt deer, waterfowl and turkey)$20.00Deer (includes archery and primitive; includes tags; required for all deer hunters in addition to Basic Hunting) 1$15.0024 more rows

Lifetime Licenses Lifetime License FeesLifetime Hunt/Fish (0-17 years old)$500Lifetime Hunt/Fish (18 years and older)$500Non-Resident Lifetime Hunt/Fish$4,000Lifetime Resident Senior Hunt/Fish (65 or older)$100

Select the Hunting category either on the left menu, or on mobile devices, in the dropdown menu at the top. Press the + button next to Deer and/or Turkey tags. If you already hold a Lifetime or Senior license on this account, your cart total will be $0. Click "Download License" to download and print your tags.

Lifetime Licenses Email it to lifetime@wlf.la.gov. Scan and attach the application and all required documents (including birth certificate) to your email. ... Mail it to the address below with all required documents and a check, money order, or cashier's check for your license fees: LDWF.

ALLOW 3 WEEKS FOR DELIVERY. TO AVOID ADDITIONAL FEES, CONTACT OUR OFFICE AT (225) 765-2887 IF LICENSE IS NOT RECEIVED WITHIN 30 DAYS. LIFETIME LICENSES ARE NONREFUNDABLE AND NONTRANSFERABLE. License application must be completed, signed, and all requested information provided or application will be returned.

DO I NEED A HUNTING LICENSE TO HUNT WITHIN THE STATE OF LOUISIANA? Yes. A Hunting License is different from a Hunter Education Certificate and is required for any person who hunts any game animal within the state. This includes both residents and non-residents.