Quiet Enjoyment Illinois Without Lease

Description

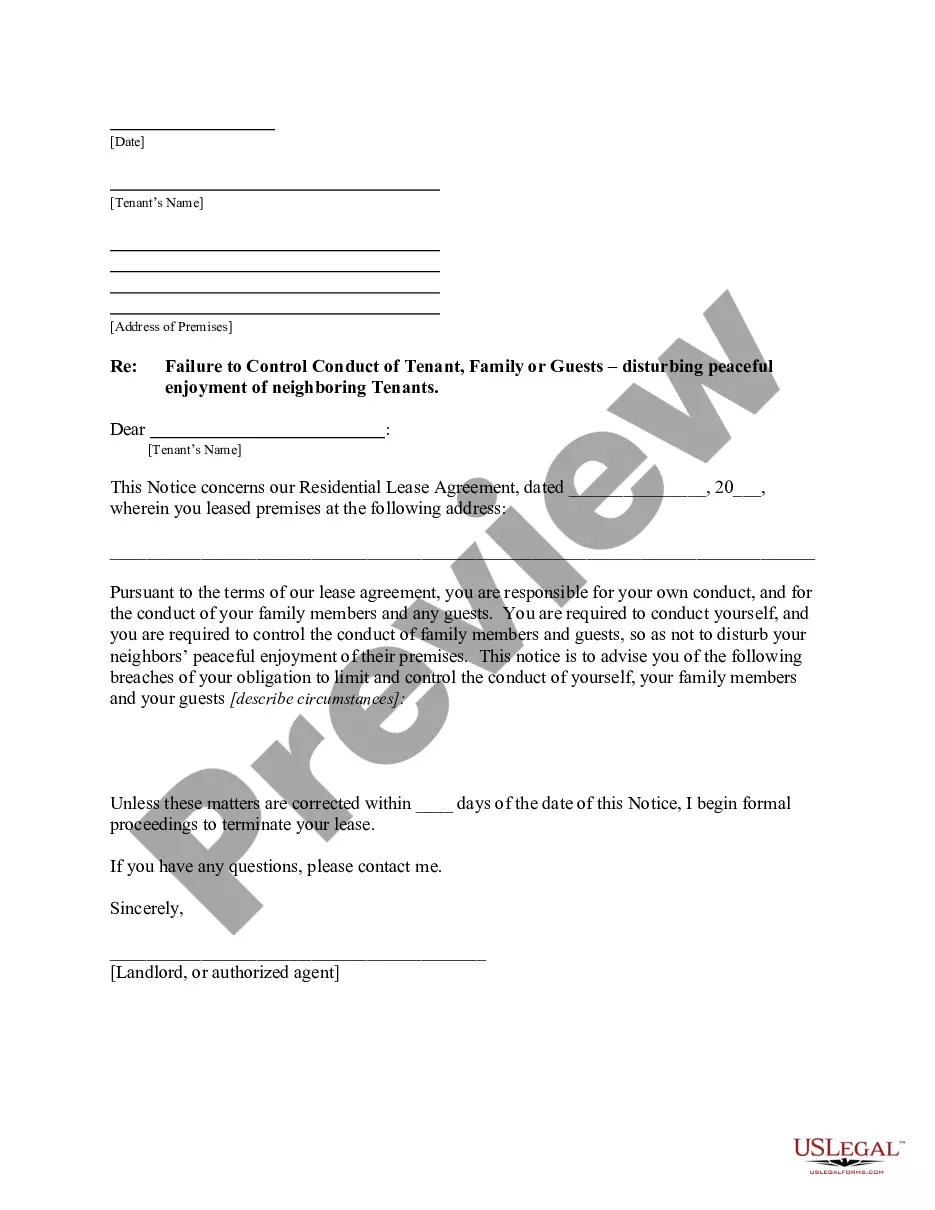

How to fill out Illinois Letter From Landlord To Tenant As Notice To Tenant Of Tenant's Disturbance Of Neighbors' Peaceful Enjoyment To Remedy Or Lease Terminates?

Managing legal documentation and processes can be an exhaustive addition to your schedule. Quiet Enjoyment Illinois Without Lease and similar forms often necessitate that you locate them and understand how to fill them out accurately.

As a result, whether you're addressing financial, legal, or personal issues, utilizing a comprehensive and easy-to-navigate online collection of forms when you require it will be immensely beneficial.

US Legal Forms is the leading web platform for legal templates, featuring over 85,000 state-specific documents and a variety of tools to help you complete your paperwork with ease.

Browse the collection of pertinent documents accessible to you with just a single click.

Then, follow the steps below to complete your form: Ensure you have identified the correct form using the Preview option and reviewing the form details. Click Buy Now when ready, and select the subscription plan that suits your requirements. Click Download then complete, sign, and print the form. US Legal Forms boasts twenty-five years of experience assisting users with their legal documents. Find the form you need today and streamline any process effortlessly.

- US Legal Forms provides you with state- and county-specific documents available at any time for download.

- Protect your document management processes with a high-quality service that enables you to create any form in minutes without extra or hidden fees.

- Simply Log In to your account, locate Quiet Enjoyment Illinois Without Lease, and download it immediately from the My documents section.

- You can also access previously saved documents.

- If this is your first time using US Legal Forms, register and create a complimentary account in just a few minutes to gain access to the form collection and Quiet Enjoyment Illinois Without Lease.

Form popularity

FAQ

The main differences between Wyoming LLCs and Delaware LLCs are cost and reputation. Wyoming LLCs provide stronger privacy, stronger asset protection, and lower fees. Delaware LLCs are more expensive to maintain, but Delaware has the reputation of being home to Fortune 500 companies.

Wyoming's charging order protection laws are effective for members to protect their LLC assets and ownership from creditors. However, that protection does not extend outside of Wyoming. Members living out of state will have to deal with different laws protecting their LLC assets from garnishment by creditors.

How much does an LLC in Wyoming cost per year? All Wyoming LLCs need to pay $60 per year for the Annual Report (aka Wyoming Annual License Tax). These Wyoming LLC fees are paid to the Secretary of State. And this is the only state-required annual fee.

State income taxes are paid where the money is made. So in Steven's case, he would get no tax advantages whatsoever by having an LLC in Wyoming and instead, he'd be paying all his state income taxes in California. What's worse, is that the Wyoming Department of Revenue may require an informational return to be filed.

To make amendments to your Wyoming Corporation, you provide in duplicate the completed Profit Corporation Articles of Amendment form and provide it to the Secretary of State by mail or in person, along with the filing fee.

We commonly use the Wyoming Secretary of State's website to search for business filings. Their online portal allows you to see what company names are available, what filings have been accepted and provides a snapshot of each company's corporate history. Every company document can be searched, viewed and downloaded.

Risks of an LLC Loss of Limited Liability. Although an LLC enjoys limited liability, poor practices could result in an LLC losing its liability shield. ... Difficulty Obtaining Investors. ... Pass-Through Taxation.

Wyoming LLCs are taxed as pass-through entities by default. This means that revenue from the business passes from the LLC to the tax returns of the LLC members. Members are then responsible for paying federal income taxes and the 15.3% self-employment tax (12.4% social security and 2.9% Medicare).