Chicago Title Quit Claim Deed Form Illinois

Description

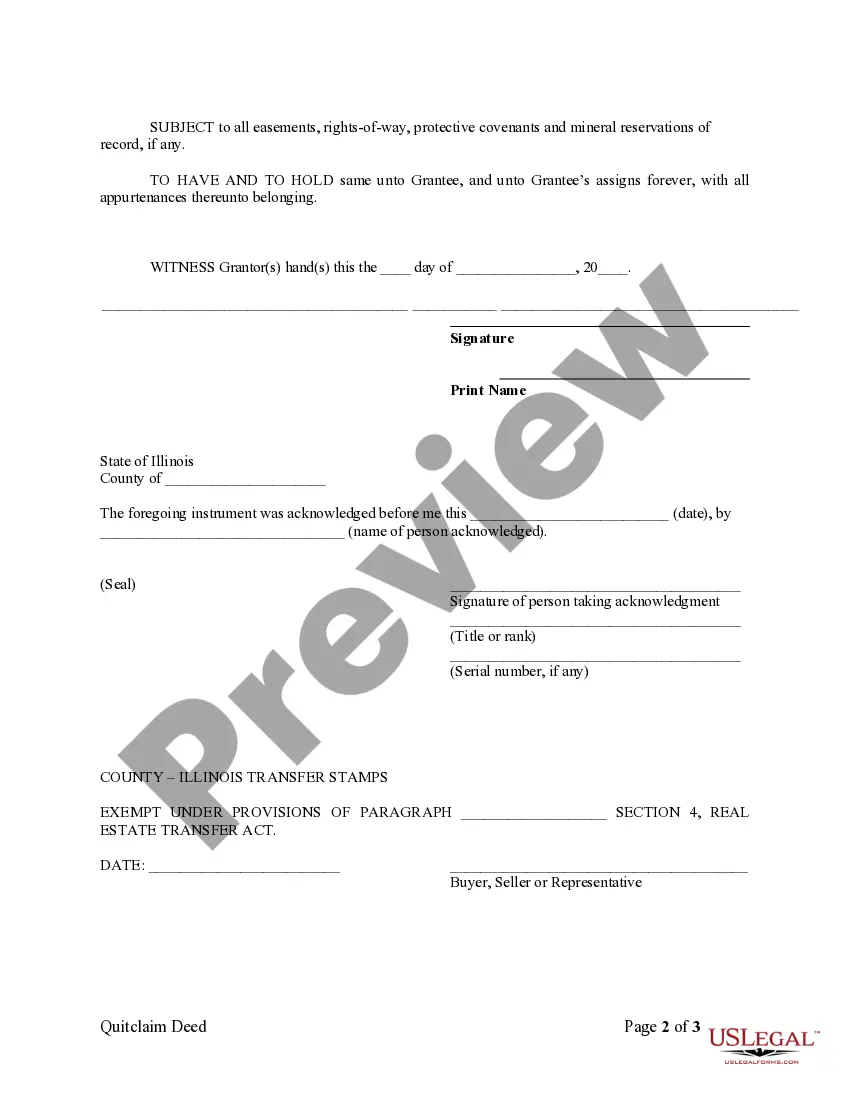

How to fill out Illinois Quitclaim Deed From Individual To LLC?

Getting a go-to place to take the most current and relevant legal templates is half the struggle of working with bureaucracy. Choosing the right legal papers requirements precision and attention to detail, which is the reason it is very important to take samples of Chicago Title Quit Claim Deed Form Illinois only from trustworthy sources, like US Legal Forms. An improper template will waste your time and delay the situation you are in. With US Legal Forms, you have very little to worry about. You can access and check all the information regarding the document’s use and relevance for your circumstances and in your state or county.

Take the listed steps to complete your Chicago Title Quit Claim Deed Form Illinois:

- Use the library navigation or search field to find your template.

- Open the form’s information to check if it matches the requirements of your state and area.

- Open the form preview, if available, to ensure the template is the one you are searching for.

- Resume the search and locate the right document if the Chicago Title Quit Claim Deed Form Illinois does not fit your requirements.

- When you are positive about the form’s relevance, download it.

- When you are an authorized user, click Log in to authenticate and gain access to your picked forms in My Forms.

- If you do not have an account yet, click Buy now to obtain the form.

- Choose the pricing plan that fits your needs.

- Go on to the registration to finalize your purchase.

- Finalize your purchase by choosing a payment method (credit card or PayPal).

- Choose the file format for downloading Chicago Title Quit Claim Deed Form Illinois.

- When you have the form on your device, you can change it using the editor or print it and complete it manually.

Eliminate the inconvenience that comes with your legal documentation. Explore the comprehensive US Legal Forms collection where you can find legal templates, examine their relevance to your circumstances, and download them immediately.

Form popularity

FAQ

Before you file the deed, get a tax stamp from the local municipality where the property is located. When you're ready to file the deed, bring it to the County Recorder of Deeds, where they will stamp and file the deed. You'll have to pay a fee for recording, or filing, the deed.

If you're preparing the quitclaim deed yourself, make sure to enter the property description just as it appears on an older deed of the property. If you can't find an old deed, check with the County Recorder of Deeds in the county where the property is located. They can tell you where to get a copy of an earlier deed.

LEGAL FEES - ILLINOIS QUIT CLAIM DEEDS The fee is $150 (or $160 if paid by credit card). It will be your responsibility to get the transfer stamps (if necessary) and get the deed recorded with the County Recorder. There is nothing legal about obtaining the municipal stamp and recording the deed.

How do you file a quit claim deed in Illinois? To file an Illinois quitclaim deed form, you must bring your signed and notarized quitclaim deed to the County Recorder's office in the county where the property is located. Make sure that you also bring the required fees.

Form PTAX-203, Illinois Real Estate Transfer Declaration, is completed by the buyer and seller and filed at the county in which the property is located. Form PTAX-203-A, Illinois Real Estate Transfer Declaration Supplemental Form A, is used for non-residential property with a sale price over $1 million.