Illinois Quitclaim Deed from Individual to LLC

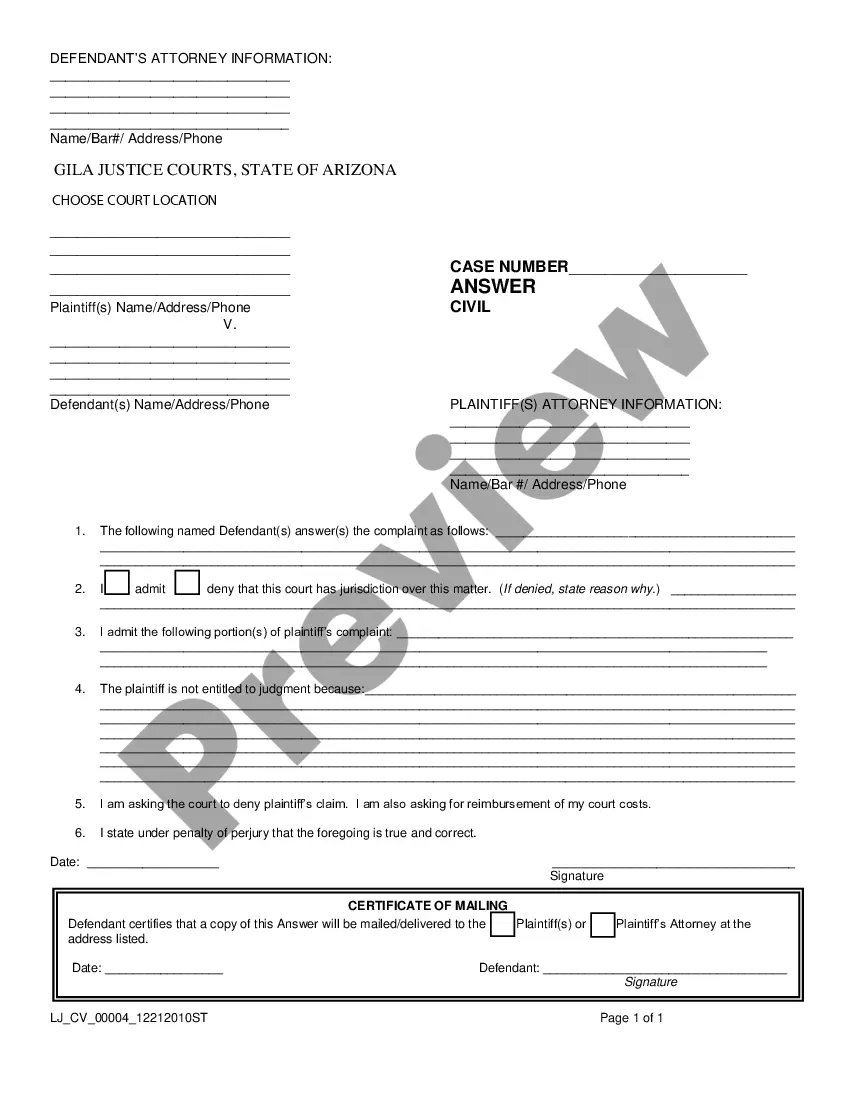

What is this form?

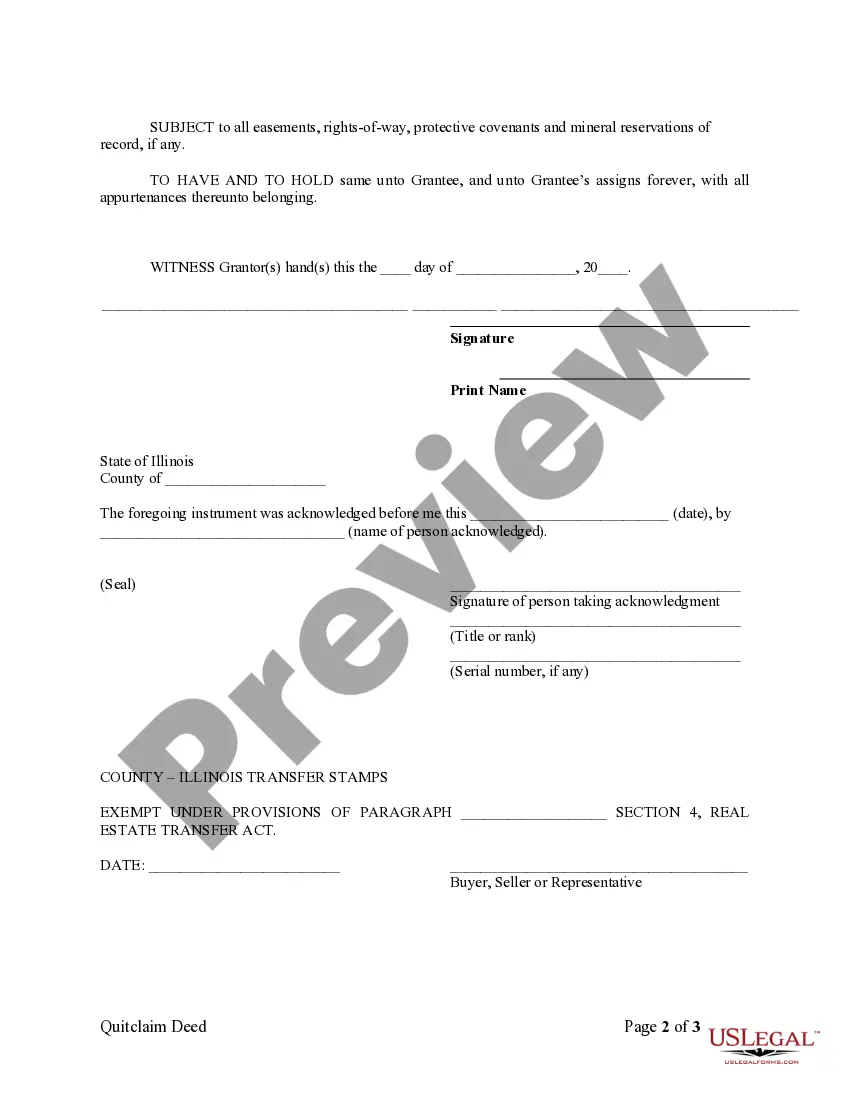

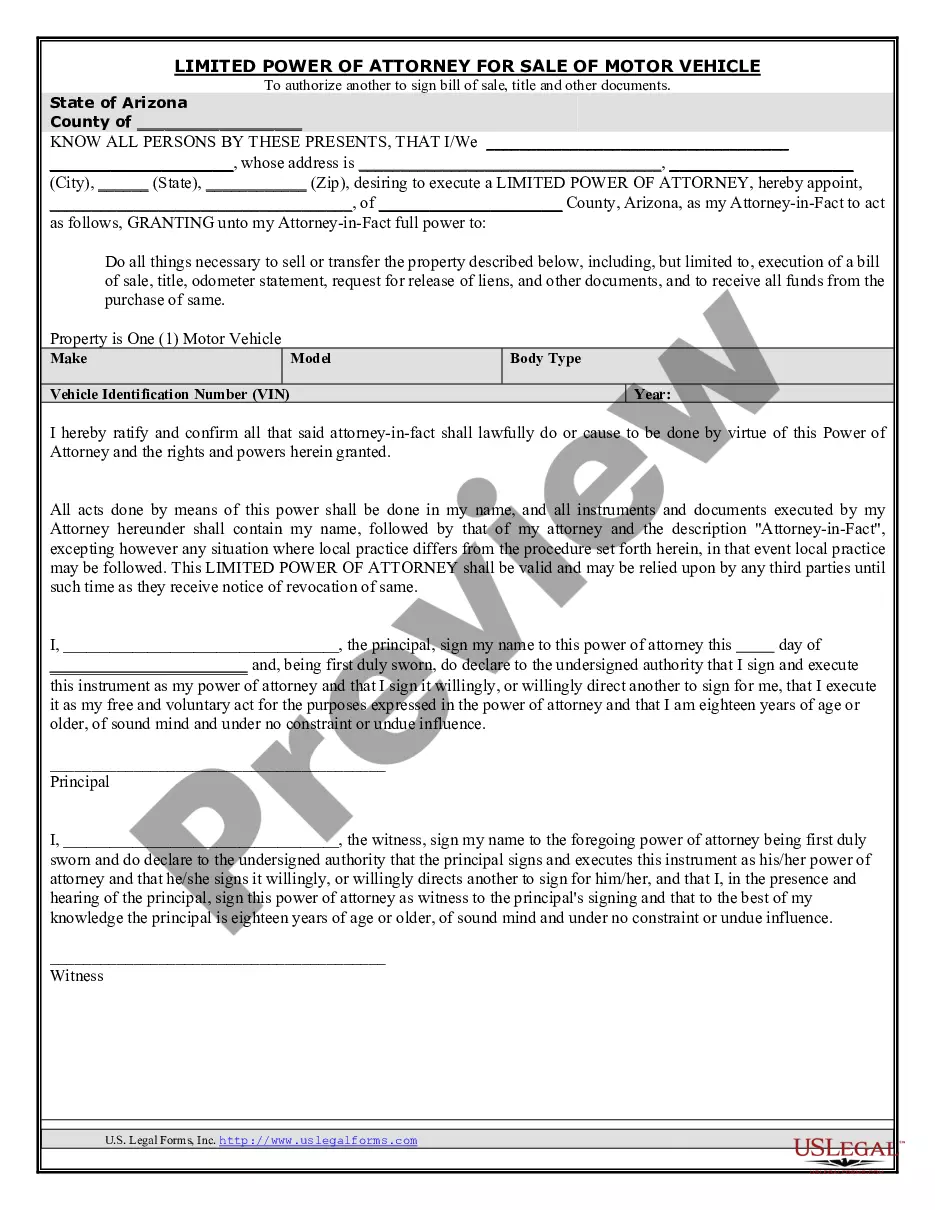

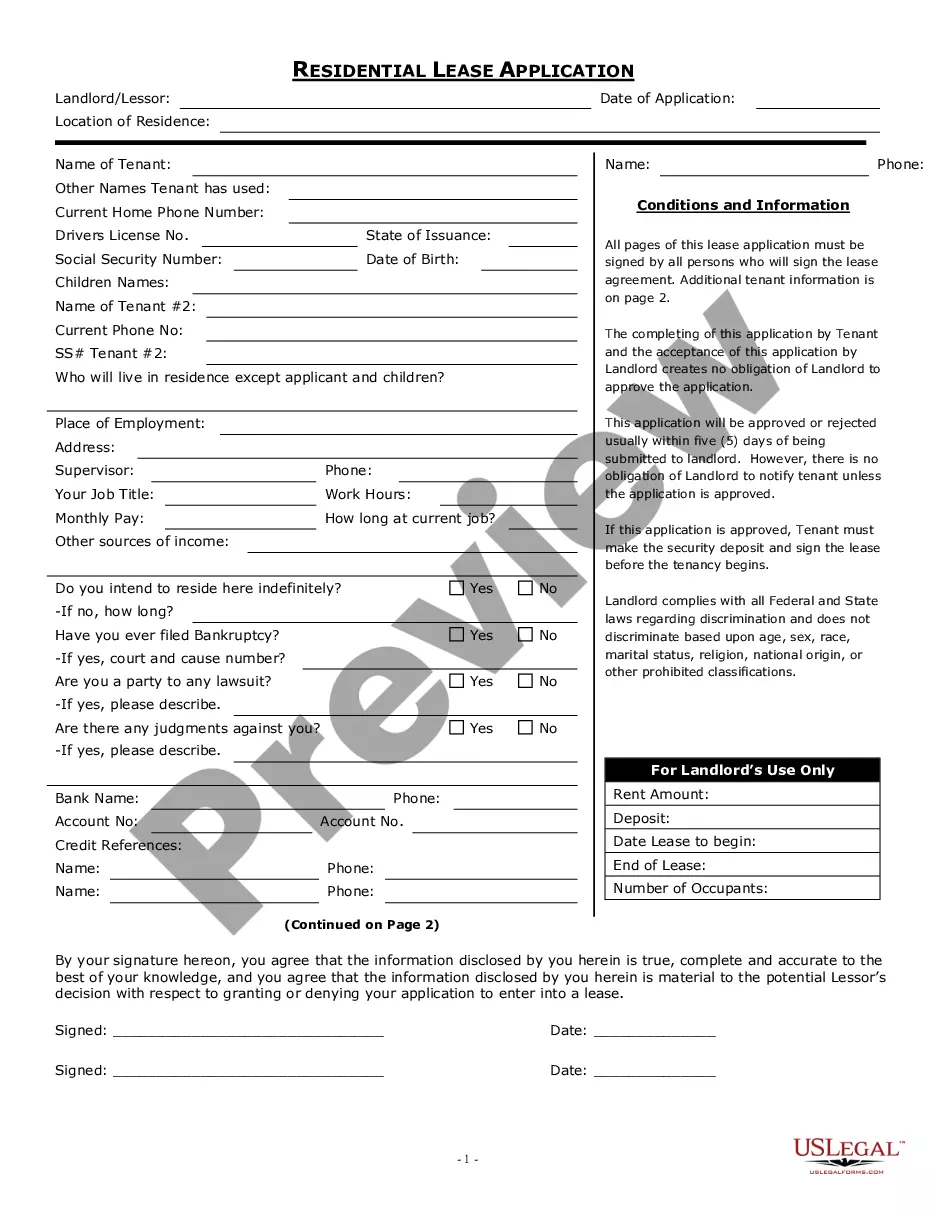

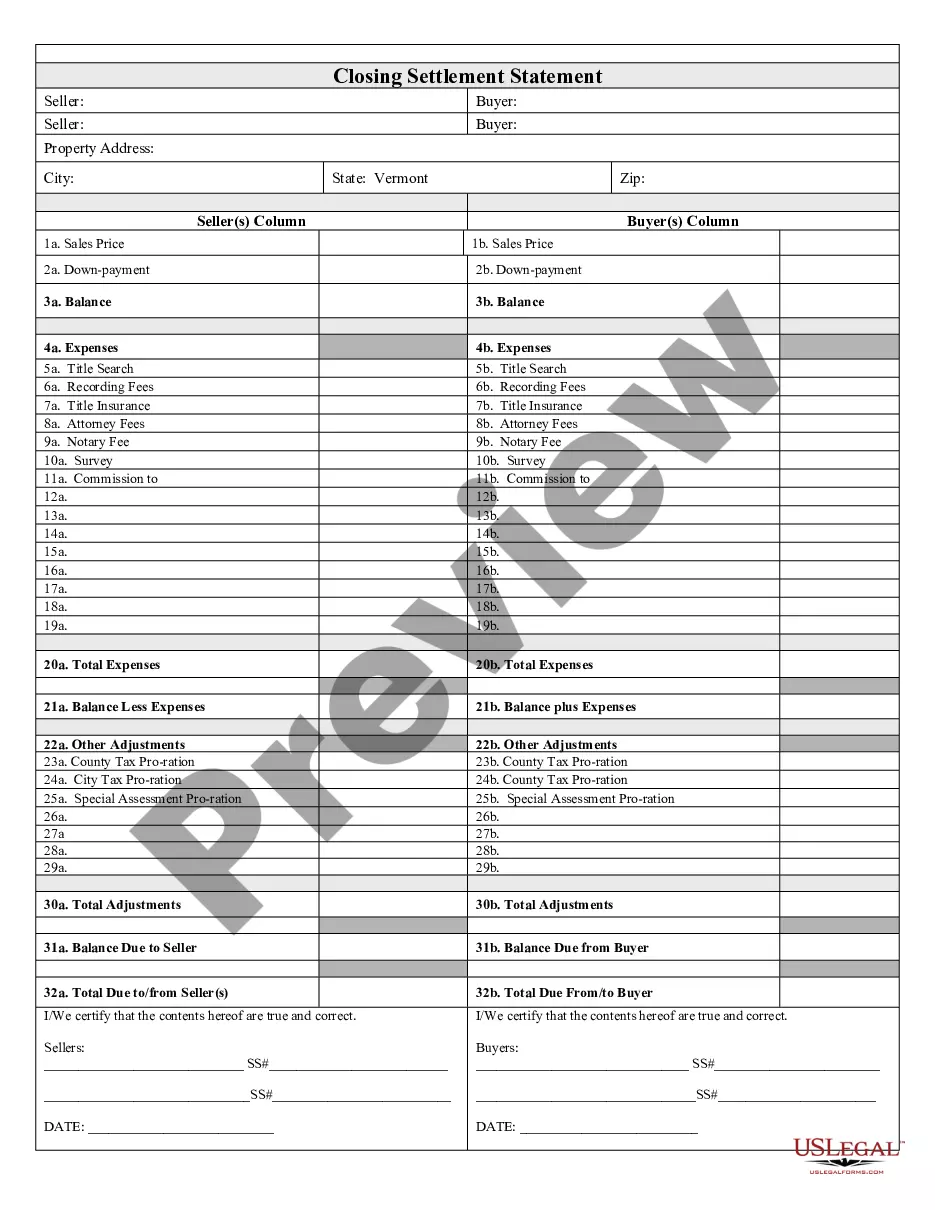

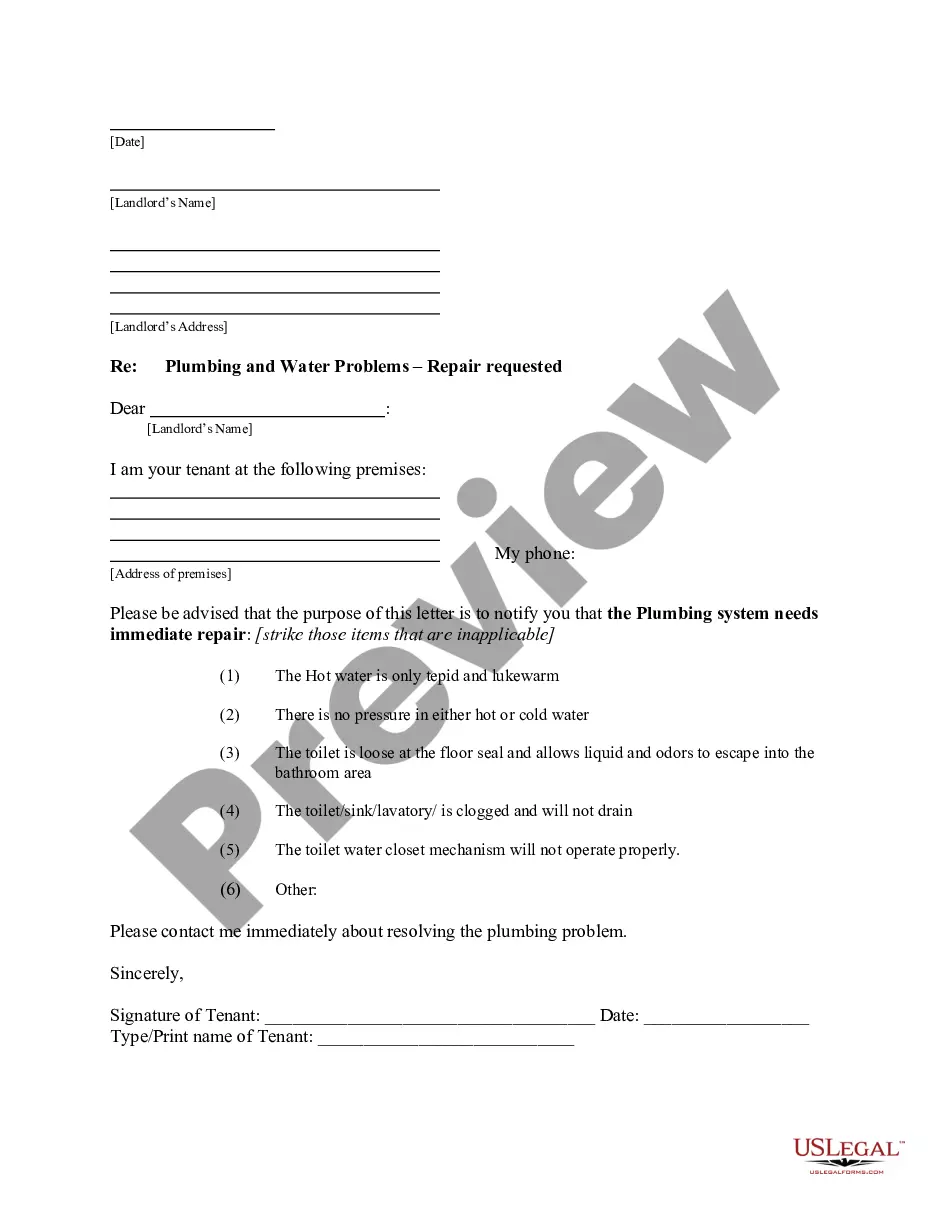

The Quitclaim Deed from Individual to LLC is a legal document used to transfer property ownership from an individual (the grantor) to a limited liability company (the grantee). Unlike other deeds, a quitclaim deed does not guarantee that the grantor holds clear title to the property. This form specifically excludes any oil, gas, and minerals from the property transfer, which may have implications for the grantee in future dealings. The primary purpose of this deed is to document the transfer and clarify ownership rights, making it distinct from warranty deeds that offer more legal protection to the grantee.

Key parts of this document

- Identification of the grantor and grantee.

- Legal description of the property being transferred.

- Clause reserving oil, gas, and mineral interests.

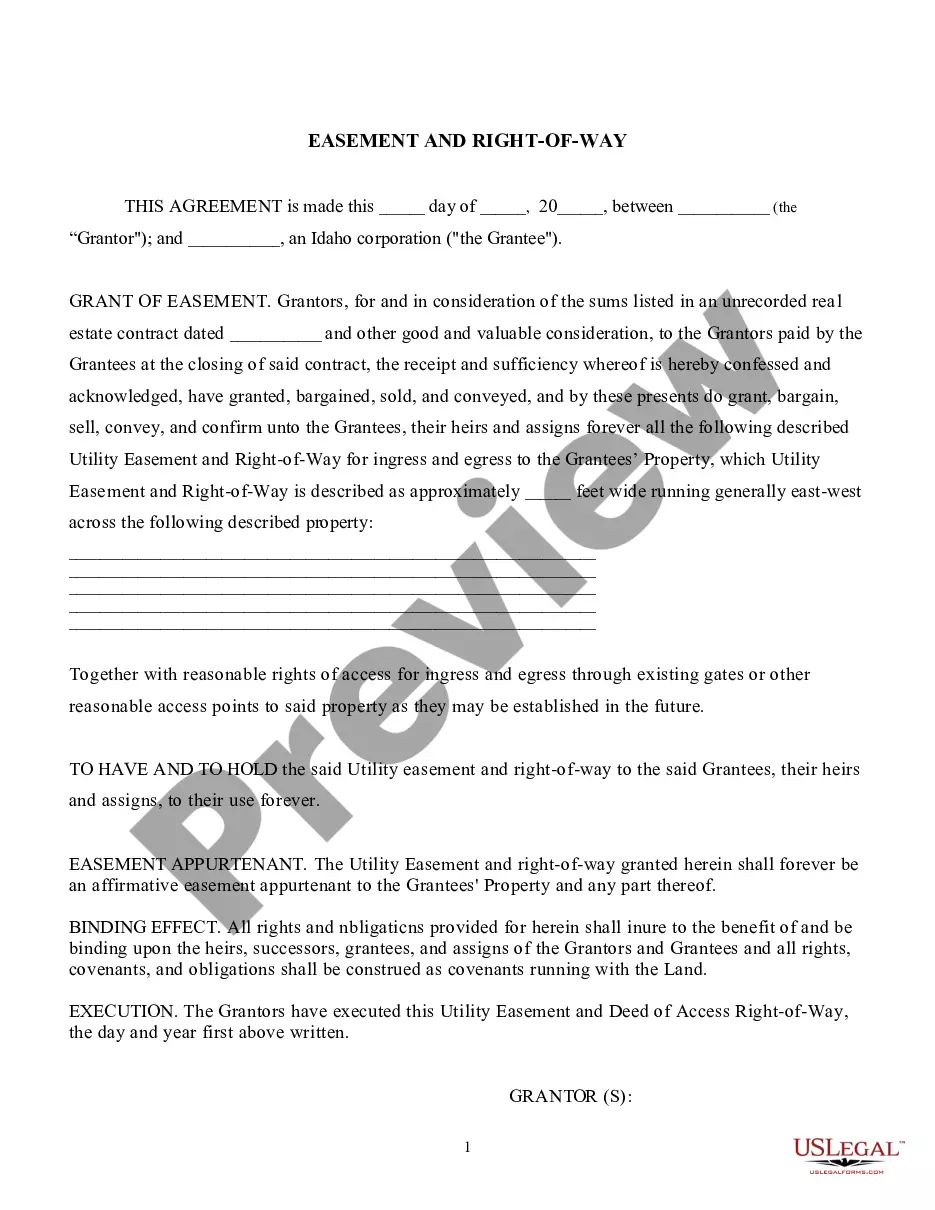

- Applicable easements and rights-of-way specifics.

- Signatures of both parties and acknowledgment by a notary public.

When to use this form

This form should be used when an individual wishes to transfer property to a limited liability company, particularly when the transfer is straightforward and there is no need for a warranty of title. Common scenarios include real estate transactions where ownership is being simplified for business purposes, estate planning for asset protection, or transferring property to a business entity to facilitate operations.

Who needs this form

This form is suitable for:

- Individuals transferring property to their own LLC.

- Business owners simplifying ownership structures.

- Lawyers or legal representatives handling property transfers for clients.

Instructions for completing this form

- Identify the parties involved by entering the grantor's name and the LLC's name.

- Provide a detailed legal description of the property in the designated section.

- Include any reservations for oil, gas, and mineral interests as specified.

- Specify any relevant easements or rights-of-way affecting the property.

- Sign the form in the presence of a notary public, ensuring all parties have signed.

Notarization guidance

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to provide a complete legal description of the property.

- Neglecting to have the form notarized, which could render it invalid.

- Not clearly stating the reservation of mineral rights, leading to potential disputes.

Benefits of using this form online

- Convenience of completing the form from anywhere, at any time.

- Editability allows for easy corrections before finalizing the document.

- Access to templates drafted by licensed attorneys ensures legal compliance.

What to keep in mind

- The Quitclaim Deed from Individual to LLC is essential for transferring property ownership without warranties.

- Ensure all details are accurately filled out to avoid potential legal issues.

- This form requires notarization to ensure its validity and enforceability.

Looking for another form?

Form popularity

FAQ

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.

A Quitclaim Deed must be notarized by a notary public or attorney in order to be valid.Consideration in a Quitclaim Deed is what the Grantee will pay to the Grantor for the interest in the property.

Quitclaim deeds are most often used to transfer property between family members. Examples include when an owner gets married and wants to add a spouse's name to the title or deed, or when the owners get divorced and one spouse's name is removed from the title or deed.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

However, there are substantial downsides associated with transferring your primary home into an LLC.If you are using your personal residence for estate planning purposes, a qualified personal residence trust (QPRT) may be more effective than transferring your property to a limited liability company.

How to Quitclaim Deed to LLC. A quitclaim deed to LLC is actually a very simple process. You will need a deed form and a copy of the existing deed to make sure you identify titles properly and get the legal description of the property.

Recording - A quit claim deed in Illinois is to be filed with the appropriate County Recorder's Office along with the appropriate fees (if they haven't already been paid). Signing - Before being filed with the County Recorder's Office, a quit claim deed must be signed by the Grantor in the presence of a Notary Public.

Fill out the quit claim deed form, which can be obtained online, or write your own using the form as a guide. The person giving up the interest in the property is the grantor, and the person receiving the interest is the grantee.

A quitclaim deed is a legal instrument that is used to transfer interest in real property.The owner/grantor terminates (quits) any right and claim to the property, thereby allowing the right or claim to transfer to the recipient/grantee.