Limited Limited

Description

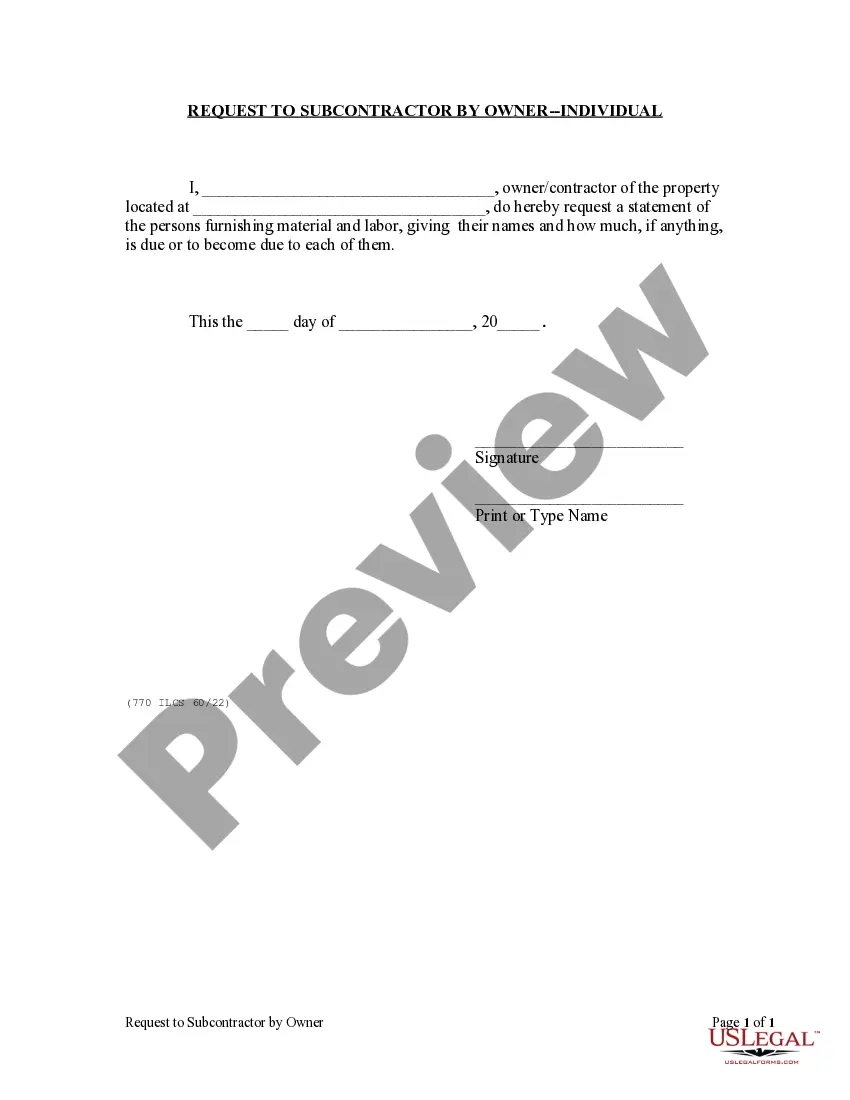

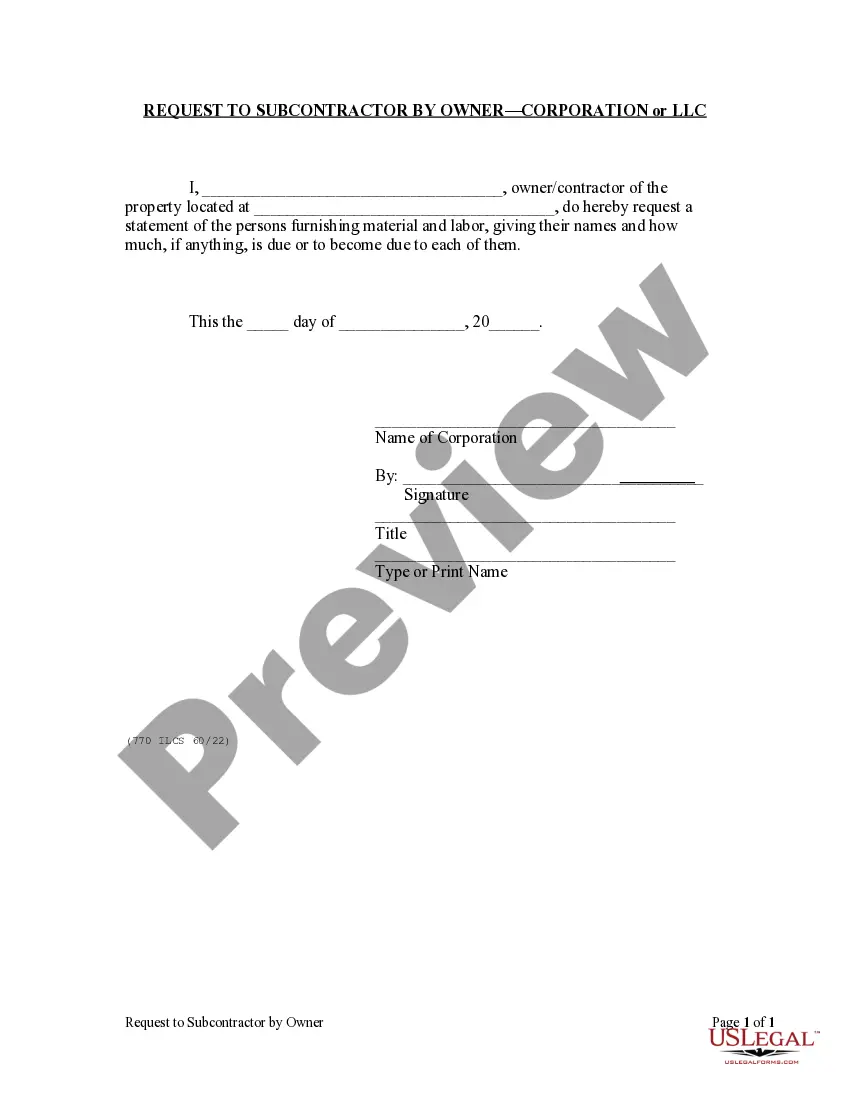

How to fill out Illinois Request By Owner To Subcontractor For List Of Suppliers, Labor - Mechanic Liens - Corporation Or LLC?

- Log in to your account if you're a returning user. Ensure your subscription is active; renew it if necessary.

- Preview available forms to confirm you’ve selected the one that aligns with your local legal requirements.

- If needed, utilize the search feature to find an alternative template that fulfills your needs.

- Procure the document by clicking the 'Buy Now' button and selecting your desired subscription plan; account registration is essential for full access.

- Complete your purchase using a credit card or PayPal for a smooth transaction.

- Download the form onto your device. You can revisit and manage your documents anytime through the 'My Forms' section in your profile.

In conclusion, US Legal Forms offers a streamlined process for obtaining legal documents tailored to your needs. With its extensive library and professional guidance, you can be confident in the legality of your forms.

Start creating your legal documents with US Legal Forms today!

Form popularity

FAQ

Yes, an LLC can have more than 100 members, unlike S Corporations, which cap ownership at 100. This flexibility allows businesses to grow and accommodate as many partners as needed, making it ideal for larger ventures or investments. Having more members can diversify skills and resources within the LLC. For assistance with forming an LLC that meets your needs, turn to U.S. Legal Forms for reliable solutions.

To fill out a W-9 for an LLC, provide the legal name of the LLC and its tax classification. If the LLC has more than one member, ensure you check the box for 'Partnership' or 'Corporation' under the relevant section. Accuracy is crucial when submitting your W-9, as it determines how you will report taxes. U.S. Legal Forms can help you with easy-to-follow examples for completing your W-9.

Yes, you can have 50/50 ownership in an LLC, which allows for equal sharing of profits, losses, and decision-making responsibilities. This arrangement fosters collaboration and shared accountability among members. To ensure you set up this structure correctly and effectively, utilize U.S. Legal Forms for clear instructions and comprehensive templates.

Yes, an LLC can have unlimited partners, which provides substantial flexibility in ownership arrangements. This characteristic makes LLCs an attractive option for various business ventures. Having more partners can lead to pooled resources and shared expertise, enhancing your business potential. Use U.S. Legal Forms for correct guidance on setting up an LLC with multiple partners.

An LLC, or limited liability company, is not limited to 100 members. Unlike S Corporations, LLCs can have an unlimited number of members, offering more flexibility in ownership. This structure combines the benefits of limited liability and fewer formalities. For those interested in forming an LLC, U.S. Legal Forms offers various resources to help you through the process.

The S Corporation, a popular business structure, is limited to 100 owners or shareholders. This restriction helps maintain a simpler structure for tax purposes while allowing for corporate benefits. It's an excellent option for small businesses looking to enjoy the advantages of limited liability. If you need assistance with setting up an S Corporation, consider resources provided by U.S. Legal Forms.

To fill out a limited power of attorney form, start by clearly stating the scope of authority you are granting. Specify the time period and any specific tasks the agent can perform on your behalf. Additionally, include your personal information, the agent's details, and provide your signature. You can streamline this process by using the U.S. Legal Forms platform, which provides templates and guidance for a limited limited power of attorney.

Roblox limited U refers to specific items that players can buy, sell, and trade with limited availability. These items often offer unique designs and can become highly sought after over time. Engaging with limited limited items can enhance your Roblox gameplay and trading experience. By participating actively in the marketplace, you can leverage these items effectively.

Ltd. Ltd. typically refers to limited editions of items or products that are available only for a short time. In Roblox, this means unique items that are not commonly distributed, creating a sense of exclusivity. Collectors often seek Ltd. Ltd. items for their rarity. Paying attention to these limited limited offerings can improve your collection's value.

Yes, you can trade limited U items within Roblox. Trading allows players to exchange items of varying values, enhancing your inventory. These trades encourage collaboration and strategy among gamers. If you're interested in transactions involving limited limited, consider the market trends before making a deal.