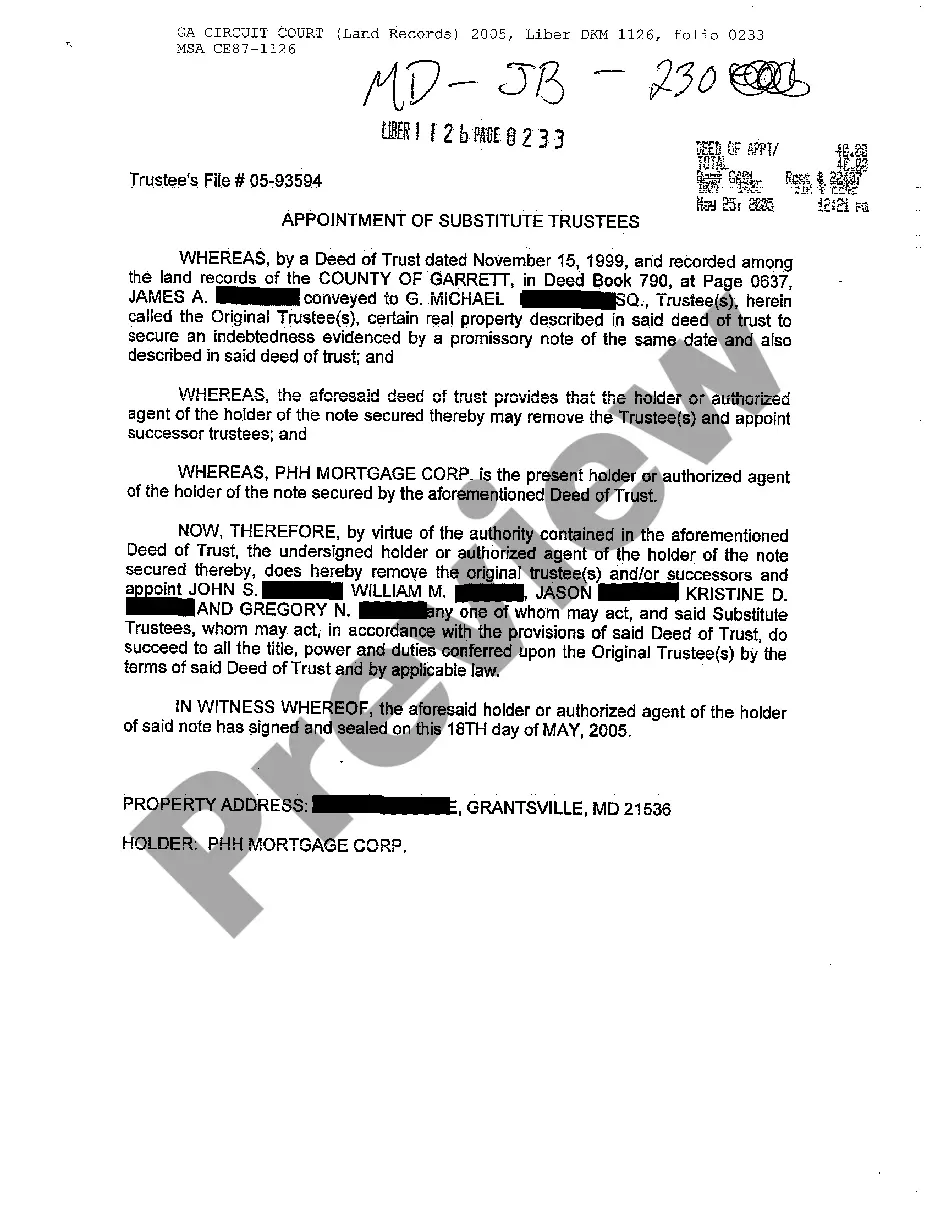

An agreement modifying a loan agreement and mortgage should be signed by both parties to the transaction and recorded in the office of the register of deeds and mortgages where the original mortgage was recorded. Such a modification is contractual in nature and should be supported by consideration.

Modification Mortgage Loan With Low Cibil Score

State:

Illinois

Control #:

IL-01400BG

Format:

Word;

Rich Text

Instant download

Description

Free preview

Form popularity

FAQ

Getting a mortgage modification with a low CIBIL score can present challenges, but it is not impossible. Lenders often consider various factors, including your current financial situation, the reason for your low score, and your overall debt-to-income ratio. While a low CIBIL score may complicate the process, demonstrating consistent payment history and a willingness to cooperate can improve your chances. Additionally, using platforms like US Legal Forms can guide you through the application process, helping you understand your options for a mortgage modification.