Llc Company Form For Company Registration

Description

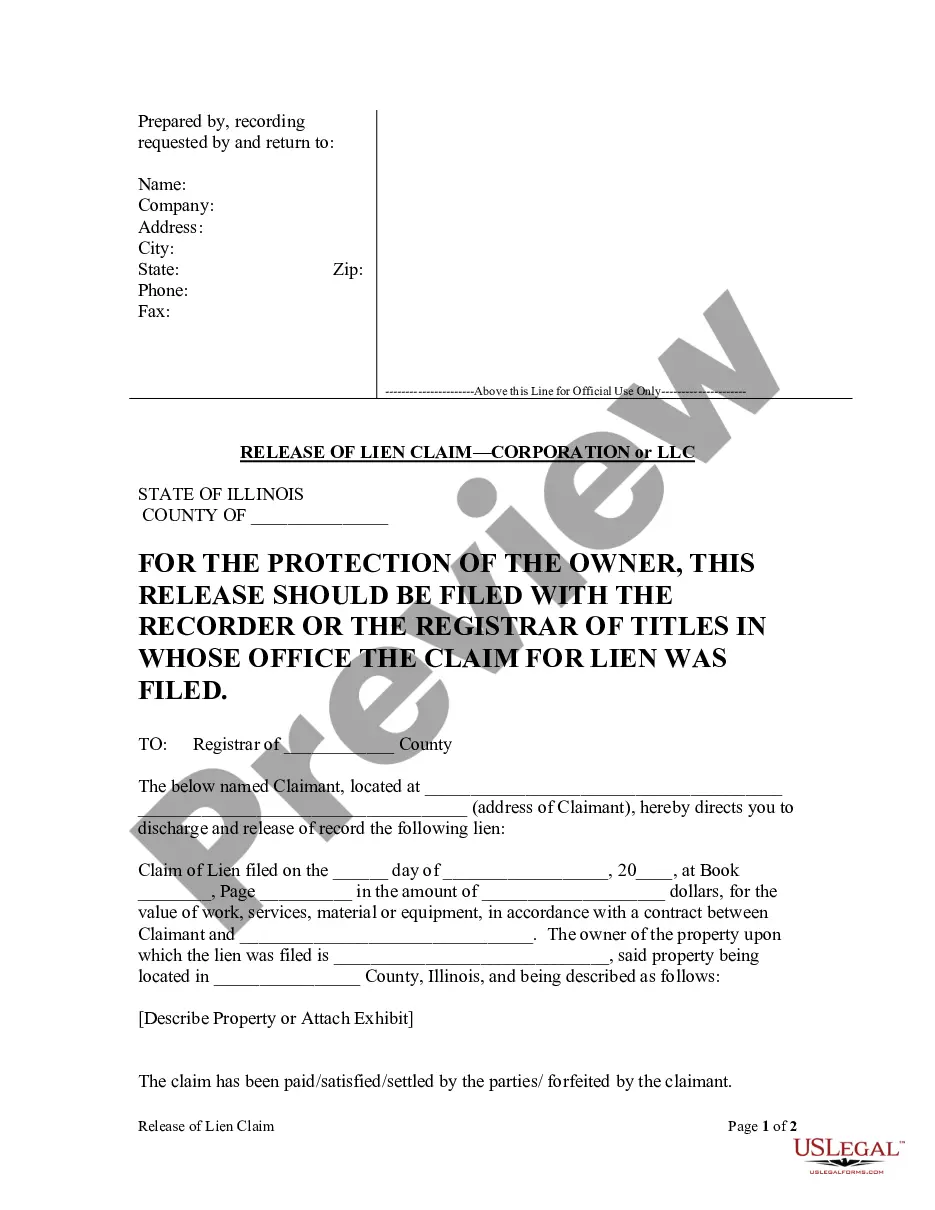

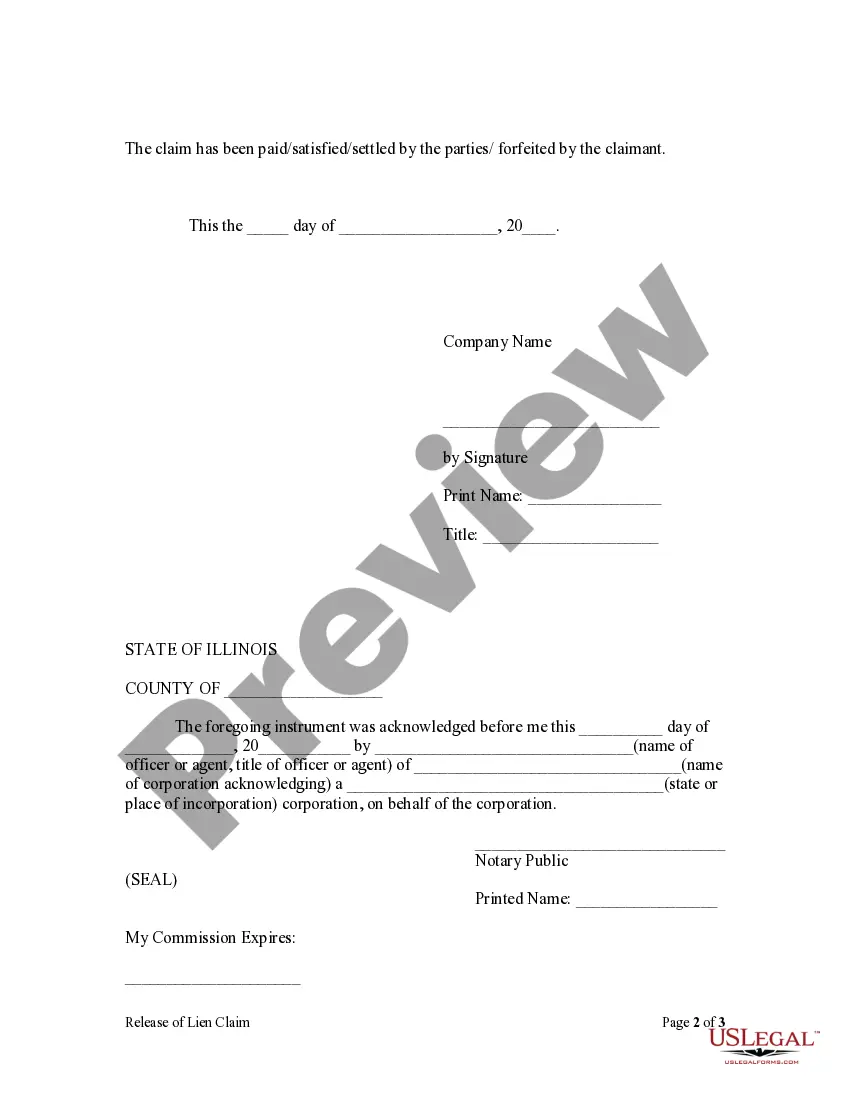

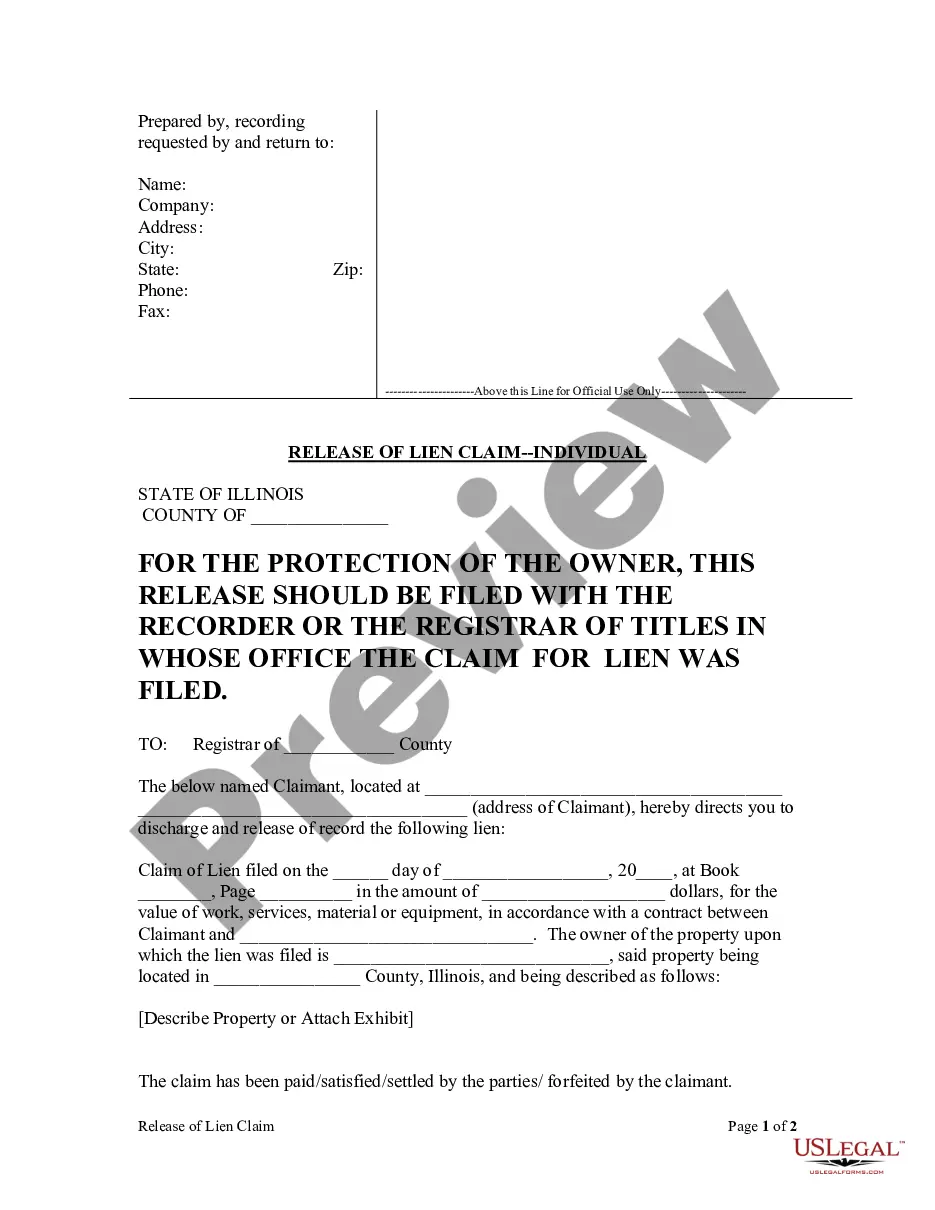

How to fill out Illinois Release Of Filed Lien Claim - Mechanic Liens - Corporation?

- Log in to your US Legal Forms account if you've used the service before. Ensure your subscription is active; if it's not, renew your plan accordingly.

- If you are a new user, begin by browsing the extensive form library. Look at the previews and descriptions to find the accurate form that matches your state requirements.

- Don't hesitate to use the search feature if you need a different form. Once you identify the necessary one, proceed to the next step.

- Purchase the document by selecting the appropriate subscription plan. You will need to create an account for full access to the resources available in the library.

- Complete your payment using a credit card or PayPal, then download your form to your device, which you can access later in your account's My Forms section.

By following these steps, you'll have your LLC company form ready to go in no time. US Legal Forms not only provides a robust collection of legal templates but also empowers users with expert support for form completion, ensuring you can navigate the legal landscape confidently.

Get started today and take the first step toward registering your LLC with ease!

Form popularity

FAQ

To determine if your LLC is an S or C Corp, look at how you've opted to file taxes. If you have not made an election, your LLC is likely treated as a C corp by default. Uslegalforms can assist with understanding your situations better while also ensuring you have the correct LLC company form for company registration.

To find out if you are an S corp or an LLC, consider your business structure and how you filed with the IRS. An LLC can elect to be treated as an S corp for tax purposes but is fundamentally a different entity. Uslegalforms offers resources to help ensure you understand your business classification in the context of your LLC company form for company registration.

To determine if your LLC is classified as a C corp or S corp, review your tax filings and IRS classification. Most LLCs are treated as pass-through entities by default, but filing for S corp status changes that. Uslegalforms can provide clarity on your tax situation and assist with the bank of knowledge necessary for your LLC company form for company registration.

To classify your LLC as an S corp, you need to file IRS Form 2553 after ensuring your LLC meets specific criteria. This classification allows you to pass income directly to shareholders and avoid double taxation. If you require assistance, uslegalforms can guide you through the necessary steps to complete your LLC company form for company registration.

A company registration form is a legal document that officially registers your business entity with the state. This form typically includes your business name, address, and details about the owners. Utilizing uslegalforms can simplify this process, especially for completing the LLC company form for company registration.

To determine the type of LLC you have, review the documents you filed when establishing your LLC. The structure and designation, like single-member or multi-member, should be clear in your Articles of Organization. If you're unsure, uslegalforms offers resources to help clarify your specific LLC type for company registration.

Filling out an LLC involves gathering essential information about your business. Complete the LLC company form for company registration, which typically requires details such as your business name, address, members, and their percentage of ownership. You can find guidance on each section directly on the form or through platforms like uslegalforms, making the process straightforward and efficient.

To write a company name with LLC, select a unique name followed by 'LLC' or 'Limited Liability Company.' For instance, 'Tech Innovators LLC' clearly identifies the legal structure of your business. This designation must also appear on all official documents, aligning with the LLC company form for company registration requirements.

When writing an LLC example, start with a clear name like 'Smith Consulting LLC.' Include the purpose of the business and specify that it's a limited liability company within your formation documents. Using the LLC company form for company registration, you will outline your business structure and main activities, making it transparent for future reference.

Yes, you can have an LLC without actively engaging in business, but it is not advisable. While the LLC company form for company registration gives you liability protection, maintaining the LLC requires some level of compliance, such as filing annual reports. Consider using your LLC to explore business opportunities when ready.