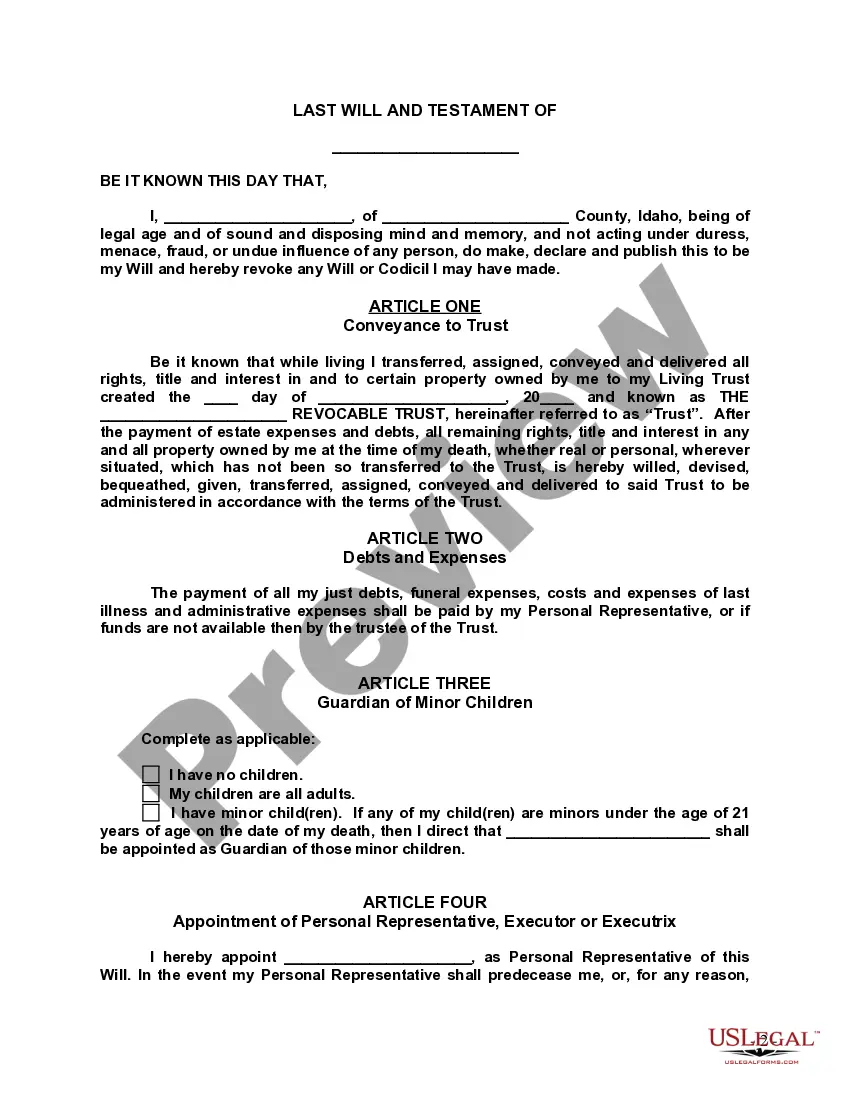

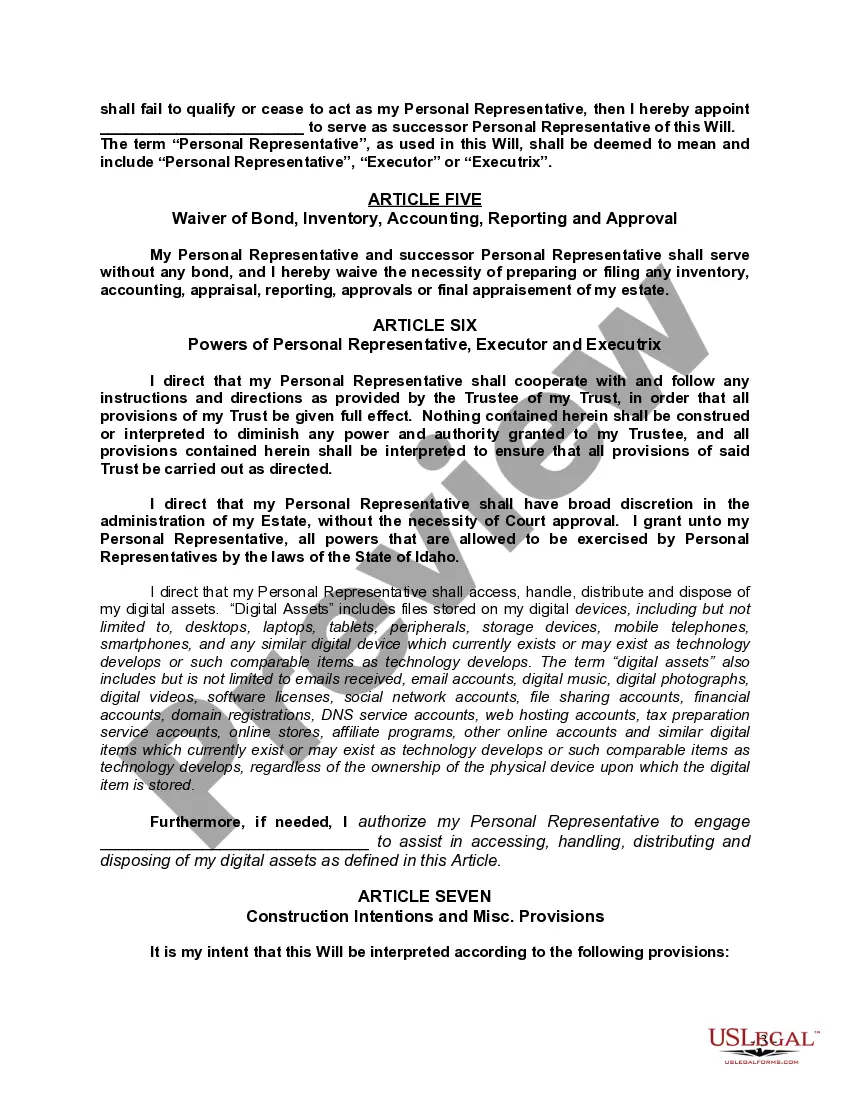

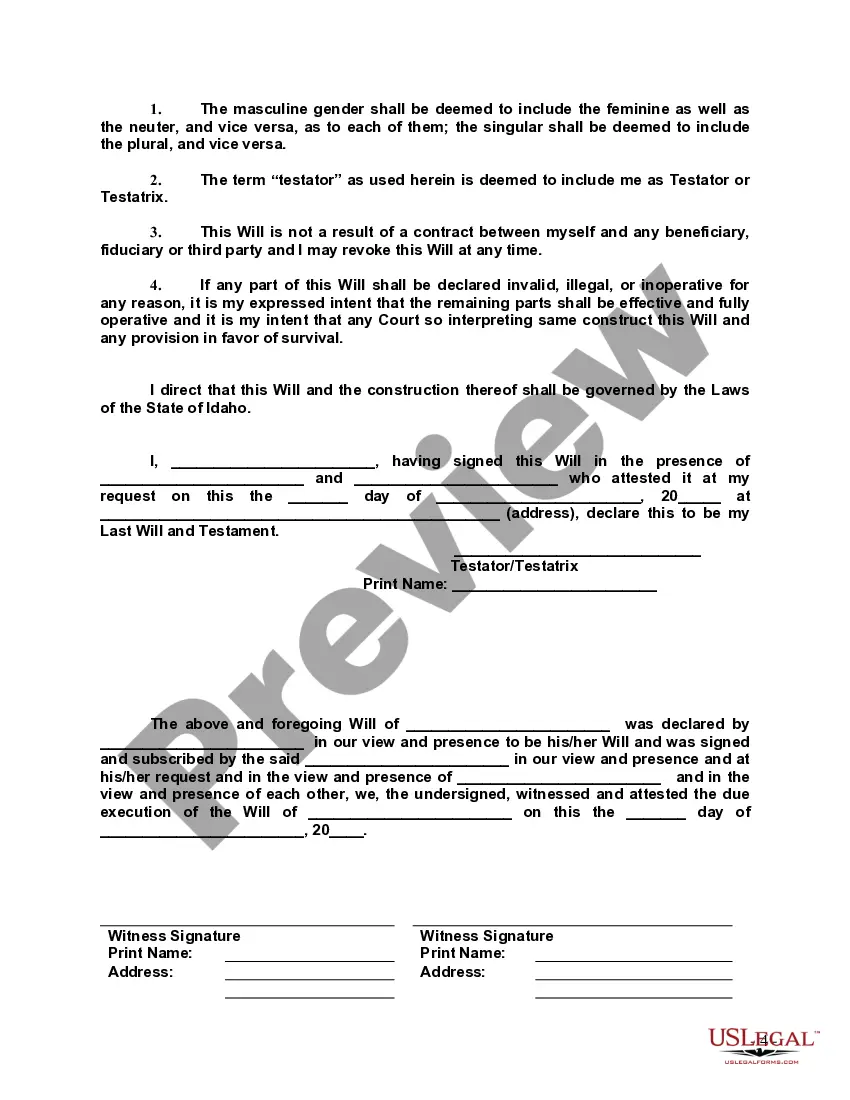

This Legal Last Will and Testament Form with Instructions, called a Pour Over Will, leaves all property that has not already been conveyed to your trust, to your trust. This form is for people who are establishing, or have established, a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. A "pour-over" will allows a testator to set up a trust prior to his death, and provide in his will that his assets (in whole or in part) will "pour over" into that already-existing trust at the time of his death.

Form Property Trust Without

Description

Form popularity

FAQ

The simplest form of trust is the revocable living trust. This trust allows you to maintain control over your assets while designating a trustee to manage them in the event of your death or incapacity. It provides flexibility as you can modify or revoke the trust at any time. Form property trust without unnecessary complexity by choosing this straightforward option.

To form property trust without issues, you need five key elements: a trustor, a trustee, beneficiaries, trust property, and a legal purpose. The trustor initiates the trust, while the trustee manages it on behalf of the beneficiaries. The trust property includes assets you wish to transfer into the trust. Lastly, a legal purpose ensures that the trust complies with state laws.

The best person to set up a trust is usually an estate planning attorney. This professional can guide you through the legal requirements to form property trust without complications. They will ensure that your specific needs are met and help you navigate any state-specific regulations. Additionally, their expertise can save time and prevent mistakes that could complicate your estate planning.

Tax-exempt income for a trust includes specific types of interest, dividends, and certain government benefits that do not require tax payment. When you form a property trust without understanding these exemptions, you may end up paying taxes unnecessarily. Reviewing tax regulations or using resources like US Legal Forms can clarify what qualifies as tax-exempt income.

A trust must generally file a tax return, specifically Form 1041, if it has gross income of $600 or more. Therefore, if you form a property trust without reaching this income level, you likely do not have to file. Always check for updates in tax laws to ensure compliance as your situation evolves.

Form 1041 is usually required only if the trust has taxable income. If you form a property trust without generating any income, you may not need to file this form. As circumstances change, evaluate your trust’s financial status to determine your filing obligations.

The IRS has updated several guidelines regarding the taxation of trusts, emphasizing clarity on income distribution and taxation responsibilities. When you form a property trust without keeping abreast of these changes, it could lead to noncompliance. Staying informed about the IRS regulations helps protect your trust and its beneficiaries.

Not all trusts are required to file a tax return, but many must do so if they earn income. When you form a property trust without income-generating activities, you typically do not need to file a return. However, always assess your trust’s specific circumstances and consult with a tax professional for accurate guidance.

Yes, certain trusts must be reported to the IRS, especially if the trust generates income. When you form a property trust without understanding the tax implications, you may unintentionally miss important reporting requirements. It’s best to familiarize yourself with the necessary forms and guidelines to avoid penalties.

To properly form a property trust without complications, you generally need to complete and submit a trust formation document, which varies by state. Many individuals use a revocable living trust form for this purpose. It's advisable to consult a legal expert to ensure compliance with state requirements and to customize the trust to your needs.