Idaho Release Form Withholding Payment

Description

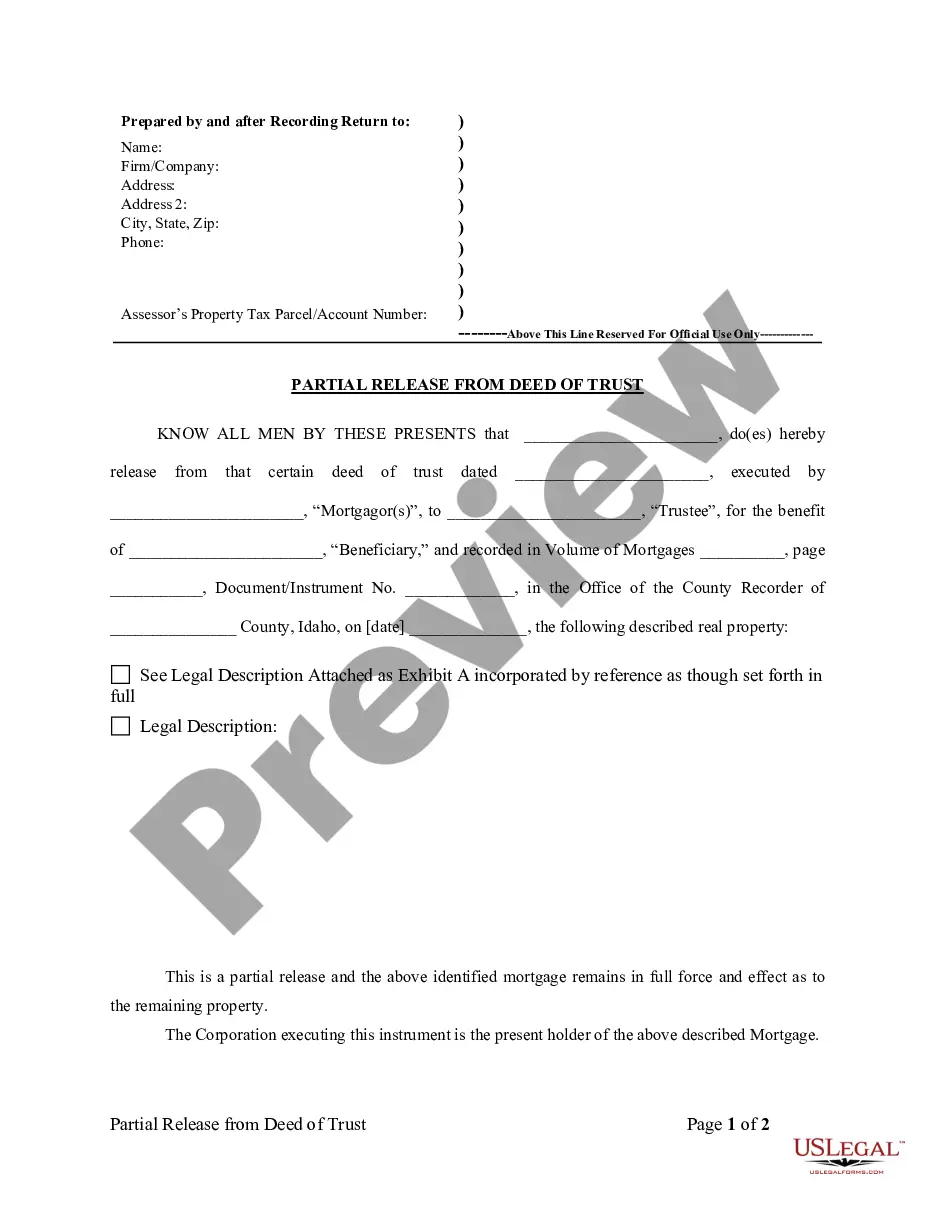

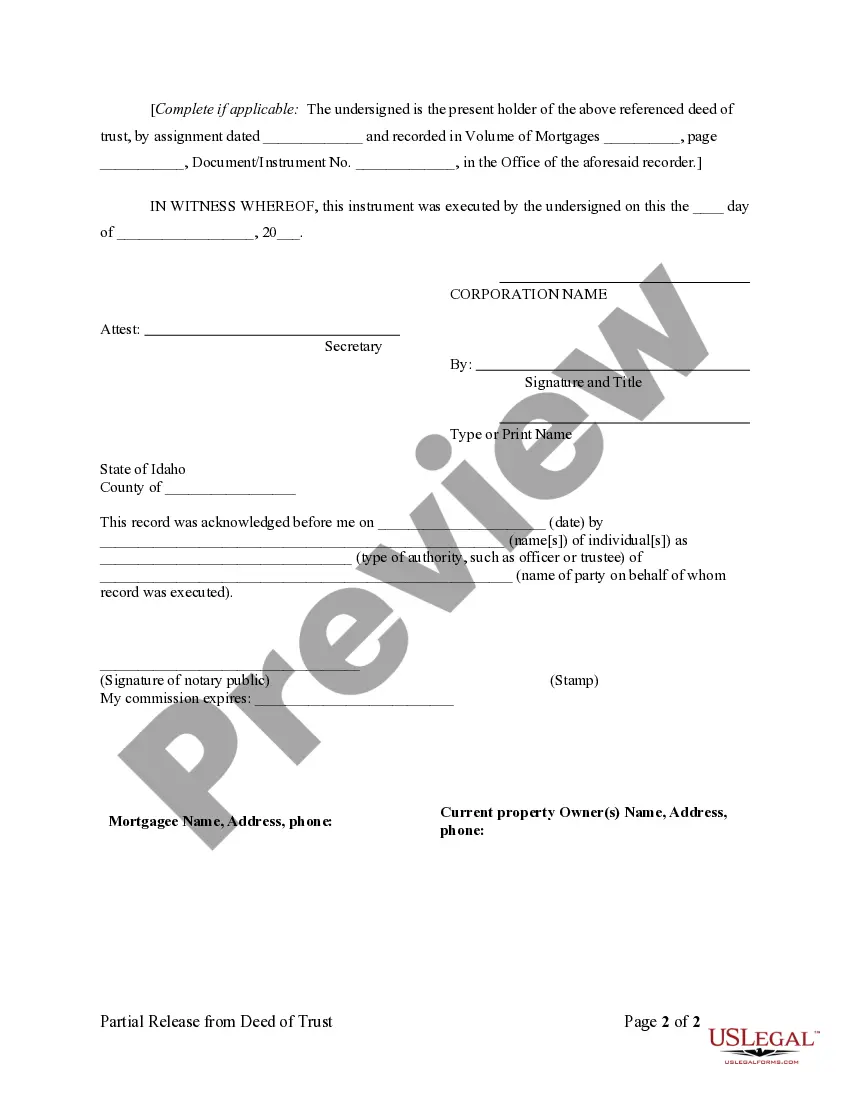

How to fill out Idaho Partial Release Of Property From Deed Of Trust For Corporation?

How to locate professional legal documents that comply with your state regulations and prepare the Idaho Release Form Withholding Payment without seeking the help of an attorney.

Numerous online services provide templates for various legal scenarios and formalities. However, it may require time to determine which of the provided samples fulfill both your use case and legal standards.

US Legal Forms is a reliable platform that assists you in finding official documents created in accordance with the latest state law revisions, helping you save on legal consulting costs.

If you do not have an account with US Legal Forms, follow the steps below: Review the webpage you opened and verify if the form meets your requirements.

- US Legal Forms is not a typical online catalog.

- It consists of over 85k verified templates for different business and personal situations.

- All documents are organized by category and state to expedite your search process and make it more convenient.

- Furthermore, it comes with powerful tools for PDF editing and electronic signatures, allowing users with a Premium subscription to quickly complete their documents online.

- It requires minimal effort and time to obtain the necessary paperwork.

- If you have an account, Log In and ensure your subscription is active.

- Download the Idaho Release Form Withholding Payment using the related button next to the file name.

Form popularity

FAQ

You must have a federal Employer Identification Number (EIN) before you apply for an Idaho withholding account. Apply for an EIN with the IRS. After you have your EIN, visit our Idaho Business Registration Information guide. Follow the instructions to register for an Idaho withholding account.

Steps to take NOW:Use the withholding estimator at IRS.gov to estimate your federal withholding. Update the federal Form W-4 with that information.Use page 2 of the Form ID W-4 to estimate your Idaho withholding. Fill out Form ID W-4 with that information.Give both W-4 forms to your employer.

Form 39-R is an Idaho Supplemental Schedule For Form 40, Resident Returns Only. It is simply a worksheet for posting your Form 40. View the IDAHO SUPPLEMENTAL SCHEDULE Form 39R. Form-39R is a supplemental form to Idaho's Form-40.

Reporting Backup Withholding Payments You must report payments you collected for backup withholding, on Form 945, Annual Return of Withheld Federal Income Tax. Form 945 is due by January 31 of the year after the tax year. So, for 2018 backup withholding, you must file Form 945 with the IRS by January 31, 2019.

Claim allowances for you or your spouse.If you're married filing jointly, only one of you should claim the allowances. The other should claim zero allowances. If you work for more than one employer at the same time, you should claim zero allowances on your W-4 with any employer other than your principal employer.