Power Of Attorney Irs

Description

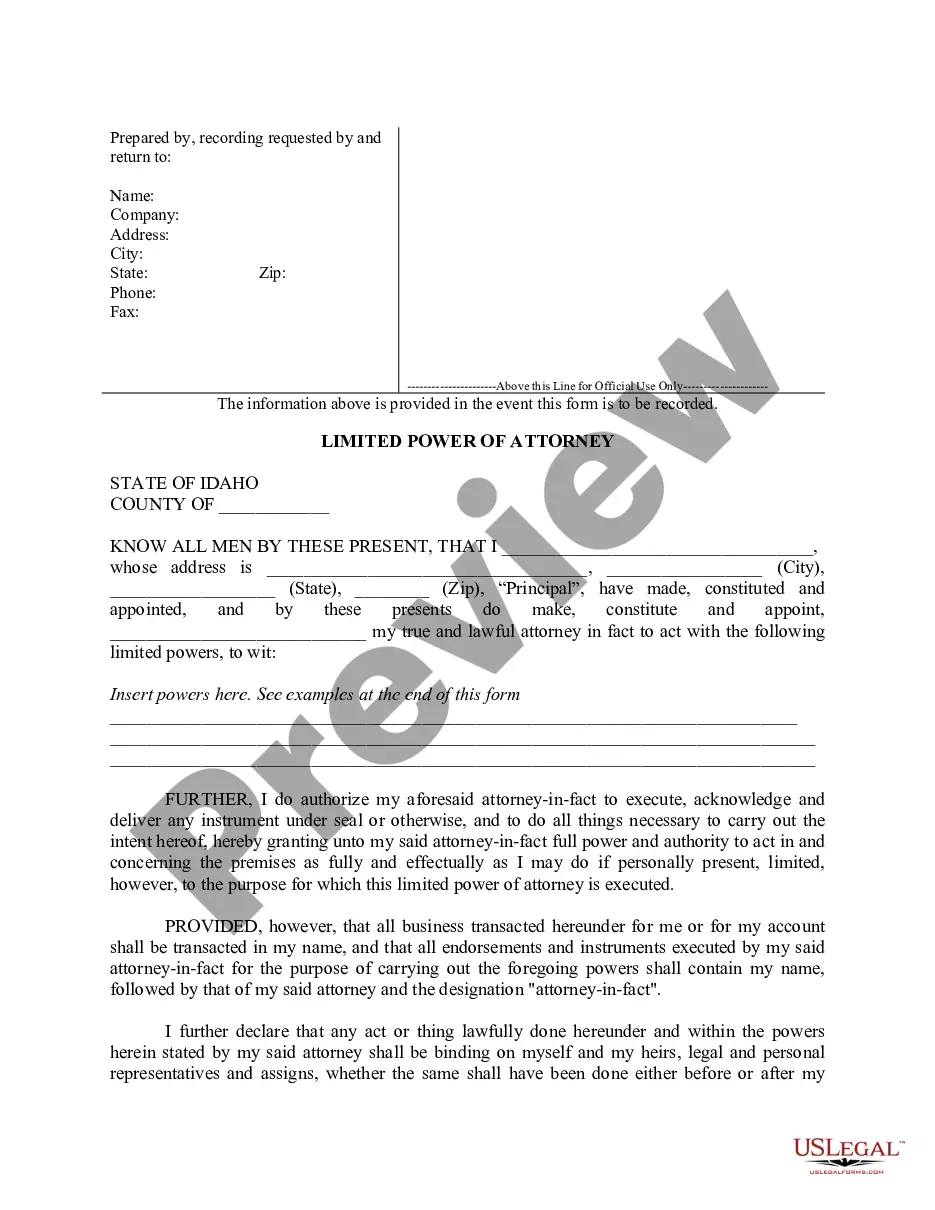

How to fill out Idaho Limited Power Of Attorney Where You Specify Powers With Sample Powers Included?

- Start by checking the Preview mode and description to ensure the selected Power of Attorney form meets your requirements.

- If the form is not suitable, utilize the Search tab to find a different template that aligns with your needs.

- Proceed to purchase the correct document by clicking the Buy Now button and selecting your preferred subscription plan.

- Create an account to gain access to US Legal Forms library for your legal resources.

- Complete the transaction by entering your payment details, either via credit card or PayPal.

- Once your purchase is complete, download the form to your device for easy completion, and access it anytime through the My Forms menu.

By following these simple steps, you can take advantage of US Legal Forms' extensive library, which offers more legal templates than its competitors. This service empowers both individuals and attorneys by providing easy access to quality legal documents.

Don't hesitate to leverage this valuable resource for all your legal documentation needs. Start your journey with US Legal Forms today!

Form popularity

FAQ

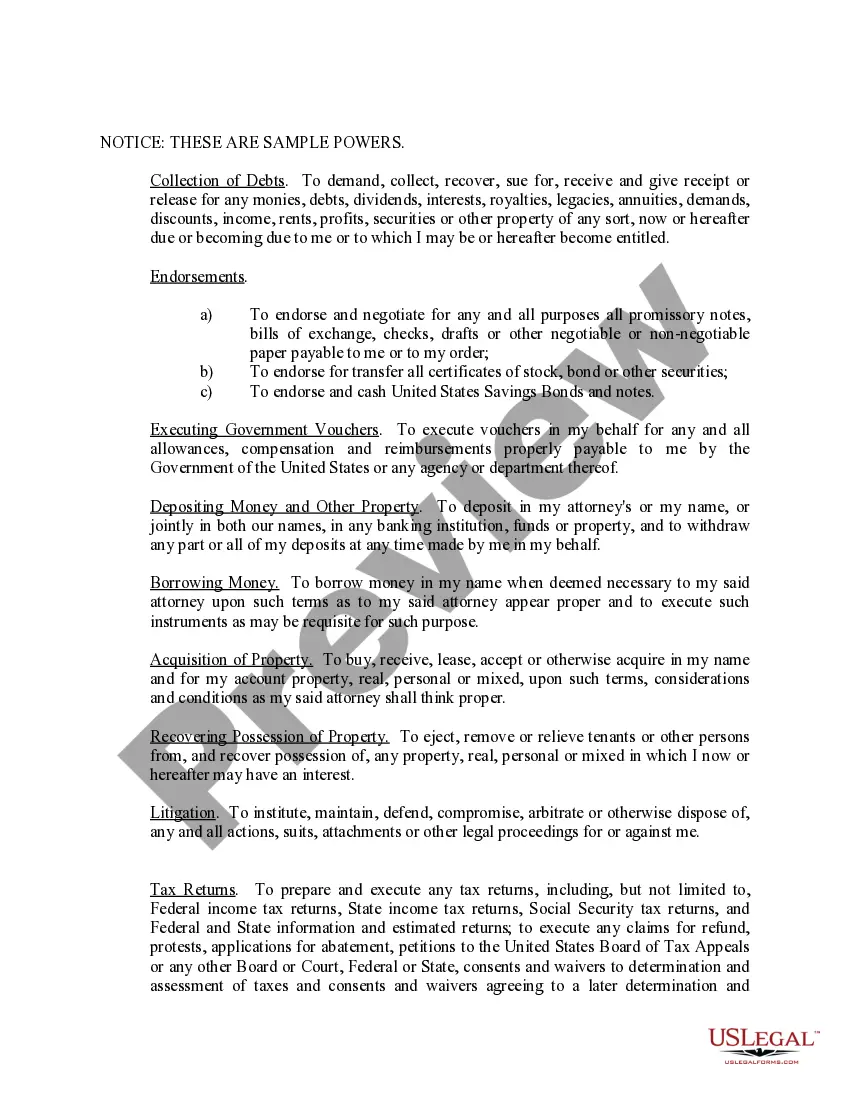

To obtain power of attorney for the IRS, you first need to complete IRS Form 2848, also known as the Power of Attorney and Declaration of Representative. This form allows you to authorize someone to act on your behalf regarding your tax matters. After filling out the form, you'll need to submit it to the IRS, which will process your request. If you want a smooth experience, consider using a service like USLegalForms, which can guide you through the entire process, ensuring everything is filled out correctly.

When it comes to IRS power of attorney, notarization is not always required. However, having the document notarized can lend additional credibility and may make it easier during audits or disputes. It is advisable to check specific requirements based on your jurisdiction and the needs of your situation. Using a service like US Legal Forms can help clarify the rules and provide forms that meet the IRS standards.

Filling out a power of attorney form for IRS purposes involves several clear steps. First, obtain the relevant form from a credible source, such as US Legal Forms, to ensure accuracy and compliance. Complete the required fields, including the names of the person granting the authority and the agent, along with specific powers granted. Finally, review the form carefully before submission to make sure it meets all requirements for IRS acceptance.

The IRS does not universally accept digital signatures for power of attorney submissions at this time. It's essential to ensure that you are compliant with all IRS requirements regarding signatures. Consulting resources, such as USLegalForms, can help you navigate these compliance issues.

Currently, the IRS does not accept virtual signatures for power of attorney forms. Thus, you will need to print, sign, and mail any necessary forms to the IRS. To simplify your process, consider using USLegalForms for templates and further guidance on submitting your power of attorney.

While many legal documents can be signed electronically, the IRS does not permit electronic signatures for power of attorney forms in all circumstances. It's important to verify the latest IRS regulations, as signing rules may change. For assistance with the process, USLegalForms can provide the necessary resources.

As per IRS policy, a power of attorney cannot be signed electronically for all situations. However, certain tax professionals may have the ability to submit forms electronically on behalf of their clients. Always check current IRS guidelines to ensure compliance.

To submit a power of attorney to the IRS, complete Form 2848 and gather any necessary documentation that supports your submission. After filling out the form accurately, mail it to the appropriate IRS office. If you prefer a more streamlined experience, consider using USLegalForms for guidance.

The IRS typically processes a power of attorney within 4 to 6 weeks. However, processing times may vary based on volume and specific cases. It's advisable to confirm the status of your submission by using the contact information provided on the IRS website.

To submit a power of attorney to the IRS, you need to complete Form 2848, Power of Attorney and Declaration of Representative. Once you fill out this form, send it to the designated address based on your location and the type of tax involved. Using USLegalForms can simplify this process, ensuring you complete the form correctly for the IRS.