Financially

Description

How to fill out Idaho Power Of Attorney Forms Package?

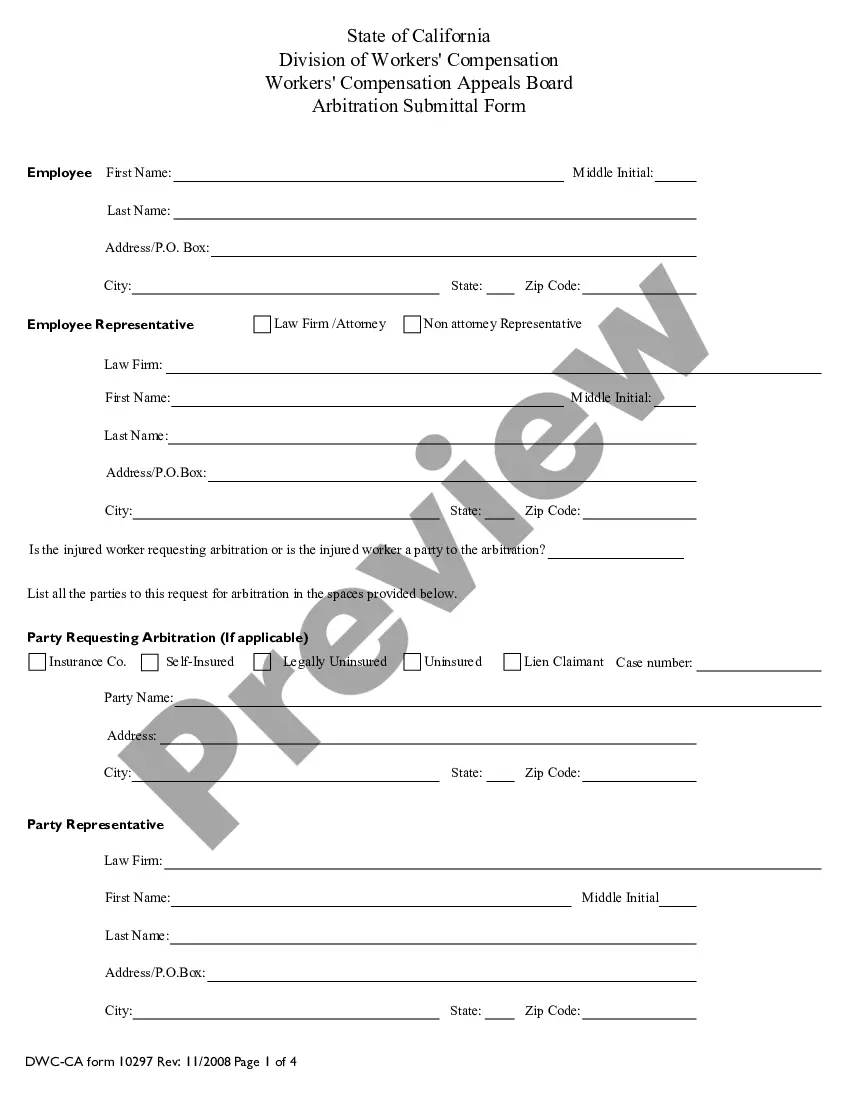

- Log in to your account if you've previously used US Legal Forms, ensuring your subscription is active. Click the Download button for your required form.

- For first-time users, explore the Preview mode to assess the form description, ensuring it aligns with your specific needs and jurisdiction.

- If necessary, utilize the Search tab to find additional templates that fit your requirements.

- Select the document, click the Buy Now button, and choose your preferred subscription plan. You'll need to create an account for full access.

- Complete your payment using your credit card or PayPal to finalize your purchase.

- Download the form to your device and access it anytime via the My Forms section in your profile.

By following these steps, you can quickly and financially access the necessary legal forms while benefiting from expert support, ensuring your documents are completed accurately.

Don’t hesitate; visit US Legal Forms today to empower yourself with the legal documentation you need!

Form popularity

FAQ

The fastest way to save $10,000 is to increase your monthly contributions and minimize non-essential expenditures. Consider taking on a side job or freelance work to boost your income. Additionally, prioritize high-interest savings accounts that can help your savings grow more quickly. Stay committed to your goals, and you'll find success in your savings journey.

Building yourself financially involves creating a solid plan that includes saving, investing, and continuous learning. Start with a budget that allows you to allocate funds for savings and investments. Educate yourself on personal finance topics to make informed decisions. Platforms like uslegalforms provide valuable resources that can assist you in your financial journey.

If you're struggling financially, start by reviewing your budget to identify where you can cut costs. Seek community resources, such as financial education programs, that can offer assistance. It may also help to consult with financial professionals for personalized advice. Taking proactive steps can empower you to regain control of your finances.

To save $10,000 in a year, start by analyzing your income and expenses. Create a detailed budget that identifies areas for saving and stick to it diligently. Consider setting up automatic transfers to a savings account, making the process easier. With dedication and the right tools, like uslegalforms, you can successfully achieve this goal financially.

The 50 30 20 rule recommends dividing your after-tax income into three categories: 50% for needs, 30% for wants, and 20% for savings. This system offers a balanced approach to budgeting. By following this rule, you can ensure you allocate enough funds to save for future financial goals. Stick to this framework to improve your financial foundation.

To save $10,000 in one year, you need to save about $833 each month. This figure encourages you to analyze your current expenses and identify areas where you can cut back. It's important to make saving a priority in your monthly budget. Additionally, tools like uslegalforms can help guide your financial planning effectively.

Yes, saving $10,000 a year is achievable with a well-structured plan. By setting aside approximately $833 a month, you can reach this milestone. Focus on creating a budget that prioritizes your savings, and consider using tools that streamline your financial management. Ultimately, adopting disciplined saving habits can improve your financial situation.

The $27.40 rule is a simple budgeting guideline that encourages you to allocate $27.40 from every paycheck to savings. This method helps you build a financial cushion over time. By following this strategy, you can enhance your ability to save and manage your finances effectively. Remember, being consistent with this rule can help you financially.

To fill out the financial aid application, you need specific information like your Social Security number, tax returns, and information about your assets. Financially, providing accurate and complete details will help determine your eligibility for various aid programs. Additionally, consider using platforms like US Legal Forms to streamline the application process and ensure you have all necessary documents ready. Being organized can significantly enhance your chances of receiving financial assistance.

Yes, parents with an income of $120,000 can still qualify for FAFSA. Financially speaking, FAFSA considers various factors beyond just income, such as household size and the number of family members attending college. Thus, even if parents earn a higher income, their financial situation may still allow them to receive financial aid. It is crucial to fill out the FAFSA form accurately to assess eligibility.