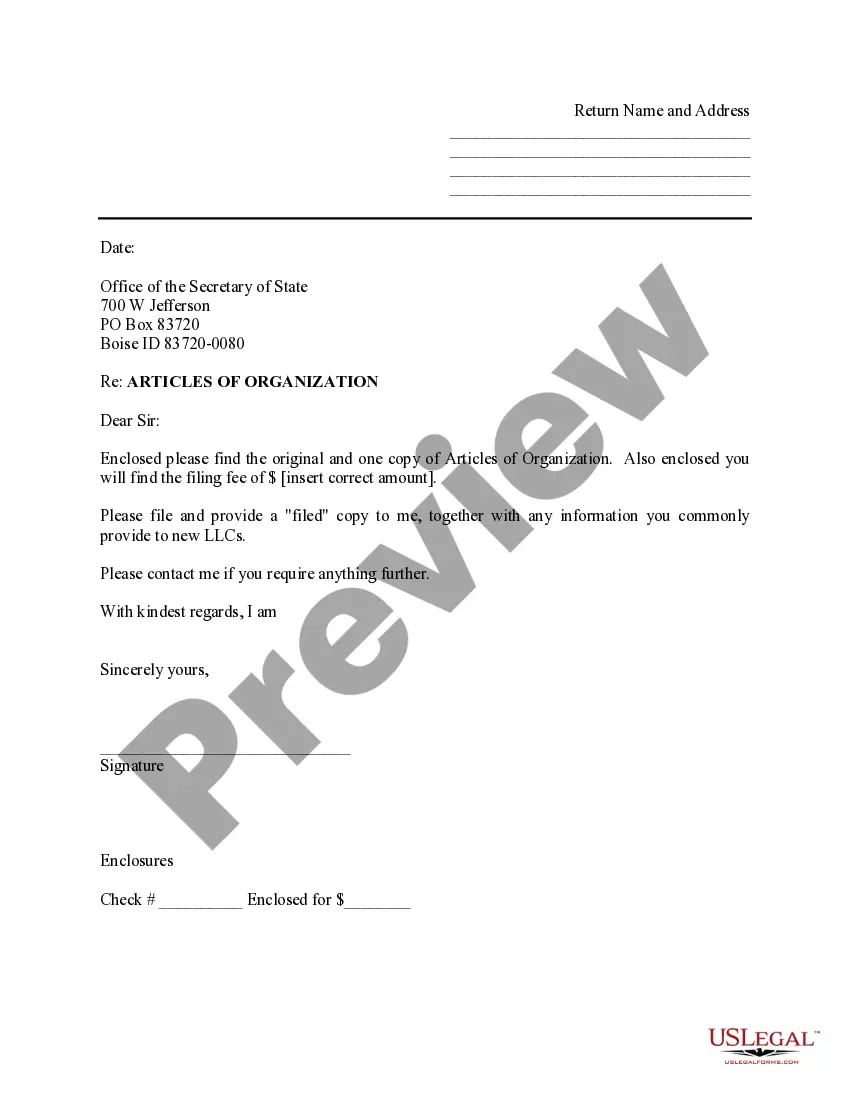

This is a sample cover letter for use with filing LLC

Idaho Llc Certificate Form St-133 Section Ii

Description

How to fill out Idaho Llc Certificate Form St-133 Section Ii?

When you need to fill out Idaho Llc Certificate Form St-133 Section Ii that adheres to your local state's laws, there can be numerous alternatives to choose from.

There's no need to review every document to ensure it fulfills all the legal requirements if you are a US Legal Forms member.

It is a trustworthy resource that can assist you in obtaining a reusable and current template on any topic.

Securing expertly crafted formal documentation becomes simple with US Legal Forms. Additionally, Premium users can take advantage of the powerful built-in tools for online PDF editing and signing. Give it a try today!

- US Legal Forms is the most extensive online repository with a collection of over 85,000 ready-to-use documents for both business and personal legal situations.

- All templates are confirmed to comply with each state's regulations.

- Thus, when you download Idaho Llc Certificate Form St-133 Section Ii from our platform, you can trust that you possess a valid and current document.

- Acquiring the necessary sample from our platform is quite simple.

- If you already have an account, merely Log In to the system, ensure your subscription is active, and save the chosen file.

- Later, you can access the My documents tab in your profile and retrieve the Idaho Llc Certificate Form St-133 Section Ii at any time.

- If this is your first experience with our library, please follow the instructions below.

- Browse the suggested page and check it for conformity with your criteria.

Form popularity

FAQ

The producer exemption in Idaho allows certain farmers and producers to operate without a traditional business license. This exemption acknowledges their contributions to the economy and simplifies their regulatory burden. If you are considering forming an LLC, understanding how this exemption relates to the Idaho LLC certificate form ST-133, section II, is crucial for your business. Using USLegalForms can help ensure that you navigate the paperwork correctly, streamlining your path to compliance and success.

Filling out a certificate of exemption involves providing your personal or business information, including tax identification numbers. You must also specify the type of exemption you are claiming, which could include sales for resale. Utilizing the Idaho LLC certificate form ST-133 Section II can make this process clearer, as it guides you through the necessary sections and requirements.

To obtain an Idaho resale certificate, you must register your business with the Idaho State Tax Commission. You can then fill out and submit the Idaho LLC certificate form ST-133 Section II, signifying your intent to make tax-exempt purchases. This certificate not only streamlines transactions but also affirms your status as a legitimate reseller in the state.

The Idaho vehicle tax exempt form is a document that allows certain individuals or organizations to claim an exemption from vehicle taxes. This form typically applies to non-profit organizations, government entities, and other qualifying groups. To obtain this form, you can start at the Idaho LLC certificate form ST-133 Section II, which provides detailed instructions and necessary information. Using this resource simplifies the process, ensuring you complete the form correctly.

Yes, Idaho sales tax exemption certificates do have an expiration date. Typically, they are valid for a maximum of three years from the date of issuance. To ensure compliance, it is essential to renew these certificates before they expire. For more specific guidance, you may refer to the Idaho LLC certificate form ST-133 Section II, which can help clarify your obligations.

An ST-101 in Idaho is a sales tax exemption certificate used by businesses to make tax-exempt purchases. It serves as proof that a buyer qualifies for tax exemption on certain transactions. Ensure you understand how it relates to the Idaho LLC certificate form ST-133 section II, as it may be relevant to your exemption claims.

To obtain an exemption certificate number, you typically need to apply through your state’s tax office and provide relevant documentation. Filling out the Idaho LLC certificate form ST-133 section II may also be necessary, depending on the specifics of your situation. Once approved, you will receive your exemption number, which allows you to benefit from tax exemptions.

North Dakota sales tax exemption certificates do expire, similar to those in Idaho. It's advisable to monitor the expiration dates of your certificates to maintain compliance. If you need to renew, follow the specified process to ensure that you remain eligible for tax-exempt purchases.

Yes, Idaho resale certificates do have an expiration date. It is crucial to check the validity of your certificate regularly, as state law requires periodic renewal. When in doubt, refer to the Idaho LLC certificate form ST-133 section II for guidance on ensuring your resale certificate remains valid.

Tax-exempt status in Idaho typically applies to individuals or organizations involved in specific types of transactions, such as nonprofits or certain businesses. To qualify, you generally need to provide relevant documentation and complete the Idaho LLC certificate form ST-133 section II. It’s essential to understand the specific criteria set by state law to ensure you meet all requirements.