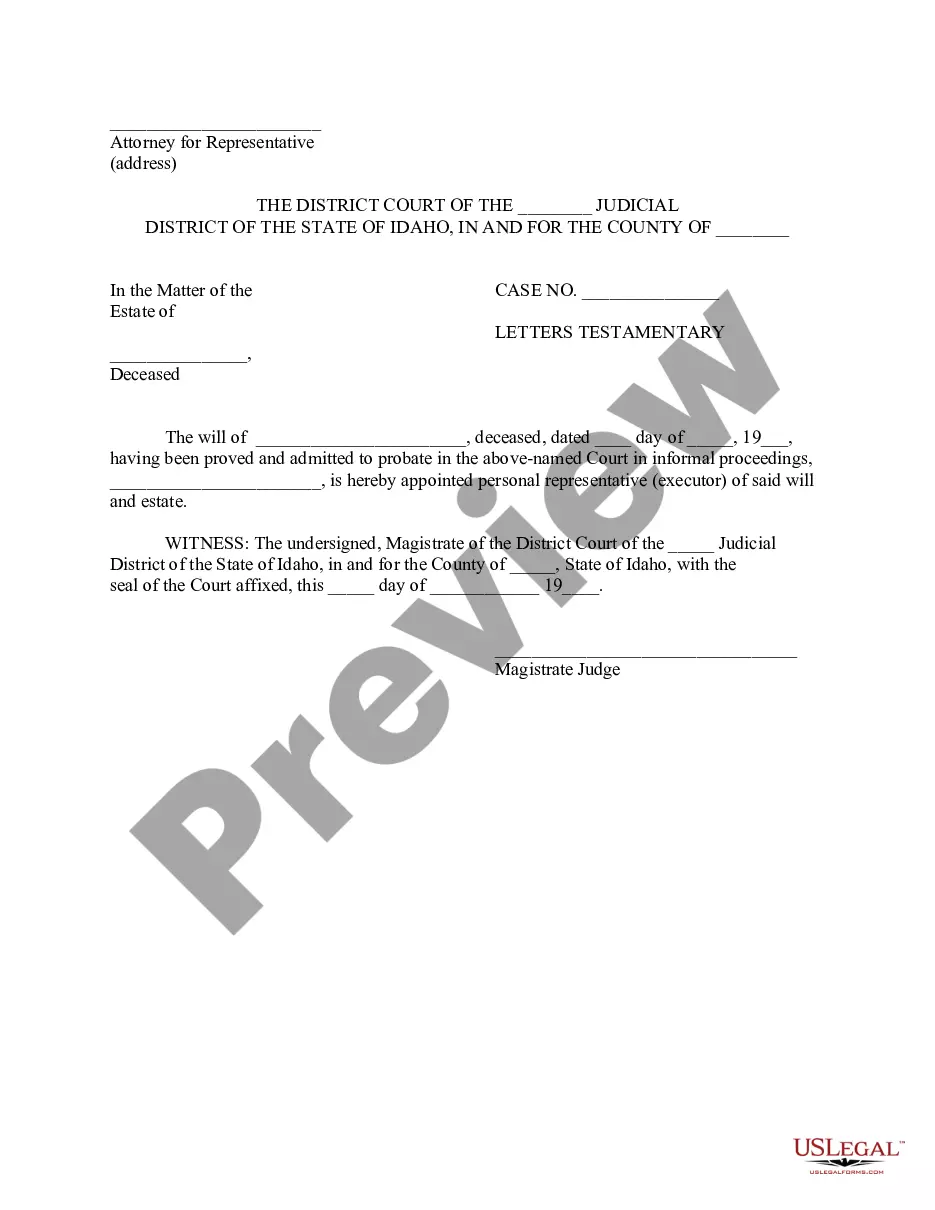

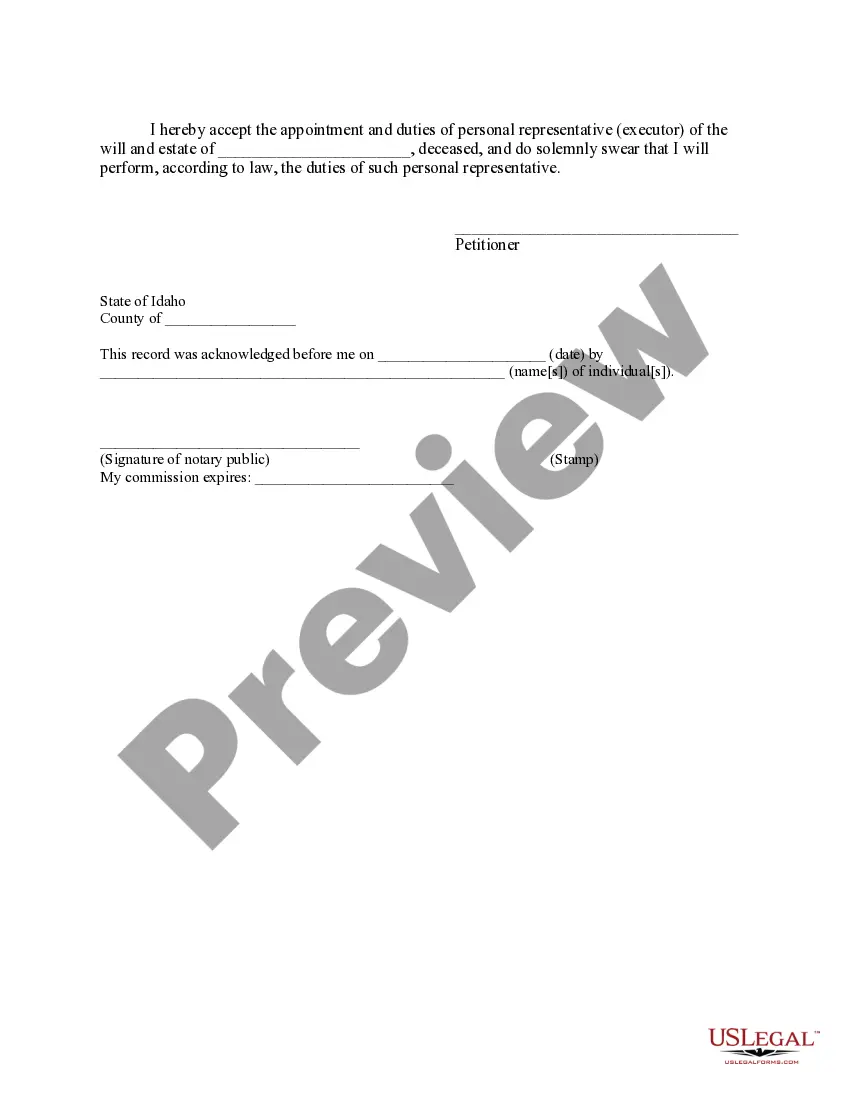

Testamentary Letter Sample For Estate Planning

Description

How to fill out Idaho Letters Testamentary?

Legal administration can be daunting, even for seasoned professionals.

When you are looking for a Testamentary Letter Sample for Estate Planning and lack the time to search for the correct and updated version, the process might be taxing.

US Legal Forms fulfills any needs you may encounter, from personal to organizational documents, all in one location.

Utilize advanced tools to complete and manage your Testamentary Letter Sample for Estate Planning.

Here are the steps to follow after acquiring the form you need: Confirm it is the correct form by previewing it and reviewing its details.

- Access a valuable repository of articles, guides, and materials pertinent to your situation and requirements.

- Save yourself time and effort searching for the documents you require, and utilize US Legal Forms’ advanced search and Review tool to locate and obtain the Testamentary Letter Sample for Estate Planning.

- If you are a member, Log In to your US Legal Forms account, search for the form, and retrieve it.

- Check your My documents tab to review the documents you have previously downloaded and organize your folders as you wish.

- If this is your first time using US Legal Forms, create a free account to gain unlimited access to all the resources of the library.

- A comprehensive online form directory could be a game changer for anyone who aims to effectively navigate these circumstances.

- US Legal Forms is a leader in online legal forms, offering over 85,000 state-specific legal forms available to you at any moment.

- With US Legal Forms, one can access state- or county-specific legal and business templates.

Form popularity

FAQ

To request a copy of either the exemption application (including all supporting documents) or the annual information or tax return, submit Form 4506-A, Request for a Copy of Exempt or Political Organization IRS FormPDF or Form 4506-B, Request for a Copy of Exempt Organization IRS Application or LetterPDF.

Your bylaws are a legally binding agreement and your members must adhere to them. Board members, officers, or employees who violate your bylaws could place your nonprofit in jeopardy by opening up the possibility for legal investigations and entanglements.

Unlike other organizational documents, like the articles of incorporation, you do not file bylaws with the state. You must keep them with your nonprofit's records and ensure they are accessible to board members. Nolo offers an online form you can use to create customized bylaws for your nonprofit.

Fill out a request form with the Internal Revenue Service (IRS): The IRS requires all tax-exempt businesses to file a copy of their bylaws. Filling out form 4506-A will get you a copy of them. Check with state agencies: Many states have regulatory agencies that hold records of bylaws.

Does my tax-exempt organization need to submit changes in its bylaws to the IRS? The Internal Revenue Code 501(c) (3) requires that any tax-exempt organization report changes in bylaws and other governing documents to the IRS every year using IRS Form 990.

Does Ohio require corporate bylaws? Ohio Rev Code § 1701.11 states that a corporation's directors MAY adopt regulations. But Ohio statutes don't explicitly state that bylaws or regulations are required. However, bylaws are essential for a well-functioning corporation.

Do amended bylaws need to be filed with the IRS? Yes, no matter if your organization is for-profit or nonprofit, you need to report all the significant changes in bylaws to the IRS. It is especially relevant when an organization is seeking to obtain a tax-exempt status.