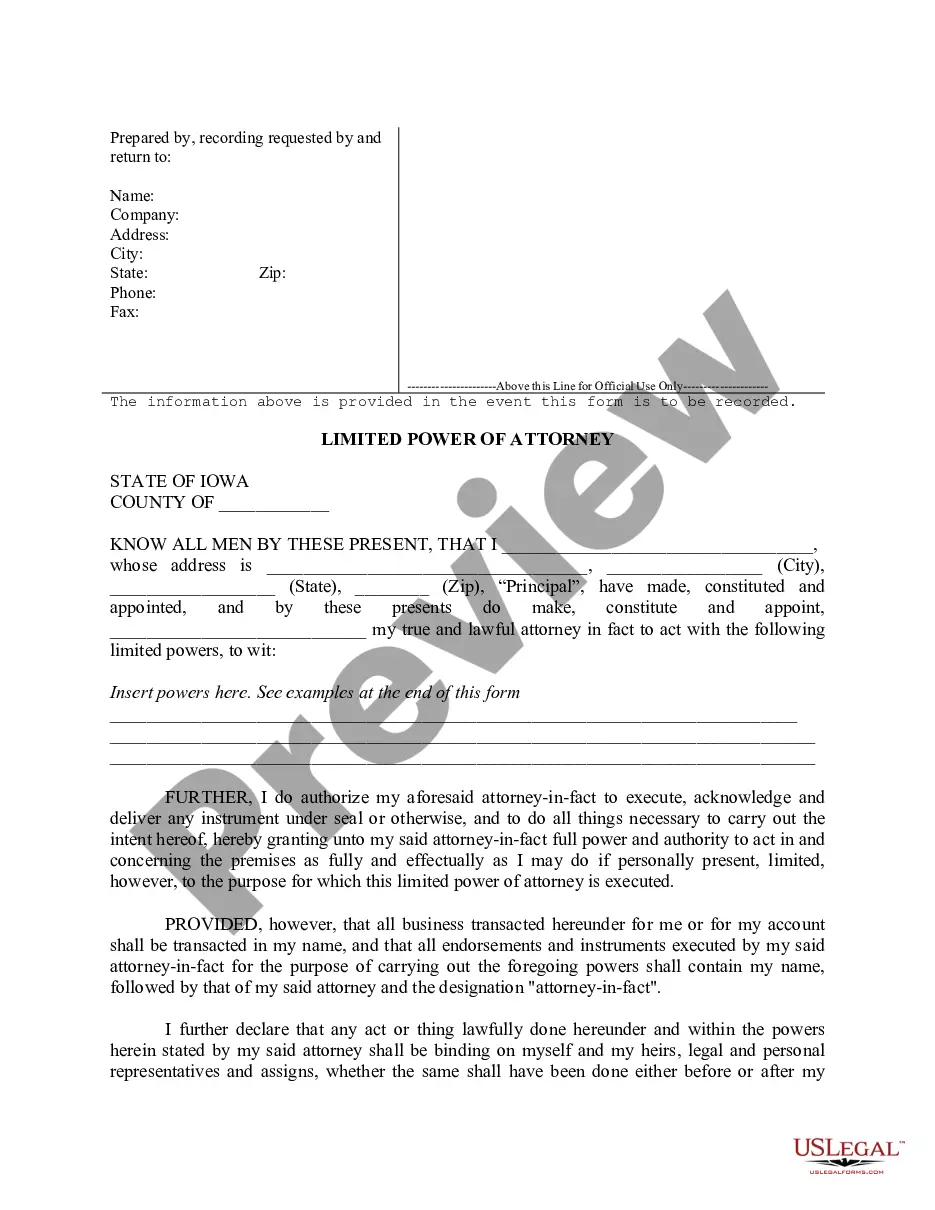

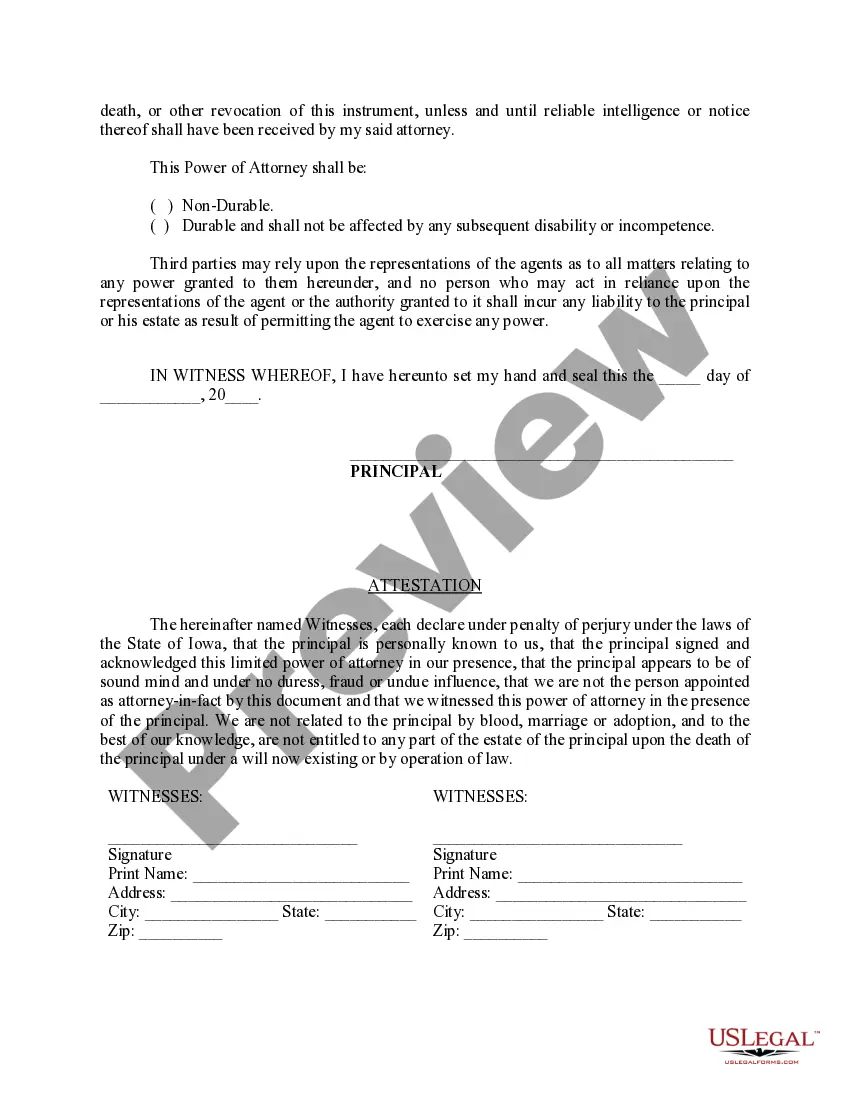

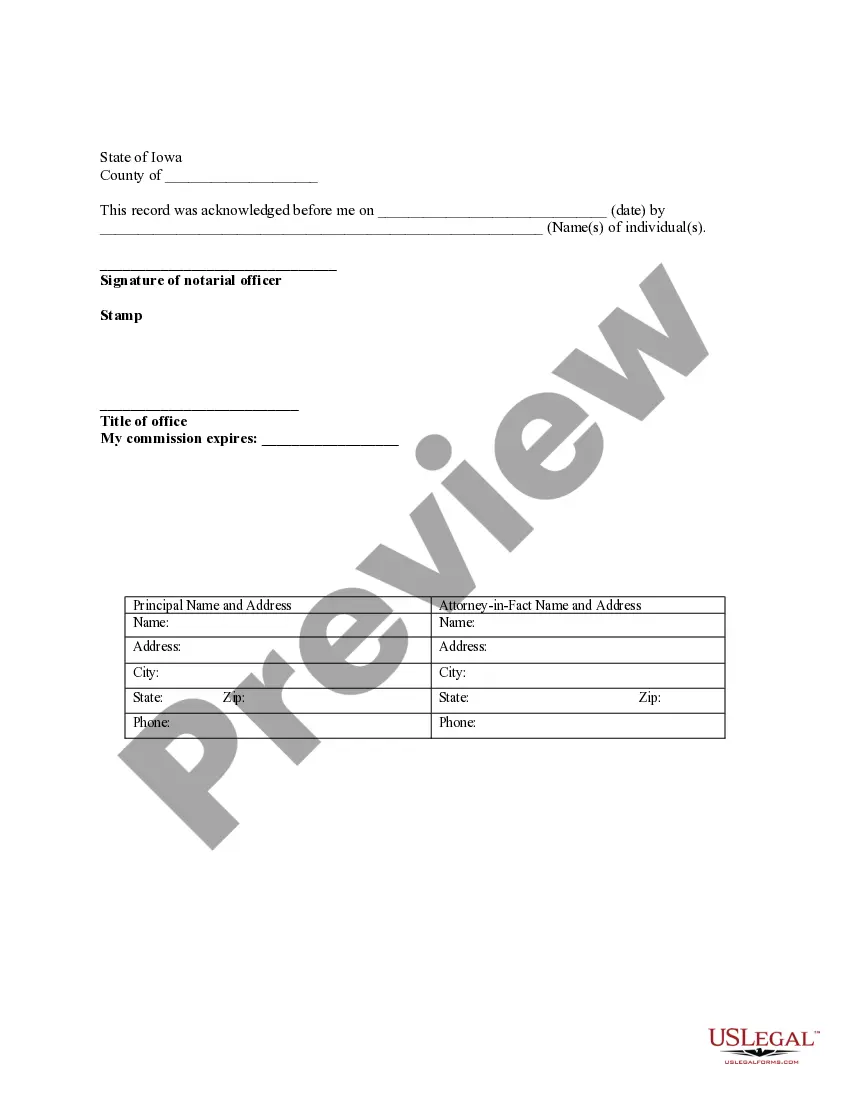

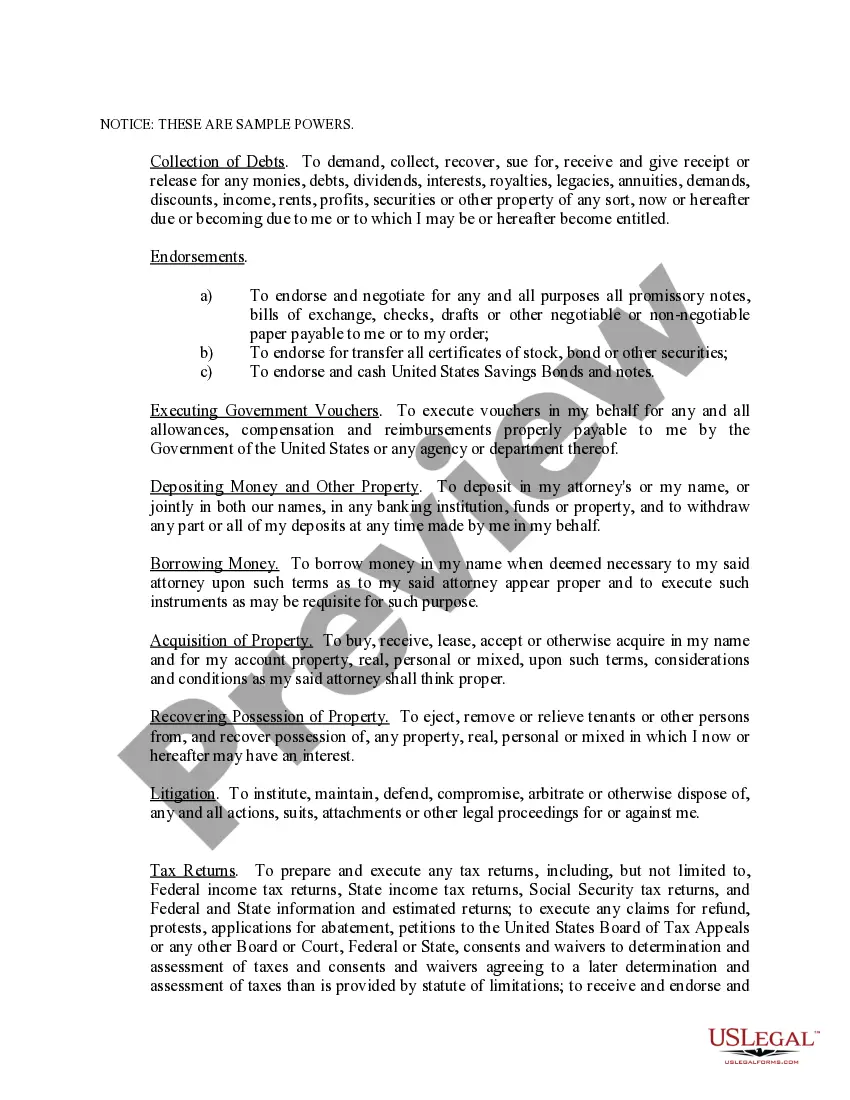

This is a limited power of attorney for Iowa. You specify the powers you desire to give to your agent. Sample powers are attached to the form for illustration only and should be deleted after you complete the form with the powers you desire. The form contains an acknowledgment in the event the form is to be recorded.

Power Attorney For Bank Account

Description

How to fill out Iowa Limited Power Of Attorney Where You Specify Powers With Sample Powers Included?

- If you already have an account with US Legal Forms, log in to access your profile and download the necessary document template by clicking the Download button. Verify that your subscription is current. If it has lapsed, renew it based on your selected payment plan.

- For new users, start by exploring the Preview mode and description of various forms. Ensure the selected template aligns with your specific requirements and adheres to local jurisdiction standards.

- If you encounter any discrepancies, utilize the Search feature to find the appropriate template. Once you find a suitable match, advance to the subsequent step.

- Purchase the required document by clicking the Buy Now button and choosing your preferred subscription plan. You will need to create an account to gain access to the full resources of the library.

- Complete your transaction by entering your credit card information or using your PayPal account to finalize the subscription.

- Finally, download your power of attorney form. Save it securely on your device, and remember that you can access it anytime from the My documents section in your account.

In conclusion, US Legal Forms offers an extensive collection of powerful tools designed to help you manage your legal documents efficiently. By providing easy access to an online library of over 85,000 editable forms and templates, you can be assured of creating legally sound documents.

Start your journey today by visiting US Legal Forms to access the resources you need for effective legal management.

Form popularity

FAQ

To get a power of attorney for a bank account, start by deciding who will act on your behalf. Next, draft the document detailing the powers you want to grant, focusing on financial matters. You can use services like US Legal Forms to access easy-to-follow templates for creating your power of attorney for bank account purposes. After preparing the document, sign it in front of a notary public for validation.

Yes, you can give someone else access to your bank account by establishing a power of attorney for bank account purposes. This legal document allows your designated person to manage your banking decisions on your behalf. It's important to choose someone you trust completely, as they will have significant authority over your finances. You can create a power of attorney for bank account transactions through platforms like US Legal Forms, ensuring the process is straightforward.

Yes, a person with power of attorney for bank account can add themselves to a checking account, but they must act in the best interest of the account holder. This process usually requires the POA to provide the bank with the power of attorney documentation. It's essential to understand that the POA has the authority to manage financial matters, including adding their name to accounts, as long as this aligns with the account holder's wishes.

To add a Power of Attorney (POA) to your bank account, you first need to obtain a legally recognized POA document. This document allows someone you trust to manage your finances on your behalf. Next, visit your bank with the POA document and the necessary identification. Bank officials will guide you through the process of adding the POA to your account, ensuring that your finances are handled according to your wishes.

Writing a power of attorney letter for a bank entails clearly stating your intentions and detailing the powers you wish to grant to the designated person. Include specific phrases such as 'power attorney for bank account' in the document to ensure it meets bank standards. You should sign the letter and have it notarized for authenticity. Platforms like uslegalforms can provide templates and guidance to create a comprehensive and legally sound document.

Yes, you can grant someone permission to access your bank account through a power of attorney. This legal document allows you to specify the powers you wish to delegate, making it clear what actions they can perform. Utilizing a power attorney for bank account can ensure that your financial matters are managed as intended while maintaining control over your assets. Always make sure to provide the bank with a copy of the authenticated document.

Banks are particular about power of attorney to protect themselves and their clients from fraud. Compliance with legal standards is crucial, as banks must verify the authenticity and authority granted in the document. The specificity required in the power attorney for bank account ensures that only the intended person can access and manage your funds. This rigid approach helps maintain the integrity of financial operations.

The time it takes for a bank to approve a power of attorney can vary, typically ranging from a few days to a couple of weeks. This process includes the bank reviewing the document to ensure it meets their requirements. Preparing a well-articulated power attorney for bank account can expedite approval. Staying in contact with the bank for updates can also streamline this process.

Power of attorney works with banks by authorizing someone to act on your behalf regarding financial decisions, including bank transactions. When you provide a power attorney for bank account, the bank allows this appointed person to manage the account as per your instructions in the document. It's crucial to inform your bank of the arrangement and present the correct documentation. This can enhance trust and transparency in your financial matters.

Choosing between a power of attorney and a joint bank account depends on individual needs. A power attorney for bank account allows for control without sharing ownership, which might be preferable for some. Meanwhile, a joint account can facilitate easier access to funds for shared expenses. Evaluate your circumstances to determine which option serves your interests best.