Dissolution Dissolve Corporation For 202

Description

How to fill out Iowa Dissolution Package To Dissolve Corporation?

- Log in to your US Legal Forms account if you're a returning user. Ensure your subscription is active to access the desired templates.

- For first-time users, start by previewing the form options available. Check the descriptions to determine which form best suits your needs.

- If you need another form, utilize the search feature to find the right template that aligns with your jurisdiction.

- Select the 'Buy Now' option for your chosen document and choose a subscription plan that fits your requirements. You will need to create an account if you're new.

- Complete the payment process by entering your credit card information or using PayPal for a hassle-free transaction.

- Download your completed form to your device. You can access it anytime via the 'My Forms' section in your account.

With US Legal Forms, individuals and attorneys can execute legal documents quickly and accurately. Take advantage of this robust form collection to make dissolution straightforward and stress-free.

Start your journey towards dissolving your corporation today. Visit US Legal Forms and streamline this essential process!

Form popularity

FAQ

To notify the IRS of your corporation's dissolution, you must file your final corporate tax return and mark the appropriate box indicating that it is the final return. Additionally, you should also send a letter explaining your corporation's dissolution along with the final return. It is important to follow all IRS regulations to ensure compliance and avoid issues in the future. Platforms like US Legal Forms can help you prepare the necessary forms and provide expert advice on IRS notifications.

Indeed, dissolving a California corporation online is possible through the California Secretary of State’s online services. This method not only expedites the process but also allows you to manage everything from the comfort of your home. It’s crucial to have all necessary information at your fingertips when you begin the online application. For additional ease, US Legal Forms can provide templates and expert guidance tailored for your needs in the dissolution to dissolve corporation for 202.

Yes, you can dissolve a California corporation online by accessing the California Secretary of State's website. They offer a streamlined process that allows you to submit your Certificate of Dissolution electronically. This option is convenient and can save you time, as you receive instant confirmation of your filing. Utilizing US Legal Forms can also assist you with step-by-step instructions to ensure everything is completed correctly.

To dissolve a corporation in California, you will need to complete the Certificate of Dissolution form. This form serves as a formal request to end your corporation's existence. It is essential to ensure all tax obligations are fulfilled and any outstanding liabilities are addressed prior to filing. Using platforms like US Legal Forms can simplify this process, providing you with the necessary documentation and guidance to ensure a smooth dissolution process.

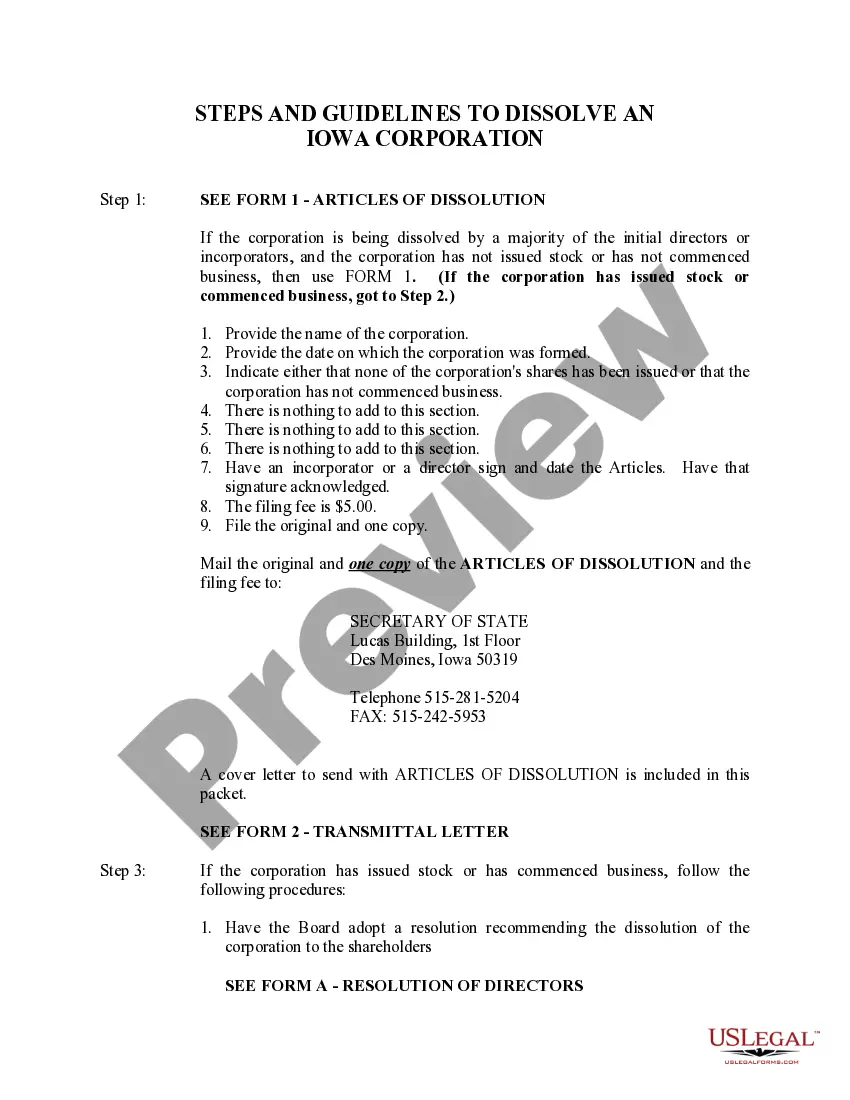

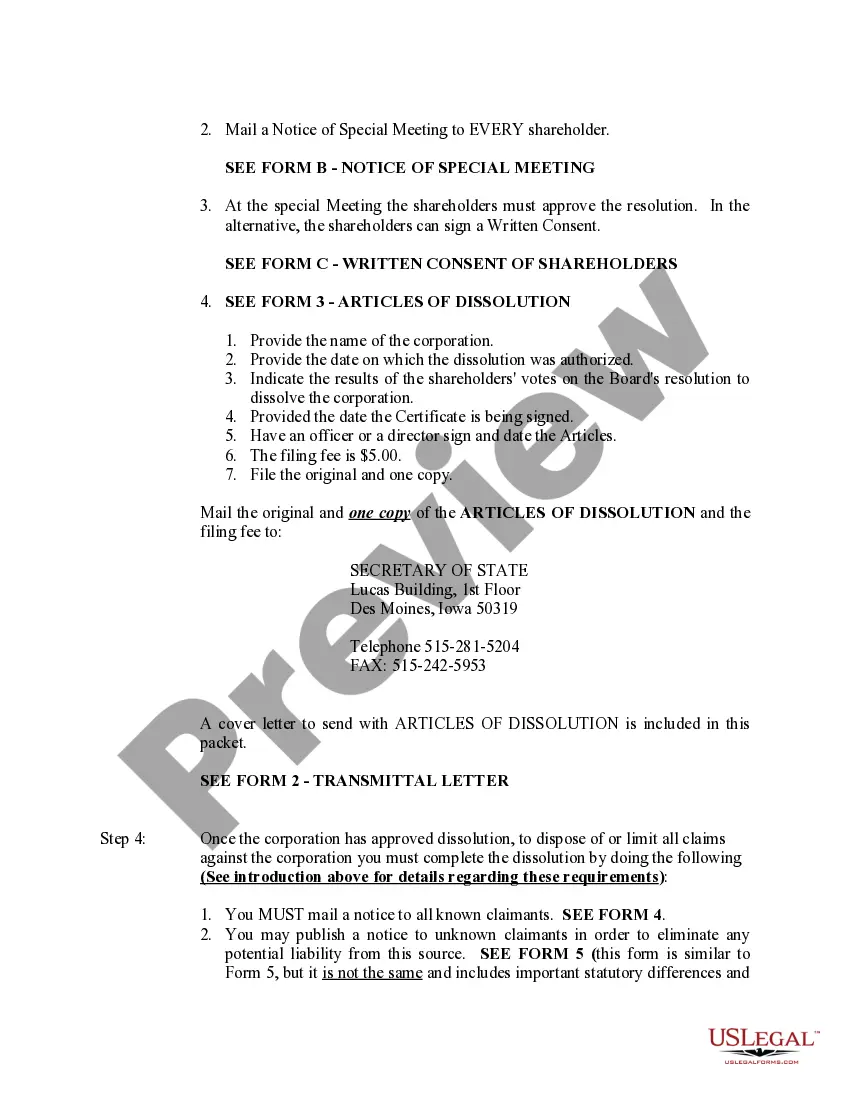

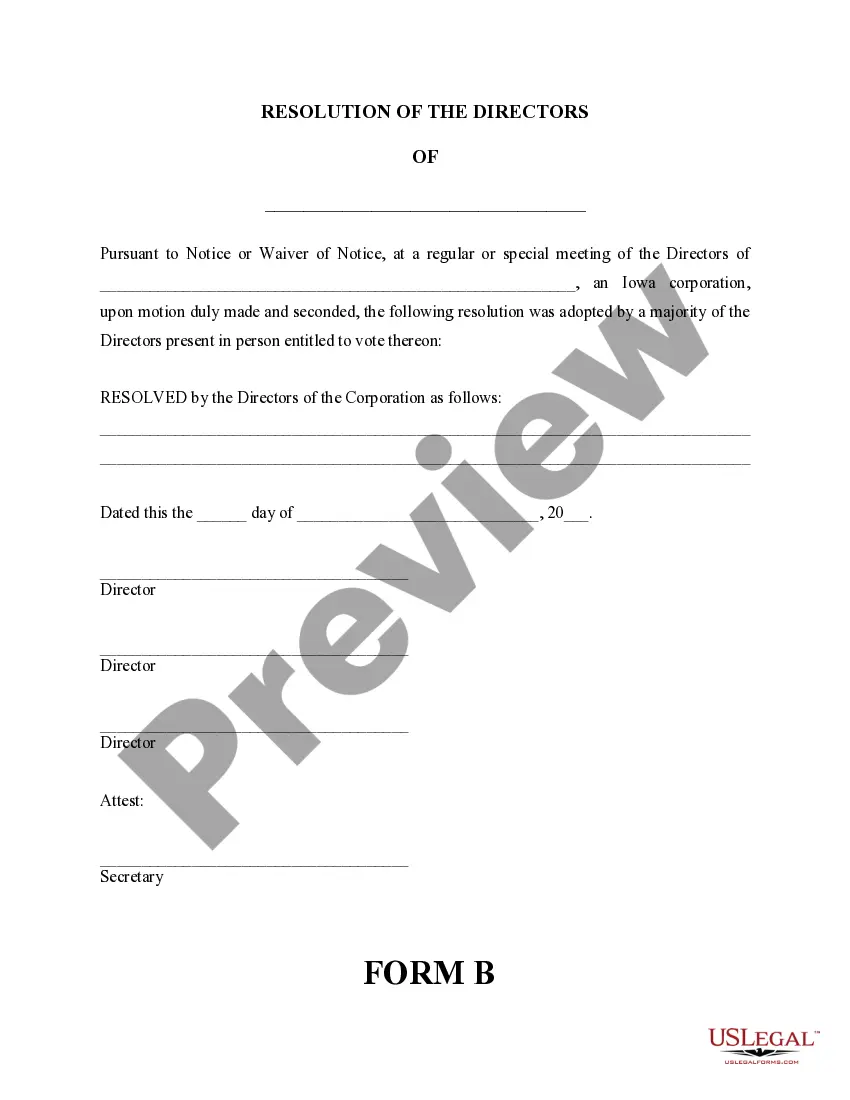

To complete articles of dissolution, gather necessary information such as the corporation's name, the date of incorporation, and the reason for dissolution. Follow the specific requirements provided by your state, as these can vary. This document officially records the decision to dissolve the corporation for 202, and it is essential for avoiding future liabilities. USLegalForms offers a straightforward solution, supplying templates that guide you through the completion process.

A dissolution letter serves as a formal notification of the intention to dissolve a corporation. Start by including the corporation's name, the date, and a clear statement about the decision to dissolve. Mention the reasons for the dissolution and any pertinent details about settling debts or distributing assets. This letter confirms your commitment to properly dissolve the corporation for 202, and it can be created easily using resources from USLegalForms.

Writing a dissolution involves several clear steps. Begin by stating the intent to dissolve the corporation and include key details such as the corporation's name and the effective date of dissolution. It is crucial to follow your state’s specific requirements to ensure that the dissolution is legally valid and effectively dissolve the corporation for 202. Using platforms like USLegalForms can simplify this process by providing templates tailored to your state's rules.

A dissolution occurs when a corporation decides to officially end its existence. For instance, if a small business finds it no longer viable to operate, it may file for dissolution. This legal action will effectively dissolve the corporation for 202, meaning it will cease all business activities and obligations. By filing for dissolution, the company protects its owners from future liabilities.

Filing Form 966 is generally necessary for corporations undergoing dissolution, but it may not be required specifically for single-member LLCs since they are often treated as disregarded entities. To be sure, assess your business structure and consult a tax professional or legal advisor. This will help you navigate the nuances of the dissolution process.

To dissolve your single-member LLC in Florida, you must file Articles of Dissolution with the Department of State. It’s crucial to settle all debts and distribute the remaining assets before filing. By following these steps carefully, you will ensure a smooth and legal dissolution process of your corporation.