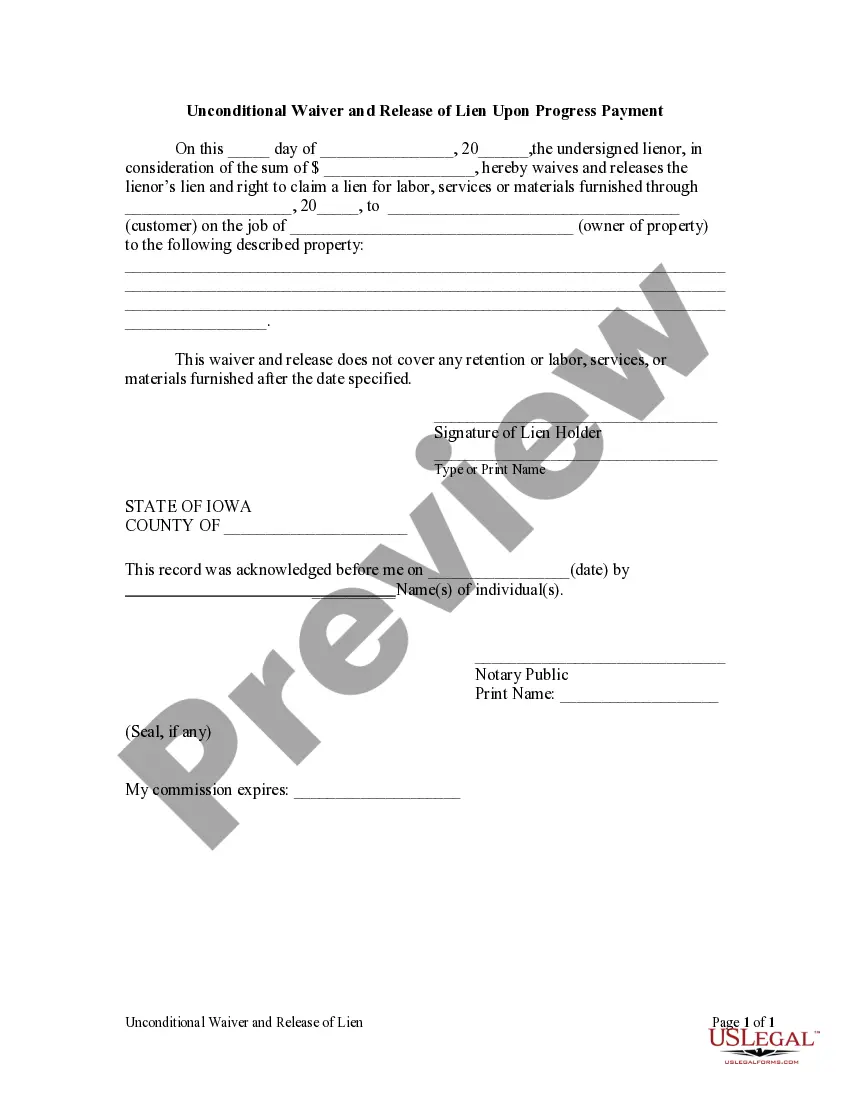

Lien Release For Payment

Description

How to fill out Iowa Unconditional Waiver And Release Of Lien Upon Progress Payment?

- If you’re an existing customer, log into your US Legal Forms account and access your necessary form template by clicking the Download button. Ensure your subscription is valid; renew it if needed.

- For first-time users, start by previewing the lien release form options. Read the descriptions to confirm that you have the correct version for your jurisdiction.

- If your initial choice doesn’t meet your requirements, utilize the search feature to find other templates that might be more suitable.

- Once you locate the right document, click on the Buy Now button and select your preferred subscription plan to proceed.

- Complete the transaction by entering your payment details, whether using a credit card or PayPal.

- After purchasing, download your form directly to your device. You can also find it in the My Forms section of your profile for future reference.

US Legal Forms offers a powerful solution, providing over 85,000 fillable and editable legal documents while also connecting users with expert assistance. Its comprehensive collection ensures you find the precise forms needed for your situation.

Start simplifying your legal documentation process today by utilizing US Legal Forms. Sign up now to explore the wealth of resources available!

Form popularity

FAQ

A lien release typically comes from the creditor or lender who initially filed the lien. Once the associated debt is settled, they issue the lien release to indicate that they relinquish their claim over the property. This document is crucial to remove any obstacles in property transactions or sales. By using uslegalforms, you can easily create the necessary documents and understand the process for securing a lien release for payment.

To obtain your lien release, start by contacting the creditor that placed the lien. Provide them with proof of payment and request the release documentation. After processing your request, the creditor should provide you with the lien release paperwork, which you need to keep for your records. If you use uslegalforms, you can find templates that facilitate this process and ensure you have everything needed for a lien release for payment.

The speed of obtaining a lien release can vary depending on the creditor and the payment process. Generally, once the payment is processed, you can expect to receive your lien release within a few business days. To expedite this, ensure you keep all payment records and communication consistent. Using our platform can help you manage these steps efficiently when seeking a lien release for payment.

To release a lien amount, you must settle the underlying debt. Once payment has been made, request a lien release from the creditor. The creditor will typically provide documentation confirming the release, which serves as proof that the lien has been satisfied. Utilizing our uslegalforms platform can streamline this process, ensuring you follow the correct steps to obtain a lien release for payment.

Typically, the borrower or debtor pays to remove a lien, as it is tied to their obligation to the lienholder. Once the debt is settled, the lienholder must submit a lien release without further costs. This ensures the title is clear and ready for future transactions. For convenience and accuracy, consider platforms like US Legal Forms when navigating lien release for payment.

The lienholder takes the primary responsibility for removing the lien and clearing the title. After receiving the full payment, they must file a lien release to officially remove it from the title. This action is essential for the property owner's future transactions or sales. Using US Legal Forms can help simplify this process and ensure compliance with local regulations.

The party that holds the lien, typically a lender or creditor, is responsible for filing a lien release. Once the borrower completes payment, the lien holder should submit the necessary paperwork to the appropriate authority. This step confirms that the debt has been settled and removes the lien from the public record. For a smooth process, you might consider using platforms like US Legal Forms to streamline the lien release for payment.

To discharge a lien means to officially remove the lien from the property's records, thereby freeing the owner from any claims. This action confirms that all financial obligations have been satisfied. A discharge can occur following full payment or a settlement agreement. Therefore, obtaining a lien release for payment is essential to clearing your property title and ensuring your rights are protected.

To obtain a lien release letter, you generally need to contact the creditor or financial institution that issued the lien. They may require proof of payment or other documentation before issuing the letter. Using services like USLegal Forms can help streamline this process by providing the necessary forms and instructions tailored to your situation. Thus, a lien release for payment becomes easier to manage.

When a lien is released, it is commonly referred to as a lien discharge. This process indicates that the creditor has accepted payment or has otherwise decided to relinquish their claim on the property. A proper lien discharge document offers peace of mind to property owners, confirming their rights. Therefore, be sure to secure a lien release for payment to ensure clear ownership.