Order Refunding Bond

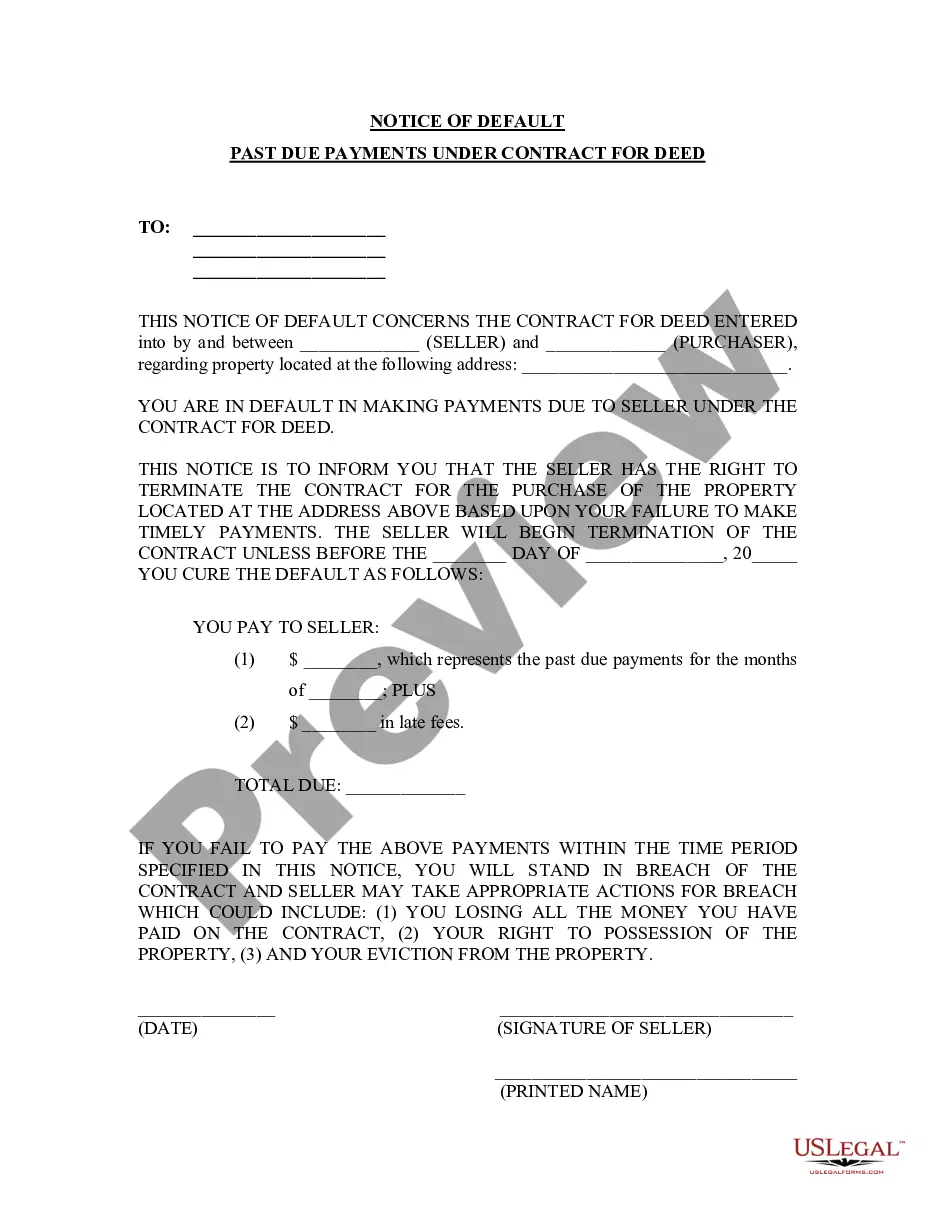

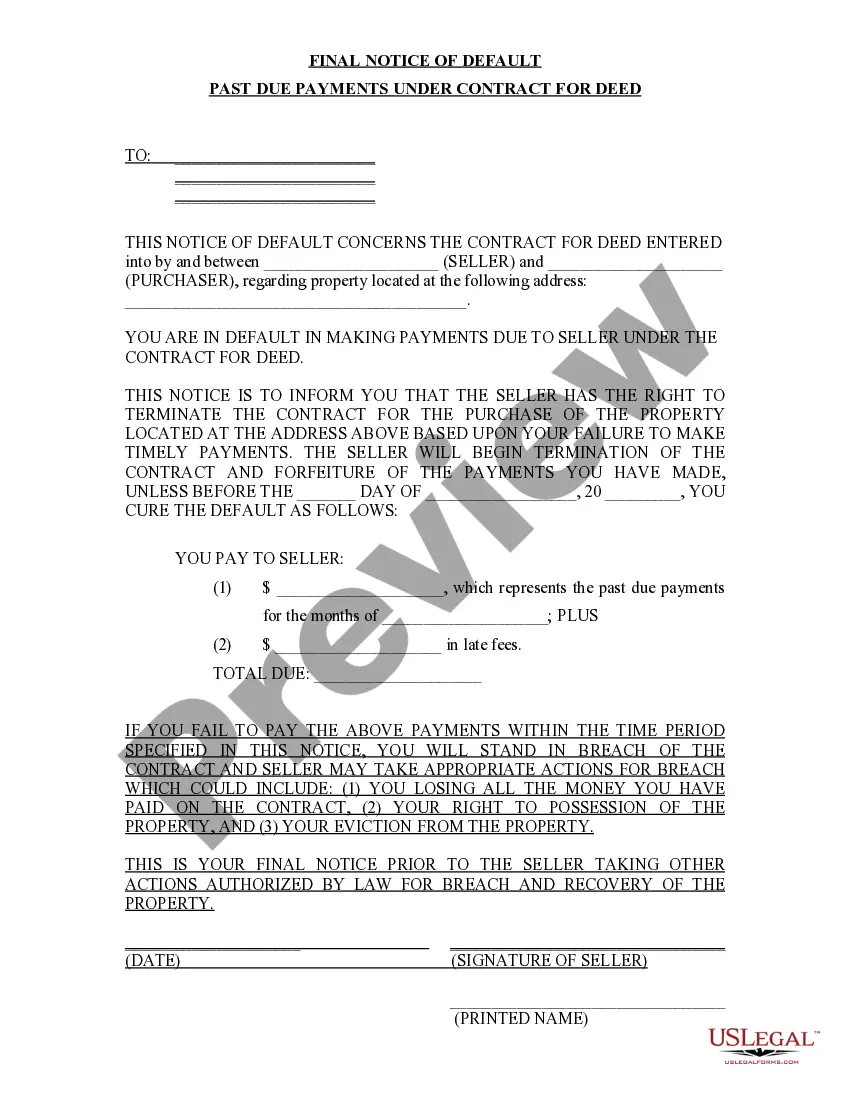

What is this form?

The Order Refunding Bond is a legal document used in court proceedings when a Defendant believes that the bond money paid should be partially or fully refunded. This form serves a specific purpose by allowing the Defendant to petition the court to return the cash bond under certain circumstances. It differs from other bond-related forms by focusing on the refund aspect rather than the issuance of new bonds or modifications to existing bonds.

What’s included in this form

- Defendant's name and their attorney's name for the refund.

- Statement confirming the court's consideration of the motion for refund.

- Order for the cash bond refund, specifying any deductions for court costs and fees.

- Date of the order issuance.

- Signature lines for the Circuit Judge and approval from the District Attorney.

Situations where this form applies

This form is applicable when a Defendant has posted a cash bond in relation to a legal proceeding and believes that the conditions justifying the bond have been satisfied. Situations for using this form include the resolution of a legal matter or a dismissal of charges, allowing for the possible recovery of the bond money. It is crucial to utilize this form when seeking a refund from the court after the conclusion of a case.

Intended users of this form

- Defendants who have posted a cash bond in court.

- Attorneys representing Defendants seeking a bond refund.

- Individuals involved in legal cases that are finished or resolved.

How to prepare this document

- Identify and enter the names of the Defendant and their attorney in the designated fields.

- Insert the date of the order being issued.

- Specify the amount to be refunded, taking into account any court costs or fees that may apply.

- Obtain the required signatures from the Circuit Judge and ensure the approval by the District Attorney.

- File the completed order with the appropriate court clerk's office as directed by local procedures.

Does this document require notarization?

This form usually doesn’t need to be notarized. However, local laws or specific transactions may require it. Our online notarization service, powered by Notarize, lets you complete it remotely through a secure video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to enter accurate names or amounts for the refund.

- Not obtaining the necessary signatures from relevant officials.

- Ignoring local court rules regarding filing and processing times for the refund order.

Why complete this form online

- Convenience of downloading and completing the form at your own pace.

- Editability allows for corrections to be made easily before submission.

- Access to templates drafted by licensed attorneys ensures compliance with legal standards.

Looking for another form?

Form popularity

FAQ

Refunded bonds maintain a cash amount held aside by the original issuer of the debt to repay its principal. A refunded bond will use a sinking fund to hold in escrow the principal amount, making these bonds less risky to investors.

Under Probate Code section 16004.5, a Trustee cannot require a beneficiary to sign a release in exchange for making a distribution of Trust assets, provided that the Trust distribution is required to be made as stated in the Trust document.

The Refunding Bond and Release has a dual purpose:Refunding To refund to the Executor or Administrator out of his/her share of the estate his ratable part of any unpaid debts, owed by the testator or intestate, if there are no other assets to pay them.

Transitive verb. 1 : to give or put back. 2 : to return (money) in restitution, repayment, or balancing of accounts. refund.

Re·fundA·ed, reA·fundA·ing, reA·funds. To give back, especially money; return or repay: refunded the purchase price. To make repayment. n. ( r01132032f016dnd2032)

Explain the difference between calling a bond and a bond refunding.The freely call provision, the bond can be called anytime before its maturity and will be redeemed by the issuer. Whereas, the deferred call provision allows redeeming the bond only after some fixed period.

Any creditor who wishes to make a claim against the estate's assets must do so within 9 months under New Jersey law. The 9 months begins on the date of debtor's death. The executor/personal representative cannot distribute assets to beneficiaries until all claims are satisfied.

A pre-refunding bond is a debt security that is issued in order to fund a callable bond. With a pre-refunding bond, the issuer decides to exercise its right to buy its bonds back before the scheduled maturity date.