Llc Llp

Description

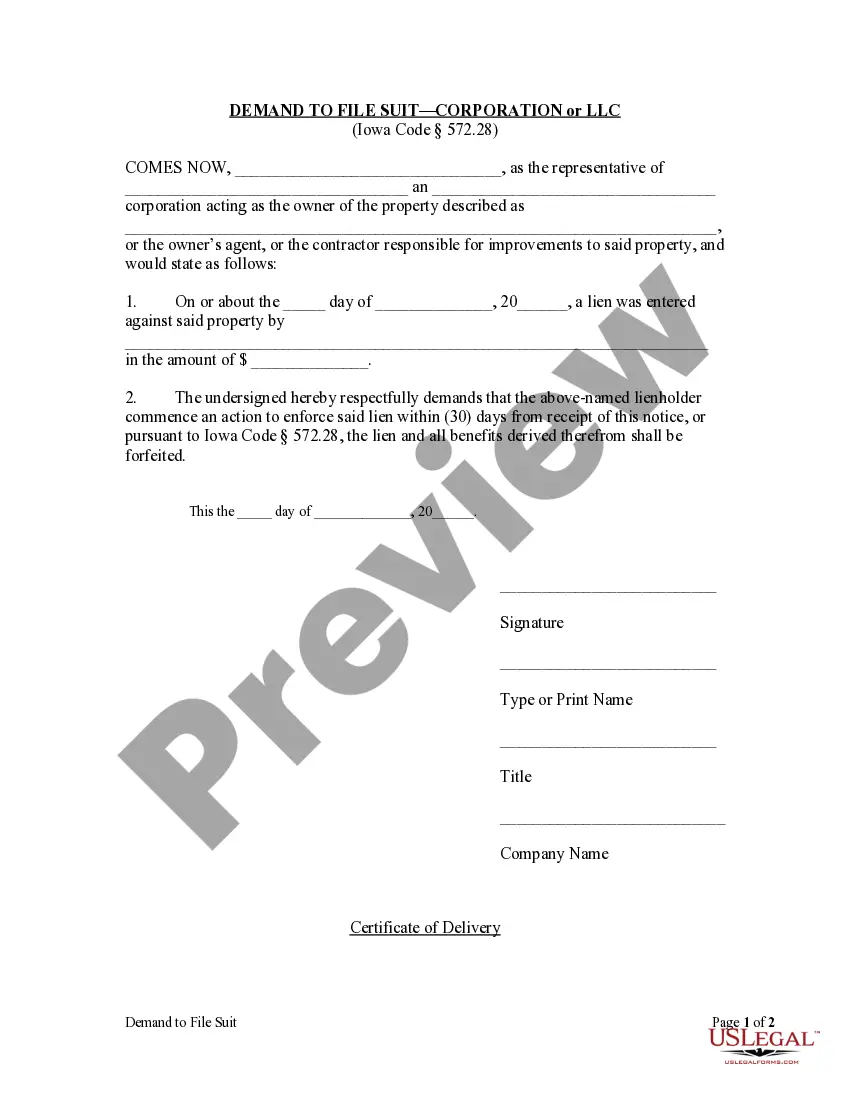

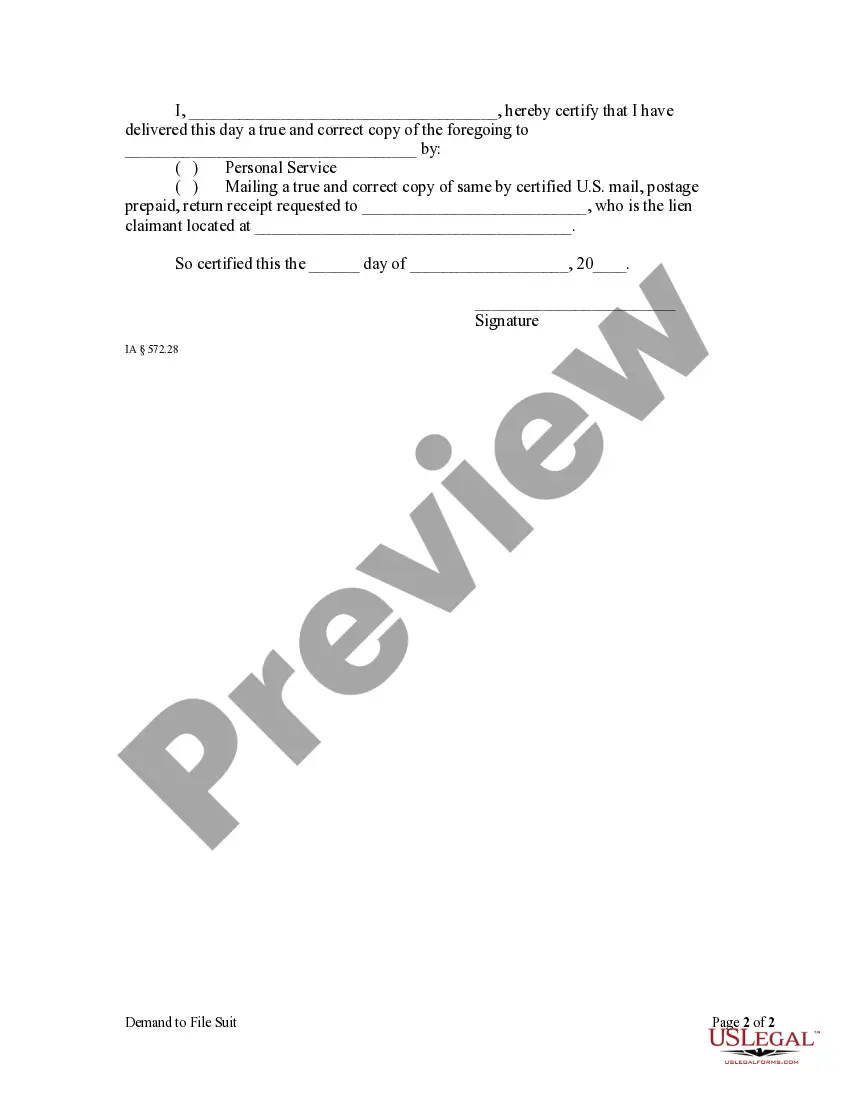

How to fill out Iowa Demand To File Suit By Corporation Or LLC?

- Log in to your existing US Legal Forms account to access your templates. Ensure your subscription is active to proceed.

- Browse the library and select the appropriate form for your needs. Check the description to confirm it aligns with your jurisdiction's requirements.

- In case you don't find the desired template, utilize the search function to explore other options.

- Once you’ve found the correct document, click the 'Buy Now' button and select your subscription plan. Account registration will be necessary for access.

- Complete your purchase by entering your payment details either through credit card or PayPal.

- Download the form and save it to your device. You can revisit it anytime through the 'My Forms' section in your account.

Using US Legal Forms empowers you to create legally sound documents quickly and efficiently.

Don't wait—unlock the full potential of your legal needs with US Legal Forms today!

Form popularity

FAQ

LLPs come with certain disadvantages, including the need for more formalities compared to LLCs. They may require specific agreements to outline the roles and responsibilities of partners, which could complicate management. Furthermore, not all states recognize LLPs for every profession, potentially limiting your business opportunities. Using uslegalforms can help navigate these complexities and ensure a well-structured approach to your business.

Whether an LLP is better than an LLC really depends on your business needs and structure. An LLP offers flexibility in management, which can be beneficial for partnerships, while an LLC generally provides simpler operational procedures and tax benefits. Both options, however, afford limited liability protection. To determine the right choice, consider consulting uslegalforms for expert guidance tailored to your situation.

LLPs can face specific challenges, such as varying regulations from state to state. Some states do not allow certain professions to operate as LLPs, which could limit your options. Additionally, if one partner commits malpractice, the entire partnership may still bear the consequences. It's essential to assess these factors thoroughly and explore options like LLCs through platforms such as uslegalforms.

Choosing an LLP instead of an LLC can provide unique advantages, especially for professional partnerships. An LLP allows partners to have limited liability while still participating in management. This setup often attracts professionals like lawyers and accountants who benefit from shared responsibility. If you are exploring the formation of a business structure, consider using uslegalforms to simplify the process.

Ltd, or Limited Company, and LLC, or Limited Liability Company, share similarities in offering limited liability to their owners, but they differ in their structure and taxation. Ltd typically refers to companies in the UK and may have more rigid regulations, while LLCs operate in the US and allow more flexibility regarding management and taxation options. Deciding between these two options requires understanding your specific business needs, and uslegalforms can provide resources to help guide your choice.

The main difference between an LLP and an LLC, or Limited Liability Company, lies in ownership and management structure. An LLC provides limited liability protection to all of its owners, called members, while an LLP requires at least one partner to have personal liability. This distinction creates a varied approach to risk management and taxation. Depending on your business goals, exploring these differences through uslegalforms can guide you in selecting the right structure.

LLP stands for Limited Liability Partnership, a unique business entity that offers partners limited personal liability. This means that, in most cases, personal assets are protected from the debts of the business. An LLP allows you to benefit from the flexibility of a partnership, while also providing legal protections akin to an LLC. Choosing this model can be beneficial for many small business owners.

When someone refers to an LLP, they are talking about a Limited Liability Partnership, which is a hybrid business model. This structure allows two or more individuals to manage a business while enjoying limited liability protection. Essentially, it means that the partners share both the profits and risks, but their personal assets are shielded from business liabilities. Understanding this term can help you decide on the best business structure for your needs.

One downside of an LLP is that it often requires more paperwork and formalities compared to a standard partnership. Additionally, some states impose restrictions on the number of partners and the type of businesses that can register as an LLP. It's important to weigh these considerations against the benefits of an LLP, which include personal asset protection and tax advantages. If you're exploring options, uslegalforms can help simplify the process.

An LLP, or Limited Liability Partnership, is a business structure that combines elements of partnerships and corporations. In an LLP, partners have limited liability, meaning they are not personally responsible for the debts of the business. This offers protection for their personal assets, similar to an LLC. If you're seeking a flexible business model with liability protection, considering an LLP might be a smart choice.