Limited Companies

Description

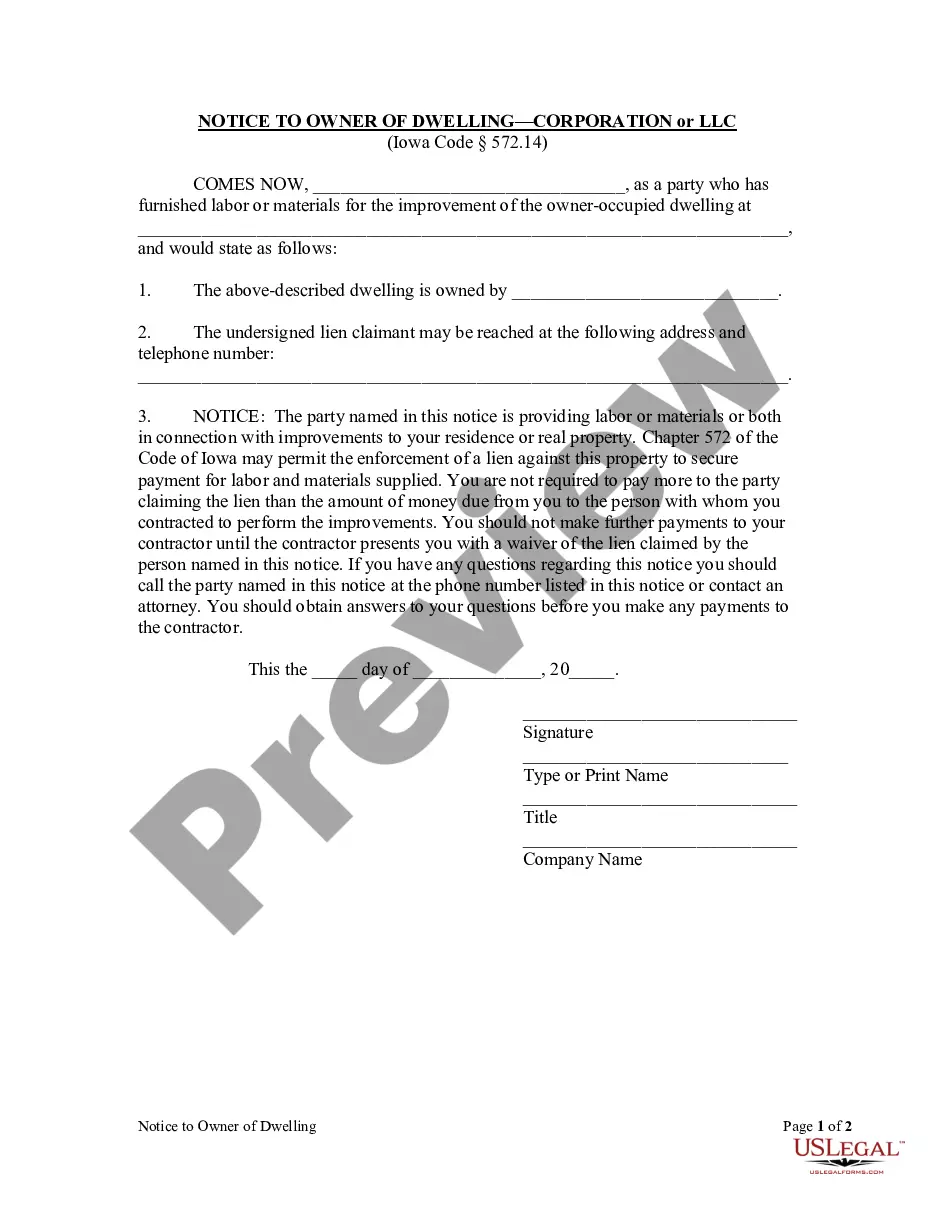

How to fill out Iowa Notice To Owner Of Dwelling By Corporation Or LLC?

- If you're a returning user, log in to your account and select the Download button for your desired template. Confirm that your subscription is active; if not, renew it based on your selected payment plan.

- For first-time users, start by checking the Preview mode to review the form description. Ensure the template meets your requirements and complies with local jurisdiction.

- If the chosen document doesn't meet your needs, utilize the Search tab to find a more suitable template. Once you find the right one, proceed to the next step.

- To purchase the document, click on the Buy Now button and choose a preferred subscription plan. Creating an account will grant you access to the extensive resources available.

- Next, complete your purchase by entering your credit card information or using your PayPal account to finalize the subscription.

- Lastly, download the form to your device for easy access. You can also find the document later in the My Forms section of your profile.

US Legal Forms not only simplifies the process of obtaining legal documents but also ensures that users have access to a vast resource of editable and fillable forms. With over 85,000 documents available, you'll likely find what you need without hassle.

Take control of your legal needs today and explore the benefits that US Legal Forms has to offer!

Form popularity

FAQ

Being a limited company means that the business is a separate legal entity from its owners. This separation protects individuals from personal liability in case of business debts or legal issues. Additionally, limited companies often enjoy certain tax advantages and more straightforward compliance processes. For those considering this structure, USLegalForms offers resources and services to streamline the formation and management of limited companies.

A limited company is typically a type of business entity that limits the liability of its members or shareholders. This means that owners are not personally liable for the company's debts beyond their investment. Limited companies can be further categorized into private or public companies, with each type having specific rules and regulations. By opting for a limited company, you can protect your personal assets while benefiting from a more credible business structure.

Limited companies and LLCs are both common business structures, but they have distinct differences. An LLC, or Limited Liability Company, offers personal liability protection to its owners while enjoying flexible tax treatment. On the other hand, a limited company usually refers to a corporate structure in which the owners' liability is limited to their investment in the company. Understanding these differences can help you choose the right structure for your business needs.

Choosing between a limited partnership and an LLC depends on your business goals and operational needs. LLCs provide limited liability for all members, while limited partnerships have general partners who hold personal liability. Additionally, LLCs typically have fewer operational restrictions and tax benefits. Analyzing these differences can guide your decision to form limited companies that fit your objectives.

Although Ltd and LLC serve similar purposes in providing limited liability, they are not the same. Ltd exists primarily in the UK, while LLC is a structure recognized in the US. Each has unique legal implications, tax treatments, and regulatory frameworks. Knowing these differences can help anyone understand the landscape of limited companies better.

One disadvantage of a limited company is the regulatory burden it faces, including compliance and reporting requirements. This can be more complex than operating as a sole proprietorship or general partnership. Additionally, the separation of personal and business finances can limit some flexibility in financial matters. It's vital to weigh these aspects when considering forming limited companies.

A limited company is a business structure where the owners' liability is limited to their investment in the company. To qualify as a limited company, it must be registered with the appropriate governmental authority, such as the Secretary of State in the US. Furthermore, it should adhere to specific regulations, including annual reporting and financial records. Understanding how these requirements apply can facilitate your venture into limited companies.

Determining which is better, Ltd or LLC, depends on your specific business needs and goals. If you operate in the UK, Ltd may serve you well, while LLC is tailored for businesses in the US. Each option has its own tax treatment and regulatory requirements, so evaluating these factors is crucial. Consulting with a professional can help you make an informed decision about forming limited companies.

The main difference between Ltd (Limited) and LLC (Limited Liability Company) lies in the country of registration and the legal structure. Ltd is typically used in the UK, while LLC is more common in the US. Both provide limited liability protection, but their management and tax implications vary. If you are considering forming limited companies, it's essential to understand these distinctions.

Limited companies typically have to file initial formation documents and annual reports to stay in good standing. Additionally, they may need to file taxes, such as income tax returns, depending on their classification. Some states require specific licenses and permits for operation. Leveraging US Legal Forms can streamline this filing process, making it easier for you to stay compliant.