Life Estate In Iowa With Condition Subsequent

Description

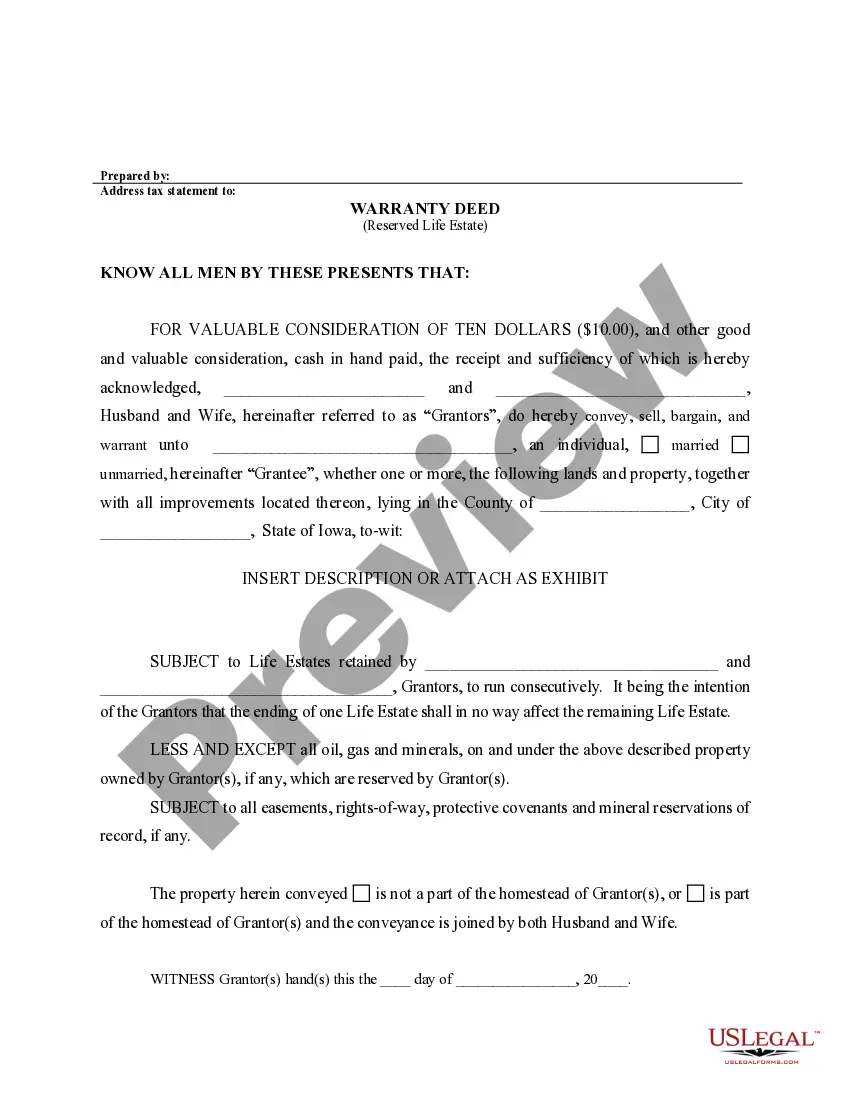

How to fill out Iowa Warranty Deed To Child Reserving A Life Estate In The Parents?

Obtaining legal templates that comply with federal and state laws is crucial, and the internet offers a lot of options to choose from. But what’s the point in wasting time searching for the appropriate Life Estate In Iowa With Condition Subsequent sample on the web if the US Legal Forms online library already has such templates gathered in one place?

US Legal Forms is the greatest online legal catalog with over 85,000 fillable templates drafted by lawyers for any professional and personal case. They are simple to browse with all papers collected by state and purpose of use. Our specialists keep up with legislative updates, so you can always be sure your paperwork is up to date and compliant when getting a Life Estate In Iowa With Condition Subsequent from our website.

Getting a Life Estate In Iowa With Condition Subsequent is fast and simple for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you require in the preferred format. If you are new to our website, adhere to the guidelines below:

- Take a look at the template utilizing the Preview option or through the text outline to ensure it fits your needs.

- Locate a different sample utilizing the search function at the top of the page if needed.

- Click Buy Now when you’ve found the suitable form and opt for a subscription plan.

- Create an account or log in and make a payment with PayPal or a credit card.

- Choose the right format for your Life Estate In Iowa With Condition Subsequent and download it.

All templates you locate through US Legal Forms are reusable. To re-download and complete earlier obtained forms, open the My Forms tab in your profile. Take advantage of the most extensive and easy-to-use legal paperwork service!

Form popularity

FAQ

A life estate is created when a property owner deeds property to another person but first reserves a life estate for a third party. The recipient of a life estate (known as the "life tenant") has full possession of the property for the duration of the tenant's life.

If there is no third-party remainderman designated in the life estate deed, property ownership reverts back to the grantor, or the grantor's estate. A life tenant pays all property costs, applicable taxes, and insurance while in possession of the property.

However it also has distinct drawbacks. The person who creates the life estate (the grantor) and the beneficiary share an ownership interest in the property, so once a life estate has been established it can't be changed without both of their consent.

A life tenant does not have complete control over the property because they do not own the whole bundle of rights. The life tenant cannot sell, mortgage or in any way transfer or encumber the property. If either party wants to sell the property, both the life tenant and remainderman must agree.

What are the pros and cons of life estates? Avoid probate. Possible tax breaks for the life tenant. Reduced capital gains taxes for remainderman after death of life tenant. Capital gains taxes for remainderman if property sold while life tenant still alive. Remainderman's financial problems can affect the life tenant.