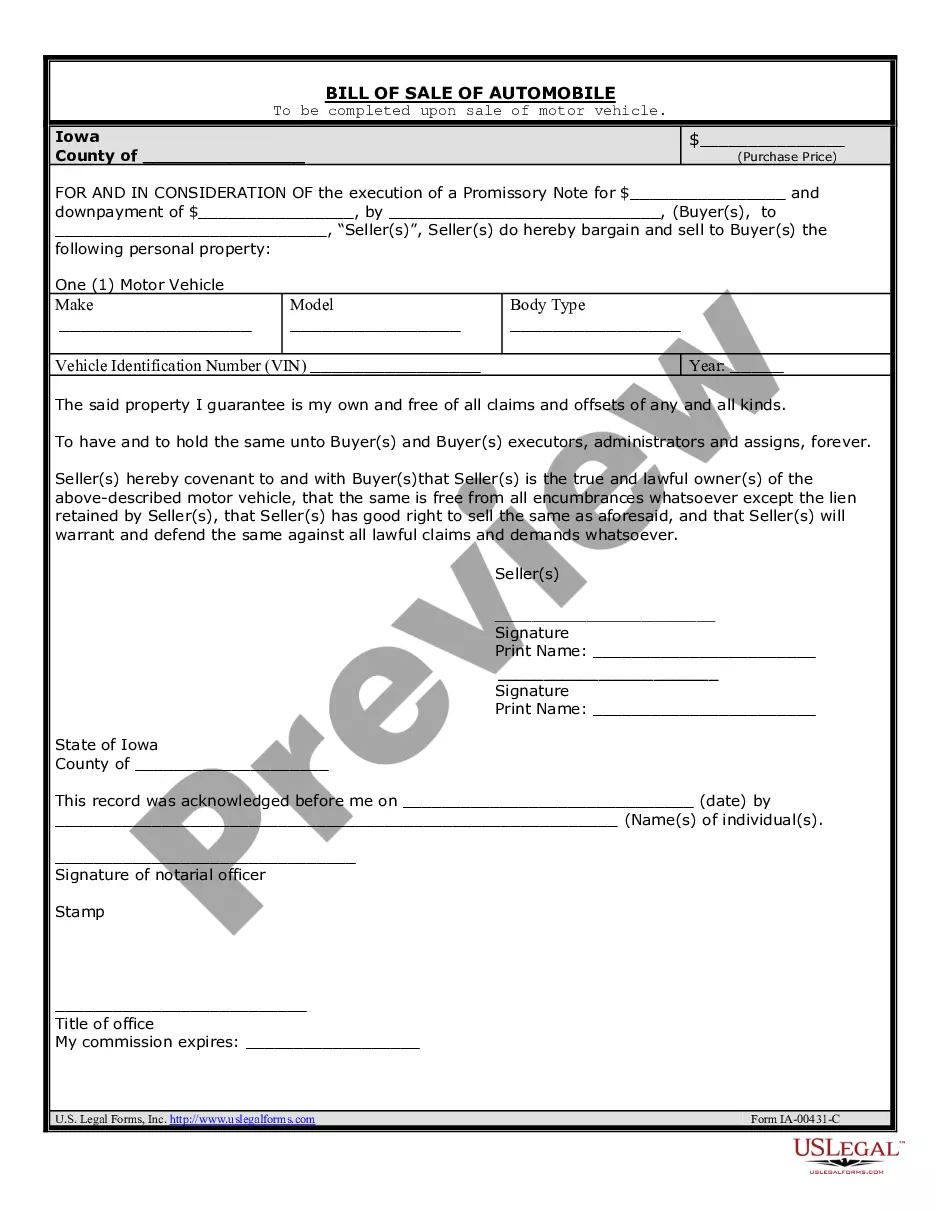

Iowa Bill Of Sale With Payment Plan

Description

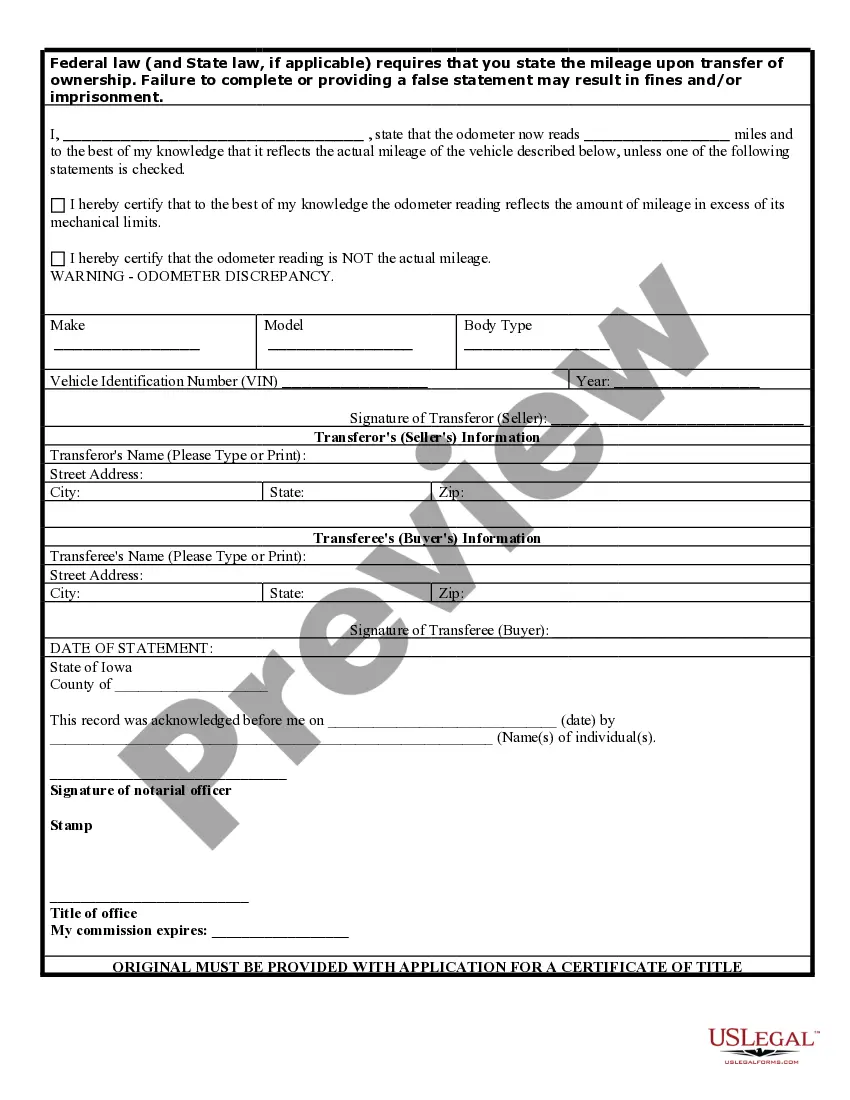

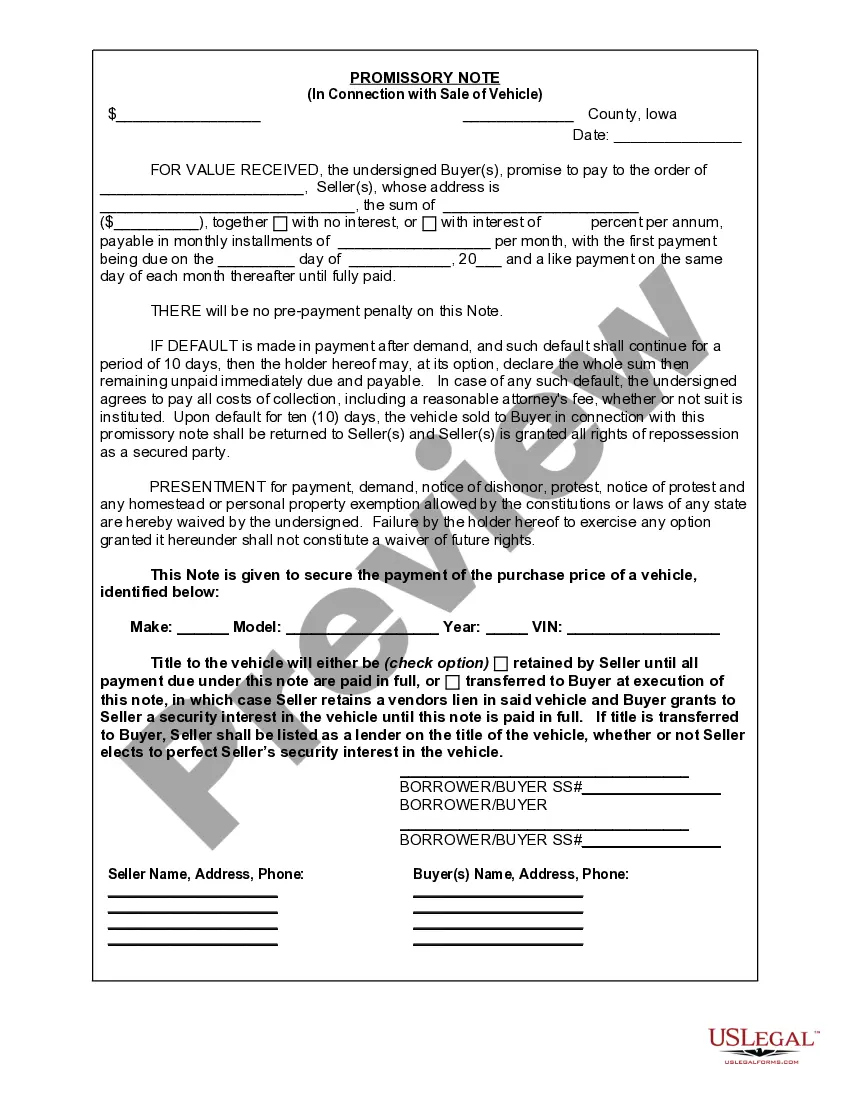

How to fill out Iowa Bill Of Sale For Automobile Or Vehicle Including Odometer Statement And Promissory Note?

There is no longer a requirement to spend time looking for legal documents to fulfill your local state obligations.

US Legal Forms has gathered all of these in one location and improved their availability.

Our platform provides over 85k templates for various business and individual legal situations categorized by state and purpose.

Utilize the Search field above to look for another sample if the prior one did not meet your needs. Click Buy Now next to the template title once you identify the appropriate one. Select the desired subscription plan and register for an account or Log In. Process your subscription payment with a credit card or through PayPal to continue. Choose the file format for your Iowa Bill Of Sale With Payment Plan and download it to your device. Print your form for manual completion or upload the sample if you prefer to use an online editor. Crafting formal paperwork under federal and state standards is quick and easy with our collection. Try US Legal Forms today to maintain your documentation organized!

- All forms are properly drafted and verified for correctness, so you can trust in receiving a current Iowa Bill Of Sale With Payment Plan.

- If you are acquainted with our platform and already possess an account, ensure that your subscription is active before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all saved documents whenever needed by accessing the My documents tab in your profile.

- If you have not previously used our platform, the procedure will require a few additional steps to finalize.

- Here is how new users can find the Iowa Bill Of Sale With Payment Plan in our directory.

- Review the page content carefully to confirm it includes the sample you require.

- To do this, make use of the form description and preview options if available.

Form popularity

FAQ

How To Set Up a Debt Repayment Plan in 6 Easy StepsMake a List of All Your Debts.Rank Your Debts.Find Extra Money To Pay Your Debts.Focus on One Debt at a Time.Move Onto the Next Debt.Build Up Your Savings.

Payment methods include credit card, direct debit from a checking account, or mail a paper check with the Department provided payment voucher. When paying by credit card, the Department's vendor charges a convenience fee based on the amount of the payment.

Terms of Payment Agreement If you need to establish a payment plan for the amount you owe on sales tax, use tax, fuel tax, or withholding tax, visit tax.iowa.gov. Maximum payment term is 36 months.

Description: The sales or lease price of vehicles subject to registration is exempt from sales tax. These vehicles are subject to a fee for new registration equal to 5% of the sales or lease price. This fee for new registration also applies when vehicles are sold between private individuals.