Release Of Mortgage Sample With Assumption

Description

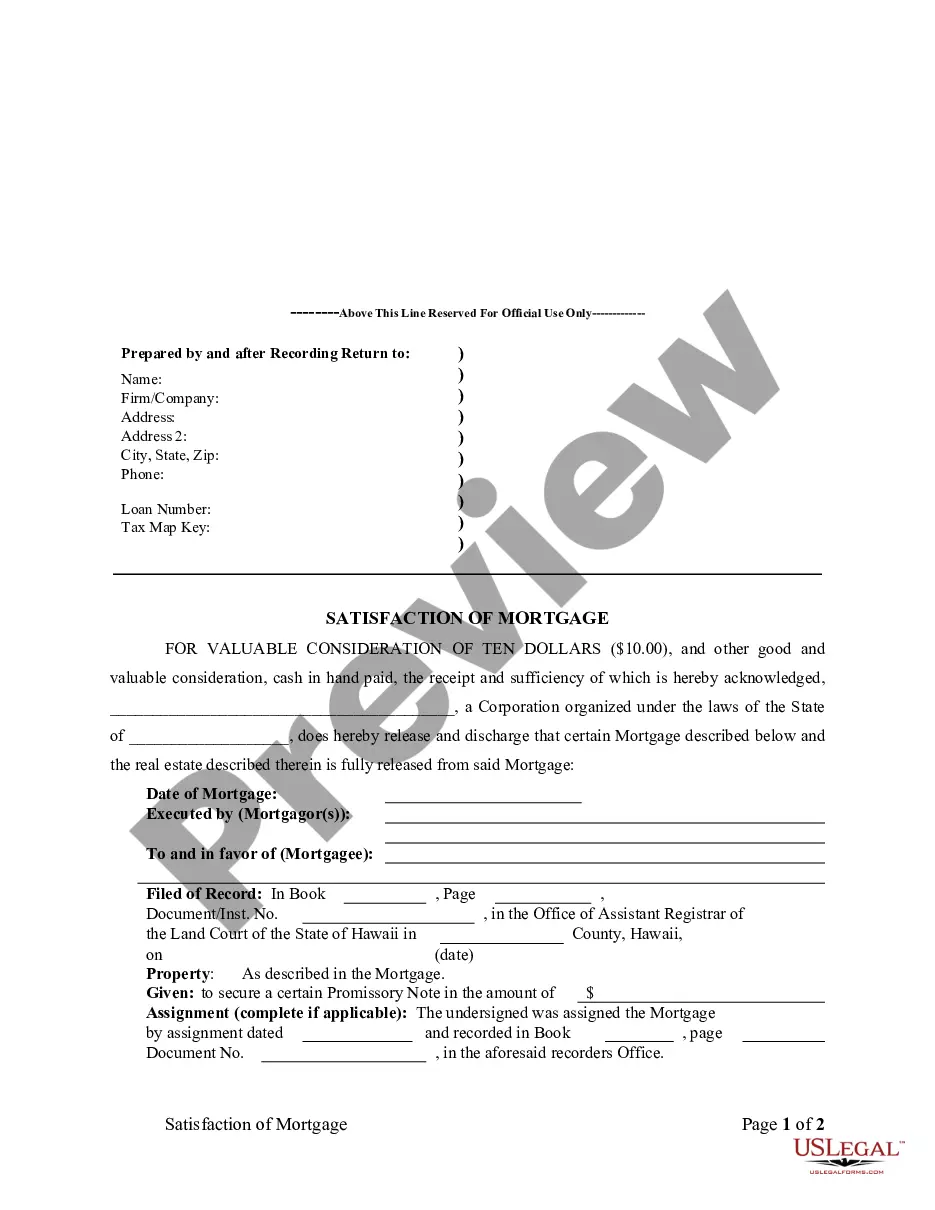

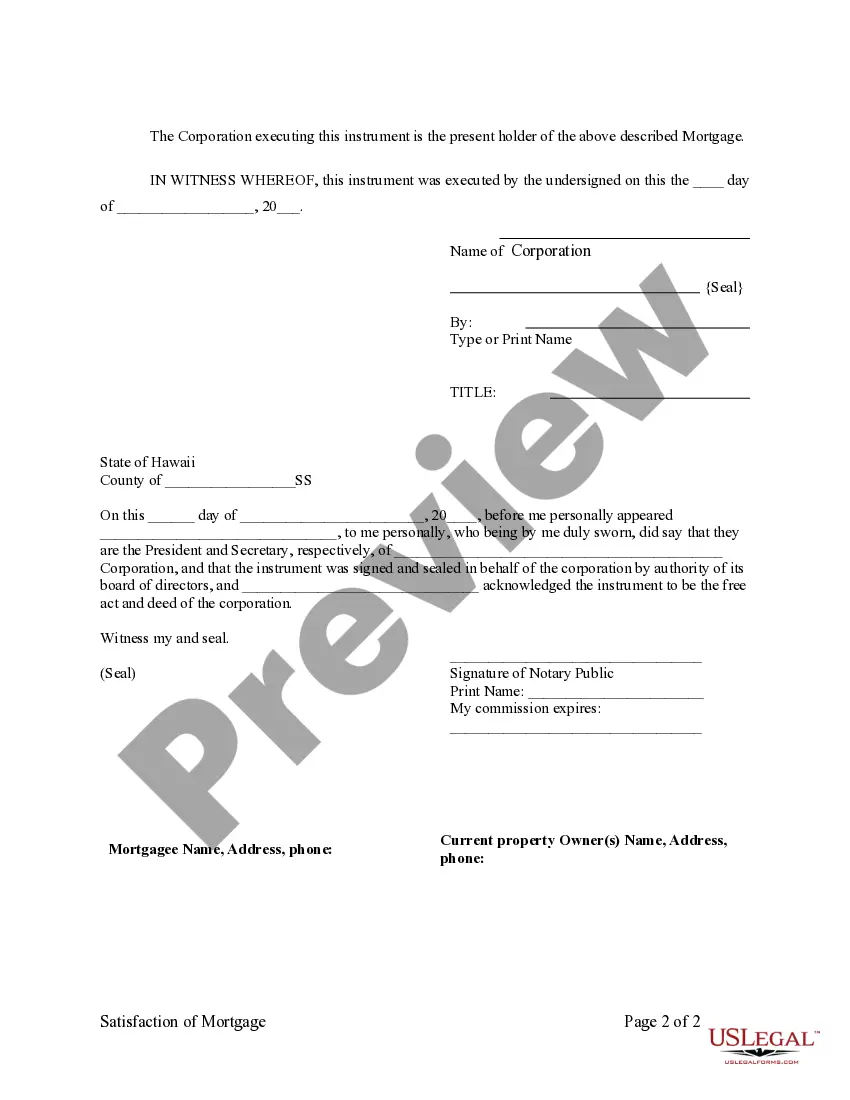

How to fill out Hawaii Satisfaction, Release Or Cancellation Of Mortgage By Corporation?

How to acquire professional legal documents that comply with your state's legislation and create the Release Of Mortgage Sample With Assumption without consulting an attorney.

Numerous online services provide templates for an array of legal situations and requirements. However, identifying which available samples satisfy both practical needs and legal standards may consume time.

US Legal Forms is a trustworthy platform that aids you in locating official documents crafted in line with the most recent updates in state law, helping you reduce expenses on legal support.

If you do not have an account with US Legal Forms, follow the steps below: Review the web page you’ve accessed and verify if the form meets your requirements. To do this, utilize the form description and preview options if available. Search for an alternative template in the header specifying your state if needed. Click the Buy Now button once you identify the suitable document. Choose the most appropriate pricing plan, then Log In or create an account. Decide on your payment method (by credit card or via PayPal). Adjust the file format for your Release Of Mortgage Sample With Assumption and click Download. The obtained templates are yours to keep; you can always revisit them in the My documents section of your profile. Join our collection and prepare legal documents independently like a seasoned legal professional!

- US Legal Forms is not merely an ordinary online directory.

- It comprises over 85,000 validated templates tailored for diverse business and personal situations.

- All documents are categorized by field and state to streamline your search process.

- Additionally, it connects with robust solutions for PDF editing and electronic signing, allowing users with a Premium subscription to effortlessly finalize their documentation online.

- Obtaining the required paperwork demands minimal time and effort.

- If you currently possess an account, Log In and confirm your subscription is active.

- Retrieve the Release Of Mortgage Sample With Assumption by using the appropriate button adjacent to the file name.

Form popularity

FAQ

An assumption agreement, sometimes called an assignment and assumption agreement, is a legal document that allows one party to transfer rights and/or obligations to another party. It allows one party to "assume" the rights and responsibilities of the other party.

Release of the Debtor. In consideration of the assumption of the Debtor's Liabilities, the Creditor (a) agrees to look solely to the Assuming Party for the payment and the performance of the Liabilities; and (b) forever releases and discharges the Debtor from the Liabilities.

A letter of assumption is a written agreement between a current homeowner and a prospective buyer. The letter states that the buyer agrees to take over the homeowner's debt in the home in exchange for ownership.

To assume a loan, the buyer must qualify with the lender. If the price of the house exceeds the remaining mortgage, the buyer must remit a down payment that is the difference between the sale price and the mortgage. If the difference is substantial, the buyer may need to secure a second mortgage.

If you're thinking of assuming a loan in a divorce, start by calling your current lender and asking them for a copy of your original promissory note. The promissory note will tell you whether the loan is assumable or not.