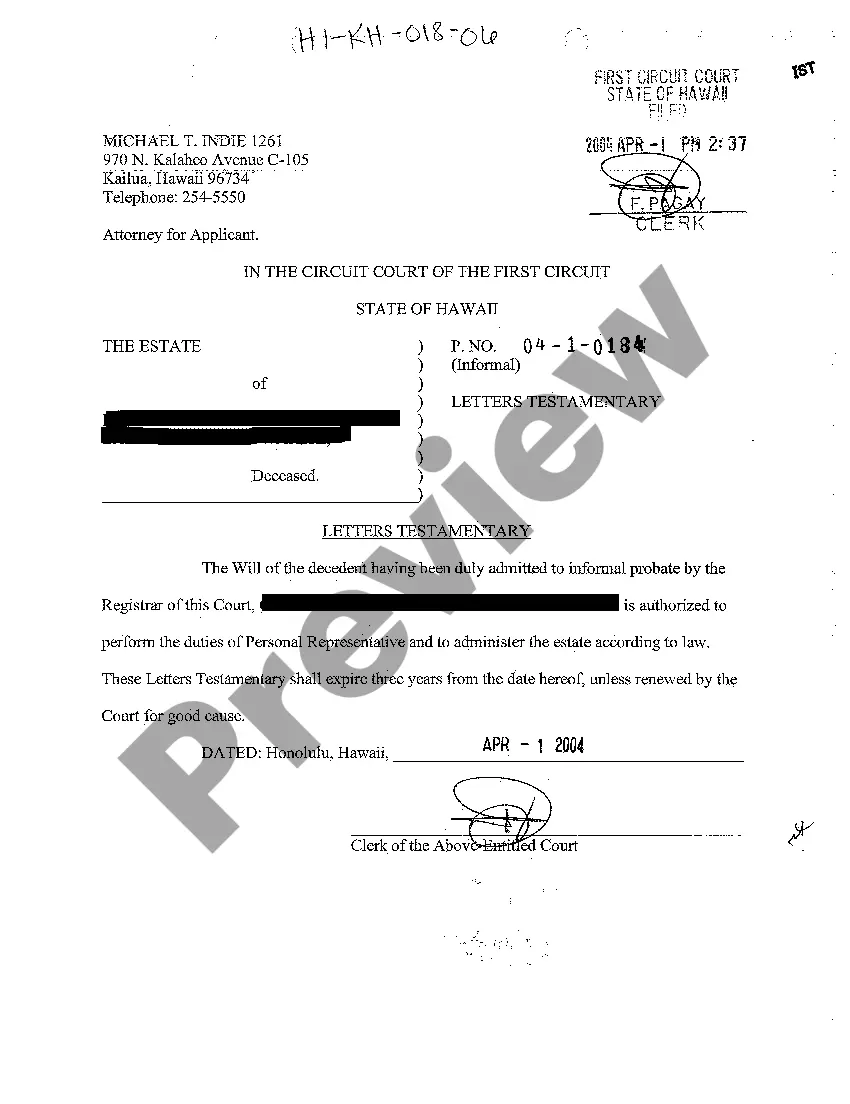

Letters Of Testamentary In Hawaii

Description

How to fill out Hawaii Letters Testamentary?

Finding a reliable source for the most up-to-date and suitable legal samples is a significant part of navigating bureaucracy.

Selecting the correct legal documents requires accuracy and meticulousness, which is why it is essential to obtain samples of Letters Of Testamentary In Hawaii solely from trustworthy providers, such as US Legal Forms. An incorrect template can squander your time and delay your current situation.

Eliminate the hassle associated with your legal paperwork. Discover the vast US Legal Forms library where you can find legal samples, verify their applicability to your circumstances, and download them instantly.

- Utilize the library navigation or search option to locate your sample.

- Examine the form’s description to determine if it meets the criteria of your state and locality.

- Preview the form, if available, to confirm that the template is indeed what you are seeking.

- Return to the search if the Letters Of Testamentary In Hawaii does not match your specifications.

- Once you are confident about the form’s relevance, download it.

- If you are an authorized user, click Log in to verify and access your chosen forms in My documents.

- If you do not yet have an account, click Buy now to obtain the form.

- Choose the payment plan that meets your requirements.

- Proceed with the registration to finalize your purchase.

- Complete your purchase by selecting a payment method (credit card or PayPal).

- Choose the document format for downloading Letters Of Testamentary In Hawaii.

- After you have the form on your device, you can modify it using the editor or print it and complete it manually.

Form popularity

FAQ

The costs associated with obtaining letters of testamentary in Hawaii can vary based on several factors, including court fees and filing costs. Additionally, if you choose to hire a lawyer, attorney fees will influence your total expenses. To get a clearer picture of potential costs, you may consider checking resources from platforms like USLegalForms, which can provide insight into what to expect.

Yes, it is possible to obtain letters of testamentary in Hawaii without a lawyer, but understanding the process is crucial. You will need to file the appropriate forms and follow all legal requirements yourself. However, using a service like USLegalForms can simplify this process and provide the forms you need, reducing the chances of making costly errors.

After you receive letters of testamentary in Hawaii, you gain the authority to act on behalf of the deceased's estate. This includes settling debts, distributing assets, and managing any ongoing business dealings. Completing these responsibilities promptly helps to honor the wishes of the deceased while ensuring the estate is managed efficiently.

Rule 42 in Hawaii probate relates to the process of obtaining letters of testamentary in Hawaii. This rule outlines the procedures and requirements for personal representatives to manage a deceased person's estate. When you apply for letters of testamentary, understanding Rule 42 ensures you follow the correct steps, which can smooth your administration process.

Assets that require letters of testamentary in Hawaii typically include real estate, bank accounts, stocks, and personal property owned solely by the deceased. If the deceased held assets in their name alone, these must go through probate process using the letters of testamentary. Proper administration of these assets ensures they are distributed according to the will or state law.

Testamentary documentation refers to legal papers that support the administration of a deceased person's estate. This includes the will, letters of testamentary in Hawaii, and any other relevant documents required by the probate court. These documents help ensure the deceased's wishes are honored and guide you in managing their financial affairs.

Filing a letter of testamentary in Hawaii involves submitting a completed petition to the probate court along with required documentation. Ensure you have the original will, a death certificate, and an inventory of the deceased's assets. After the court processes your application, you will receive your letters of testamentary, allowing you to manage the estate.

To obtain letters of testamentary in Hawaii, you need to file a petition with the probate court in your county. This petition must include important documents, such as the deceased's will and an inventory of their assets. Once the court reviews your petition and validates the will, it will issue letters of testamentary, granting you the authority to act on behalf of the estate.

A letter of testamentary in Hawaii remains valid as long as the estate is in probate. Once the probate process concludes, the executor's authority ceases. It is essential for executors to act promptly and responsibly to ensure that all necessary tasks are completed within a reasonable timeframe to avoid complications.

The purpose of letters of administration in Hawaii is to appoint an individual to oversee a decedent's estate when no will exists. This document gives the administrator the authority to settle debts, manage assets, and distribute property according to state law. Without these letters, the estate cannot proceed through probate efficiently.