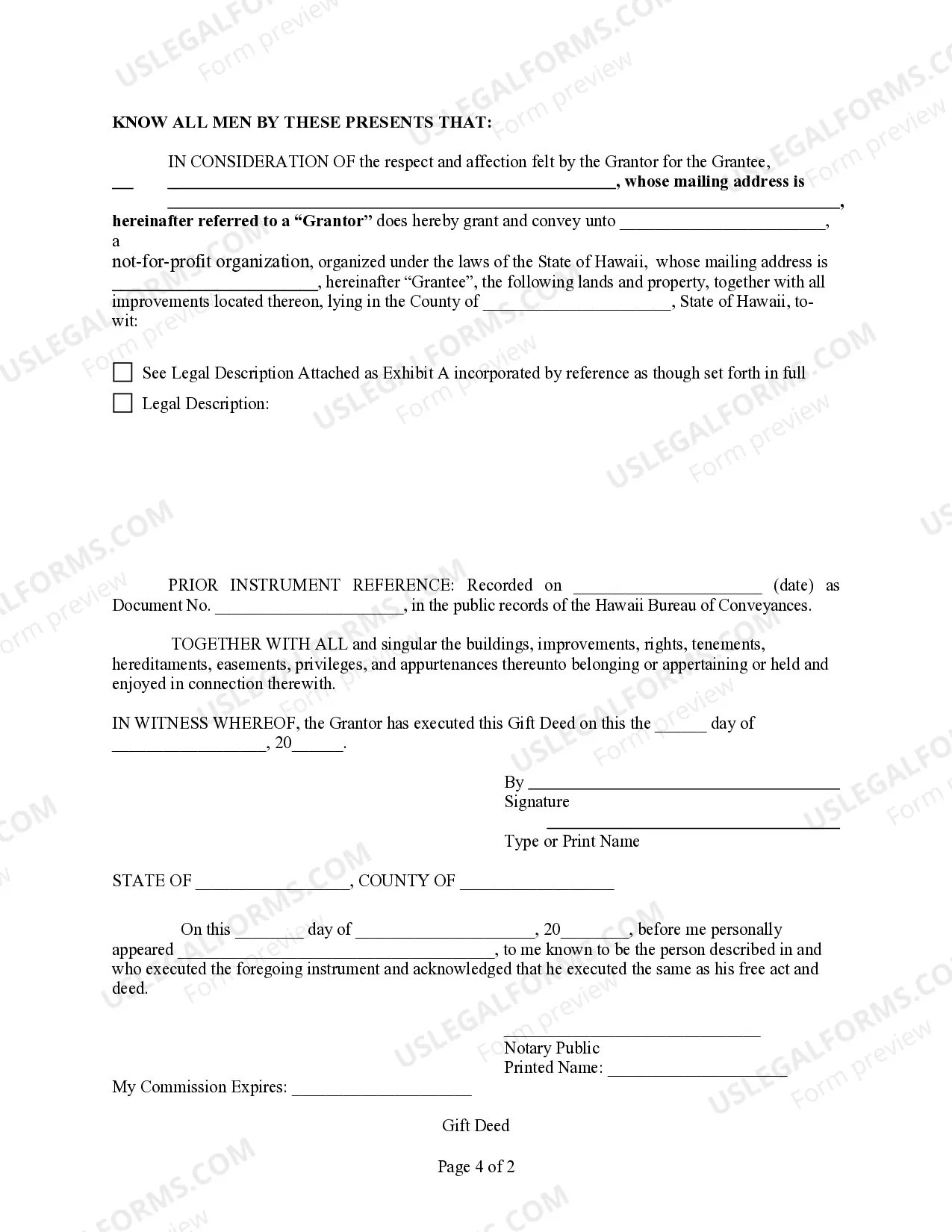

This form is a Gift Deed where the grantor is an individual and the grantee is an Unincorporated Association or a Not-for-Profit Organization. Grantor conveys and grants the described property to the grantee. This deed complies with all state statutory laws.

Hawaii Unincorporated With A Partnership

Description

How to fill out Hawaii Gift Deed From An Individual To An Unincorporated Association Or A Not-for-Profit Organization?

- For returning users, log in to your account and select the desired form template to download it to your device.

- If you’re new, first check the Preview mode and form description to ensure you’ve selected the right form that aligns with your jurisdiction's requirements.

- Search for alternate templates if necessary. Use the Search tab above to find any inconsistencies, then move on when you find the appropriate one.

- Proceed to purchase your document by clicking the Buy Now button and choosing a suitable subscription plan, which requires you to create an account.

- Complete your purchase by entering your payment details using a credit card or PayPal.

- Finally, download your form to your device. You can always find it in the My Forms section of your profile.

In conclusion, with US Legal Forms, accessing legal documents has never been simpler. Their extensive library and user-friendly platform ensure that you’ll find the forms you need with ease, while also providing expert assistance.

Don't wait any longer; get started today and take the stress out of legal documentation!

Form popularity

FAQ

Filing requirements for a partnership in Hawaii include submitting Form N-20 annually if the partnership generates income. Each partner must also report their share of income using the Schedule K-1 form. Staying compliant with these requirements, particularly as a Hawaii unincorporated with a partnership, is vital to avoid penalties or issues with tax authorities.

To fill out a W-9 for a partnership, indicate the partnership’s name exactly as it appears on the partnership agreement. Next, provide the partnership’s taxpayer identification number (TIN) and check the box indicating that it is a partnership. It is essential for the W-9 to represent your Hawaii unincorporated with a partnership correctly to ensure accurate tax reporting.

To fill out a partnership agreement, start by clearly defining the roles, responsibilities, and ownership percentages of each partner involved in your Hawaii unincorporated with a partnership. Include terms for profit sharing, decision-making processes, and provisions for resolving disputes. Make sure all partners review, agree, and sign the document to formalize the agreement.

The Schedule K-1 form N-20 provides detailed information about each partner’s share of income, deductions, and credits from the partnership. It is crucial for partners to report this information on their individual tax returns. If you operate a Hawaii unincorporated with a partnership, ensure your K-1 forms are filled out accurately to facilitate proper tax reporting.

Partnerships in Hawaii should fill out Form N-20 for their partnership return. This is specifically designed for Hawaii unincorporated with a partnership entities and requires detailed financial information. Ensure that the form is completed accurately to prevent delays in processing your return.

In Hawaii, any partnership that earns income or has gross receipts must file a Hawaii partnership return. This includes both limited partnerships and general partnerships that fall under the Hawaii unincorporated with a partnership category. Additionally, each partner may need to report their share of the partnership income on their individual returns.

To fill out a partnership form in Hawaii unincorporated with a partnership, begin by providing basic information about your partnership, such as the names of partners and the business name. Next, specify the type of partnership, whether general or limited, and outline the partnership’s address. Make sure to include details about the partnership’s purpose and the fiscal year, followed by signatures from all partners.

Setting up a corporation in Hawaii involves several steps, including choosing a suitable business name, appointing directors, and filing formal documents. If you're forming a partnership and exploring Hawaii unincorporated opportunities, ensure everyone's roles and responsibilities are clear from the beginning. US Legal Forms can provide you with templates and resources needed to navigate this process smoothly.

To incorporate in Hawaii, you must file the Articles of Incorporation with the Department of Commerce and Consumer Affairs. For those intrigued by Hawaii unincorporated with a partnership, consider involving your partnership in this process for enhanced collaboration and support. Using platforms like US Legal Forms can simplify this task, guiding you through necessary documents and compliance requirements.

Yes, Hawaii permits the formation of a single member LLC, making it a favorable option for solo entrepreneurs. If you're considering a Hawaii unincorporated business structure with a partnership, think about how a single member LLC can streamline your operations. This structure offers liability protection while allowing for flexible management and taxation.