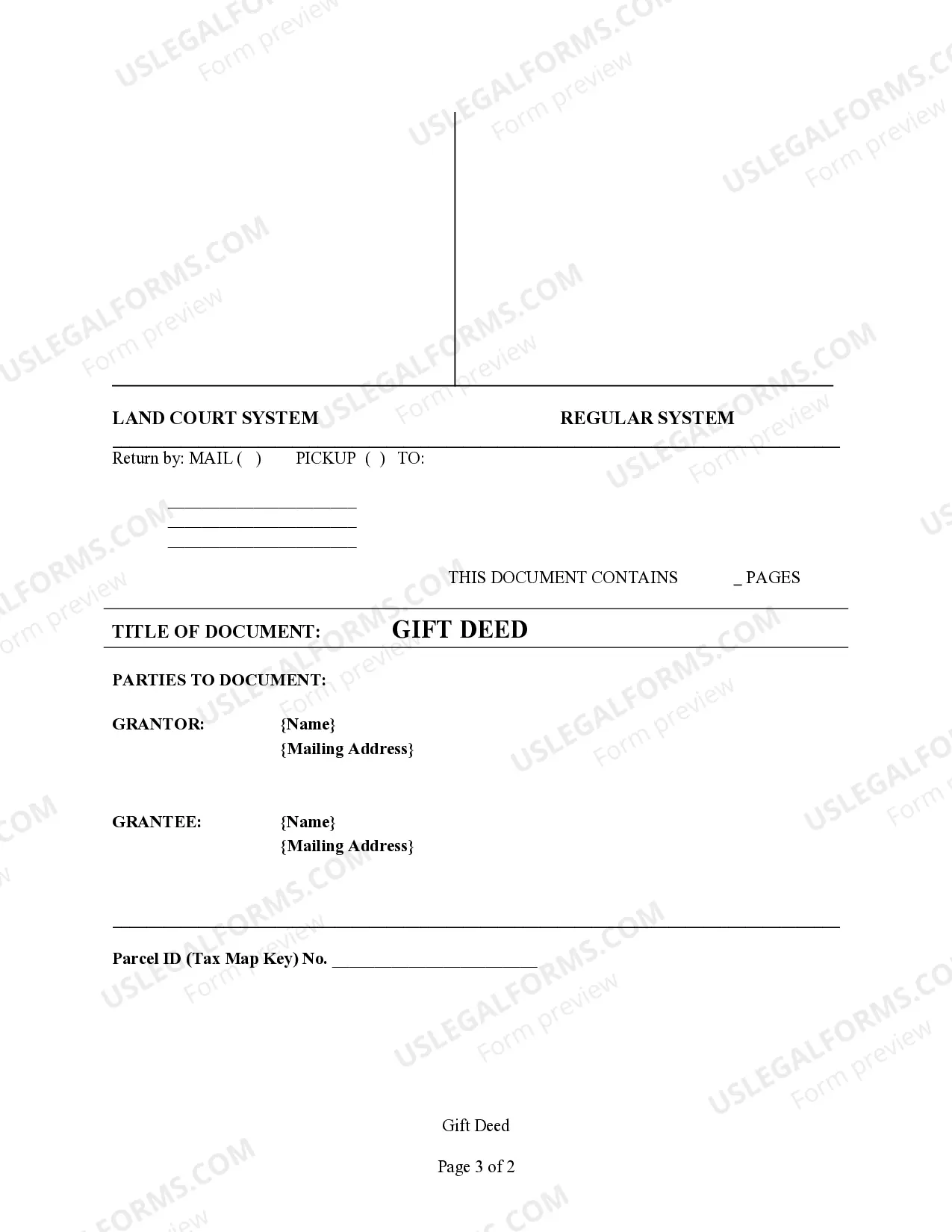

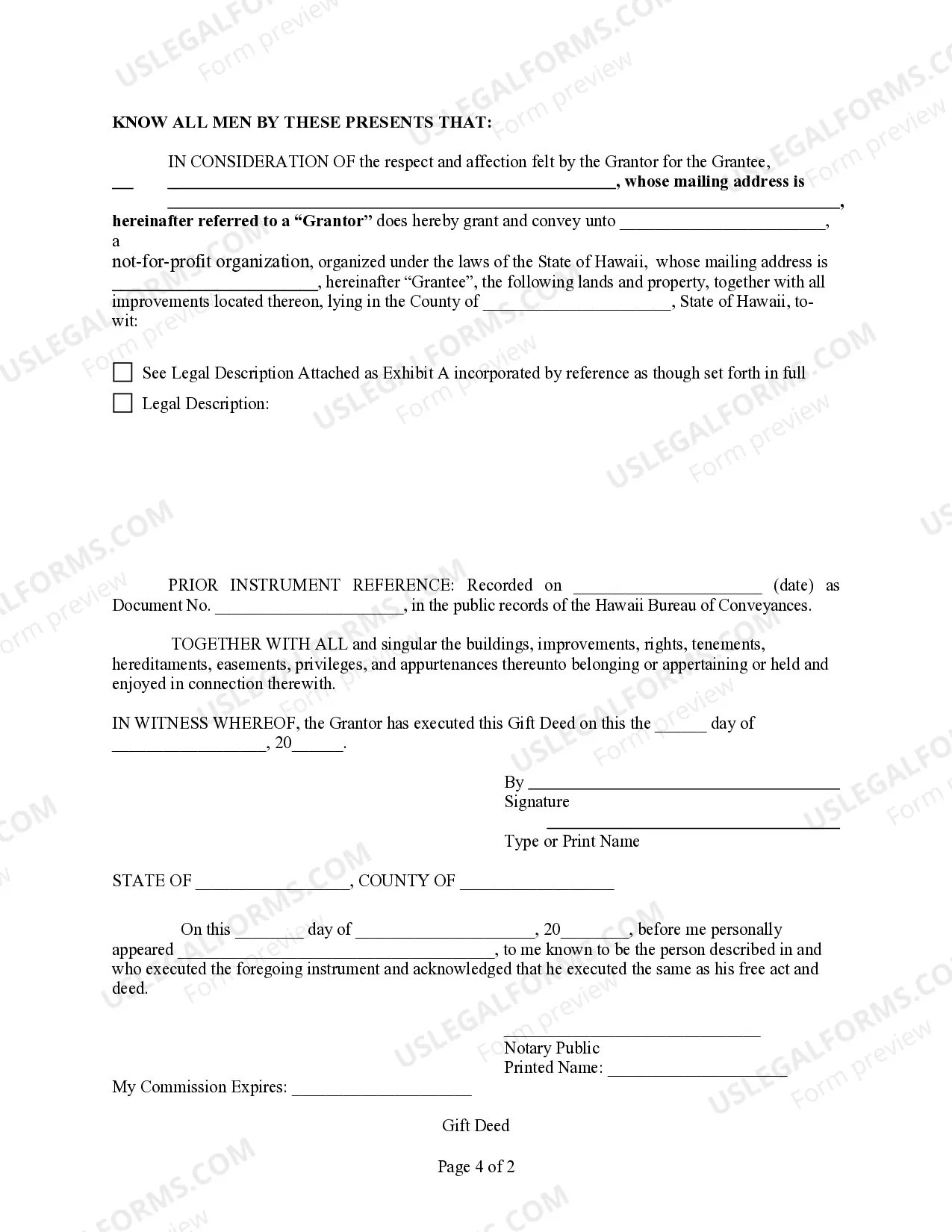

This form is a Gift Deed where the grantor is an individual and the grantee is an Unincorporated Association or a Not-for-Profit Organization. Grantor conveys and grants the described property to the grantee. This deed complies with all state statutory laws.

Hawaii Unincorporated Printable For Businesses

Description

How to fill out Hawaii Gift Deed From An Individual To An Unincorporated Association Or A Not-for-Profit Organization?

- Log in to your US Legal Forms account if you're a returning user, or create a new account for first-time access.

- Search for the Hawaii unincorporated business form you require using the search feature, ensuring it adheres to local jurisdiction standards.

- Preview the selected form to confirm it meets your specific needs before making any decisions.

- Select the appropriate subscription plan by clicking on the 'Buy Now' button.

- Provide your payment details, either via credit card or PayPal, to finalize your purchase.

- Download the completed form, which will also be available in the 'My Forms' section of your account for future access.

By following these easy steps, you can acquire your essential legal documents swiftly and accurately. US Legal Forms offers over 85,000 forms, ensuring you have access to what you need with confidence.

Start your journey with US Legal Forms today and empower your business to thrive legally!

Form popularity

FAQ

Yes, a sole proprietor in Hawaii typically needs a business license to operate legally. This applies even if you're running a home-based business. Obtaining the necessary licenses helps you comply with state regulations and avoid potential fines. Our Hawaii unincorporated printable for businesses can serve as a helpful reference to ensure you're following all requirements.

The timeframe for obtaining a business license in Hawaii can vary, but it often takes around 2 to 8 weeks. This depends on the specifics of your business and the local authorities. To speed things up, ensure that you submit all required paperwork correctly. You might find it useful to refer to our Hawaii unincorporated printable for businesses to prepare your application.

To register a small business in Hawaii, start by choosing your business structure, such as a sole proprietorship or LLC. Next, complete the registration forms and submit them along with the necessary fees to the appropriate state office. For easier navigation through the process, check out our Hawaii unincorporated printable for businesses available on uslegalforms.

Registering a business in Hawaii generally takes about 3 to 10 business days. This timeline may depend on the type of business and how you submit your application. Filing online is often quicker than traditional methods. For more detailed guidance, consider exploring our Hawaii unincorporated printable for businesses.

Typically, it takes about 2 to 4 weeks to receive your Hawaii ID by mail. The processing time may vary based on the volume of applications. To streamline the process, ensure you have all necessary documents ready when applying. Using resources like uslegalforms can help guide you through the requirements for a smoother experience.

In Hawaii, if you plan to operate your business under a name different from your legal business name, you must register a DBA, or 'Doing Business As.' This process ensures that your business name is unique and not already in use. Utilizing a Hawaii unincorporated printable for businesses can simplify this registration, making it easier to secure your brand identity in the marketplace.

Yes, Hawaii does require a business license for most businesses operating in the state. Operating without a license can lead to fines and other penalties, which is why it’s essential to understand the specific requirements for your business type. Additionally, using a Hawaii unincorporated printable for businesses can help streamline the process of applying for your license and ensure compliance with local regulations.

Filing an annual report for your LLC in Hawaii requires you to complete the report form provided by the Department of Commerce and Consumer Affairs. You can file it online or submit a paper form by mail. It is essential to keep your business information current to maintain good standing. The uslegalforms platform simplifies this process, providing you with Hawaii unincorporated printable for businesses to ensure your filing is accurate and timely.

To obtain a certificate of good standing in Hawaii, you need to request it from the Department of Commerce and Consumer Affairs. You can do this online, by mail, or in person. Ensure your business is compliant with all state regulations and up to date on your taxes. By utilizing the uslegalforms platform, you can easily navigate the request process for this important document, especially when dealing with Hawaii unincorporated printable for businesses.