Transfer Deed When Someone Dies

Description

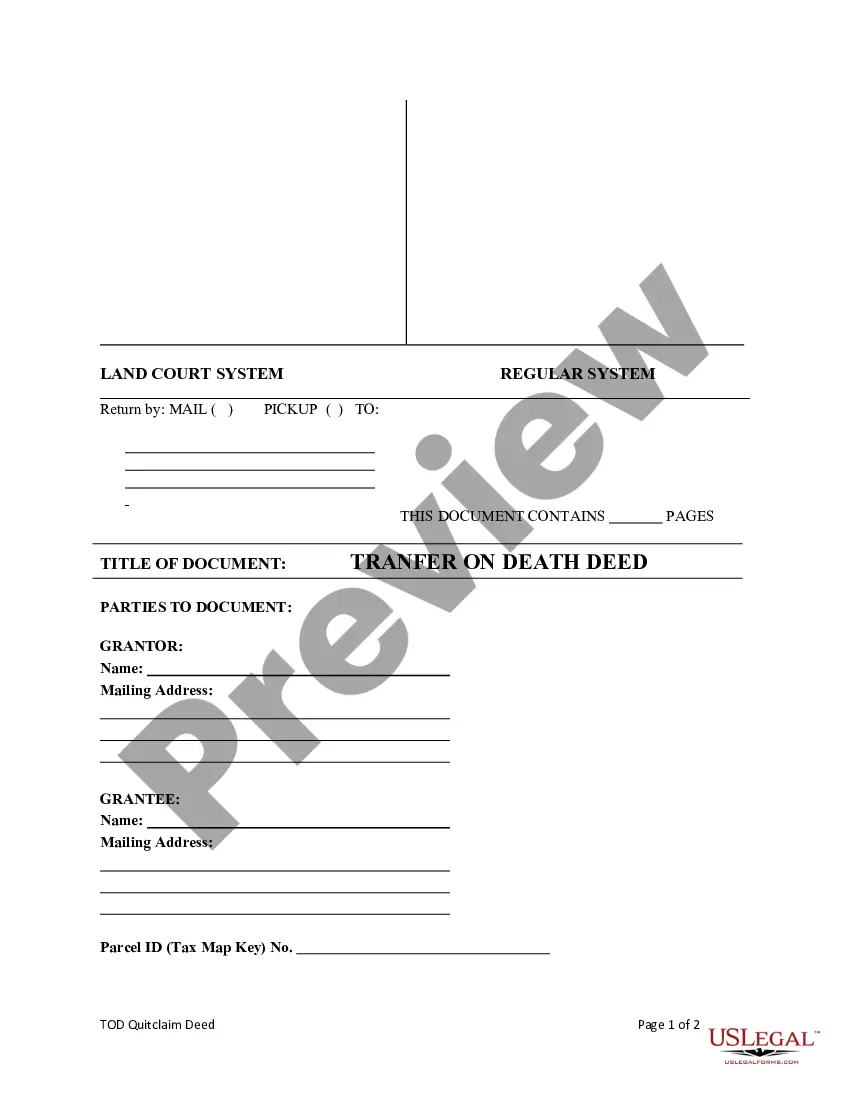

How to fill out Hawaii Transfer On Death Quitclaim Deed From Individual To Individual?

Handling legal paperwork and processes can be a lengthy addition to your schedule.

Transfer Deed When Someone Passes Away and similar documents typically demand that you search for them and learn how to complete them accurately.

For this reason, if you are managing financial, legal, or personal issues, having a comprehensive and user-friendly online library of forms readily available will be extremely beneficial.

US Legal Forms is the leading online resource for legal templates, boasting over 85,000 state-specific forms and a variety of tools to assist you in completing your documents with ease.

Is this your first time using US Legal Forms? Register and create an account in a matter of minutes, granting you access to the form library and Transfer Deed When Someone Passes Away. Then, follow these simple steps to fill out your form: Ensure you have the correct form using the Review feature and examining the form details. Choose Buy Now when you're ready, and select the subscription plan that suits you best. Click Download, then complete, eSign, and print the form. US Legal Forms has 25 years of expertise helping users manage their legal paperwork. Get the form you need today and improve any process with minimal effort.

- Explore the collection of suitable documents accessible to you with just one click.

- US Legal Forms provides state- and county-specific forms available for download at any time.

- Safeguard your document management processes with a premium service that enables you to create any form within minutes without extra or hidden charges.

- Simply Log In to your account, find Transfer Deed When Someone Passes Away, and obtain it directly from the My documents section.

- You can also retrieve previously saved forms.

Form popularity

FAQ

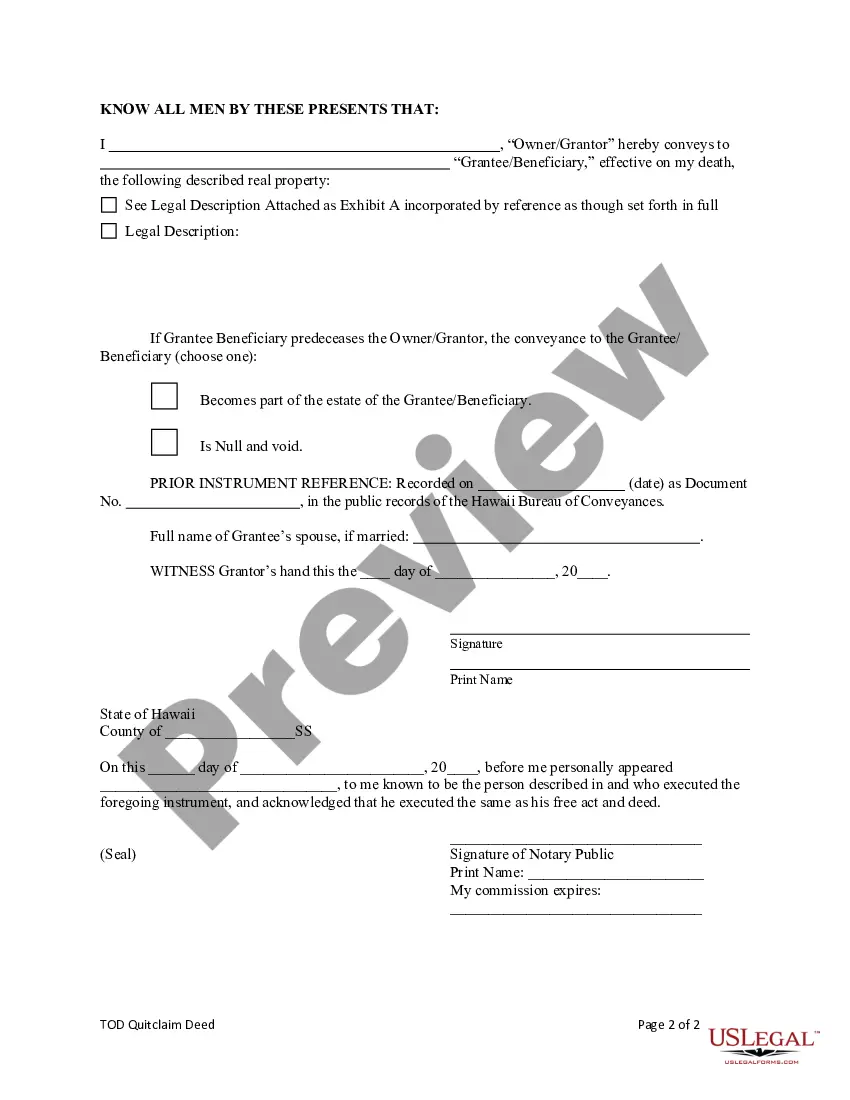

Meanwhile, our fee to prepare a Transfer on Death Deed is $195. Good to know: Since the Transfer upon Death Deed conveys property outside of Probate, it avoids incurring costs to transfer the property to your beneficiaries upon your death.

How to Minimize Capital Gains Tax on Inherited Property Sell the inherited property quickly. ... Make the inherited property your primary residence. ... Rent the inherited property. ... Qualify for a partial exclusion. ... Disclaim the inherited property. ... Deduct Selling Expenses from Capital Gains.

After one year, if the executor doesn't complete their duties, beneficiaries may demand payment (possibly with interest) by taking the executor to court.

A transfer on death (TOD) bank account is a popular estate planning tool designed to avoid probate court by naming a beneficiary. However, it doesn't avoid taxes.

The deed could get complicated, and its validity contested if it is not recorded correctly or if the legal criteria are not met. If there is no provision for a contingent beneficiary, the transfer on the death deed is rendered ineffective if the named beneficiary passes away before the property owner.