Transfer Death Deed Sample For A Trust

Description

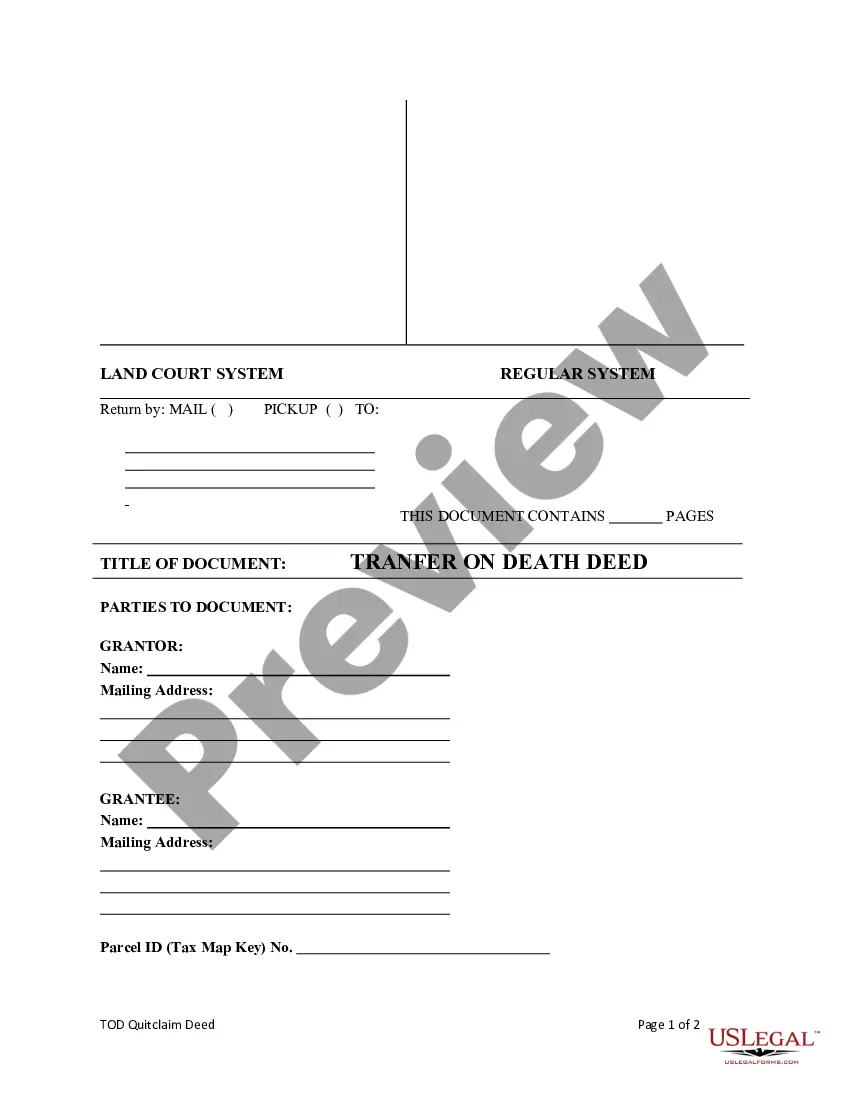

How to fill out Hawaii Transfer On Death Quitclaim Deed From Individual To Individual?

- Log in to your US Legal Forms account. If you’re a returning user, ensure your subscription is active. If not, you may want to renew it according to your payment plan.

- Explore the library for the appropriate death deed template. Utilize the Preview mode to verify that it fits your requirements and complies with your local laws.

- In case you need a specific form, leverage the Search tab to find alternative templates that address your needs.

- Purchase your selected document by clicking 'Buy Now.' Choose a subscription plan and create an account to access the full library of forms.

- Complete your financial transaction using your credit card or PayPal to finalize the purchase.

- Download the form to your device for completion. You can also find it later in the 'My Forms' section of your account.

US Legal Forms empowers both individuals and attorneys, offering the most robust collection of legal templates available online. With over 85,000 forms, users can easily find and fill out legally sound documents.

Start simplifying your legal paperwork today by visiting US Legal Forms for all your document needs!

Form popularity

FAQ

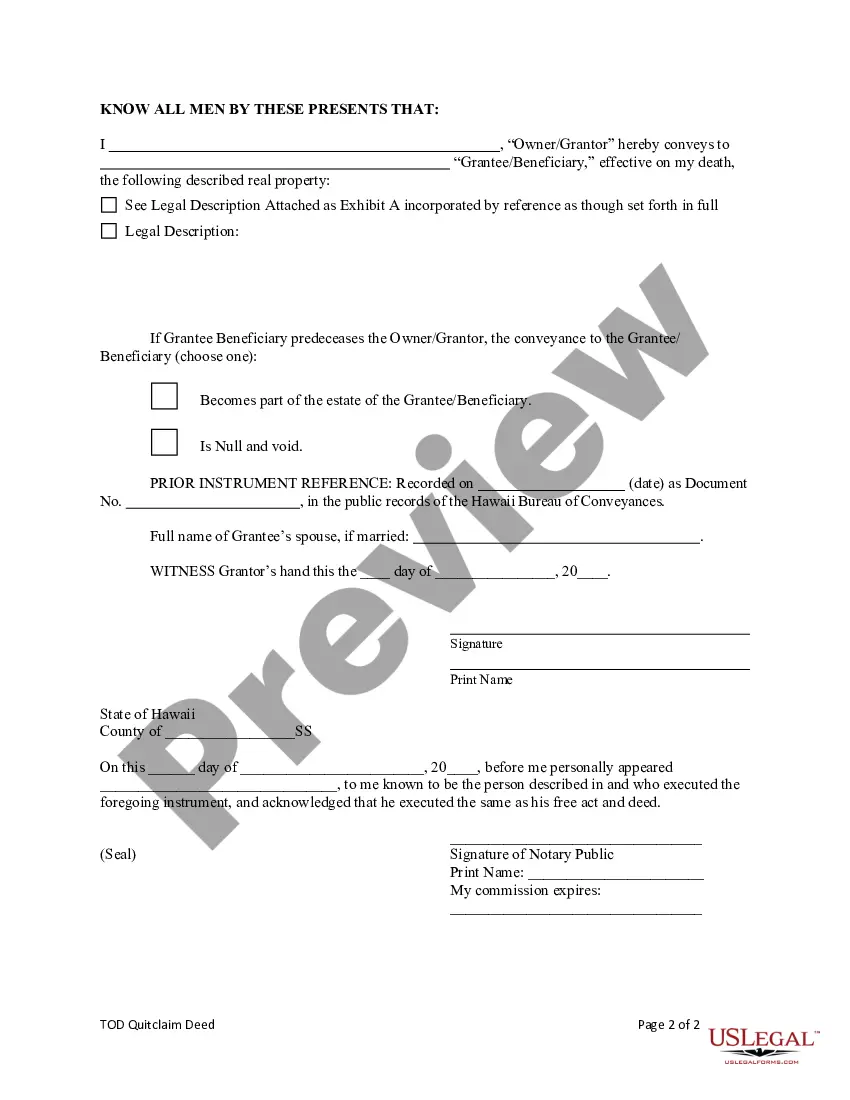

The purpose of a trust deed is to define the relationship between a trustee and the beneficiaries. It outlines the terms under which property is managed and transferred, providing clarity and legal enforcement. Trust deeds can also safeguard assets and ensure that property is handled according to your wishes. To better understand this, you may consider reviewing a transfer death deed sample for a trust.

Yes, you can sell a house with a deed of trust, but the process may include some additional steps. Typically, you need to settle any outstanding obligations tied to the deed before proceeding. Furthermore, when selling, it is vital to communicate clearly with all parties involved to avoid any legal issues. Utilizing a transfer death deed sample for a trust can aid in managing such transitions smoothly.

Transferring property to a trust can provide crucial benefits like avoiding probate and protecting assets from creditors. This move allows for a smoother transition of property to your heirs. Moreover, a trust can help maintain privacy, as it keeps property out of the public eye. Using a transfer death deed sample for a trust can help ensure this process is efficient and effective.

A Transfer on Death deed typically does not avoid inheritance taxes, as the transfer occurs at death. However, the specific tax implications can depend on your state's laws and the value of the estate. Consulting a tax professional along with your transfer death deed sample for a trust will provide clarity. Proper planning can help mitigate tax burdens creatively.

While it is not mandatory to hire a lawyer for a TOD deed, consulting with one can be beneficial. An attorney helps clarify the legal nuances and ensures that the transfer is executed correctly. Using a transfer death deed sample for a trust can assist you, but professional guidance is valuable, especially for those unfamiliar with the process.

The timeline for transferring a deed after death can vary widely depending on several factors. Generally, if you have a Transfer on Death deed in place, the transfer can happen relatively quickly without going through probate. Accessing a transfer death deed sample for a trust can help expedite the process by ensuring that everything is in order. However, delays can still occur if disputes arise.

You can transfer a deed without an attorney, although it comes with risks. If you choose to do it yourself, it’s essential to obtain a reliable transfer death deed sample for a trust to guide you through the process. Ensure that you understand all legal requirements and implications before proceeding. Mistakes could lead to complications later on.

A trust deed transfer involves conveying property into a trust for the benefit of beneficiaries. This method allows for more controlled distribution of assets, according to the terms of the trust. If you're considering a transfer death deed sample for a trust, this could be a strategic option for managing your estate. It streamlines the process and protects your assets from probate.

Yes, a trust can be named as a beneficiary in a Transfer on Death deed. This allows assets to go directly to the trust, bypassing probate. It's crucial to ensure that the transfer death deed sample for a trust is structured correctly to achieve this goal. By doing so, you maintain control over the distribution of the assets according to your wishes.

The primary disadvantage of a Transfer on Death deed is that it may not avoid all probate issues. If there are outstanding debts or claims against the estate, those could affect the transfer. Furthermore, without proper planning, a transfer death deed sample for a trust might not align with your overall estate strategy. It's important to evaluate your entire estate plan.