This form is a Transfer on Death Deed where the Grantor is an individual and the Grantee is also an individual. This transfer is revocable by Grantor until death and effective only upon the death of the Grantor. This deed complies with all state statutory laws.

Hawaii Transfer On Death Deed With Beneficiaries

Description

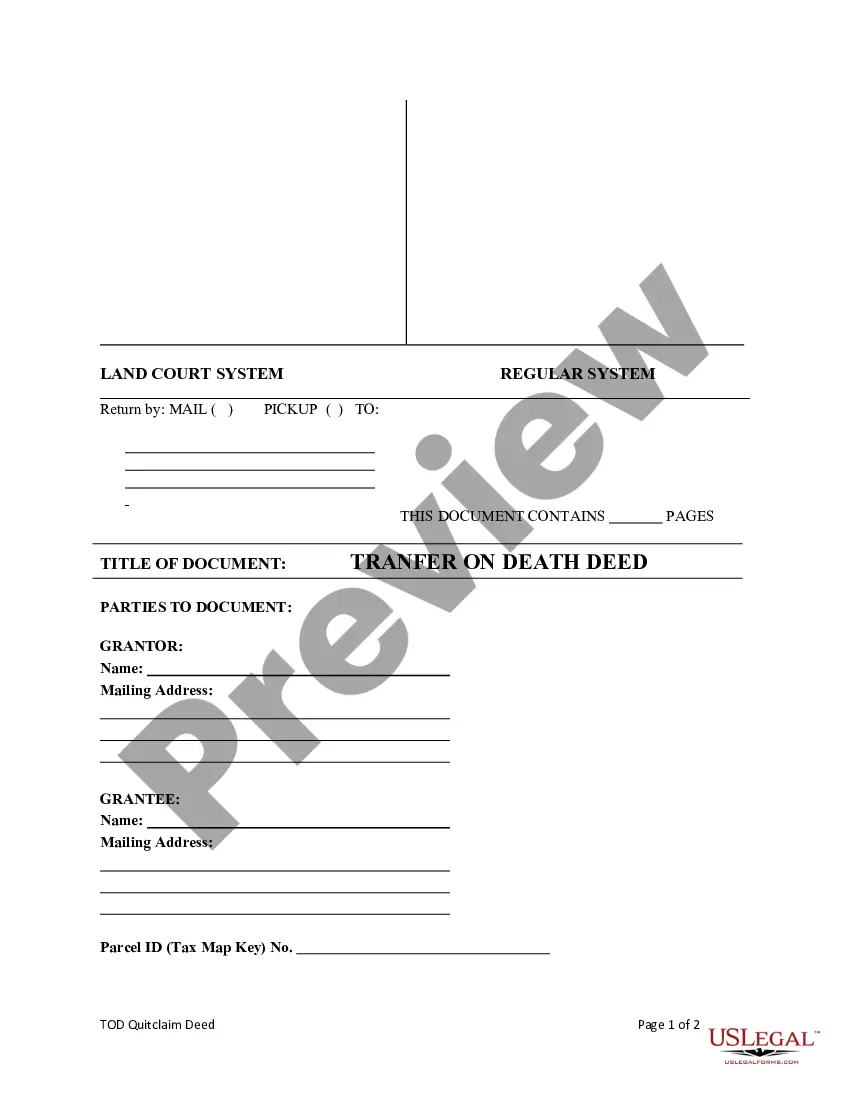

How to fill out Hawaii Transfer On Death Quitclaim Deed From Individual To Individual?

The Hawaii Transfer On Death Deed With Beneficiaries displayed on this page is a versatile legal template crafted by expert attorneys in compliance with federal and state regulations.

For over 25 years, US Legal Forms has offered individuals, businesses, and legal experts over 85,000 authenticated, state-specific documents for various professional and personal circumstances.

Utilize the same document again when necessary. Access the My documents tab in your account to redownload any previously saved templates. Enroll in US Legal Forms to have verified legal templates for every situation in life at your fingertips.

- Search for the document you require and examine it.

- Browse through the file you located and preview it or verify the form description to ensure it meets your needs. If it doesn’t, utilize the search bar to find the correct one. Click Buy Now once you have identified the template you are looking for.

- Choose a pricing option that fits you and create an account. Use PayPal or a credit card for a swift payment. If you already possess an account, Log In and check your subscription to proceed.

- Select the format preferred for your Hawaii Transfer On Death Deed With Beneficiaries (PDF, DOCX, RTF) and store the template on your device.

- Print the template to complete it by hand. Alternatively, employ an online versatile PDF editor to efficiently and accurately fill out and sign your document.

Form popularity

FAQ

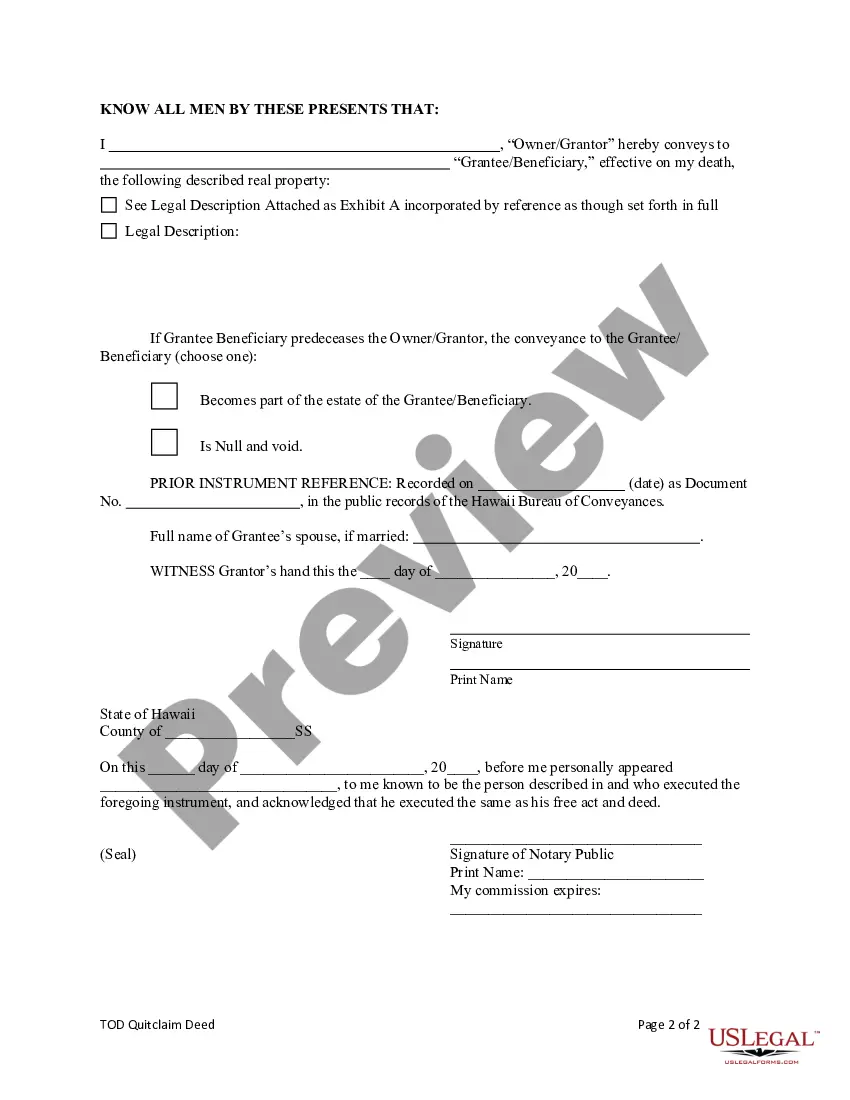

Hawaii Transfer on Death Deeds You must sign the deed and get your signature notarized, and then record (file) the deed with either the Bureau of Conveyances or the Office of the Assistant Registrar of the Land Court (see "Recording Your Deed" below to determine which) before your death. ... The beneficiary's rights.

Primary tabs. Transfer-on-death (TOD) refers to named beneficiaries that receive assets at the death of the property owner without the need for probate, facilitating the executor's disposition of the property owner's assets after their death. This is often accomplished through a transfer-on-death deed.

Cons To Using Beneficiary Deed Estate taxes. Property transferred may be taxed. No asset protection. The beneficiary receives the property without protection from creditors, divorces, and lawsuits. Medicaid eligibility. ... No automatic transfer. ... Incapacity not addressed. ... Problems with beneficiaries.

A Revocable Living Trust A trust can be a great mechanism to avoid probate and is the recommended method. While there are some upfront fees for creating a trust, the fees are typically much less than probate costs. Generally, you, as trustee, retain control of the assets held within the trust during your lifetime.

What Is the Difference Between TOD and Beneficiary? A transfer on death is an instrument that transfers ownership of specific accounts and assets to someone. A beneficiary is someone that is named to receive something of value.