Hawaii Transfer On Death Deed Form With Signature Required

Description

How to fill out Hawaii Transfer On Death Quitclaim Deed From Individual To Individual?

Handling legal documents and processes can be a lengthy addition to your schedule.

Hawaii Transfer On Death Deed Form With Signature Required and similar forms usually necessitate that you search for them and learn how to fill them out accurately.

For that reason, whether you are managing financial, legal, or personal issues, having a comprehensive and easy-to-use online collection of forms readily available will be very beneficial.

US Legal Forms is the premier online platform for legal templates, featuring over 85,000 state-specific forms and various tools to help you complete your documents effortlessly.

Is it your first time using US Legal Forms? Register and create a free account in a few moments, and you will gain access to the form library and Hawaii Transfer On Death Deed Form With Signature Required. After that, follow the steps below to fill out your form.

- Explore the collection of relevant documents available to you with just one click.

- US Legal Forms provides you with forms specific to your state and county that can be downloaded at any time.

- Safeguard your document management processes by utilizing a top-notch service that allows you to assemble any form in minutes without extra or concealed charges.

- Simply Log In to your account, find Hawaii Transfer On Death Deed Form With Signature Required, and obtain it immediately from the My documents section.

- You may also access previously downloaded forms.

Form popularity

FAQ

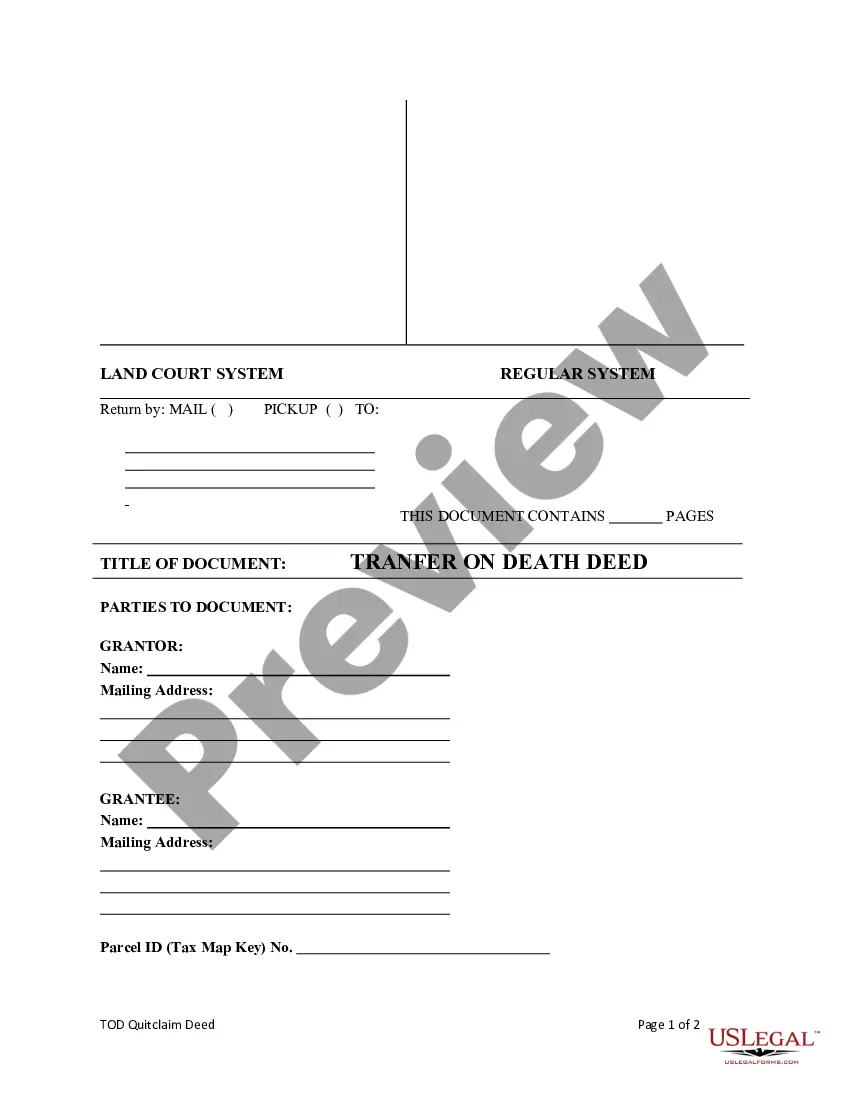

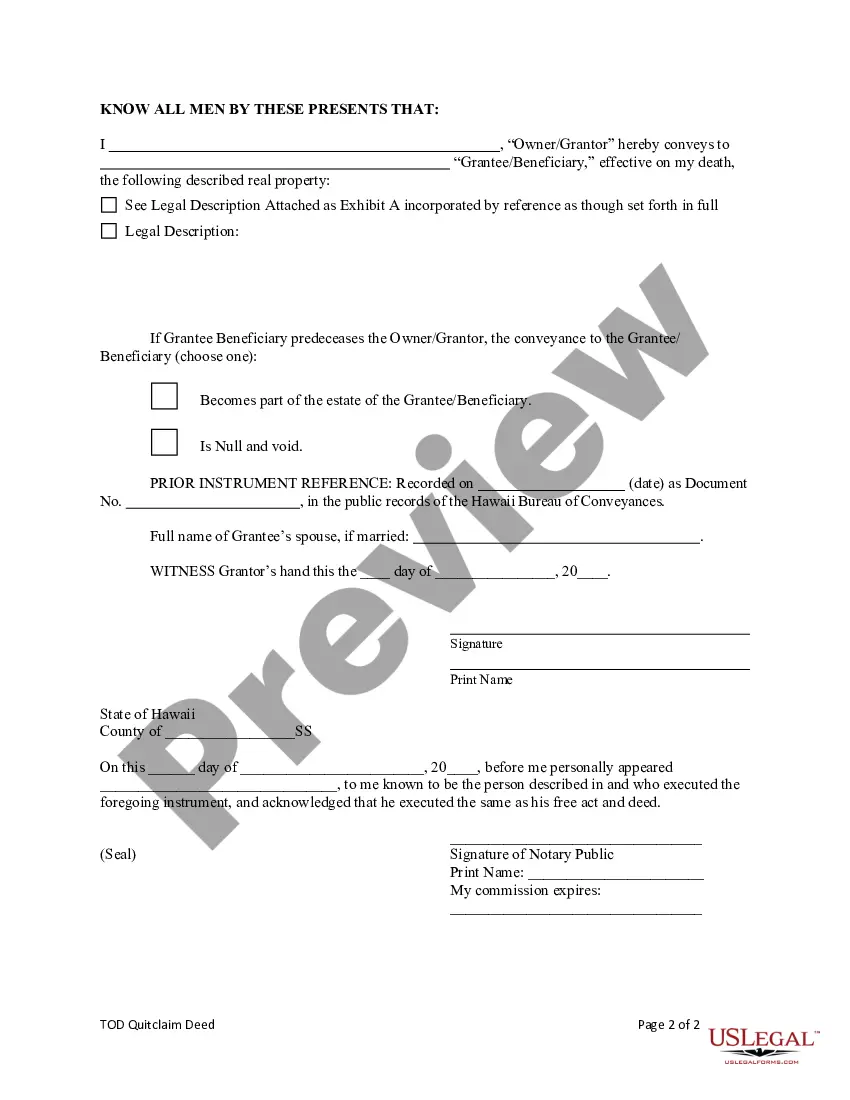

Hawaii Transfer on Death Deeds You must sign the deed and get your signature notarized, and then record (file) the deed with either the Bureau of Conveyances or the Office of the Assistant Registrar of the Land Court (see "Recording Your Deed" below to determine which) before your death. ... The beneficiary's rights.

The deed or assignment of lease must be signed (in black ink) by the current owner and the new owner before a notary public. The deed or assignment of lease must be recorded in the State of Hawaii Bureau of Conveyances or Land Court. A Conveyance Tax Certificate must be filed and any tax due must be paid.

How to Minimize Capital Gains Tax on Inherited Property Sell the inherited property quickly. ... Make the inherited property your primary residence. ... Rent the inherited property. ... Qualify for a partial exclusion. ... Disclaim the inherited property. ... Deduct Selling Expenses from Capital Gains.

A transfer on death (TOD) bank account is a popular estate planning tool designed to avoid probate court by naming a beneficiary. However, it doesn't avoid taxes.

A beneficiary who receives real estate through a transfer on death deed becomes personally liable for the debts of the dead property owner without proper counsel from an estate planning professional or a title company. The beneficiary becomes liable to potential financial obligations as a result.