Hawaii House For Sale

Description

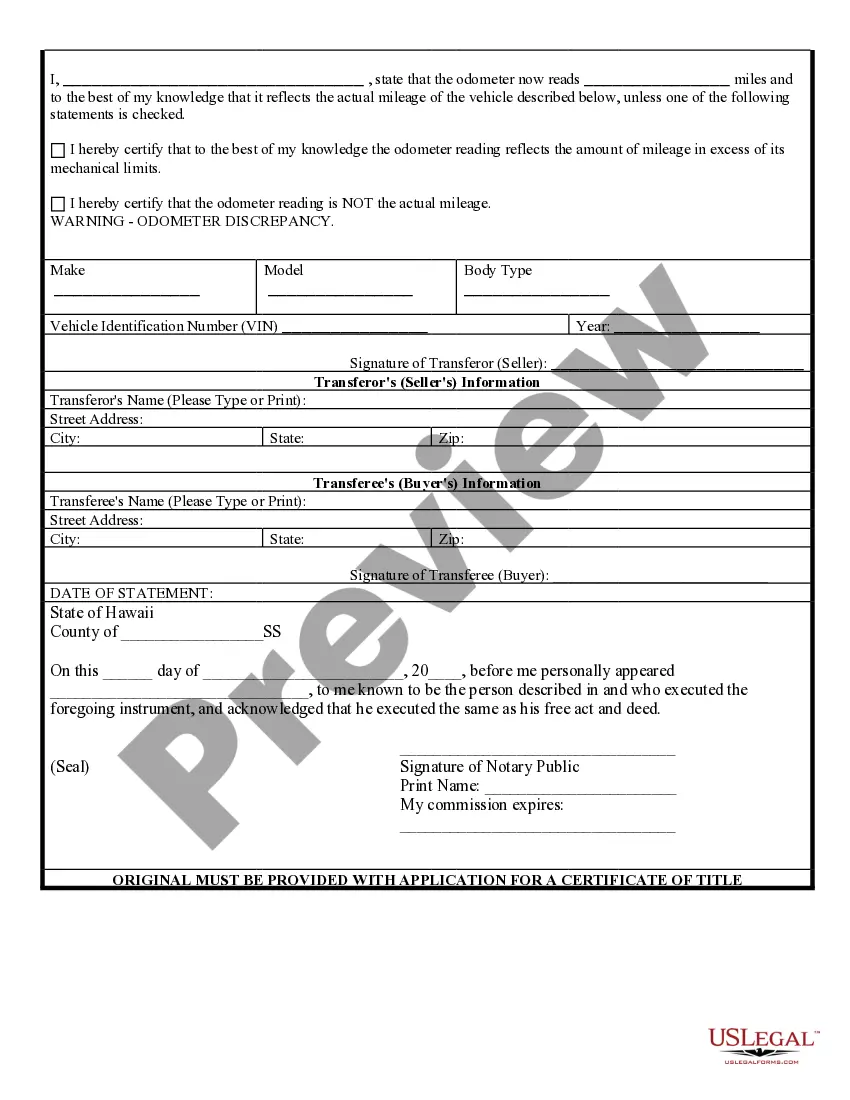

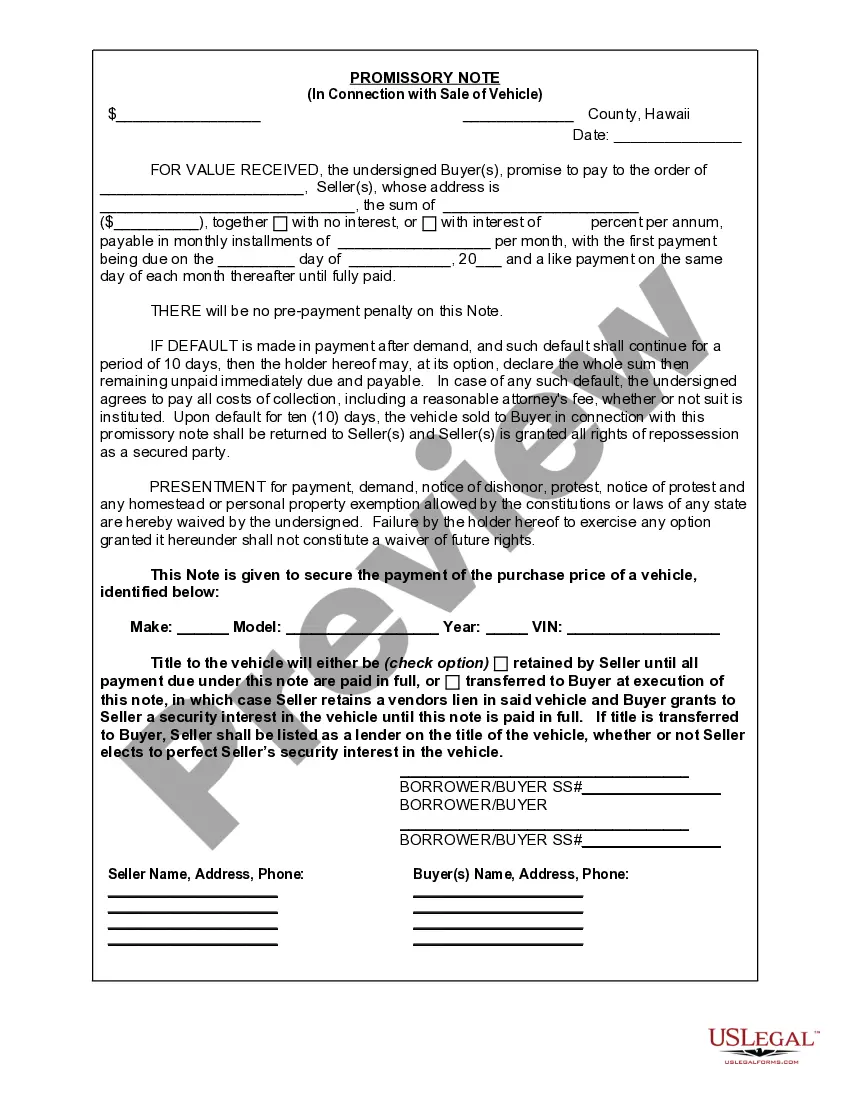

How to fill out Hawaii Bill Of Sale For Automobile Or Vehicle Including Odometer Statement And Promissory Note?

- Log into your account if you're an existing user, ensuring your subscription is active. Click the Download button to save your needed forms.

- If you're new to US Legal Forms, start by checking the Preview mode and description of the forms to confirm you’ve chosen the correct one, tailored to your local requirements.

- If necessary, utilize the Search tab to find another template. Make sure it matches your needs before proceeding.

- Purchase the document by clicking on the Buy Now button and selecting a subscription plan that suits you. You'll need to register an account for full access.

- Complete your purchase using a credit card or PayPal account to finalize your subscription.

- Download your form and save it on your device for easy access, or find it anytime in the My Forms section of your profile.

With a vast library of over 85,000 forms, US Legal Forms empowers users to efficiently manage their legal document needs while ensuring accuracy and compliance.

Start your journey today and explore the extensive resources US Legal Forms has to offer!

Form popularity

FAQ

Yes, a US citizen can buy a house in Hawaii without any restrictions. The process is similar to purchasing property in other states. When searching for a Hawaii house for sale, you will want to consider factors like location, amenities, and financing options. Additionally, using a platform like USLegalForms can help you navigate the necessary paperwork and ensure a smooth transaction.

Yes, if you earn income or receive property in Hawaii, you are typically required to file a Hawaii tax return. This includes income generated from a Hawaii house for sale or rental properties. Understanding your tax obligations ensures you remain compliant and can take advantage of any potential deductions available to property owners.

To legally avoid estate tax, consider strategies such as gifting assets or establishing a living trust. These measures can help reduce your taxable estate, especially if you own a Hawaii house for sale. Resources like US Legal Forms can provide documentation and guidance to create a tax-efficient estate plan.

As of 2025, the estate tax exemption in Hawaii is expected to remain competitive compared to other states. The exemption is anticipated to be around $5.5 million per individual, which means that well-planned investments in assets like a Hawaii house for sale may fall below this threshold. Keeping updated with estate tax regulations can greatly benefit your long-term planning.

In Hawaii, property owners who are 65 years or older may qualify for property tax exemptions or deferrals. This can significantly lower the burden of property taxes, especially for those looking to invest in a Hawaii house for sale. Be sure to check with local county offices to understand the requirements and benefits available.

To avoid estate tax in Hawaii, consider establishing trusts or making annual gifts. Additionally, investing in a Hawaii house for sale may allow you to structure your assets in a way that qualifies for various exemptions. It's wise to consult with a financial advisor to create a plan that minimizes tax liability while preserving your wealth.

In Hawaii, certain assets are exempt from estate tax, which includes life insurance policies, retirement accounts, and some forms of trusts. When considering a Hawaii house for sale, it's important to understand that primary residences may also qualify for certain exemptions. Familiarizing yourself with these exemptions can help you plan your estate and protect your investments effectively.

Yes, as a U.S. citizen, you can buy a house in Hawaii without any special restrictions. The process is quite similar to purchasing a home in other states. When considering a Hawaii house for sale, be sure to follow standard mortgage requirements and local regulations. It's wise to consult with a real estate professional familiar with the area to navigate any complexities.

To buy a house in Hawaii, you should generally aim to have a household income at least three times the monthly mortgage payment. Lenders typically look for a stable income to assess your ability to afford a Hawaii house for sale. It's essential to budget for other costs like property taxes, insurance, and maintenance to ensure you can comfortably manage your new home.

Yes, both parties typically need to be present for a title transfer in Hawaii. This ensures that all necessary paperwork, including the deed and other essential documents, can be signed correctly. When you’re closing on a Hawaii house for sale, having both the buyer and seller present helps facilitate a smoother transaction.