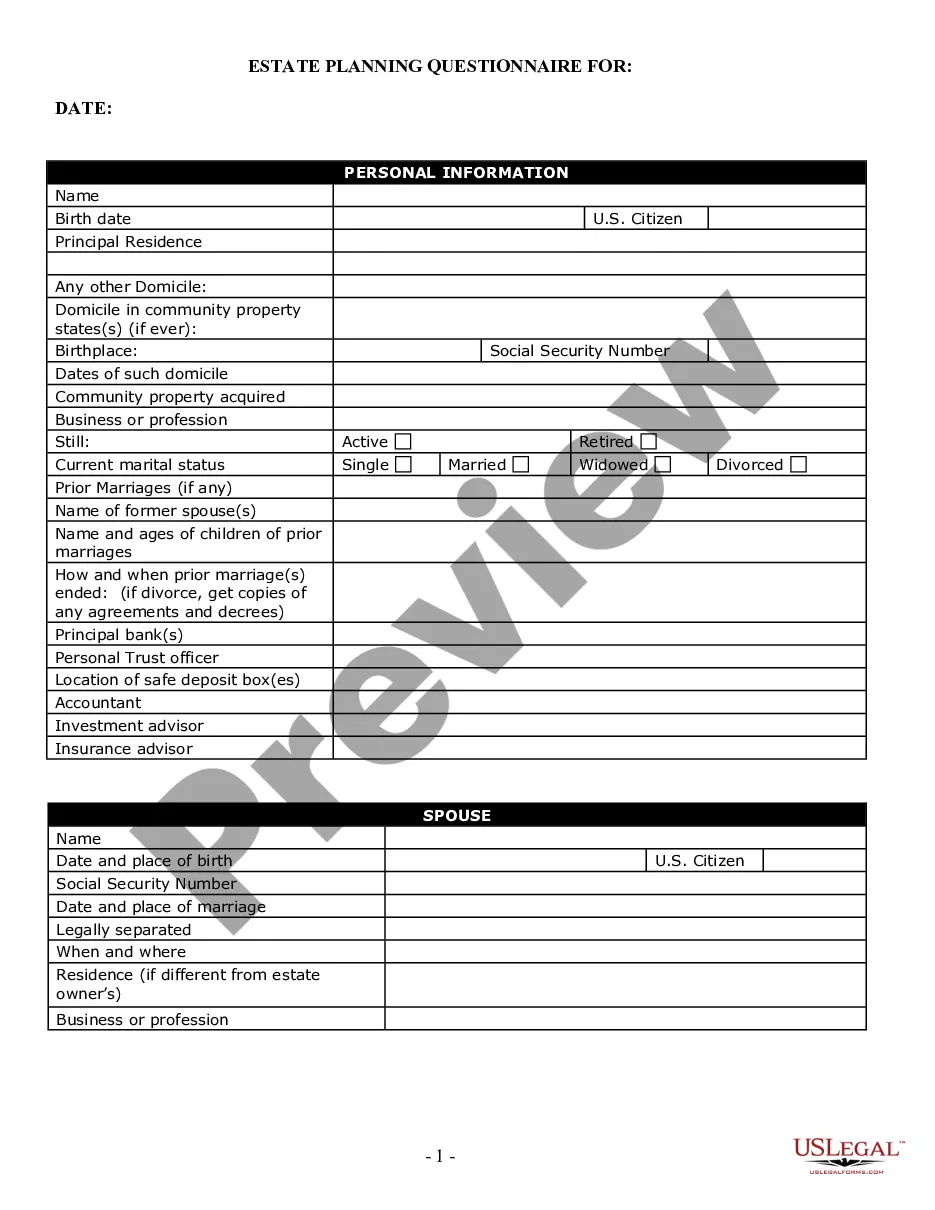

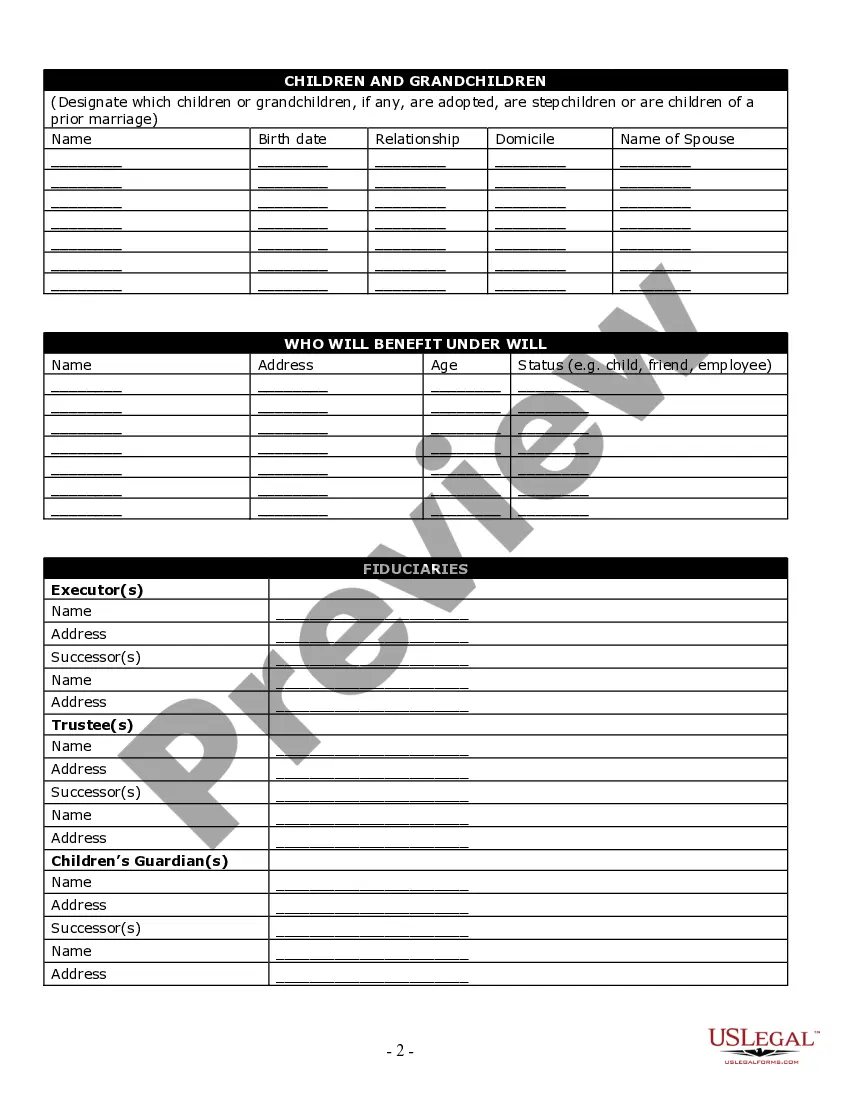

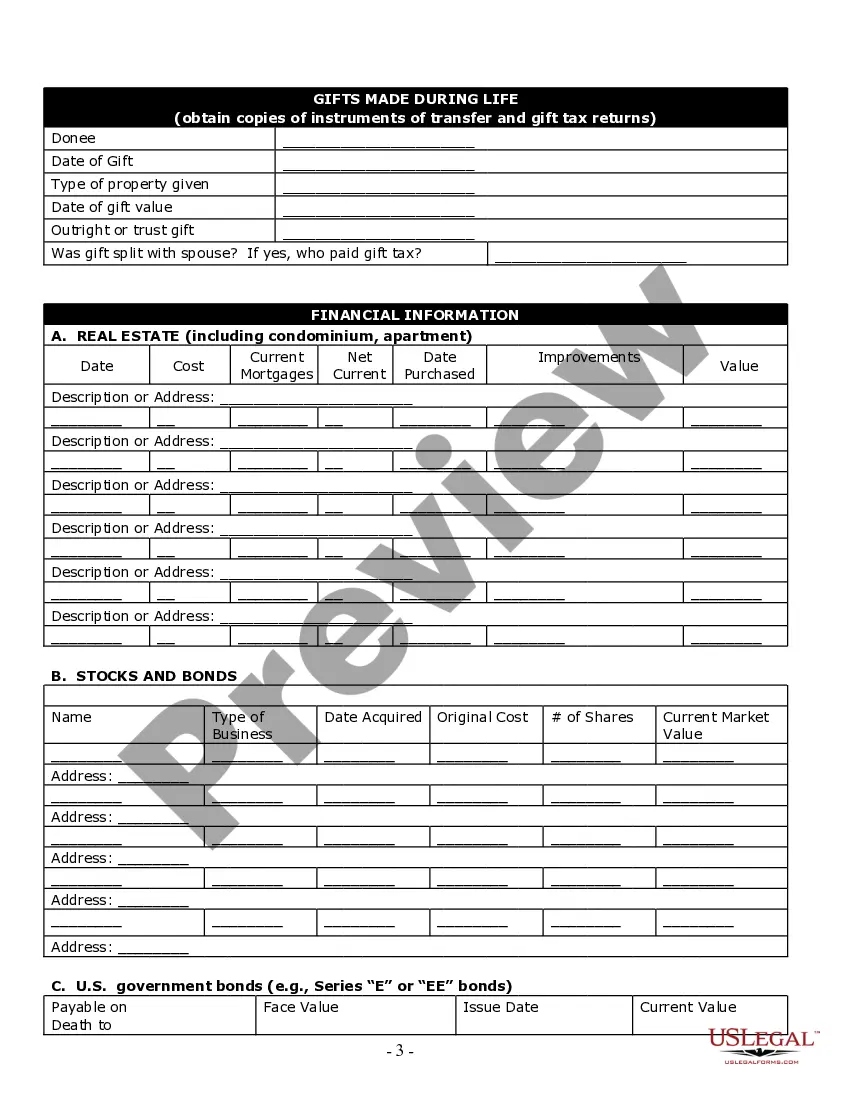

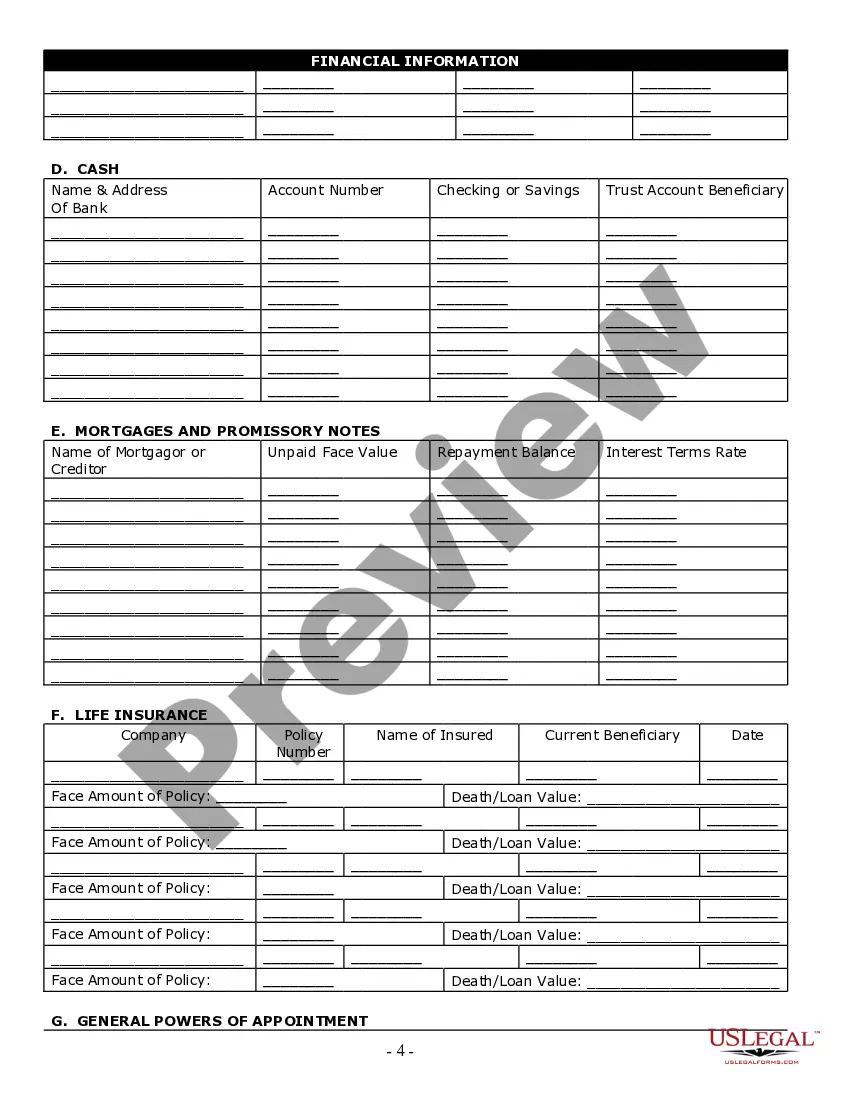

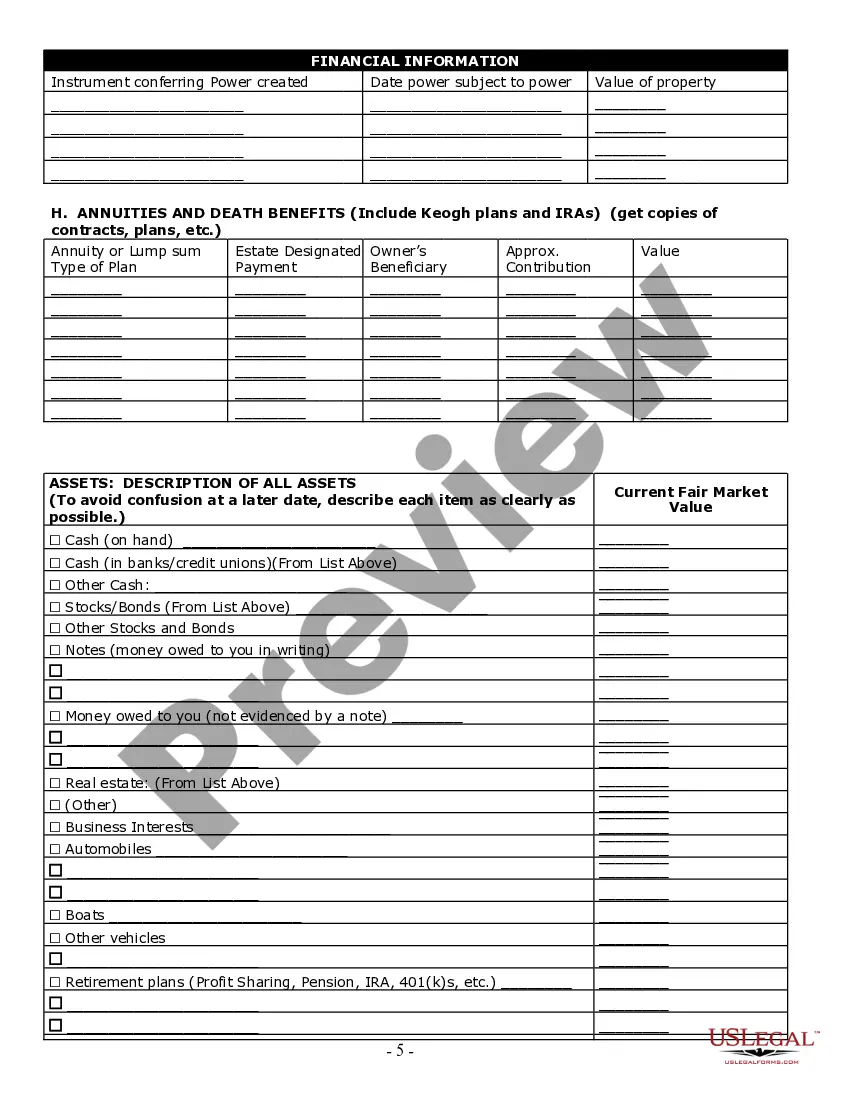

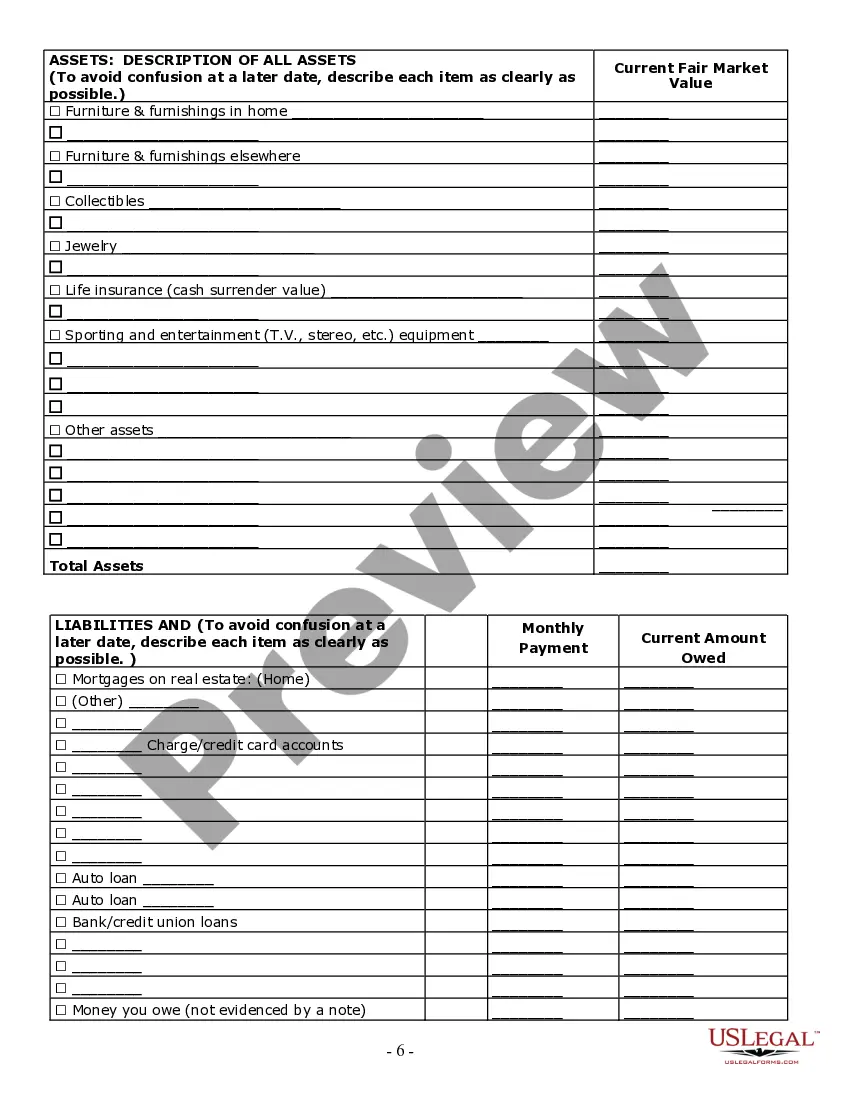

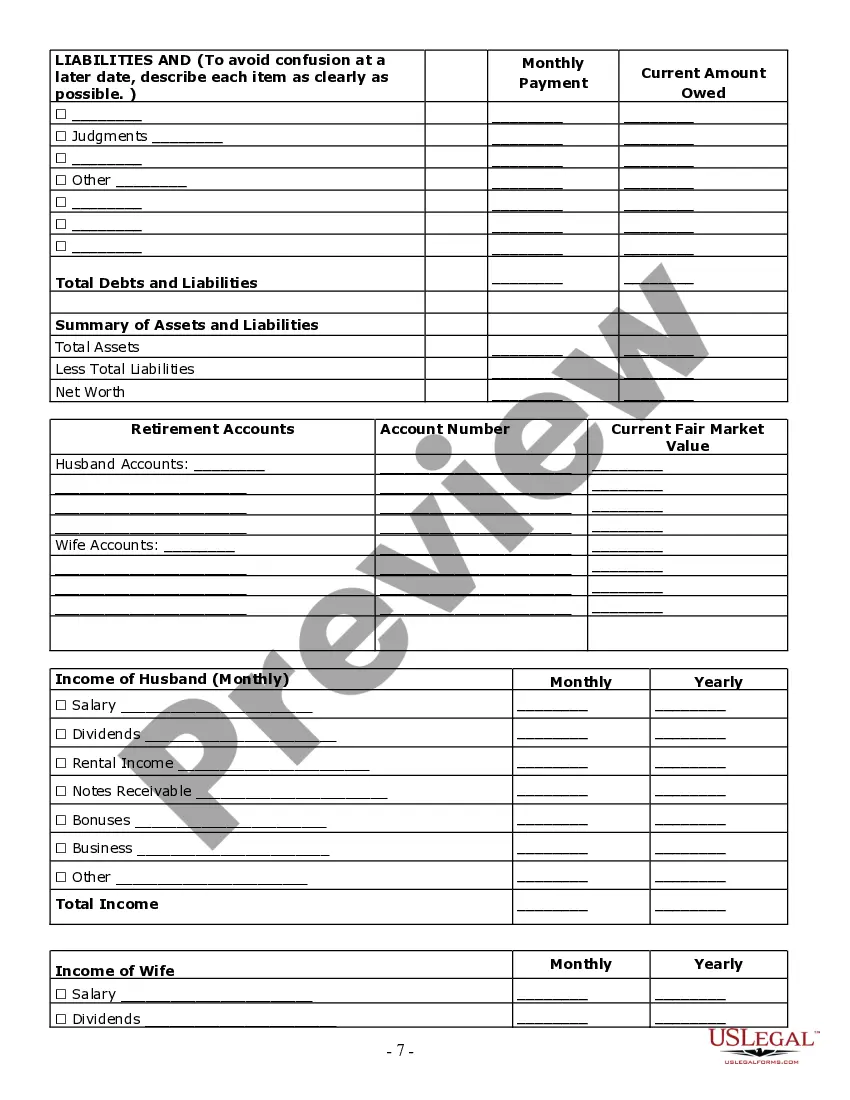

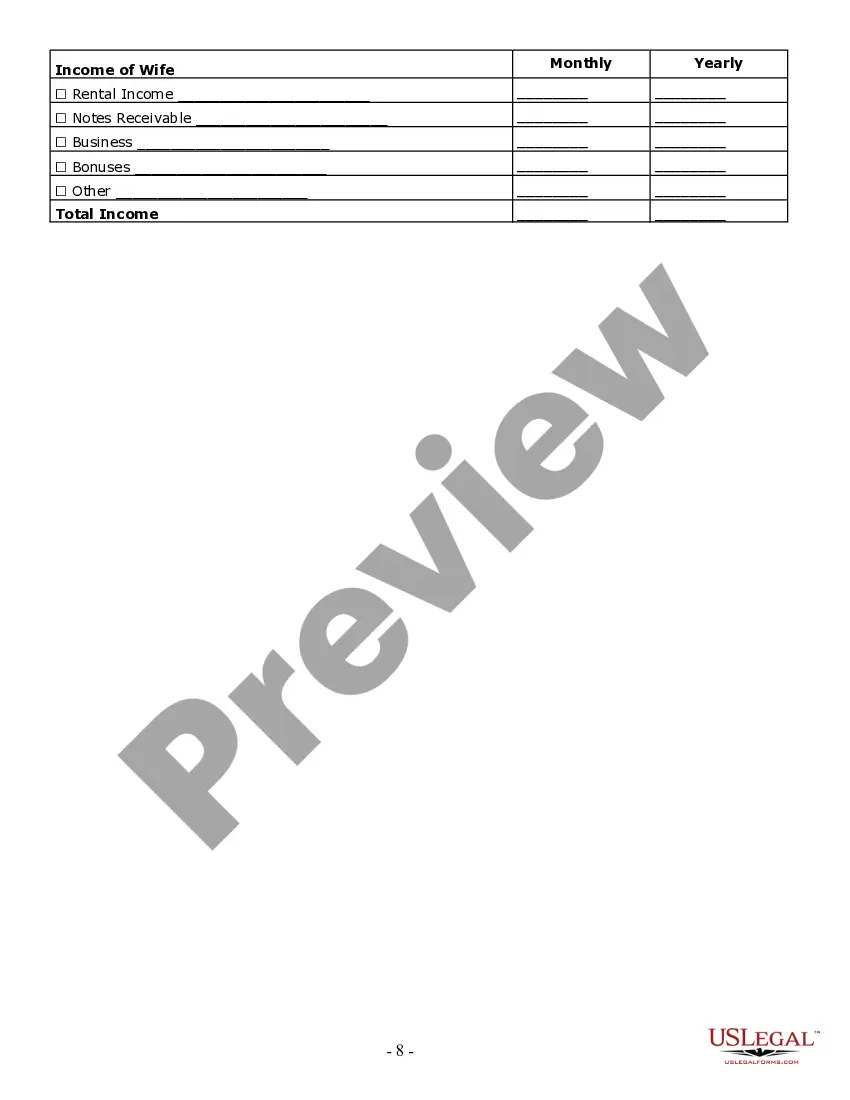

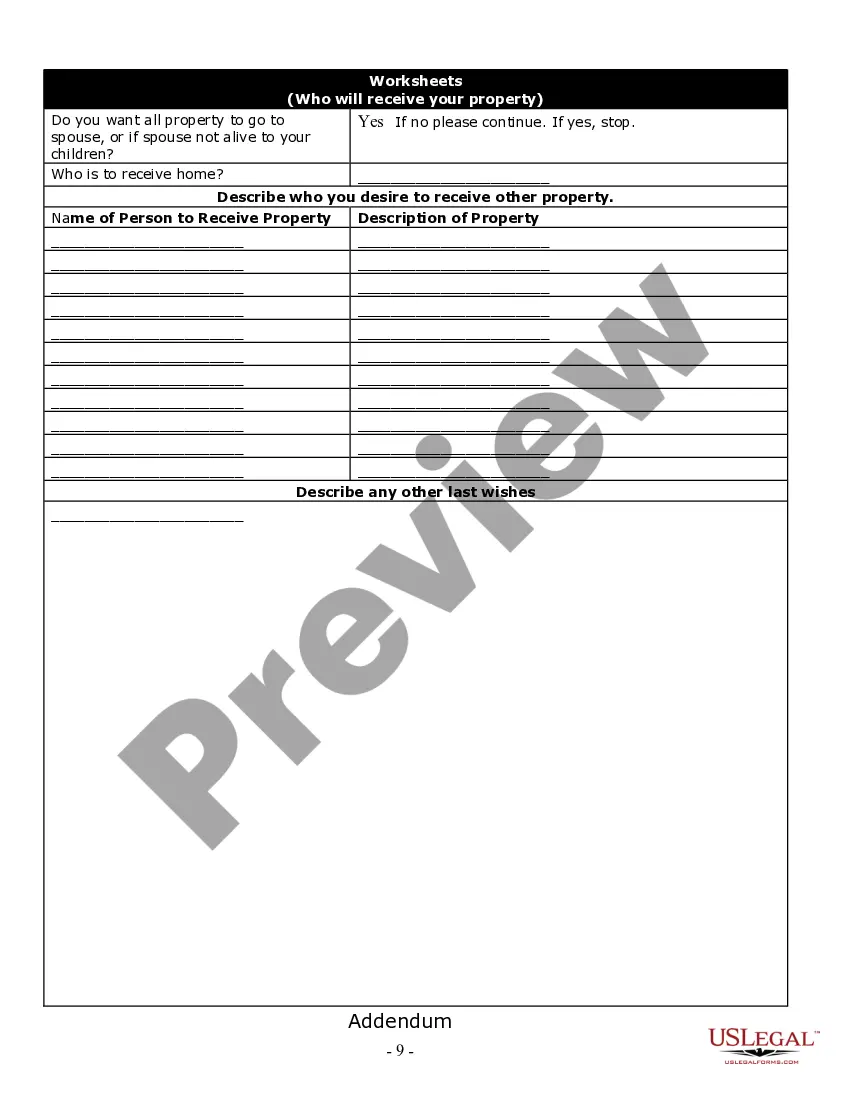

This Estate Planning Questionnaire and Worksheet is for completing information relevant to an estate. It contains questions for personal and financial information. You may use this form for client interviews. It is also ideal for a person to complete to view their overall financial situation for estate planning purposes.

Estate Planning Checklist Form For Farm Families

Description

How to fill out Georgia Estate Planning Questionnaire And Worksheets?

When you are required to finalize Estate Planning Checklist Form For Agricultural Families that adheres to your local state's statutes, there may be numerous alternatives to select from.

There's no necessity to scrutinize each form to ensure it meets all the legal requirements if you are a US Legal Forms subscriber.

It is a reliable service that can assist you in obtaining a reusable and current template on any topic.

Acquiring professionally crafted official documents becomes uncomplicated with US Legal Forms. Furthermore, Premium users can also benefit from the robust integrated tools for online PDF editing and signing. Try it out today!

- US Legal Forms is the most comprehensive online directory with a collection of over 85k ready-to-use documents for professional and personal legal situations.

- All templates are verified to comply with each state's regulations.

- So, when downloading Estate Planning Checklist Form For Agricultural Families from our site, you can be assured that you acquire a valid and current document.

- Acquiring the needed sample from our platform is extraordinarily straightforward.

- If you already possess an account, simply Log In to the system, verify your subscription is active, and save the chosen file.

- Later, you can access the My documents section in your profile and have access to the Estate Planning Checklist Form For Agricultural Families at any point.

- If it’s your initial experience with our site, please follow the steps below.

- Review the suggested page and verify it for conformity with your needs.

Form popularity

FAQ

Maintaining your estate plan documents involves regularly reviewing and updating them as personal circumstances change. Consider conducting an annual check, which can ensure your estate planning checklist form for farm families remains relevant. Additionally, keep your documents in a secure yet accessible location for you and your family. Platforms like uslegalforms provide resources to help you revise and manage your estate planning documents efficiently.

To organize papers for Next of Kin, collect and securely store vital documents, including wills, trusts, and health care directives. Use a clear labeling system, which can enhance the accessibility of your estate planning checklist form for farm families. By keeping these documents together and informing your family about their location, you can make their lives easier during challenging times. Consider utilizing digital tools to store and share important files with your next of kin.

Suze Orman emphasizes the importance of four key documents for effective estate planning: a will, a durable power of attorney, a healthcare proxy, and a living trust. These documents form the foundation of your estate planning checklist form for farm families and ensure your wishes are respected. Having these in place protects your assets and guides your family in times of need. Moreover, using a platform like uslegalforms can help you create these documents easily.

To organize documents for estate planning, start by gathering all important papers in one location. Use a dedicated folder or binder, which can help you keep track of your estate planning checklist form for farm families. Ensure you include essential financial documents, property titles, and insurance policies. Categorizing these documents will simplify the estate planning process and provide clarity for your beneficiaries.

A farm succession plan outlines how a family farm will transition to the next generation. This plan addresses ownership, management, and tax implications to ensure a smooth transfer. By using an estate planning checklist form for farm families, you can ensure that all aspects of the succession plan are considered and documented, making the process easier for everyone involved.

The 5 and 5 rule for irrevocable trusts allows beneficiaries to withdraw up to 5% of the trust's value each year while also offering a five-year carry-forward option. This rule can enhance financial planning for farm families by providing a way to access resources without incurring gift taxes. An estate planning checklist form for farm families is crucial for navigating these provisions effectively.

One of the biggest mistakes parents make is not clearly defining the terms of the trust. This lack of clarity can lead to disputes among beneficiaries, which can complicate the administration of the trust. Utilizing an estate planning checklist form for farm families helps address this issue by ensuring that specific goals and terms are well communicated and documented.

To create a comprehensive estate plan, you typically need a will, durable power of attorney, healthcare proxy, and possibly a trust. For farm families, including an estate planning checklist form for farm families ensures that all relevant documents, like property deeds and business agreements, are gathered and reviewed. This can save time and avoid confusion later.

The 5 by 5 rule allows beneficiaries to withdraw up to 5% of the trust's total value each year for a maximum of five years. This rule is essential for managing funds in a way that benefits farm families without triggering hefty tax penalties. Using an estate planning checklist form for farm families can help you organize documents required to implement this rule.

The 5 or 5 rule refers to a strategy that allows you to withdraw up to 5% of the value from an irrevocable trust each year without incurring gift tax. It's important for estate planning, especially for farm families, as it provides flexibility in managing assets. By using an estate planning checklist form for farm families, you can ensure all necessary steps are covered to benefit from this rule effectively.