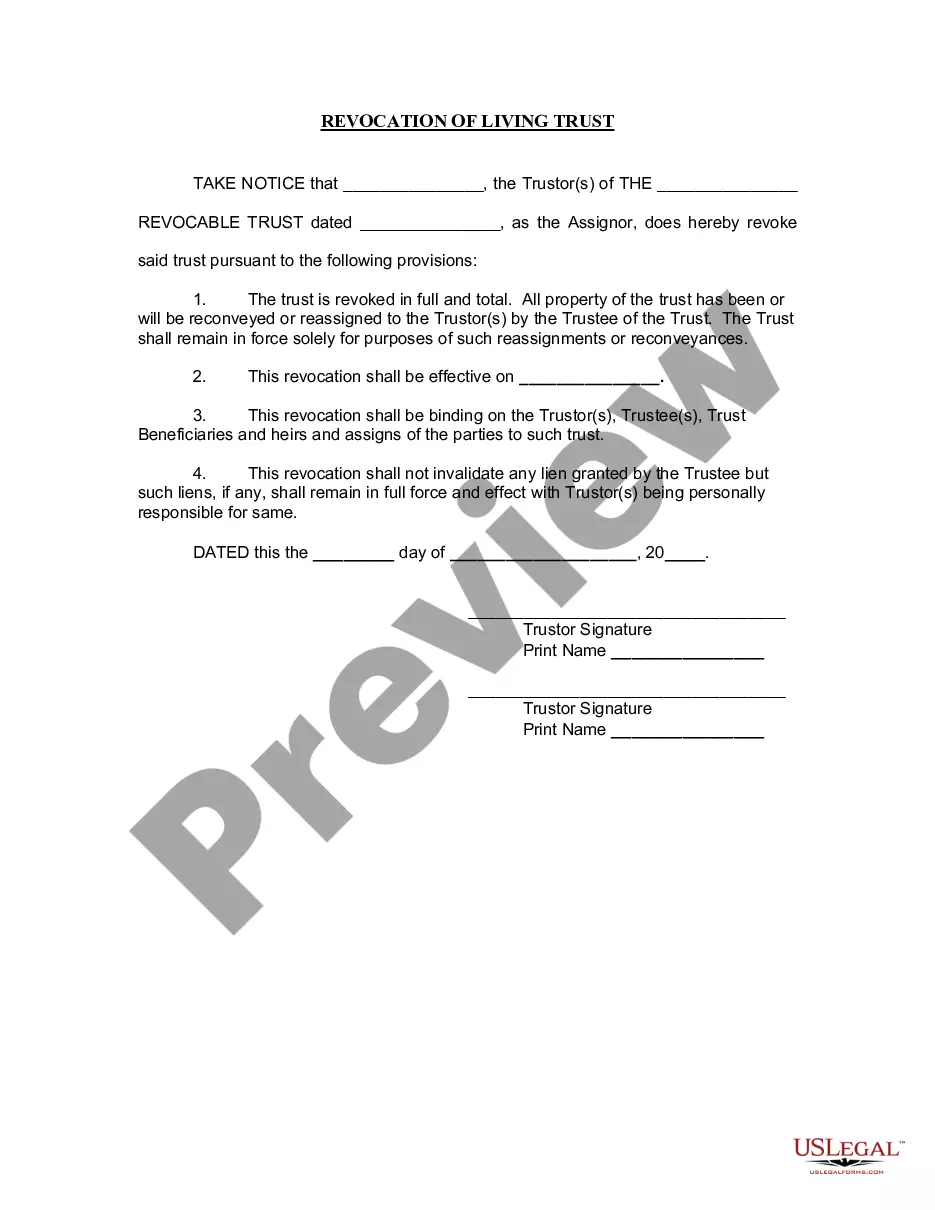

Revocation Of A Living Trust

Description

How to fill out Georgia Revocation Of Living Trust?

- Access your US Legal Forms account. If you already have an account, log in to download your desired form template. Ensure your subscription is active; renew it if necessary.

- Preview the form. Review the description and ensure it meets your requirements and adheres to your local jurisdiction's rules.

- Search for alternatives. If the form is incorrect, use the Search bar to find the right template that suits your needs.

- Make a purchase. Click 'Buy Now' to select your subscription plan. You'll need to create an account to access the library.

- Complete your transaction. Enter your payment details via credit card or PayPal to finalize your subscription.

- Download and save. After purchase, download your form to your device, accessible anytime under the My Forms section.

These user-friendly steps highlight how US Legal Forms empowers individuals and attorneys to efficiently handle legal documents. Its extensive library, featuring over 85,000 forms, ensures you have access to what you need.

Ready to handle your legal documents with ease? Start your journey with US Legal Forms today!

Form popularity

FAQ

There are several ways to terminate a trust, including revocation by the grantor, fulfillment of the trust’s purpose, or expiration of the trust term. The most common method is a formal revocation of a living trust, which allows the grantor to dissolve it when they choose. Additionally, a trust may be terminated if all beneficiaries agree to its dissolution. Exploring these options can give you clarity on how to proceed.

Invalidating a living trust involves demonstrating that the trust does not meet legal requirements. This can occur if there was no proper execution, lack of mental capacity, or undue influence at the time of creation. By hiring a qualified attorney, you can navigate the complexities of the revocation of a living trust and understand the grounds for invalidation. Legal help ensures you follow the appropriate procedure to declare the trust invalid.

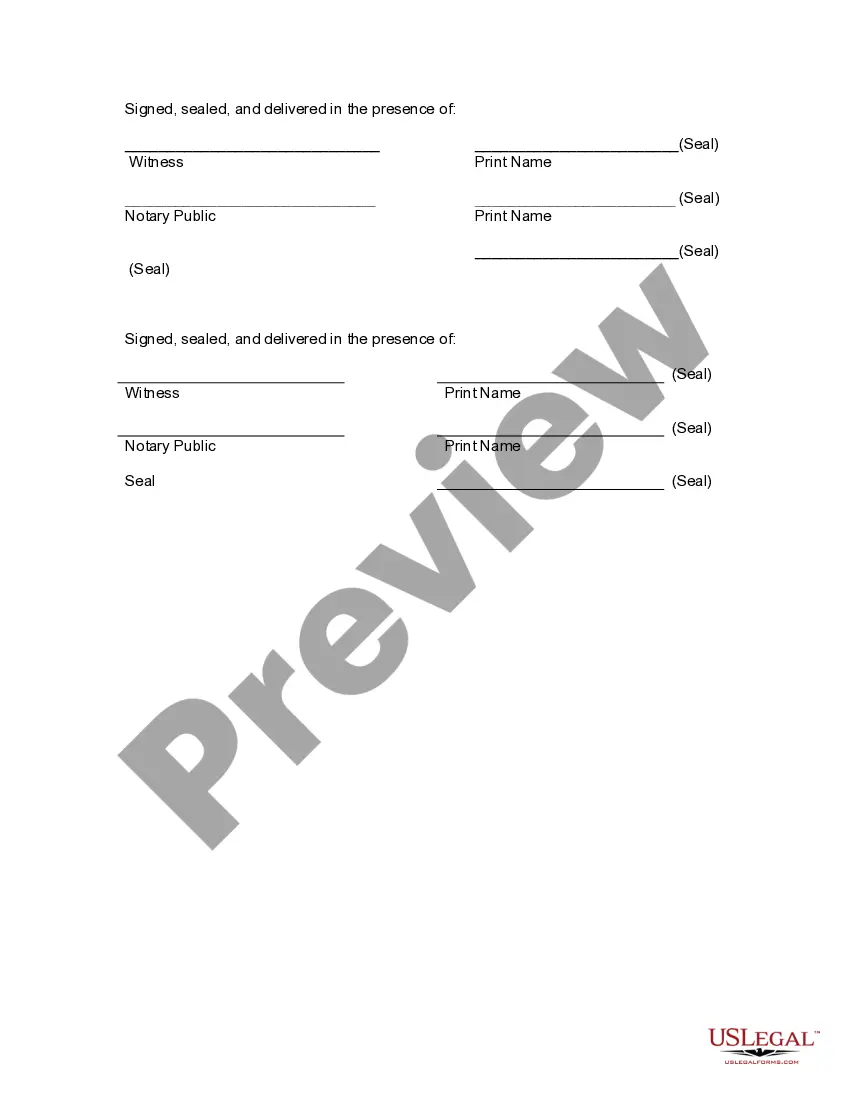

To shut down a trust, you must execute a formal revocation of a living trust. This process usually involves drafting a revocation document that states your clear intention to dissolve the trust. After creating this document, you should sign it in front of a notary. Lastly, you need to provide copies to the relevant parties involved, ensuring everyone is informed of the trust's termination.

To dissolve a revocable trust, you need to complete a trust revocation form, which allows you to officially cancel the trust's terms. After signing this form, inform all beneficiaries and relevant parties, as this ensures clarity about the trust's status. The revocation of a living trust allows you to manage your assets in a way that aligns with your current wishes, making it a significant step for many individuals.

A trust revocation declaration is a written statement indicating that you no longer wish for the trust to exist. An example might start with your name and the name of the trust, followed by a clear statement of revocation. This declaration is vital in the revocation of a living trust, as it formally ends the trust’s obligations and terms.

A form to dissolve a revocable trust is often a standardized document that outlines the intent to terminate the trust. This form typically requires your signature and may need to be notarized or witnessed. Utilizing a reliable platform like US Legal Forms can help you obtain the correct form for the revocation of a living trust.

Revoking a revocable trust is generally straightforward, provided you follow the correct legal procedures. In most cases, you simply need to complete a trust revocation document and notify any involved parties. The revocation of a living trust allows you to regain control of your assets, making this process beneficial for many individuals.

A letter of termination of a trust is a formal document declaring the end of a trust. This letter typically includes details about the trust and outlines the reasons for its dissolution. When discussing the revocation of a living trust, this letter serves as the official notice to beneficiaries and relevant parties about the trust's termination.

The revocation of a living trust can be accomplished through a few straightforward steps. First, consult your trust documentation to confirm the procedure for revocation. Typically, you will need to sign a document indicating your intent to revoke the trust, and then distribute any assets accordingly. For ease and reliability, consider using the US Legal Forms platform, which provides resources and templates to guide you through the entire revocation of a living trust process.

A trust can be declared null and void for various reasons, including the absence of a legitimate purpose, lack of a valid beneficiary, or if it was created through fraud. Additionally, if the trust's terms violate public policy or statutory provisions, it may be annulled. Understanding the revocation of a living trust can help you avoid these pitfalls. Always engage with knowledgeable professionals to safeguard your trust.