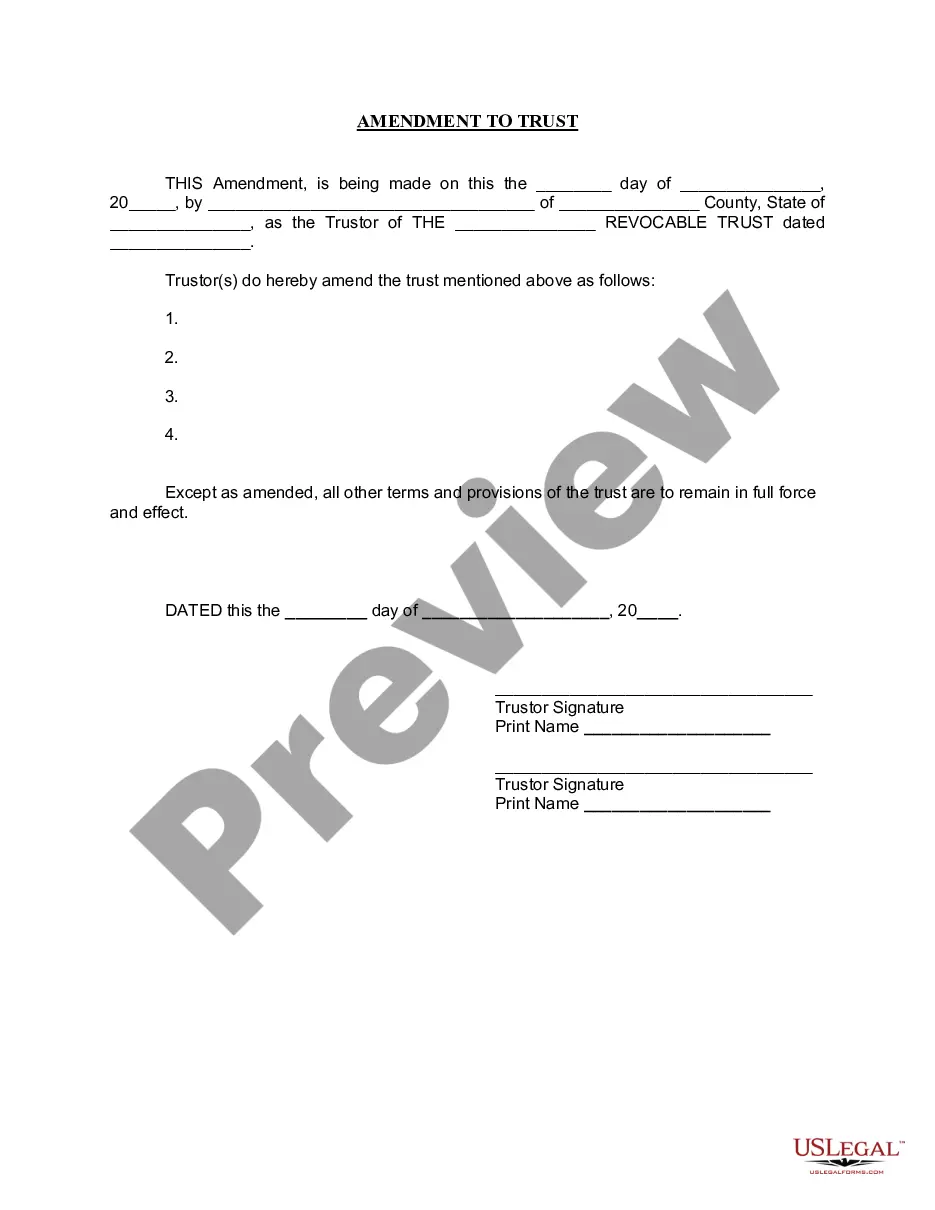

Amendment Living Trust

Description

How to fill out Georgia Amendment To Living Trust?

- Begin by logging in to your US Legal Forms account. Verify that your subscription is active; if necessary, renew it based on your current payment plan.

- Preview the desired Amendment Living Trust template, ensuring it aligns with your local regulations and needs.

- If the template does not meet your requirements, use the search function to explore additional options until you find the right one.

- Select your preferred plan and click 'Buy Now' to proceed. You’ll need to create an account if you haven’t done so already.

- Complete your purchase by entering your payment details through credit card or PayPal.

- Download the completed document to your device for easy access anytime through the 'My Forms' section in your account.

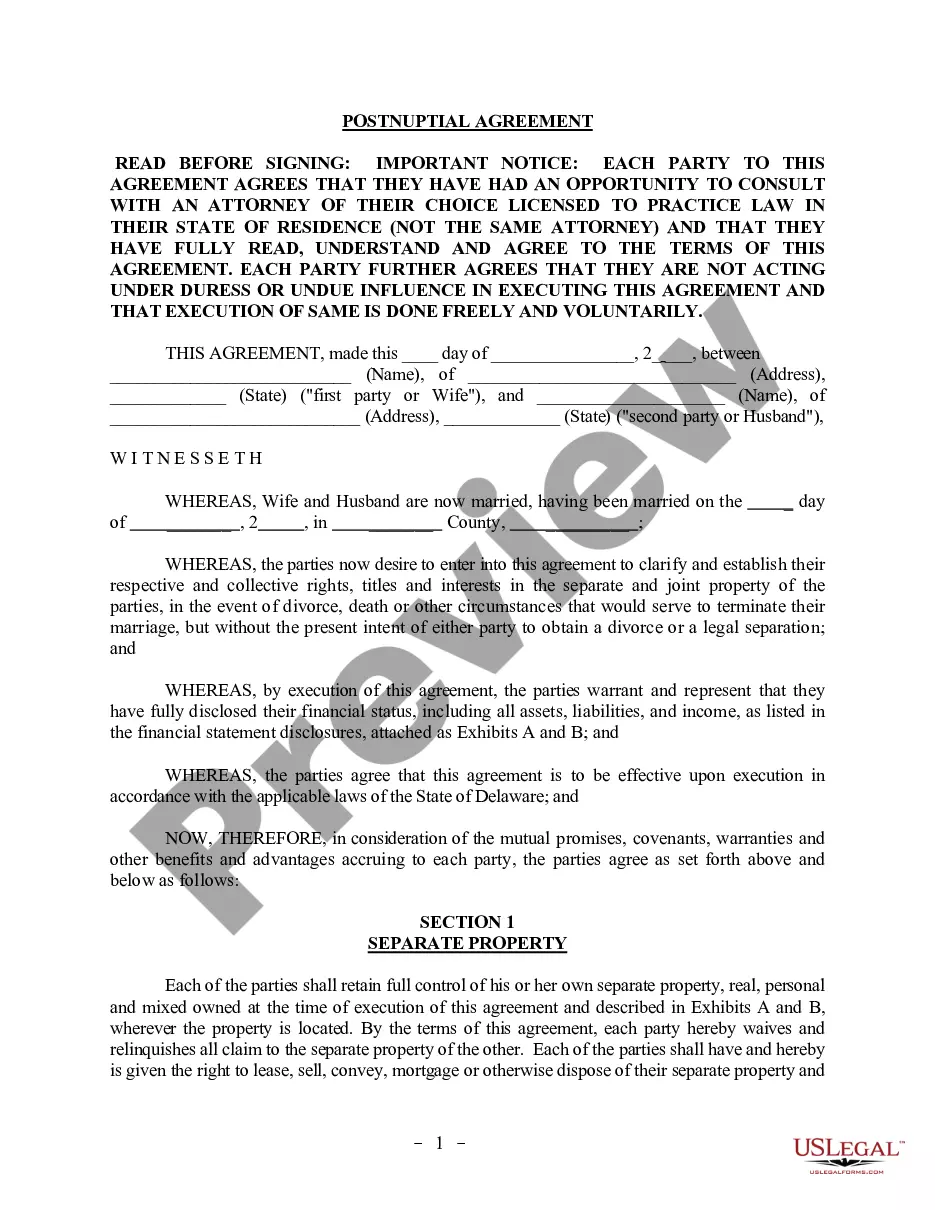

In conclusion, US Legal Forms offers a comprehensive collection of legal documents that empower users to create their Amendment Living Trust efficiently. With over 85,000 forms available, getting legal assistance has never been easier.

Start your journey towards securing your assets today by visiting US Legal Forms and discovering the perfect legal documentation for your needs.

Form popularity

FAQ

Writing an amendment to a living trust involves creating a formal document that states the changes you want to make. Start by identifying the specific sections of your existing trust that will change, and then clearly outline your new provisions. It's essential to sign and date this document in accordance with your state’s laws to make it legally binding. For added peace of mind, you can also utilize platforms like US Legal Forms to access templates and expert guidance on drafting an amendment living trust.

Changing a living trust can be straightforward, but it does depend on how the trust was initially set up. If you have an amendment living trust in place, making adjustments generally requires a simple amendment process. This can involve drafting a document that outlines the changes you wish to make. However, if you are unsure how to proceed, consider consulting with a legal expert to ensure your amendments are valid and effective.

Yes, you can write a codicil yourself as long as you follow the correct legal requirements. Creating a handwritten or typed document that clearly indicates your intention to modify the amendment living trust is acceptable. Ensure that you sign and date the codicil, and consider having it witnessed or notarized as an added step for validation. This empowers you to manage your trust effectively.

A codicil does not need to be handwritten; it can also be typed. However, some states may have specific requirements about the method of creation. Ideally, to ensure the validity of your amendment living trust with a codicil, follow the formatting guidelines that your state mandates. This way, your changes will stand up to scrutiny.

Generally, an amendment to a trust does not need to be recorded with a government office. However, it is wise to keep the amendment living trust and any amendments in a safe, accessible place. Certain states may have specific rules about documentation, so check local laws to ensure compliance. Proper documentation helps clarify your wishes for your heirs.

Writing a codicil to a trust involves creating a document that specifies the amendments to the existing amendment living trust. Begin by stating your intention to change specific provisions in the trust. Include clear language that outlines the modifications and ensure you sign and date the codicil as required by law. This keeps your intentions legally recognized and effective.

Yes, you can amend your trust by yourself, provided you understand the legal requirements. Writing an amendment living trust does not require an attorney, but it is wise to follow all local laws and formalities. Make sure to retain a copy of the original trust with any amendments for future reference. However, seeking professional help can ensure that everything is legally sound.

To amend a trust document, clearly draft the amendment that specifies the changes you want to make. You must reference the original amendment living trust document and specify what you are changing. Once the amendment is complete, sign it in accordance with your state laws. Keeping a copy of both the original trust and the amendment together ensures clarity.

A written codicil is a document that acts as an amendment to your existing trust. For example, if you want to change the beneficiaries of your amendment living trust, you can create a codicil stating those new beneficiaries. It is essential to ensure that the codicil is properly signed and dated for it to be valid. This way, your wishes are clearly stated and easily understood.

Placing your home in an amendment living trust can have drawbacks, such as potential tax implications and loss of control in some situations. Additionally, transferring ownership could complicate mortgages or insurance policies related to the property. It's crucial to evaluate these aspects carefully, and consider seeking advice through platforms like US Legal Forms to navigate the intricacies of this decision.