Georgia Dissolve Llc Withdrawal

Description

Form popularity

FAQ

One disadvantage of an LLC in Georgia is the potential for annual fees. Additionally, the administrative requirements can be more demanding than in other business structures. If you decide to Georgia dissolve LLC withdrawal, you face a specific process with fees and paperwork. It's essential to weigh these factors when choosing the right business structure.

Yes, in Georgia, you must file an annual registration for your LLC. This registration keeps your business in good standing with the state. Failing to renew may lead to complications, including Georgia dissolve LLC withdrawal. Timely compliance is crucial for maintaining your business operations.

Dissolving an LLC can be straightforward if you follow the right steps, but it often requires careful attention to detail. Each state, including Georgia, has specific procedures to complete the dissolution process. While some view it as manageable, others might benefit from professional assistance. Using platforms like UsLegalForms can streamline the Georgia dissolve LLC withdrawal, making it easier to navigate the paperwork.

Yes, notifying the IRS is a crucial step when you close your LLC. This generally involves filing a final tax return and marking it as ‘final’ to inform the IRS that your business has ceased operations. Keeping the IRS informed is particularly important to avoid future tax liabilities. Thus, being thorough in your Georgia dissolve LLC withdrawal process is beneficial.

Dissolving an LLC in the USA generally involves filing dissolution documents with the state where your LLC is registered. While the exact requirements may vary by state, most will ask for a formal vote from members and settling any outstanding debts. You may also need to notify the IRS regarding your business closure. Adhering to the correct procedures ensures a complete and orderly Georgia dissolve LLC withdrawal.

Deciding whether to dissolve your LLC or keep it inactive often depends on your business intentions. If you no longer wish to pursue business activities, formally dissolving your LLC might be a better choice. This process helps you avoid ongoing fees and reduces potential liabilities. If you think you may return to business, keeping it inactive could be a viable option, but it still incurs certain costs.

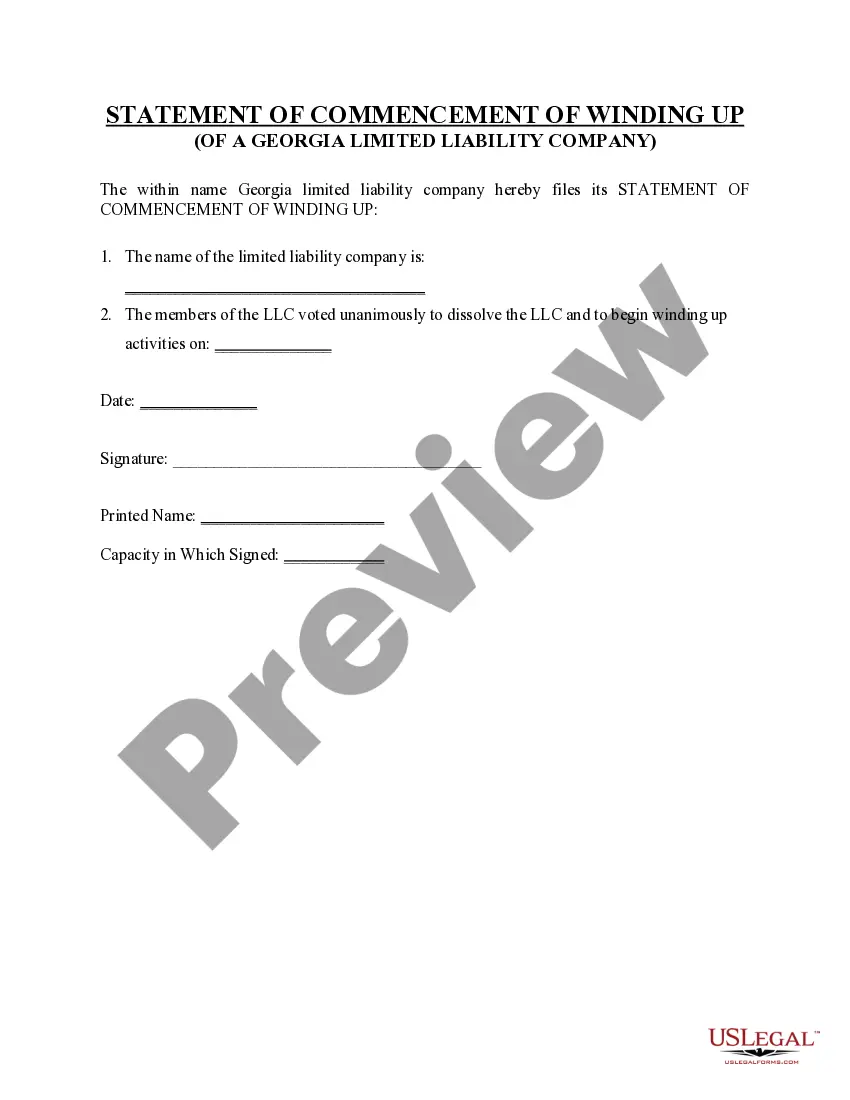

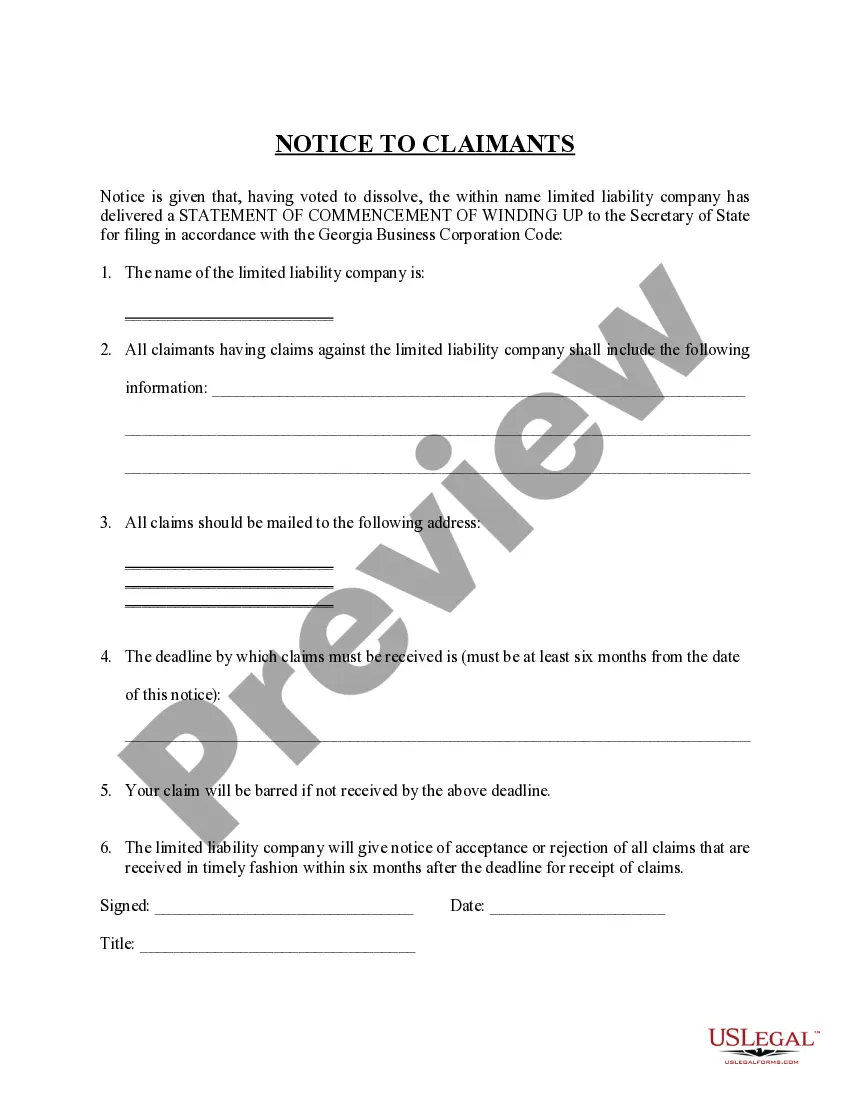

Withdrawing from an LLC in Georgia requires you to follow a specific process outlined in your operating agreement. Typically, you should notify the LLC members, ensure settled obligations, and file a withdrawal form with the state. For a smoother experience during your Georgia dissolve LLC withdrawal, consider utilizing the services offered by US Legal Forms to guide you through the necessary steps.

An administrative dissolution occurs when the state dissolves an LLC for failing to comply with legal requirements, such as not filing annual reports or paying fees. This dissolution can happen without your request and could complicate your ability to operate. Understanding the implications of a Georgia dissolve LLC withdrawal is crucial for maintaining compliance.

To dissolve a corporation in Georgia, you must file a Notice of Intent to Dissolve form with the Secretary of State. Following that, you may need to settle debts, distribute assets, and notify stakeholders. If you are looking for assistance in navigating this process, platforms like US Legal Forms can provide valuable resources for your Georgia dissolve LLC withdrawal needs.

Obtaining a business license in Georgia usually takes between a few days to several weeks, depending on your local requirements. Each county and city may have its own regulations and processing times. For those looking to manage their documentation efficiently, using a resource like US Legal Forms can help streamline your Georgia dissolve LLC withdrawal and licensing efforts.