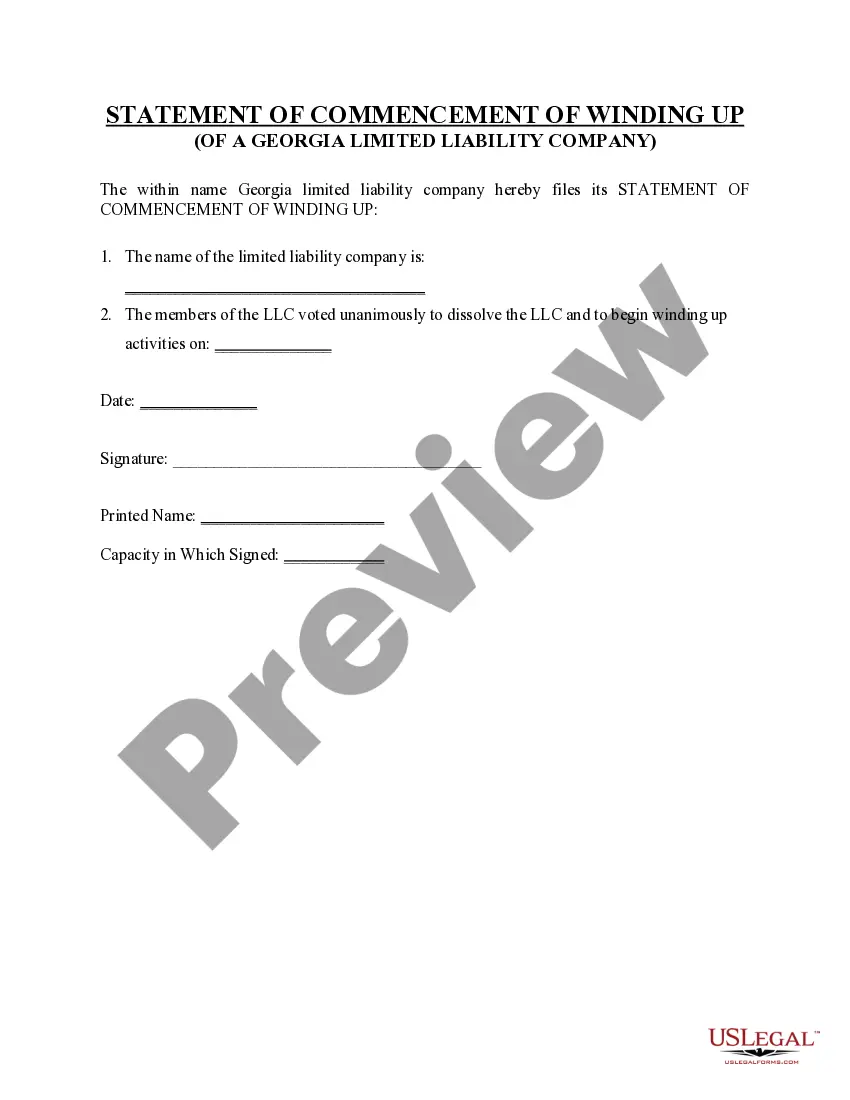

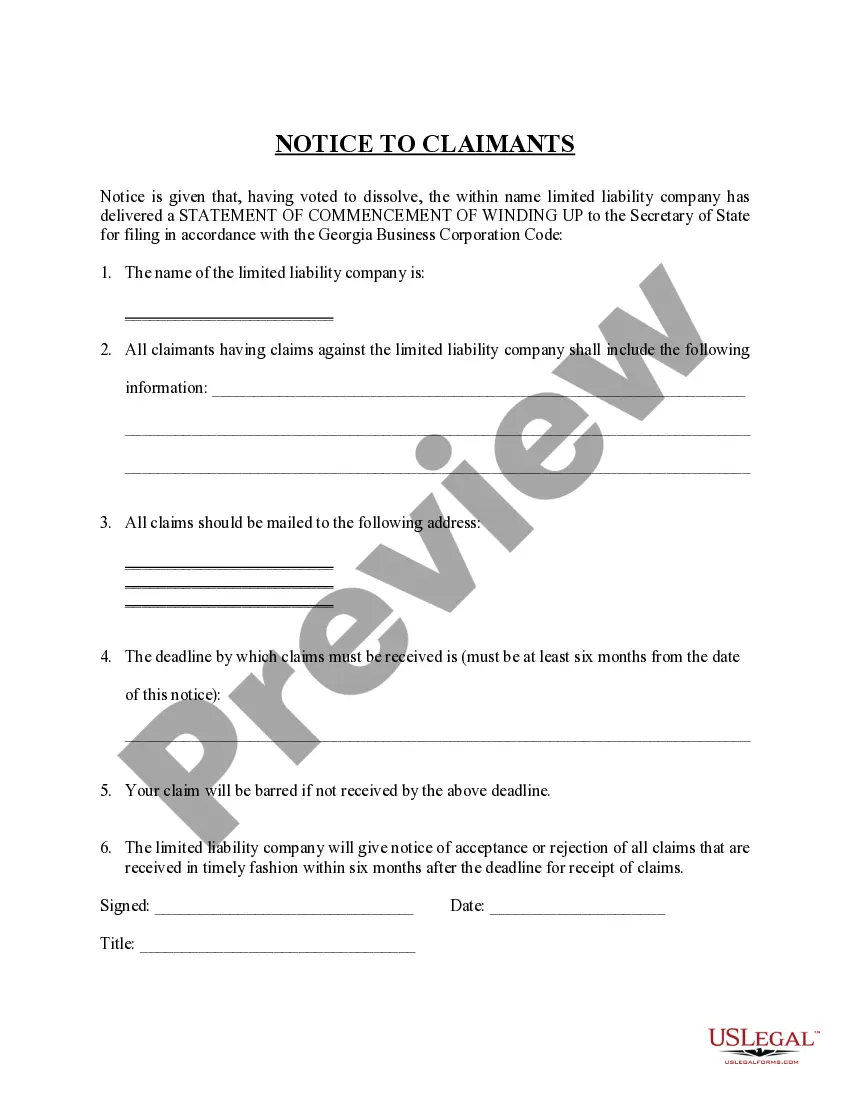

The dissolution package contains all forms to dissolve a LLC or PLLC in Georgia, step by step instructions, addresses, transmittal letters, and other information.

Dissolve Company in NJ: Dissolve company in NJ refers to the process of legally closing down or dissolving a business entity in the state of New Jersey. This can be done voluntarily by the business owners or required by the state if certain criteria are not met. Keywords: Dissolve company, NJ, process, legal, closing down, dissolving, business entity, voluntarily, state, criteria. Types of Dissolve Companies in NJ: 1. Limited Liability Company (LLC) Dissolution: LCS are one of the most common business entities in NJ. Their dissolution involves filing a Certificate of Dissolution with the New Jersey Division of Revenue and Enterprise Services. This involves settling any pending debts, taxes, and distributing assets among the members. 2. Corporation Dissolution: Corporations in NJ can dissolve voluntarily or be dissolved through administrative dissolution if they fail to comply with annual reporting requirements. The process typically involves filing articles of dissolution with the NJ Division of Revenue and Enterprise Services and settling any outstanding liabilities. 3. Partnership Dissolution: In NJ, partnerships can dissolve voluntarily through a written agreement between the partners or due to the expiration of a partnership term. The partners must settle any debts, distribute assets, and file a Statement of Dissolution with the NJ Division of Revenue and Enterprise Services. 4. Nonprofit Organization Dissolution: Nonprofits in NJ can dissolve either voluntarily or involuntarily due to non-compliance with legal requirements. The process includes adopting a resolution to dissolve, settling outstanding obligations, and filing a Certificate of Dissolution with the NJ Division of Consumer Affairs. 5. Sole Proprietorship Cessation: While not a separate legal entity, a sole proprietorship can cease its operations by voluntarily closing the business, settling debts, cancelling permits and licenses, and informing relevant government agencies. There is no formal filing required for a sole proprietorship dissolution in NJ. 6. Foreign Corporation Withdrawal: A foreign corporation that has been authorized to do business in NJ but wishes to cease its operations in the state can file a Certificate of Withdrawal with the NJ Division of Revenue and Enterprise Services. This involves settling any obligations in NJ and officially withdrawing from conducting business in the state. Keywords: Limited Liability Company dissolution, Corporation dissolution, Partnership dissolution, Nonprofit organization dissolution, Sole proprietorship cessation, Foreign corporation withdrawal, NJ Division of Revenue and Enterprise Services, Certificate of Dissolution, settlement of debts, assets distribution, legal requirements.