Dissolve A Ltd Company With Debts

Description

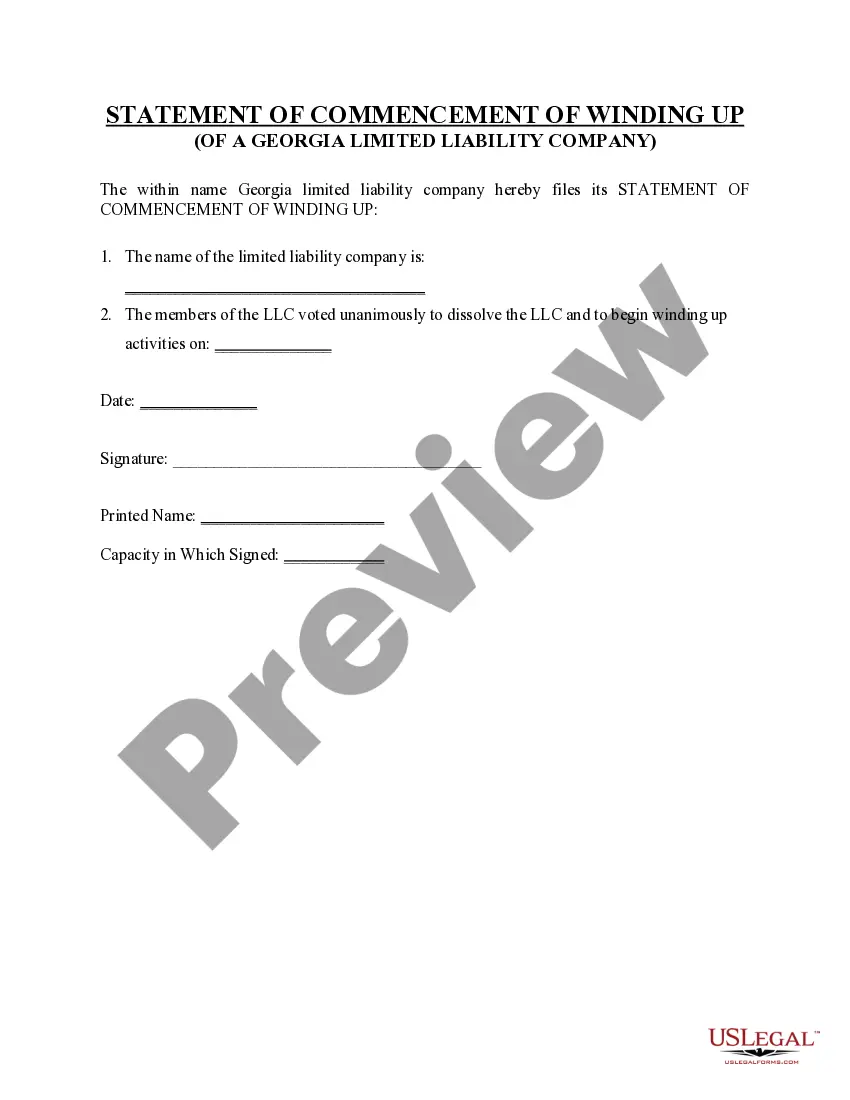

How to fill out Georgia Dissolution Package To Dissolve Limited Liability Company LLC?

- If you are a returning user, visit US Legal Forms, log in to your account, and download the required document by clicking the Download button. Make sure your subscription is active; otherwise, renew it as per your payment plan.

- For first-time users, start by browsing the US Legal Forms library. Use the Preview mode to review document descriptions and ensure the selected form meets your local jurisdiction requirements.

- If the form doesn’t match your needs, utilize the Search tab to locate a suitable template. Confirm it meets your criteria before proceeding.

- Purchase the document by clicking the Buy Now button and selecting a subscription plan that suits you. You’ll need to create an account to unlock resources.

- Complete your purchase by providing your payment information through credit card or PayPal.

- Finally, download your completed form and save it to your device. You can also access it later in the My Forms section of your account.

By utilizing US Legal Forms, you ensure that your dissolution process is efficient and legally compliant. With a robust collection of legal templates and expert access, you can feel confident that you are making informed decisions.

Don't hesitate! Start the dissolution of your ltd company with debts today by visiting US Legal Forms and exploring the available resources.

Form popularity

FAQ

When you dissolve a ltd company with debts, the company remains liable for its outstanding obligations. Creditors can still pursue the company for repayment, even after dissolution. It is crucial to address these debts before proceeding with the dissolution process to avoid personal liability. Utilizing a platform like US Legal Forms can help you understand your responsibilities and guide you in effectively managing company debts during dissolution.

Yes, you can dissolve a company that has debts, but it requires careful handling. You must address the creditors and settle outstanding amounts to avoid complications. Utilizing the resources of platforms such as US Legal Forms can assist you in the proper procedures to dissolve a ltd company with debts, ensuring you meet legal obligations.

To exit a limited company, you should follow specific legal steps, including informing shareholders and completing the necessary paperwork. It’s vital to address the company's debts before dissolving it fully. By using services like US Legal Forms, you can simplify the process to dissolve a ltd company with debts.

Removing yourself from a limited company typically involves transferring your shares or resigning as a director. Ensure that all legal filings are completed to avoid potential issues later. Consulting platforms like US Legal Forms can help you navigate the process to dissolve a ltd company with debts in compliance with the law.

If you walk away from your business, it could lead to several complications, including legal actions from creditors. This may harm your personal credit rating and result in financial liabilities. Instead, consider options to dissolve a ltd company with debts to manage your responsibilities effectively.

Walking away from a limited company is not a simple solution. When you do so, you may still be held responsible for any outstanding debts. To properly dissolve a ltd company with debts, you should explore official processes that ensure your obligations are fulfilled.

Debts from a dissolved LLC do not simply disappear; creditors may still seek payment from members or managers depending on the financial structure. If the LLC had personal guarantees, those liabilities could transfer to the individuals involved. It is advisable to resolve as many debts as you can before officially dissolving. Platforms like US Legal Forms provide resources to assist you in navigating these complexities.

When a corporation is dissolved, its debts remain, and creditors can still pursue collection. The dissolution does not eliminate existing obligations; instead, it can complicate them. Owners may be personally liable if they signed guarantees or if the debts were related to personal transactions. Understanding these implications is vital for anyone considering closing a business.

To dissolve a ltd company with debts, you should first address the outstanding obligations. It often involves negotiating with creditors or arranging payments prior to dissolution. You may also need to file necessary paperwork with your state to formally dissolve the business. Utilizing a platform like US Legal Forms can streamline this process, guiding you through the necessary documentation.

When you close a business, including dissolving a ltd company with debts, those debts do not simply vanish. Creditors may pursue payment from the business owners or directors. This is especially true if personal guarantees were made during borrowing. Addressing these debts before closure can help you manage your financial obligations effectively.