Executor Deed Form Texas

Description

How to fill out Georgia Executor's Deed?

Whether for commercial aims or personal matters, everyone must manage legal circumstances at some stage in their lives. Completing legal documents necessitates meticulous attention, starting from selecting the right form template. For example, if you choose an incorrect version of an Executor Deed Form Texas, it will be rejected when you submit it. Therefore, it is essential to find a trustworthy source for legal paperwork like US Legal Forms.

If you need to obtain an Executor Deed Form Texas template, follow these straightforward steps.

With a vast archive of US Legal Forms available, you don’t need to waste time searching for the correct template online. Utilize the library's simple navigation to find the right form for any circumstance.

- Locate the template you require using the search feature or catalog navigation.

- Review the form's details to verify it corresponds with your case, state, and county.

- Click on the form's preview to assess it.

- If it is not the correct form, return to the search function to find the Executor Deed Form Texas example you need.

- Acquire the template if it satisfies your requirements.

- If you already possess a US Legal Forms account, simply click Log in to access previously saved documents in My documents.

- If you do not yet have an account, you can obtain the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the profile registration form.

- Choose your payment method: use a credit card or PayPal account.

- Select the file format you prefer and download the Executor Deed Form Texas.

- Once downloaded, you can fill out the form using editing software or print it and complete it manually.

Form popularity

FAQ

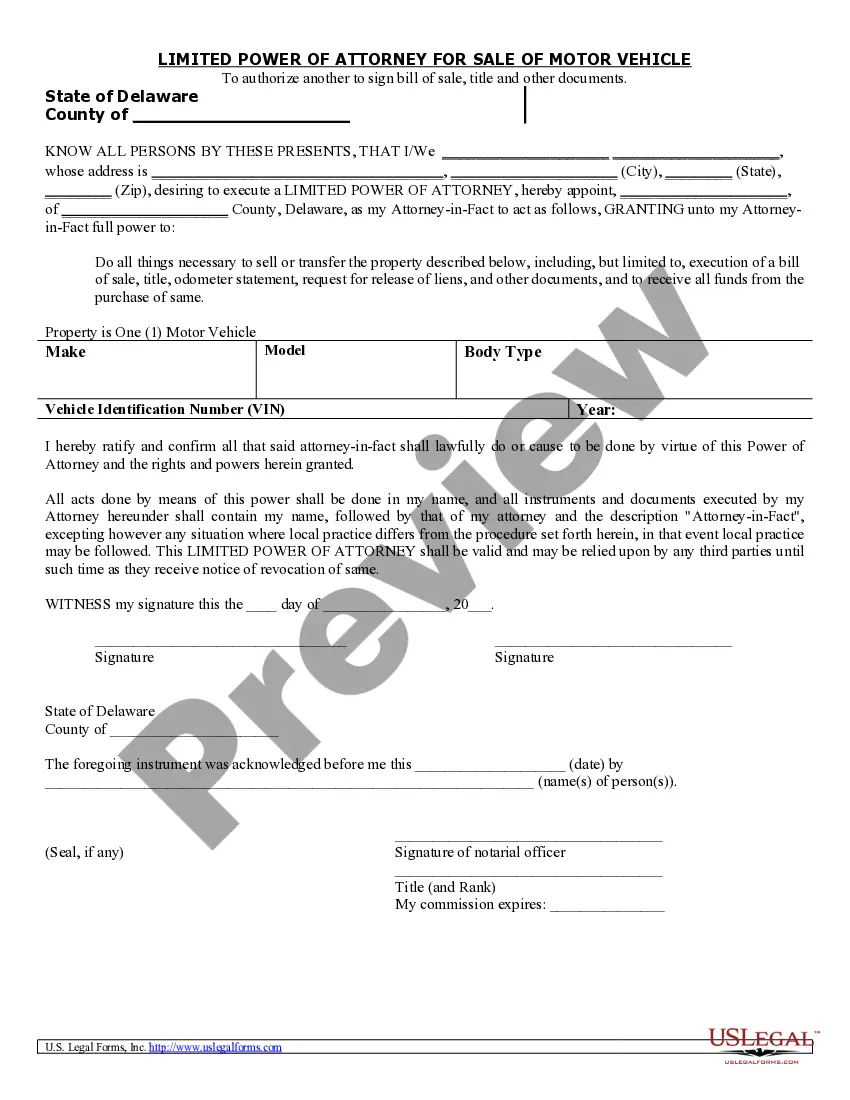

Filling out a transfer on death deed in Texas involves specific steps to ensure accuracy. Begin by stating your name as the grantor, along with the names of the beneficiaries. Clearly describe the property you wish to transfer, then indicate that the transfer will occur upon your death. To make the process easier, you can use uslegalforms to find an accurate Executor deed form Texas.

An executor's deed in Texas is a legal document that allows an executor to transfer property on behalf of the deceased. This deed is crucial for executing the will as it provides authorization and details about the transaction. By using the Executor deed form Texas, executors can efficiently manage the estate and ensure compliance with Texas laws, making the process smoother for everyone involved.

To revive or reinstate your Massachusetts LLC, you need to submit the following to the Secretary of the Commonwealth of Massachusetts: a completed Massachusetts Application for Reinstatement Following Administrative Dissolution. a Certificate of Amendment to change your Massachusetts LLC's name (if needed)

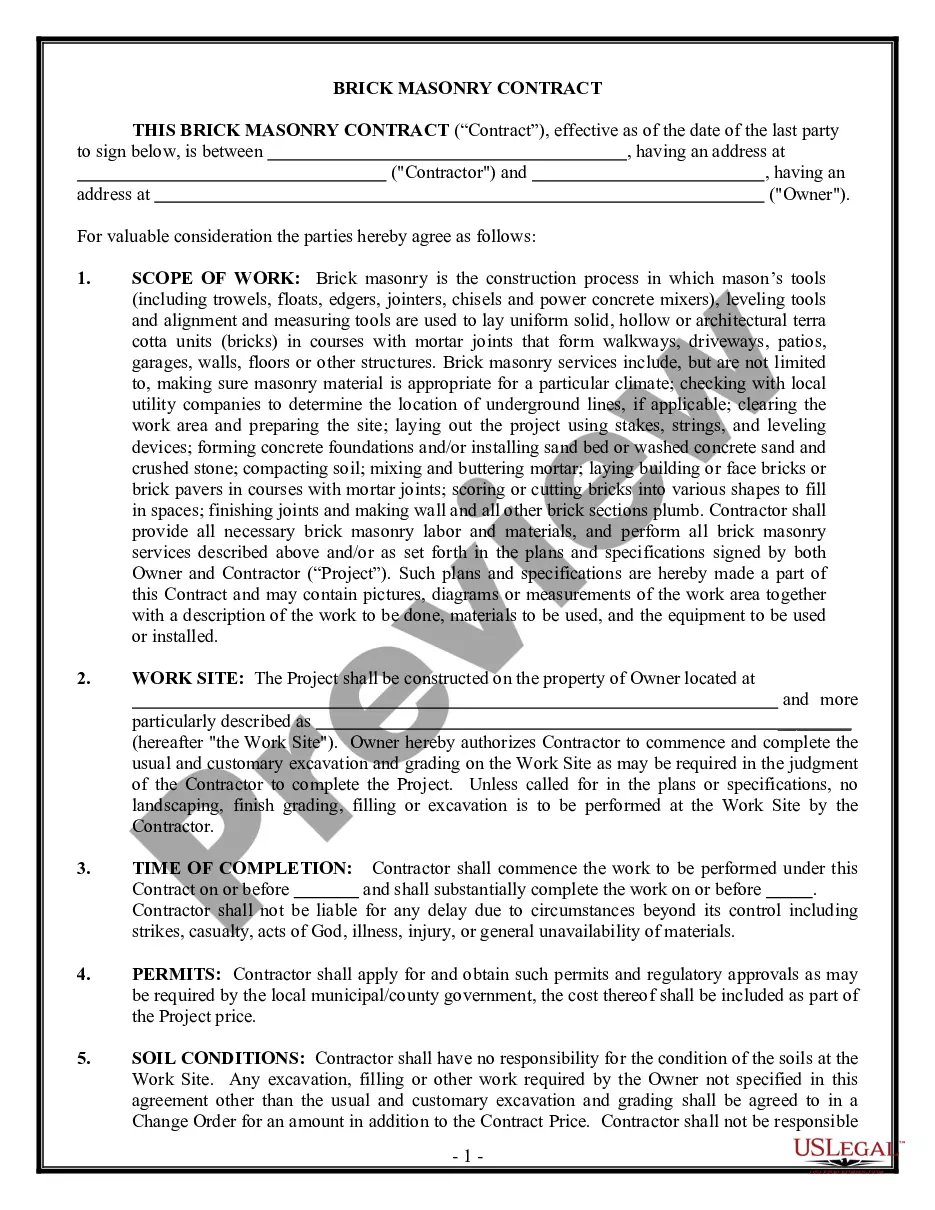

All business contracts should include fundamentals such as: The date of the contract. The names of all parties or entities involved. Payment amounts and due dates. Contract expiration dates. Potential damages for breach of contract, missed deadlines or incomplete services.

The following assets and liabilities are normally included in the sale: Working capital. Cash (but only the amount necessary to pay expenses for a reasonable period of time) Accounts receivable. Inventory. Work in progress. Prepaid expenses. Accounts payable. Wages payable. ... Furniture & fixtures. Equipment. Vehicles.

At its most basic, a purchase agreement should include the following: Name and contact information for buyer and seller. The address of the property being sold. The price to be paid for the property. The date of transfer. Disclosures. Contingencies. Signatures.

My company has already been administratively dissolved. How can I get reinstated? Fix the problem that caused it to be dissolved. For example, if you have overdue annual reports, you will have to file them all. ... Fill out the Reinstatement Form. ... File the Reinstatement Form and pay fee reinstatement fee.

Parts of a Business Sale Agreement Parties. The names and locations of the buyer and seller will be clearly stated in the first paragraph or two of the contract. ... Assets. The agreement will detail the specific assets being transferred. ... Liabilities. ... Terms. ... Disclosures. ... Disputes. ... Notifications. ... Signatures.

Here are ten tips on how to write a business contract: Include All The Required Information. ... Make It Easy To Understand. ... Negotiate With The Decision-makers. ... Confirm All Verbally Agreed-upon Terms Are Included. ... Describe Situations And Criteria That Call For Termination Of The Contract. ... Include Detailed Payment Obligations.

Revocation refers to cases in which the Articles of Incorporation for a Corporation or Articles of Organization for an LLC are revoked by the Secretary of State. Another term for Revocation is Administrative Dissolution.