Name Change For Business With Irs

Description

How to fill out Georgia Name Change Notification Package For Brides, Court Ordered Name Change, Divorced, Marriage?

- Log into your US Legal Forms account if you're a returning user and download the necessary form template. Ensure your subscription is active; renew if needed.

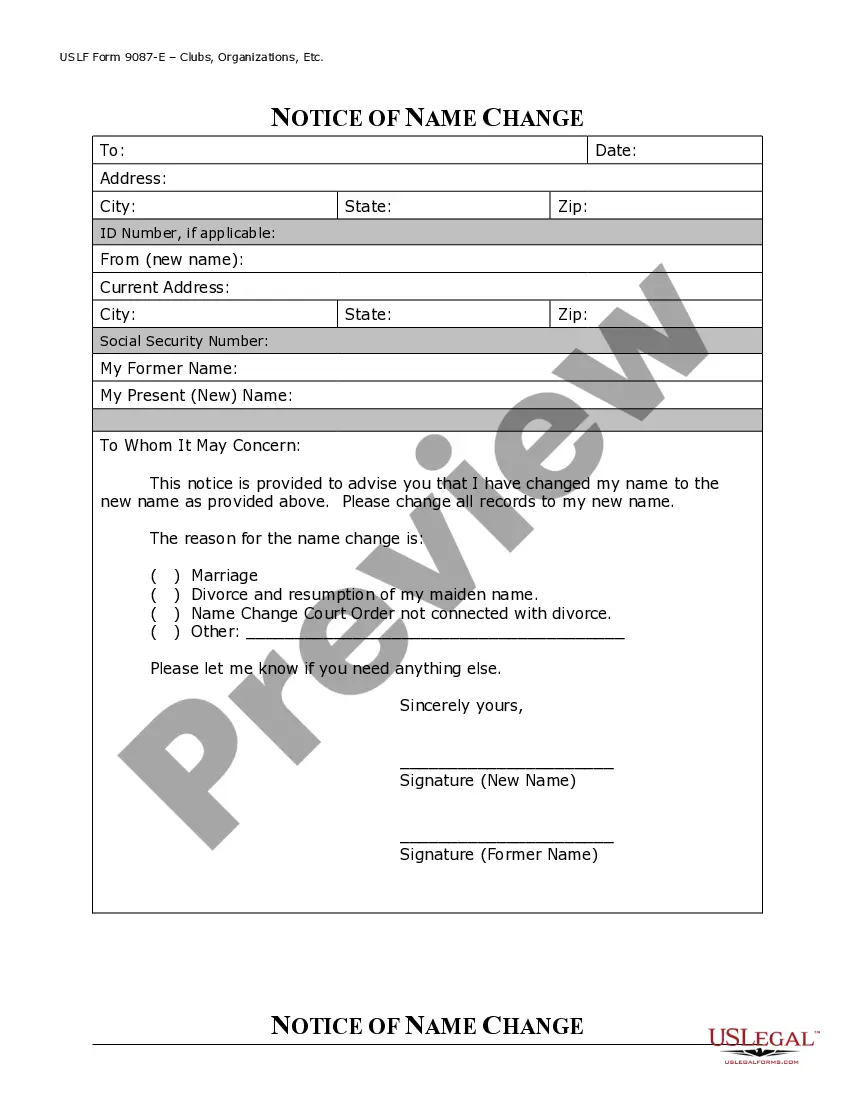

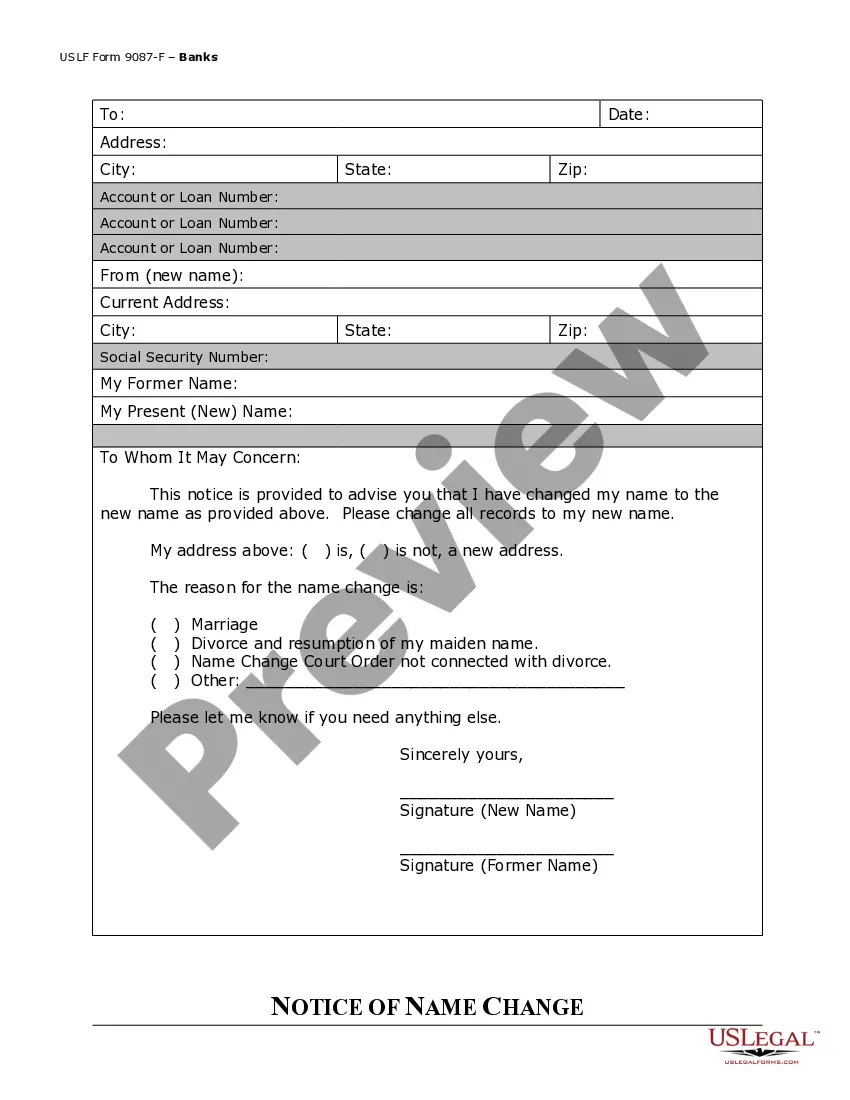

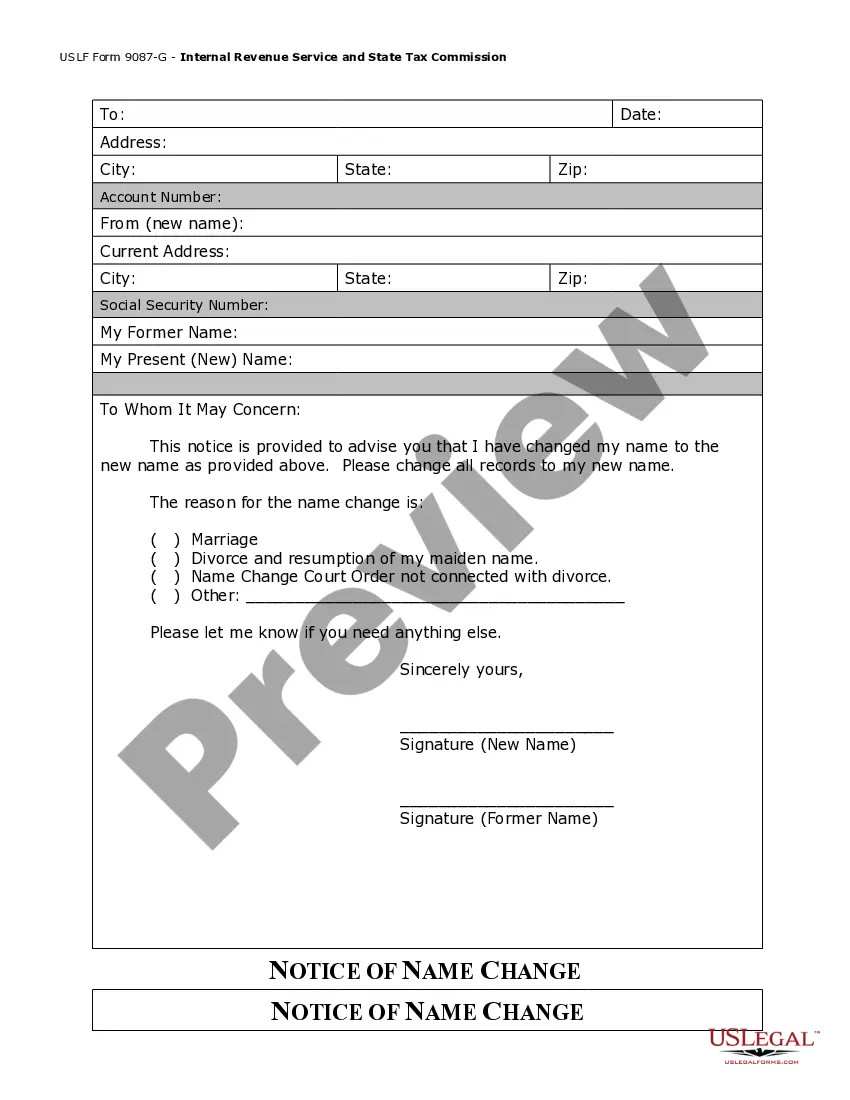

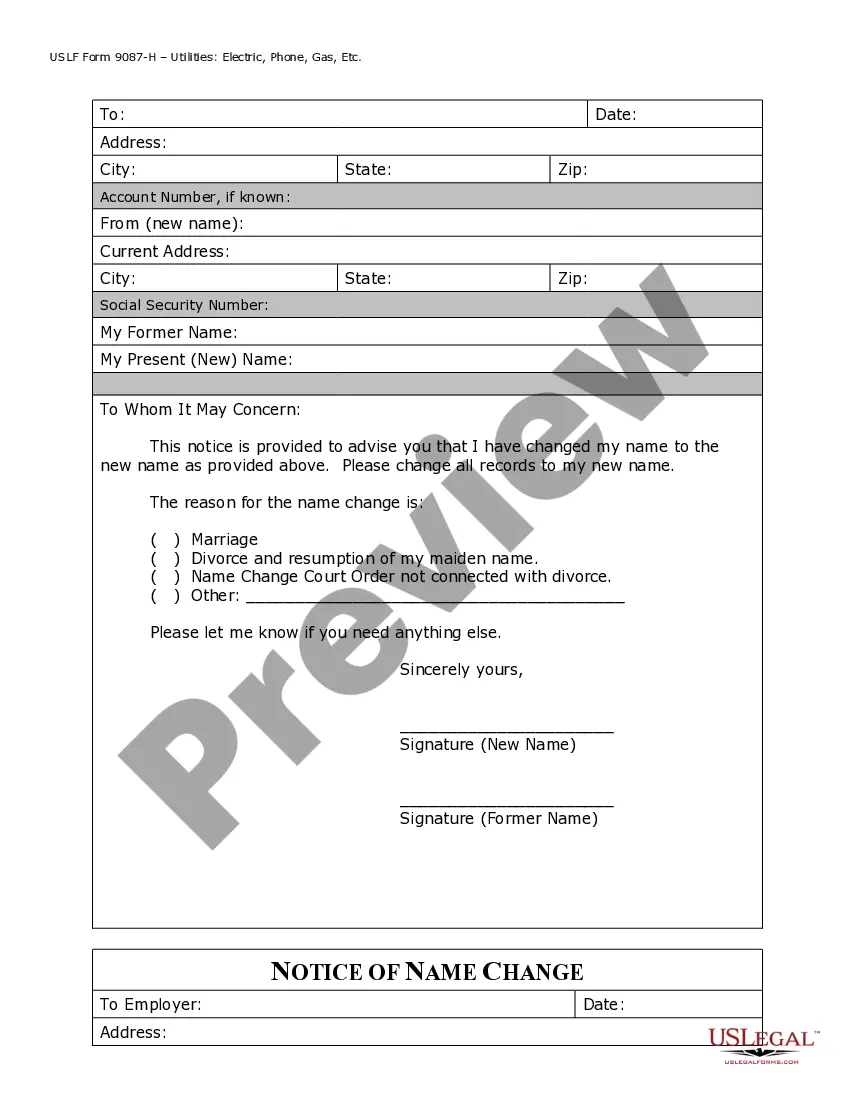

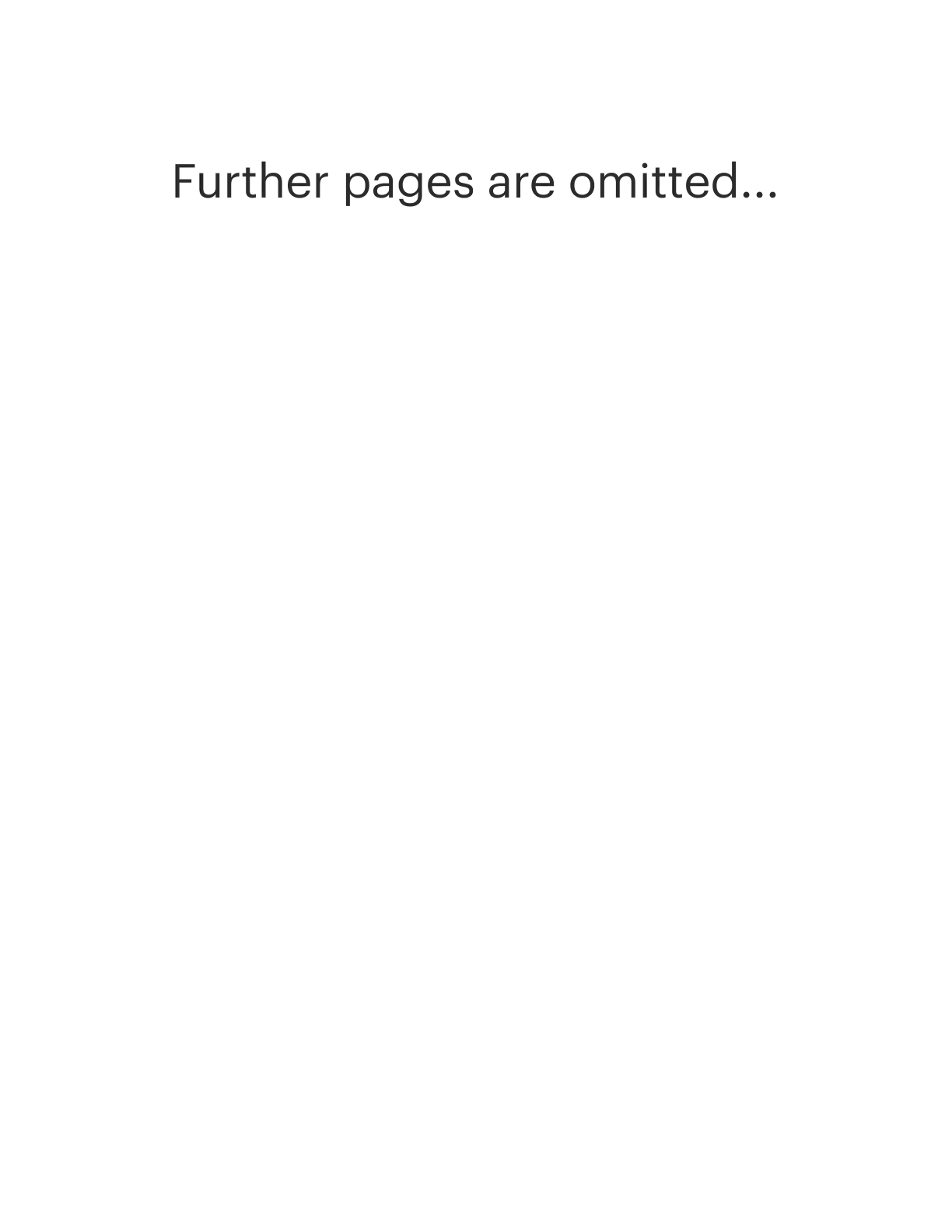

- Preview the form to confirm it matches your specific requirements and complies with local jurisdiction mandates.

- If the form doesn’t meet your needs, utilize the Search feature to locate an appropriate template before proceeding.

- Select the document by clicking the Buy Now button and choose your desired subscription plan, which requires account registration for resource access.

- Complete the purchase by entering your credit card information or opting for PayPal to finalize your subscription.

- Download your form to your device, enabling you to fill it out and access it later through the My Forms section in your account.

US Legal Forms stands out by empowering users with a vast library of over 85,000 legal forms, ensuring both accuracy and compliance. With access to premium experts, you can be confident in your completed documents.

Take the next step in your business's journey. Visit US Legal Forms today to streamline your name change process with the IRS!

Form popularity

FAQ

Notifying the IRS of a name change involves completing the appropriate forms and providing documentation to verify the new name. For most businesses, this can be done by including the name change in your tax return. Alternatively, you can send a written request directly to the IRS. Our USLegalForms platform provides templates and guides to help streamline this process, ensuring your name change for business with IRS is handled smoothly.

To inform the IRS of your business name change, you should write to them directly with your request and attach any necessary documentation, such as a copy of the Articles of Incorporation reflecting the new name. You can also indicate the name change on your upcoming tax return. Make sure to include your current EIN in your correspondence for their reference. USLegalForms offers resources to ensure you communicate effectively with the IRS about your name change for business with IRS.

Yes, you can change your business name and retain the same Employer Identification Number (EIN) if you are a sole proprietorship or a corporation that has not changed its structure. It’s essential to inform the IRS of the name change while maintaining your EIN for continuity. This allows for uninterrupted business operations under the same tax identification. Utilizing USLegalForms can guide you through the necessary steps for a seamless transition.

The approval time for a business name change with the IRS can vary, but it typically takes around 4 to 6 weeks. However, processing times may lengthen during busy seasons or due to incomplete submissions. To help expedite your request, ensure all documents are accurately completed and submitted. Staying organized and following up can help you keep track of the status of your name change for business with IRS.

To request a name change for your business with the IRS, you need to file the appropriate forms based on your business structure. For example, if you're a corporation, you may need to submit Form 1120 and update your Articles of Incorporation with the new name. Ensure you notify the IRS on your next tax return by using the new name. Using our platform, USLegalForms, simplifies this process by offering templates specifically designed for name changes.

To update your business name with the IRS, you should first complete Form 1065 for partnerships or Form 1120 for corporations, depending on your business structure. It’s essential to ensure that the new name is reflected consistently on all official documents. You can submit the change alongside your next tax return or send a written request for the name change. This process simplifies your name change for business with IRS, helping maintain compliance and prevent any discrepancies.

To change your business name with the federal government, you should file Form 8822-B with the IRS. This form officially updates your business name in the IRS records. Additionally, ensure that any state or local registrations reflect this change for complete compliance.

Typically, you do not need a new EIN if you change your business name, as long as your entity type remains the same. The IRS allows name changes without the need for a new EIN, simplifying the process for business owners. Make sure to keep your records aligned to reflect your new name.

To change your business name on your taxes, submit Form 8822-B to the IRS. This form allows you to officially notify them of your name change for business with IRS. Keep a copy for your records and ensure that your business name matches all tax documents to avoid confusion.

To notify the IRS of an LLC change of ownership, you should file Form 8822-B, Change of Address or Responsible Party – Business. This form informs the IRS of changes in the responsible party or ownership status. Ensuring accurate records with the IRS is crucial for maintaining good standing.