Third Party Guarantee Meaning

Description

How to fill out Georgia Guaranty Attachment To Lease For Guarantor Or Cosigner?

Using legal document samples that comply with federal and state laws is essential, and the internet offers a lot of options to choose from. But what’s the point in wasting time searching for the appropriate Third Party Guarantee Meaning sample on the web if the US Legal Forms online library already has such templates accumulated in one place?

US Legal Forms is the greatest online legal catalog with over 85,000 fillable templates drafted by lawyers for any professional and life case. They are easy to browse with all papers collected by state and purpose of use. Our experts keep up with legislative changes, so you can always be sure your form is up to date and compliant when obtaining a Third Party Guarantee Meaning from our website.

Getting a Third Party Guarantee Meaning is simple and fast for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you need in the preferred format. If you are new to our website, follow the guidelines below:

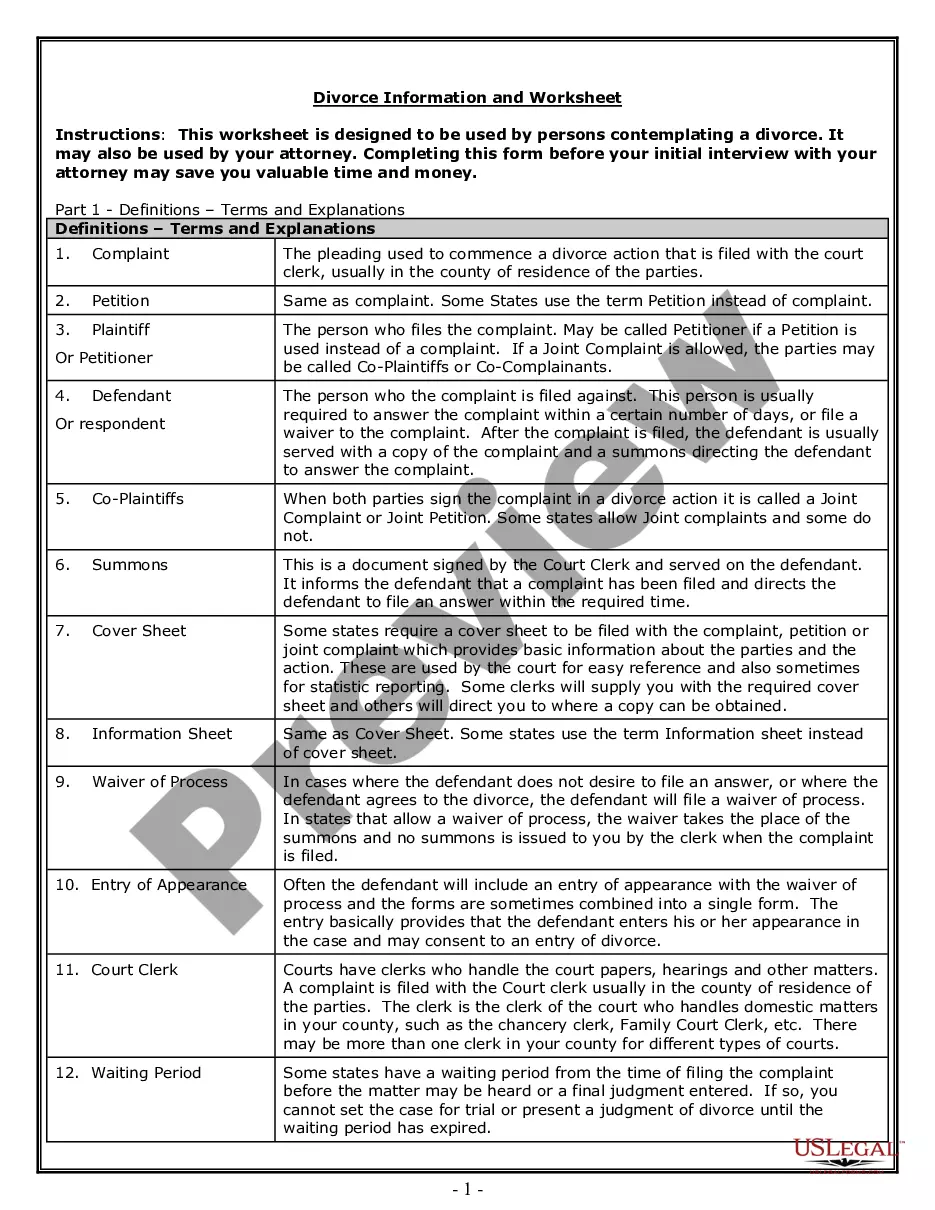

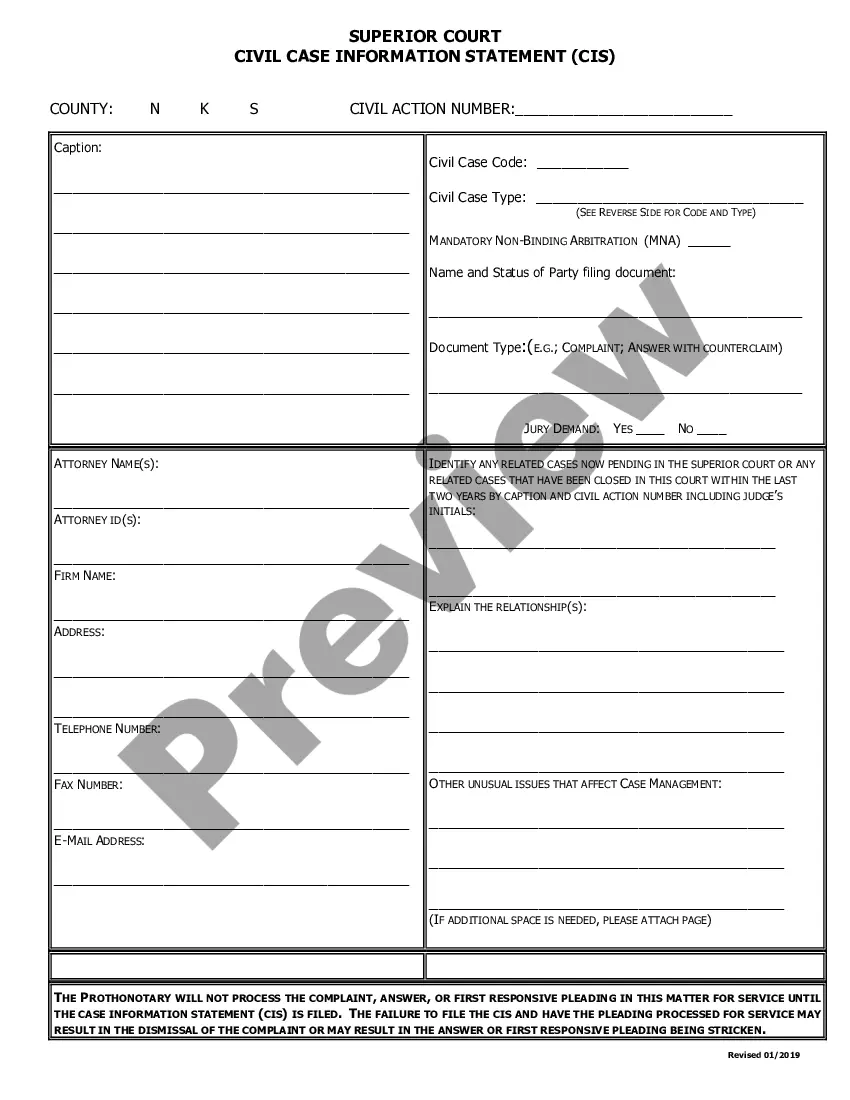

- Take a look at the template using the Preview option or via the text outline to ensure it meets your needs.

- Locate another sample using the search function at the top of the page if needed.

- Click Buy Now when you’ve found the correct form and select a subscription plan.

- Create an account or sign in and make a payment with PayPal or a credit card.

- Pick the format for your Third Party Guarantee Meaning and download it.

All documents you find through US Legal Forms are reusable. To re-download and fill out earlier saved forms, open the My Forms tab in your profile. Enjoy the most extensive and easy-to-use legal paperwork service!

Form popularity

FAQ

As another instance, if a debtor owes a creditor a sum of money and has not been making the scheduled payments, the creditor is probably to hire a third party, a collection agency, to ensure that the debtor honours his agreement.

Third-party guarantees are a form of securing loans, where the guarantor is liable for the outstanding debt including interest in case the borrower defaults. By granting a guarantee one can help family and friends to gain access to credit.

A guaranteed loan is used by borrowers with poor credit or little in the way of financial resources; it enables financially unattractive candidates to qualify for a loan and assures that the lender won't lose money. Guaranteed mortgages, federal student loans, and payday loans are all examples of guaranteed loans.

Traditionally, a distinction is made between: Real guarantees relating to assets having an intrinsic value. Personal guarantees involving a debt obligation for one or more people. Moral guarantees that do not provide the lender with any real legal security.