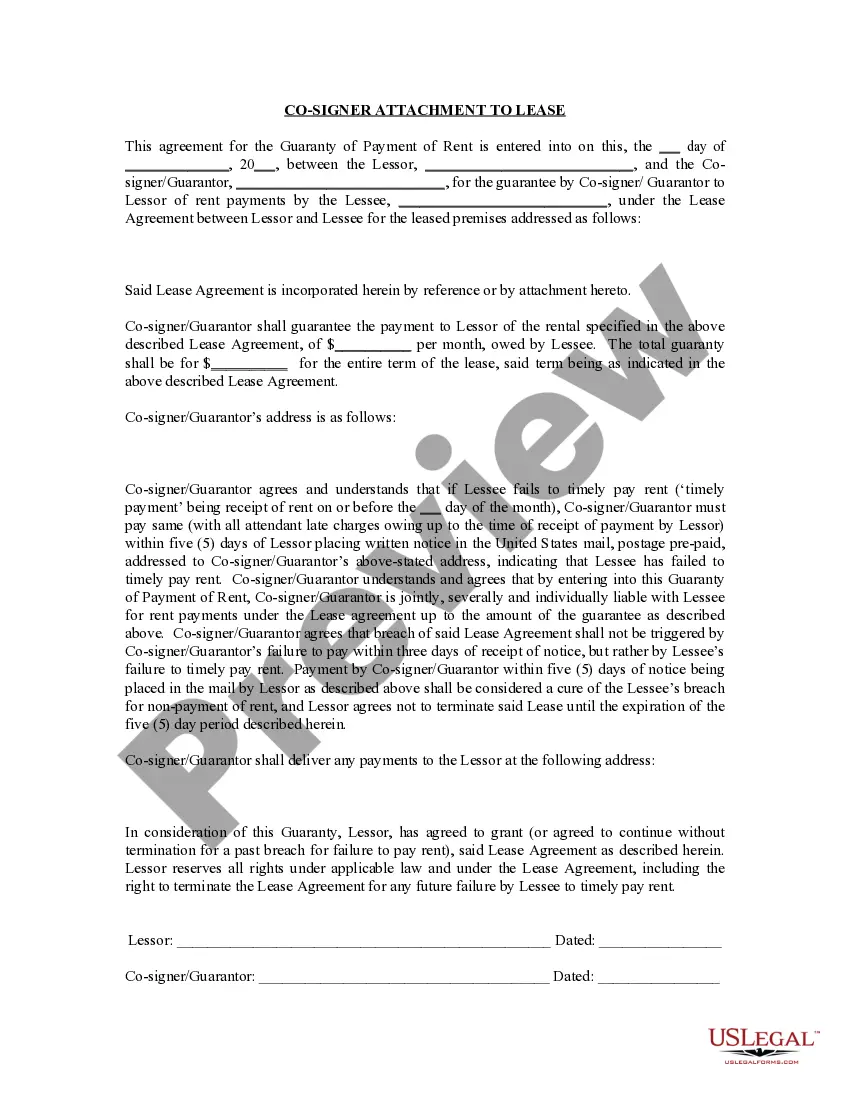

Third Party Guarantee In A Loan

Description

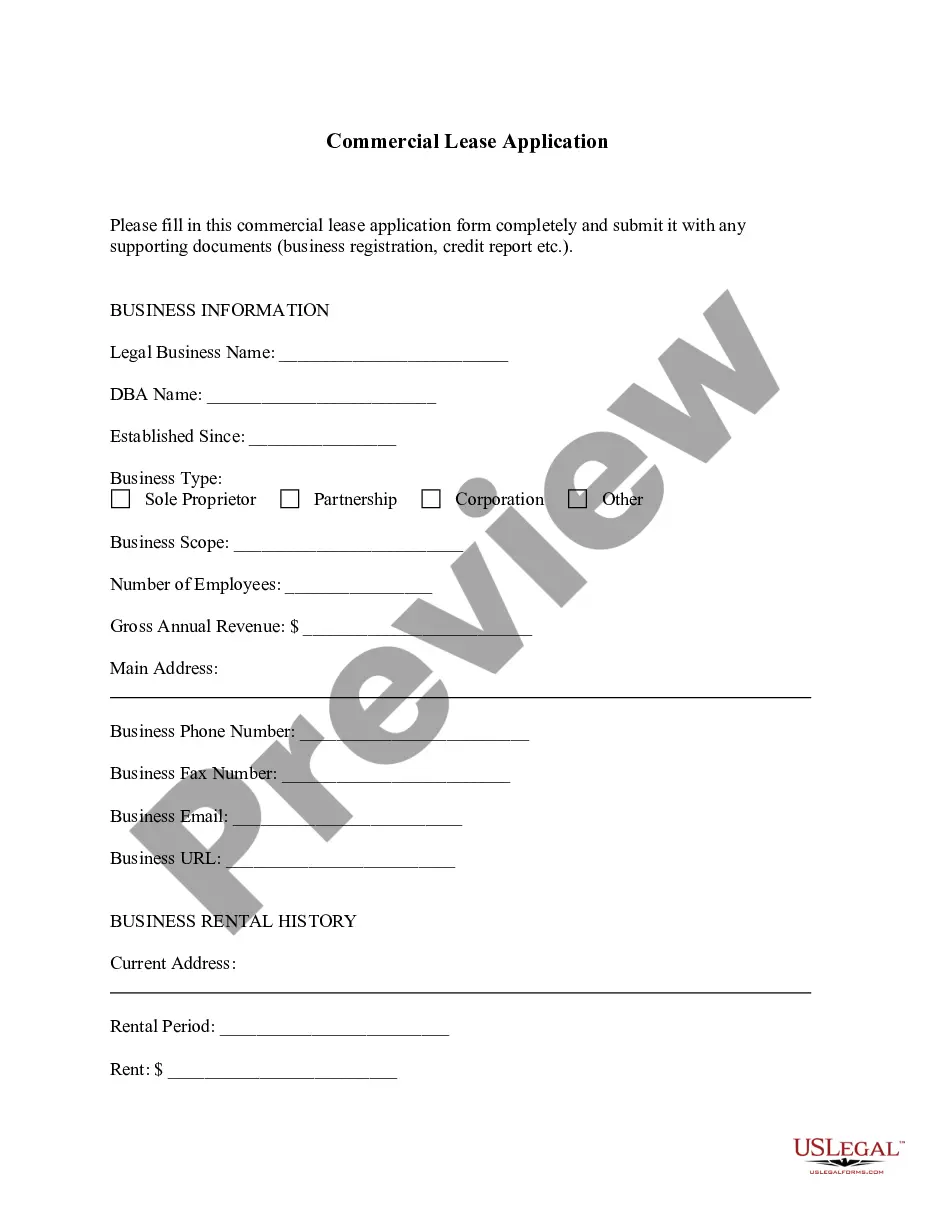

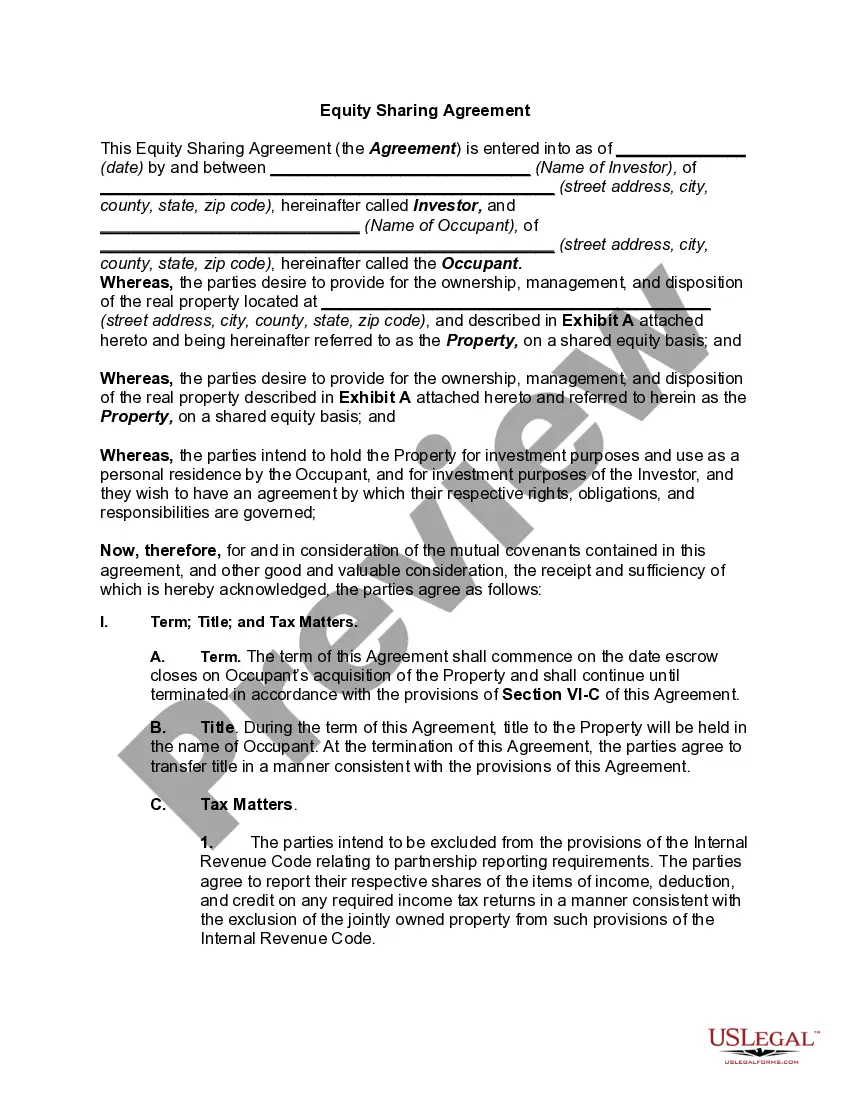

How to fill out Georgia Guaranty Attachment To Lease For Guarantor Or Cosigner?

Whether for business purposes or for personal matters, everyone has to handle legal situations at some point in their life. Completing legal documents needs careful attention, starting with picking the appropriate form sample. For instance, when you choose a wrong version of the Third Party Guarantee In A Loan, it will be declined when you submit it. It is therefore essential to have a trustworthy source of legal files like US Legal Forms.

If you need to obtain a Third Party Guarantee In A Loan sample, follow these simple steps:

- Find the template you need by utilizing the search field or catalog navigation.

- Examine the form’s description to ensure it matches your case, state, and county.

- Click on the form’s preview to examine it.

- If it is the incorrect document, go back to the search function to find the Third Party Guarantee In A Loan sample you need.

- Get the template when it meets your needs.

- If you have a US Legal Forms account, just click Log in to access previously saved documents in My Forms.

- In the event you do not have an account yet, you may obtain the form by clicking Buy now.

- Choose the proper pricing option.

- Finish the account registration form.

- Choose your payment method: use a bank card or PayPal account.

- Choose the document format you want and download the Third Party Guarantee In A Loan.

- Once it is saved, you are able to fill out the form by using editing software or print it and finish it manually.

With a substantial US Legal Forms catalog at hand, you do not need to spend time looking for the right template across the web. Make use of the library’s straightforward navigation to get the proper template for any occasion.

Form popularity

FAQ

A guarantor guarantees to pay a borrower's debt if the borrower defaults on a loan obligation. The guarantor guarantees a loan by pledging their assets as collateral.

As another instance, if a debtor owes a creditor a sum of money and has not been making the scheduled payments, the creditor is probably to hire a third party, a collection agency, to ensure that the debtor honours his agreement.

Traditionally, a distinction is made between: Real guarantees relating to assets having an intrinsic value. Personal guarantees involving a debt obligation for one or more people. Moral guarantees that do not provide the lender with any real legal security.

A guaranteed loan is used by borrowers with poor credit or little in the way of financial resources; it enables financially unattractive candidates to qualify for a loan and assures that the lender won't lose money. Guaranteed mortgages, federal student loans, and payday loans are all examples of guaranteed loans.

Third-party guarantees are a form of securing loans, where the guarantor is liable for the outstanding debt including interest in case the borrower defaults. By granting a guarantee one can help family and friends to gain access to credit.